‘Far over, in misty mountains cold’ – on Central Asian gold mining, part 2

Everyone interested in gold mining knows that main producing countries are China, Russia and Australia. It’s also common knowledge that it is Africa, Asia, and Central & South America who dominate analysis on geographical gold distribution. But there is also one region, which usually doesn’t receive enough coverage, or at least not enough to what it deserves. This is Central Asia.

Analysis continuous subject of gold mining in Central Asian republics. In first part we’ve explained our reasoning, made introduction to the region and covered subject of gold mining in Uzbekistan and Turkmenistan. Now it is time to focus on Kyrgyzstan, Kazakhstan and Tajikistan.

Gold production 2010-2022 in Russia, Uzbekistan, Kazakhstan, Kyrgyzstan and other members of CIS. Source: WGC

High in the mountains cold - Kyrgyzstan’s gold mining

Kyrgyzstani gold comes predominantly from Kumtor gold mine, located deep in the Tien Shan mountains approx. 4k meters above sea level, which makes it second highest located gold mine in the world after Yanacocha in Peru, and one of the largest open pits in region. It is also largest industrial investment in the country, giving employment to 2.5-4 k workforce (depending on sources), and being directly responsible for 23% of aggregated industrial output and 12% of state’s overall GDP. Indirectly even more. It also used to be one of the Central Asia’s biggest single, western, foreign investments.

Exploration of local gold deposits first started in 1978 but was ceased due to lack of resources to bring mine online. Besides USSR just recently invested heavily in Uzbeki gold mining. After Kyrgyzstan gained independence in 1991, Canadian corporation Cameco shown its interest in developing Kumtor mine in 1992. And presence of well-established western miner and investor, also opened gates for funding from World Bank and the European Bank for Reconstruction and Development.

Kumtor gold mine effectively started to mine gold since 1997. At that time, state owned 67% of shares in mine with Cameco remaining 33%. Table had turned in result of restructuration of 2003 when Cameco’s and part of the state’s share went to a Cameco subsidiary, Centerra Gold, diluting state’s hold to 33%. Actually to 16%, as 33% were effect of early 2000’s re-negotiations, being effect of nationalisation threat imposed by local government. For years to come, Centerra held 100% shares of the mine via established for this purpose operator Kumtor Gold Company (Kyrgyzaltyn). However, Government of Kyrgyzstan owned 33% of Centerra shares making it indirect shareholder. Later, thanks to a series of ‘unprofitable’ agreements, state’s share dropped to 26.4%.

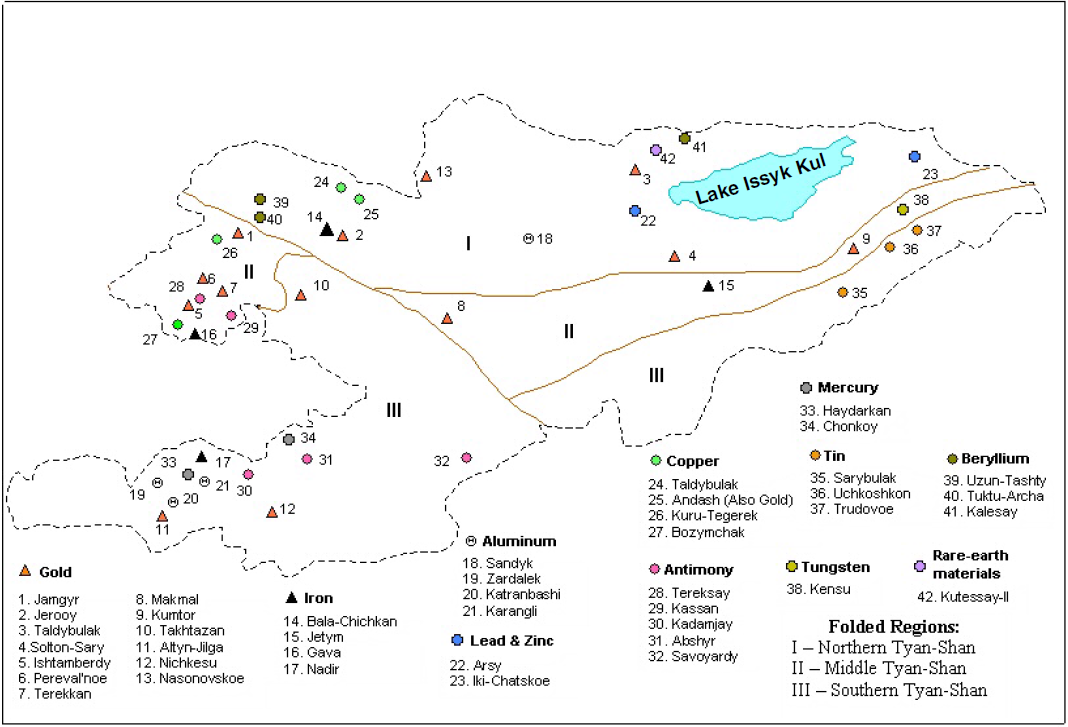

Metal mining sector in Kyrgyz Republic. Source: https://www.trade.gov/country-commercial-guides/kyrgyz-republic-mining

This has changed however in May 2021, when state announced nationalisation of operation, citing environmental issues caused by Canadians. Mining at Kumtor was directly connected to damaging the surrounding glaciers, which in turn feed Naryn river. Together with another river, Karadarya, Naryn forms Syr Darya, one of the local main water arteries that crosses Uzbekistan and Tajikistan, and eventually reaches remnants of Aral Sea. Pollution or reduction of the water levels carry potentially catastrophic consequences for the whole region. In addition, many local inhabitants protested on forceful dispossession and environmental issues. Local outrage also occurred against other entities, among them Chinese Zhong Ji and Full Gold Mining. However president of the republic enforced mining operations resuming.

For years, environmental subject wasn’t much of a problem as Kyrgyz state kept ignoring subject, occasionally applying and later lifting small fines on operator. This had changed however, few months after authorities released from prison Sadyr Japarov, who became in January 2021 president of the republic. Environmental factors have been used as main reasons for nationalisation, backed up with other, as auditing state commission indicated that Kyrgyzstan only received 1.5 bln USD from the development of Kumtor deposit, while Centerra 11.5 bln USD which was unproportionate to shares owned. And so, it proposed to introduce external manager, to leave all mined gold in Kyrgyzstan and to recover money of Canadians. Centerra quickly initiated international arbitrage. Eventually, on 29th July 2022, parties had come to an agreement over the mine in form of swap Kirgystani government ceded its shares at Cetnerra, worthy 972 mln CAD receiving in return 100% equity interest in mine. Kumtor became property of ‘Heritage of the Great Nomads’ holding, led by one of the presidential friends. Soon after, independent sources started informing about such growth in corruption, that even new government couldn’t dare to ignore.

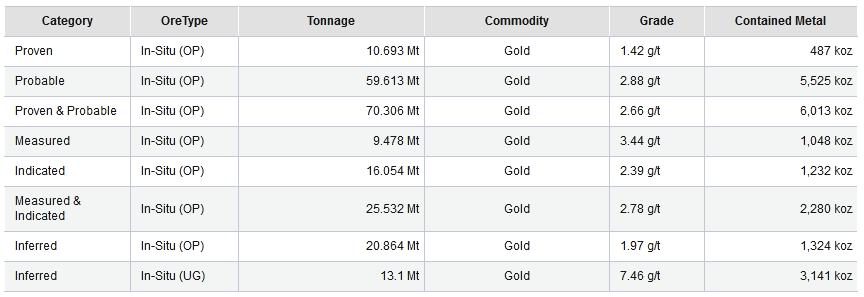

Currently mine is about to cease operations in 2031, although it’s very likely its lifetime will be extended. In 2020 annual fillings, Centerra informed that Kumtor Mine 70 mln t. of ore, at 2,66 g/t. which would be 6 k ounces of proven and probable gold and potentially more marked so far as measured and indicated. In 2020 Kumtor provided 556k ounces of gold which is 17.3 t. out of 24.3 reported that time by Kyrgyzstan.

Reserves as on 31st Dec 2020 in Kumtor Mine. Source: https://miningdataonline.com/property/1029/Kumtor-Mine.aspx

Second largest gold mine in Kyrgyzstan is Makmal. Operated as well by by Kyrgyzaltyn in behalf of government. Production at the Makmal gold mine totalled to 21.47 t. of gold in the period of 1986-1996. Nowadays, mine is on the last stage of extended operation with yearly output on 1.2 t. yearly. Other gold mines predominantly under development - are Ishtamberdy, Solton-Sary, Terek and Terekkan. Development of Taldy-Bulak Levoberezhnyi and Bozymchak gold deposits started in 2015. Local precious metals sector is incentivised by presence of Chinese capital and Chinese companies in joint-venture with local entities, but as it is with everything, this comes at price.

Revenues from gold mining remain important aspect of local economy. In 2022 Kyrgyzstan exported 139 mln USD of gold. Predominantly, in 67% to Switzerland, nearly 23% to China with Hong Kong and 2.5% to UEA.

In the land of steppe eagle – Kazakhstan

Kazakhstan, once a significant holder of gold reserves, has fallen to 17th place globally. In 2021, the country's gold reserves reached 402.38 tons, but a recent trend shows a reduction in holdings. Gold remains, next to oil and uranium, one of the country's most important export commodities. In 2022, this value amounted to 9.7 trl USD and the main recipients in the proportions of 67.6% and 29.3% were the UK-Switzerland duopoly.

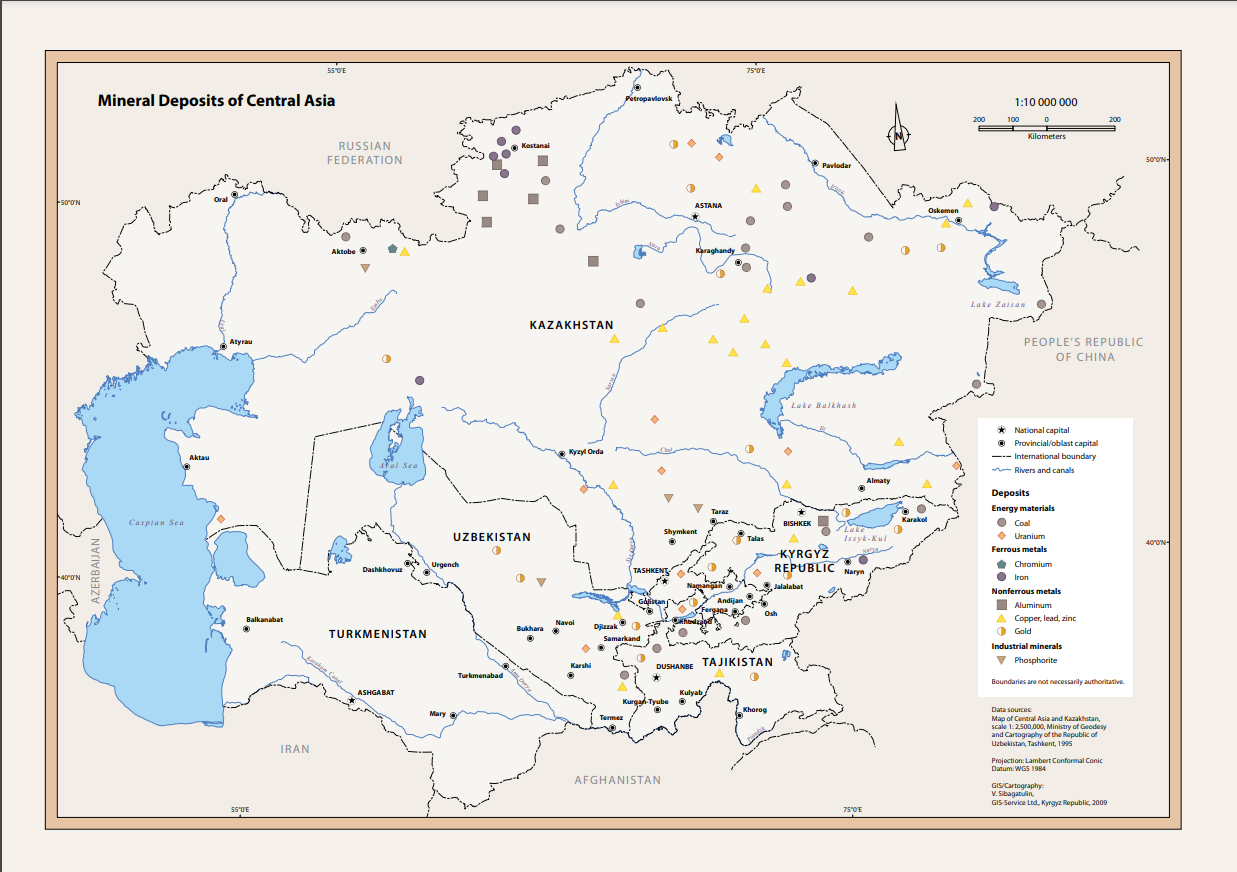

Map of Mineral deposits in Central Asia, in this context used to show gold deposits in Kazakhstan. Source: Mineral Resources Geologists Paradise

Gold mining industry of Kazakhstan is mainly represented by small and medium-sized deposits by the standards of the industry. To simplify and compare – Uzbekistan has one extraordinary deposit – Muruntau – which dominates its gold production figures. Kazakhstan has many smaller gold deposits dispersed on East, North-East and northern part of country. World Bank specifies them as extensive. Identified large gold deposits are scarce in Kazakhstan.

Most of known mineral deposits in country (not only gold), were already being mined while country formed part of USSR. Kazakhstan experienced big surge in mining production during Soviet period due to central-planned industrialisation efforts. However, gaining independence in 1991 and wave of privatisation failed to keep up and reinvigorate industry after USSR’s economic collapse. Despite access to cheap power, low labour costs, and reasonably adequate infrastructure, Kazakh mining industry stagnated and lost competitiveness because of depletion of high-quality reserves, low operating efficiency and limited adoption of modern technologies.

Let’s give Kazakhstani Republic some time and move over decade forward. In Kazakhstan International Business Magazine from 2004 we read that largest gold producer in country was able to deliver up to 6 t. during past year, with second largest 3 t.

In total, annual gold production at a time hovered around 10 t. a year. As a reasons for such low volumes, source quoted: prevalence of small and medium fields, old equipment and obsolete technologies used by the majority of extracting and refining enterprises, absence of sufficient working capital and limited fundraising capabilities of many domestic enterprises, poor management and ineffective ownership structure preventing participation of outside direct and portfolio investors, unavailability of sound and environment friendly technologies for processing carbonic and arsenic ores, absence of domestic mining machinery and reliance on foreign imports leading to increasing production costs, and finally high transportation costs. So, yet another proof for sectoral stagnation and description of problematic sectoral aspects present even nowadays. Country also struggled for a long time to finance proper geological studies in search for new minerals. Fact that its geological maps are even now in majority outdated or present inadequate situation is confirmed by international miners present in Kazakhstan.

Additional problem, effectively slowing development of gold mining in Kazakhstan, lied in high number of illegal gold mining activities. Decades of persistent high unemployment levels (over 10% up to 2006) among youths especially in rural areas, were incentivising to gold ASM (artisanal small mining) and became important profit source for organised grey zones. Government didn’t discourage such mining activities, but until recently lacked consistent or regulated approach. Even with introduction of updated mining code of 2018, ASM remains largely unregulated, especially in case of gold.

Despite of described issues, Kazakhstan may account some success as within last decade it has taken position of one of the important centres for mining and processing of gold. Country produces slightly over 80 t. of gold annually, which marks increase x2.5 since volumes in year 2010. Why is that so? Gold mining in Kazakhstan has become prominent in recent years as country is encouraging foreign miners to invest in this mineral rich country. Still, after over 30-years of independence, sector is dominated by government owned giants, Russians and Chinese. Despite of presence of foreign capital, Kazakhstan struggles to encourage miners other than junior and mid-size, who are willing to accept possibility of higher risk in attempt to have higher returns. That’s of course with certain exceptions.

Altyntau Kokshetau gold mine – open pit, 135 m. deep. Source: https://aboutkazakhstan.com/blog/business/gold-mining-in-kazakhstan/

What is incentivising for miners - national law says that no parts of the country’s economy are closed to outsiders. This means that international firms have free reign to do what they feel with fewer regulations involved compared to other countries of the region. And speaking on legislation. In attempt to reform mineral mining sector, in 2018 government adopted new mining code. After all, overall mining sector was responsible for approx. 17% of total GDP. With regards to gold, legislators want to increase gold production to place Kazakhstan among ten largest gold-mining countries in the world. Plus in the medium term, most growth in the industry would come from the development of smaller deposits with lower capital costs and production capacity.

New legislation separated regulation on minerals from hydrocarbons and uranium mining and set out a much less burdensome procedural framework for operations, in line with international good practices. A major improvement was the introduction of ‘first-come-first-served’ principle for granting mining permits which follows Western Australia’s legislation standards. Since then, more than 1.9 k new licenses were granted since approval of the new code with about 800 junior exploration companies active in Kazakhstan, as per 2021.

So we observe steady progress from Kazakhstani side. But how it is being perceived by other side of equation? According to the Fraser Institute, Kazakhstan’s overall Investment Attractiveness Index in mining in 2021 was 65th out of 84 constituencies surveyed, ahead of Kyrgyzstan (74th) but behind Mongolia (63rd). Poor ranking is combination of poor perception by investors regarding environmental policies and underestimated geological potential. Although being the highest ranked Central Asian jurisdiction in terms of mining policy, country is perceived to perform poorly in its legal system, taxation regime, labour regulations, and geological database.

Six largest gold mines described below cumulatively produced approximately 40 t. of yellow metal in 2022, which is aprox. 50% of total Kazakhstani annual output. Below is a mix of Kazakh, International Western and Russian capital, with certain direct or indirect involvement of Chinese capital.

• Altyntau Kokshetau Mine in Akmola, was the largest gold-producing mine in Kazakhstan, producing approximately 395 thousand ounces (12.2 t.) during 2022. Altyntau Kokshetau Mine is owned by Kazzinc, whose major shareholder is Glencore, and is due to operate until 2031. That is most noticeable presence of western miner in local gold sector.

• Second largest gold-producing mine with an estimated gold production of 330k ounces (10.2 t.) in 2022 is Kyzyl Project. It is owned by Polymetal International Plc, and is due to operate until 2050.

• Another large gold mines in the country is Varvara Mine located in Kostanay, Varvara, owned again, by Polymetal International, delivered 211k ounces (6.5 t.) in 2022 and has expected operational lifetime until 2039.

• Abyz Mine belongs to Kazakhmys Holding Group. It is an open pit mine located in Karagandy. It produced estimated 135k ounces (slightly over 4 t.) of gold in 2022. However, its operational due date ends in 2024.

• Bozshakol Mine located in Pavlodar is being owned by Kaz Minerals. In 2022 it delivered further 122k ounces (3.8 t.). Mine will operate until year 2060.

• Pustynnoe gold mine, located in Karagndy belongs to JSC AK Altynalmas. Company owns nine gold mines across country and attempts to make its vision of becoming leading regional gold miner to come true. Over 100k ounces (3 t.) had been delivered from Pustynnoe in 2022. However, that is yet another object that will cease mining in current year.

Treasures of Sughd – on gold mining in Tajikistan

Natural resources in Tajikistan. Source and better resolution: https://geoportal-tj.org/wp-content/uploads/deposits_map-scaled.jpg

Landlocked Tajikistan, located near ‘roof of the world’ remains one of the poorest nations we discuss in our analysis on gold in Central Asia. Despite of its potential mineral richness, which is in hard-to-reach places. Right after gaining its independence succumbed in bloody civil war which ended in 1997. But country seems to be constantly being involved in conflicts, either internal – clan - or Afghani Talibs. Its border drawn during Soviet rules, remains subject of ongoing tensions against Kyrgyzstan. Since 1994 it is ruled by authoritarian President Emomali Rahmon. Rahmon’s presidency is accompanied by repeating reports on violating human rights. Nearly 29% of Tajikistan's GDP comes from immigrant remittances - mostly from Tajiks working in Russia. Apart of that, country’s economy remains highly dependent on cotton (which accounts for vast majority of its agricultural output) and aluminium exports. With above three major branches of revenue, Tajik economy remains prone to external factors. With small share of arable area and instable fiscal policies, country’s inhabitants remain on the brink of malnutrition, with repeatedly occurring famines and remain dependant on foreign aid. At the same time, post-soviet and government-owned Tajik Aluminium Company (TALCO) remains main industrial company in the country, one of the largest of its kind in the world, and highly contributes to president’s ‘personal retirement fund’ in British Virgin Islands.

How is gold found in the structure? It turns out that in 2022 it was the country's most important single export commodity, worth USD 644 billion, 60% of which was directed to Switzerland and the rest to China and Hong Kong.

Main goldfields of the country are concentrated in the Northern (Sughd Province), central areas of Tajikistan and Southern Pamir. In total, more than 150 gold deposits have been identified in Tajikistan. Most of them remain underexplored or unexplored. Most significant gold deposit – Taror - is located 44 km far from the city of Penjikent. Other, neighbouring deposit - Jilau - is located just in neighbourhood, just 10 km from Taror. To develop them, in the late 90s, gold ore plant had been built with an estimated capacity of about 2 tons. Several smaller deposits of gold (Aprelevka, Burgunda, Ikkizhelon, Anzob, Chore, Duoba etc.) have been identified and studied within the Karamazar ore field. Another notable deposit is Pokrud gold deposit is in the southern part of Gissar, 107 km far from the capital city of Dushanbe.

Tajik gold mining grows, with 1.1 t. mined in 1996, to 2.7 t. in 2000. Due to civil war up to 1997 and clan hostilities, lot of infrastructure suffered. Darvaz joint venture, in the Hatlon region of Eastern Tajikistan, mined the gold from 1997 to 1999, producing 110 kg. in 1997. However, operational problems arose following damage to the placer mining operation that took place during hostilities in the area in December 1996, with mills and living quarters at the facility being damaged as result of the hostilities.

Upon end of hostilities, for majority of years to come, country was delivering up to 1.3 to 1.5 t. annually, with a significant investment from China, with Zijin Mining working in the country. By 2012, gold production has surpassed 2 t. annually and started to increase slowly. Since 2019, country mines approx. 8 t. of yellow metal per annum. According to State Fund for Geological Information on the Subsoil of Tajikistan, just before pandemic, extraction and processing of gold was carried out at 26 deposits. According to the National Academy of Sciences of Tajikistan, all gold deposits currently known in territory of the country amount to about 500 t. of yellow metal.

Increase in gold mining comes in line with more participants interested in local market. If in 1991 there were four industrial enterprises working in the industry, in 2021 their number reached 29. There about ten relatively large gold-mining enterprises, just to mention most important – ‘Zarafshon’, ‘Aprelevka’, ‘Tilloi Tojik’, ‘Odina’, ‘Pakrut’, ‘Naziri’. Tajik-Chinese joint venture ‘Zarafshon’ dominates in local picture, being responsible for 70% of gold production. Other are ‘Pakrut’ (14%), ‘Tilloi Tojik’ (8%), and Tajik-Canadian joint venture ‘Aprelevka’ (5%). Especially ‘Aprelevka’ remains interesting in this case, as it represents investor from so called ‘western world’, with 49% of interest in joint venture. That was Canadian Gulf International Minerals, whose Tajik operation shares were acquired by UK based Vast Resources – as per late 2023 data. Vast attempting to increase Aprelevka's production to historical peaks of 27k ounces of gold and 0.25 mln of silver ounces per year.

Speaking of silver – and other interesting minerals. Should be no surprise, that Tajikistan is also reach in zinc and lead bearing ores. And where these two, and gold, there definitely must also be silver. Proven Big Kon-i Mansur silver reserves were determined long ago by Soviets, to be at 50k t. with average of 49 g. of silver per t.

It should not be surprising, that in case of this Central Asian landlocked nation, located on the outskirts of former soviet empire, prevalence of one particular investor dominates landscape. China – as per 2021 figures – remains most significant source of foreign direct investments (FDI), making up to 62% (211 mln USD) of overall figure. One of the recent gold related investments was TALCO Gold – gold processing plant, costing 136 mln USD, able to process 2.2 t. of yellow metal anually, among other metals. Talco Gold is a joint venture between mentioned previously Tajik Aluminum Company and China’s Tibet Huayu Mining. Opened in 2022 in Sughd region provides jobs for 1.5k Tajiks, which remains especially important in light of sanctions imposed on Russia, which affects seasonal labour market, which – as noted already – makes nearly 1/3 of Tajikistan’s economy. However, In this particular case we could discuss scenario as:

China gives money as a loan to Tajikistan for specific projects, and often the parliament approves tax exemptions during the construction period (…) Construction equipment is brought in from China, Chinese workers are engaged in the building. As a result, all the money goes back to China, and Tajikistan remains saddled with the debt.

Tajikistan has adopted a program for the rapid development of the gold mining industry, which is aimed to facilitate extraction and production of precious metals in the country. It is planned to incentivise production of gold from known deposits, but also to carry out detailed geological exploration in the North and South of the country. According to the program, country is soon expected to produce 10 tons of gold annually. However approx. 84% of gold is being mined by Tajik-Chinese joint enterprises. This lack of diversification along with heavy debt burden towards Beijing already causes issues. Some analysts even perceive local border corrections as part of debt settlements.

Increasing in fast pace gold production, remains worrying geologists who share alarming predictions that the Chinese will exhaust Tajik gold mines in 30 years.

Summary

Above concludes our story on gold occurrences in Central Asia. On this occasion, let us remind why we decided to present such obscure region. According to World Gold Council, in 2022 Central Asia delivered combined volume of 240 t. which is nearly 7% of total global mine production (as for now, we do not have yet detailed 2023 output figures). That is just 40 t. less than Canada and Mexico combined. However very disproportionate coverage makes subject of Central Asian gold mining basically unknown even to specialised sectoral readers.

We hope we managed to cover the subject extensively, although please bear in mind our aim was focused on yellow metal. These two papers do not attempt to discuss local ethnical, cultural, political and geopolitical matters, and neither full local geological database with its mineral and hydrocarbon abundance or water scarcity. These subjects, along with corruption and cases of human rights violation had been mentioned contextually to provide wider background information on the subject.