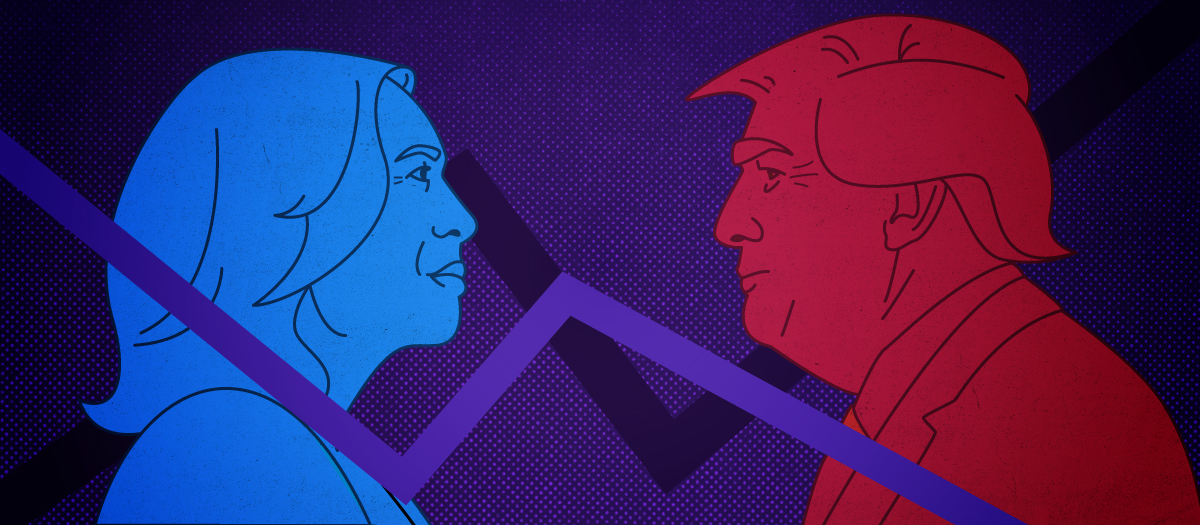

US presidential elections set for 5th November are cherry on the top and grand finale of 2024 – year tightly packed with local, parliamentary and presidential elections held worldwide. But none are perceived as more important than those in US. Especially in times of such extreme polarisation and geopolitical turmoil.