Year after CEPA – how trade deal changed gold and silver import/export landscape between UAE and India

United Arab Emirates – most important precious metals distribution centre for South East Asia and large chunk of Africa. India – market always hungry for precious metals What could happen if combine those two into one subject? Analysis of import / export landscape between UAE and India, in the context of precious metals in Comprehensive Economic Partnership Agreement. Only on Metal Market Europe Blog.

What is CEPA and why is it so important?

CEPA stands for Comprehensive Economic Partnership Agreement. It is trade agreement signed between Government of United Arab Emirates and Government of India. It aims to eliminate large portion of mutual existing tariffs between signatories. Lawyers mention on approx. 10k individual tariff lines. Its removal should take place within next decade. Expected effect is tightening mutual trade relationship between countries and boost of bilateral trade from 60 to 100 bln USD just in the next five years. There are quite few sectors which should immediately feel the difference resulting in introduction of CEPA. These are oil and gas (energy), petrochemicals, minerals, textiles, agriculture, metals, jewellery and gems.

Initiall agreement was signed on 18th February 2022 and entered into force on 1st of May same year. Due to ongoing political tensions on energy markets and then due to outbreak of war on Ukraine, it wasn’t covered much or at all, by geopoliticians in our latitude. Which is pity, as it may change trade environment in the region and potentially be extended into more countries of Arabian Sea and Gulf region. That may even happen despite of certain political animosities, as it happens just few years ago in case of other big trade treaty - Regional Comprehensive Economic Partnership (RCEP). It consists China, Taiwan, Japan, Australia and other countries of a region. Despite of geopolitical differences, alliegance to different camps or territorial disputes, trade must go on.

But more on CEPA. It has its roots in old India-Gulf Cooperation Council Framework Agreement on Economic Cooperation signed in 2004. It consisted India and all countries of Arab Peninsula with exception of Yemen. It has been soon shaped onto another, bilateral Free Trade Agreement (FTA) signed between Delhi and Abu Dhabi. CEPA is its natural extension, making trade between these two subjects of lifting, reduction or phasing out some of the tariffs. It has to be considered as the most, or at least one of the most comprehensive trade agreements in the world. After all it reduces 65% tariffs from Indian side and 80% from UAE (quota volumes are different – at 90-97%).

In the words of Abdulla Albasha Alnoaimi - Commercial Attaché of UAE embassy in India:

“India and UAE took their partnership to a whole new different level with the signing of the CEPA agreement on 18th February 2022. The agreement would unleash a golden era in the bilateral relationship by boosting investments, trade, technological partnerships and creating employment opportunities across sectors. The agreement was finalised in a record time of 88 days. India-UAE CEPA would help in setting economic priorities for the post-pandemic era and help in boosting the merchandise trade between the two countries to $100 billion over the next five years. Gems and jewellery sector has been given special emphasis in the CEPA.”

Shri Sunjay Sudhir – India ambassador to UAE was speaking in similar way:

“The historic India-UAE CEPA is a major trade agreement to transform bilateral economic, trade and investment ties and propel economic growth. The agreement also holds promise as a gateway for the Indian exporters to emerging economies in the Middle East and Africa. The gems & jewellery sector is among the industries which are poised to a gain considerably from CEPA.”

Language of diplomacy has its rights. However what is interesting, that both diplomats decided to especially underline gains to sectors related to precious metals. Gems and jewellery sector… special emphasis… in between two countries known for having special place in their hearts for precious metals?

After over the year, of CEPA being in existence, it seems to be good time to have a closer look onto how it changed, and did it really improve flows of precious metals in between India and UAE.

Duties on precious metals across Arabian Sea

Just above introduction should point to a fact of great changes occurring. “Change” is however not the best word to use on this occasion. “Improvement” should be more suitable, as even before CEPA, trade relationship between counterparts were thriving. So let’s focus on data and find out how this trade deal affects flows of gold and silver. First of all have to assess changes in tariffs:

- Tariff Reduction on gold, including gold plated with platinum, unwrought, for non-monetary purposes (excluding gold in powder form) is to be reduced by 1% and introduced over period of five years (already is). That is tariff number 7108.12.00, which includes gold bullion and doré (mixture of precious metals formed in bars for further refining) as well as gold with purity no less than 999.5. Just to explain – that is the most common import and export tariff for gold. When reporting gold import or export of any country, this category will consist usually 99% of gold considered.

- Tariff Elimination Phased changes affects tariff 7118.90.10. That is gold coin of legal tender, whether or not being legal tender and platinum coin of legal tender (excluding medals, waste and scrap coin, jewellery made from coins and collector’s items of numismatic value. Under Tariff Elimination Phased customs duty should reach 0% within 5,7 or 10 years, being gradually lowered.

- Under Tariff Elimination Phased, customs duty on silver is being also lowered. Tariff 7109.00.00 refers to base metals or silver, clad with gold, not further worked, than semi-manufactured. In this example that would mean i.e. silver grain. Again, duty should reach 0% gradually within period of 5, 7 or 10 years.

Let that sink in – Indian import duty on silver bullion from UAE under CEPA will gradually decline and eventually reach zero at the end of 2032. As for now, nearly year after introduction, it stands at 9%. That is significantly lower tariff rate than 15% applicable when importing silver from other countries (i.e. UK). Just this element seems to be ground-breaking as makes UAE most important and cheapest location to import silver for India located jewellers.

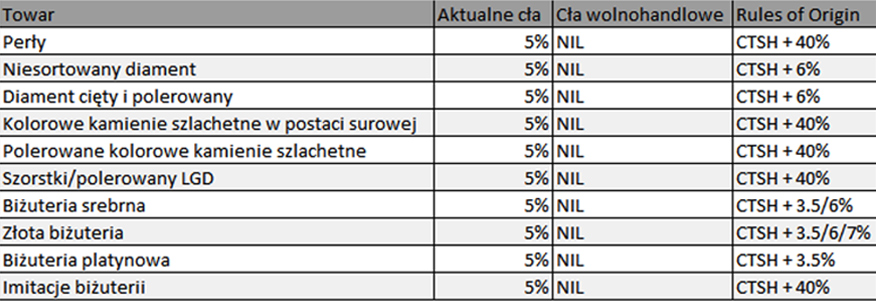

But how would CEPA affect flows of precious metals in opposite direction? Indian goods shipped to UAE, compliant with Rules of Origin – which is basically main trade agreement – will be granted either tariff rate zero since day one, or appropriate Tariff Reduction.

- In case of precious metals, jewellery and parts of precious metals such as platinum (7113.19.10) will be subject of 0% duty since the day CEPA went live.

And of course that is just part of a deal related to precious metals. Just to give scope on how wide CEPA is, worthy to mention that since day one, India imports of petroleum and crude oil, as well as unsorted diamonds are being made on the basis of 0% customs tariff. Bananas, fruits and wide basket of ‘fresh’ goods will be subject of duty reduction to 15% over 10 years. And these are just some examples.

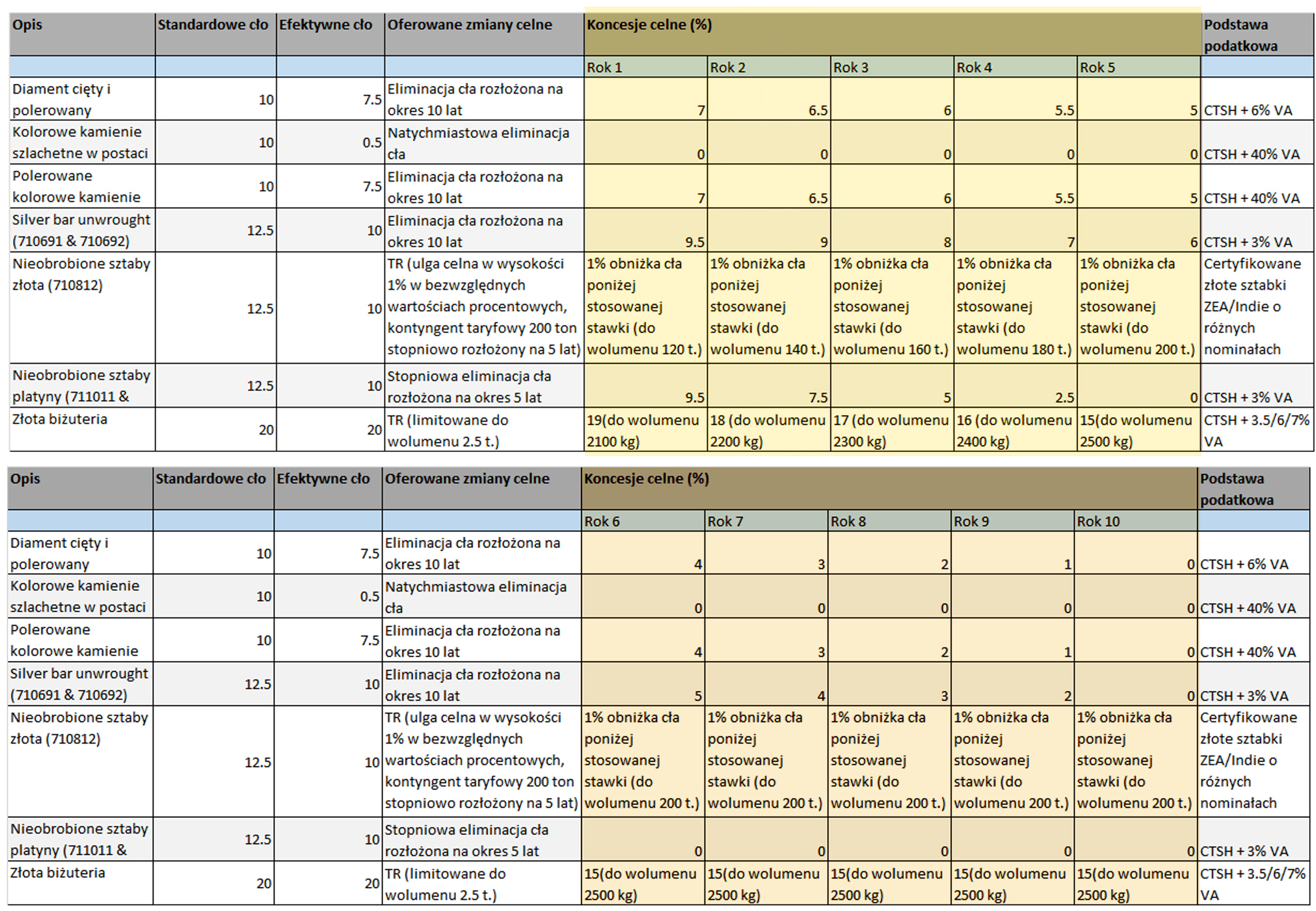

Tariff Elimination on Imports on precious metals, gems and jewellery in India. Source: Gjepc.org

What it means in reality for local precious metals markets? CEPA made gold imports from UAE cheaper for Indian manufacturers by 1%, which is capped at 140 t. At the same time, Indian jewellery exports to Emirates have become 5% cheaper in comparison to other competing nations like Malaysia, Turkey, etc. This reduction in costs has resulted in a 16.5% increase in Indian jewellery exports to the UAE in just one year. If this trend going to be continued at such pace, value of jewellery exports from India to the UAE is expected to reach pre-Covid levels of $9 billion in a short time.

How to benefit of CEPA in terms of flows and duties?

But how counterparts would benefit of such solution? UAE is largest local precious metals and jewellery trading centre for South-East Asia and Middle East. Apart of that, it serves as a final destination to large volumes of African gold – both legally exported, and smuggled. Main precious metal centre in UAE is Dubai, which growth recently on popularity as tourist destination. One of the obligatory places to visit there is famous Dubai Gold Souq. Hundreds of jewellers offer goods for sale, with most popular 24 karat gold bars, and 22, 21 or 18 karat jewellery. As an incentive, consumers may not only enjoy lowest gold price in the world (thanks to zero import duty in UAE), but also VAT refund for tourists. Not even to mention individually applied discounts per size of sale, cashbacks, lifetime free maintenance, special campaigns etc. And be damned, who didn’t even try to bargain, as it is culturally required and expected. Overall, Dubai serves as local centre for customers from South and South-East Asia, as assures savings of around 12-15% comparing to Indian market.

Of UAE, gold and silver flows i.e. to India, well known for its jewellers and their skills. CEPA is being considered as a game changer for Indian gem and jewellery industry, as it lowers costs of acquiring raw material. In the past, approx. 50-60% of imported gold originated from Switzerland with UAE share in between 12-19%. Considering duopoly of Bern and London, that meant of course indirect imports from London. With 15% duty on gold imported from rest of the world, and 1% duty less on gold originating from UAE, this incentivises Indian importers to buy yellow metal from this Gulf country. Additionally considering that price of gold in rupees were at high levels in the last couple years, which eventually impacted local demand.

However real revolution on duties is on silver. We covered subject of silver in India partially in our summary of silver trends in 2022, on this occasion indicating sharp growth on demand in India. One of the reasons lied in high gold prices in the country so attached to precious metals. Other in lifting pandemic restrictions. But in large share, this could be attributed to CEPA. India is one of the largest consumers of white metal in the world, with bullion imports averaging around 6k t. annually in the five years preceding the pandemic. On this occasion, let us mercifully skip the data for 2020 and 2021, as this was very unusual period of dump and boom, hence any comparisons would lack on reliability. However in 2022 India imported 9.5k t. of silver, establishing this way highest volumes in at least decade. In normal circumstances, silver import had been conducted among others from UK (50% in 2022) and Hong Kong & China (34% in 2022) making up approx. 75-80% of total volume.

Tariff Elimination on Imports on precious metals, gems and jewellery in UAE from India. Source: Gjepc.org

CEPA is likely to lead to some notable changes in the years ahead. It allows for silver imports at a lower duty as long as certain conditions are fulfilled. These include Certificate of Origin (COO) and a 3% Value Addition (VA). This means that importer has to provide documents to prove that silver has been refined in UAE, and that value addition of 3% has been processed. Effectively, to meet requirements of the COO and VA, silver refineries in the UAE will have to convert bars into grain and then export to India.

Until recently, import duties on silver were not supporting imports from this direction in 2022 as the custom duty outside of CEPA was 10.75% and under said trade deal at 10%. However, basic Indian customs duty on silver was raised to 15% in February 2023. At the same time, on 2nd year of CEPA existence, Indian jewellers had only 9% duty applicable on silver import from UAE. Hence 6% differential with certainty that it will be increased soon as silver duty under CEPA will be 8% in 2024 and 7% in 2025. If that is not incentivising for Indian jewellers, then we don’t know what else could be. Duty incentives should therefore upgrade levels of silver grain shipments from UAE. Question remains on scale. To put this into some perspective - in 2022, silver grain from ZEA accounted for just 3% of total imports of said 9.5k t.

While share of silver imports from UAE to India may rise in the coming years, market observers see issue in limited refining capacity of silver in UAE. UAE worked on improvement of its refining capacity since many years. That is progressive development, as in i.e. 1996 no-one thought UAE could acquire share of gold market dominated by LBMA-Switzerland. However flow of oil made money and certain changes in perceiving gold compliance to sharia law enabled such development. It was creation of Dubai Multi Commodities Centre (DMCC) in 2002, which helped to strengthen Dubai’s role as a key location in the Middle East. In 2020, UAE accounted for around 10% of both total world gold bullion and the gold jewellery exports, making it the third largest in the world behind mainland China/Hong Kong and Switzerland.

As per 2014 data, UAE had capacity of 850 t. of gold per year and unknown silver capacity. At the time, Switzerland’s gold refining capacity stood at 3k t., which was considered to be 50% of worldwide. According to LBMA’s current data, there are at least ten active precious metals refineries in UAE with majority located in or around Dubai. They are active Dubai Good Delivery members (local equivalent of London’s Good Delivery), however they remain not accredited to LBMA. Sectoral expansion is however ongoing. Of the large examples, we invoke Kaloti refinery (owned jointly by Al-Kaloti and Medakka families) – with 1.4k t. refining capacity of gold per year and further 600 t. of silver. And on most recent developments, SAM Precious Metals – UAE based refiner announced in 2022 plans to set up 13 gold and silver refineries around the globe. Just in 2021 it has opened facility in Egypt.

We have described silver, now it is time to go back to gold. As higher or lower import volumes of yellow or silver metal are effect of internal changes on subcontinent’s market. India is one of the most absorbent markets for precious metals in the world, next to China. Pre-pandemic gold import levels stood at 1k t. yearly. However high gold prices in rupees along with tax changes on internal market supressed imports, which stood at 760 t. for 2022. Current gold import volumes seem to bounce up benefiting from low prices. In June 2023 India imported 110 t. of gold, which is best y/y result in the last 10 years. Shift back to traditional yellow metal affected however flows of silver – with 55 t. being imported, that marks 95% y/y change and 2nd worst June since 2010.

Of course high demand is result of gold bearing significant cultural role, being traditional wedding and seasonal gifts. Just to mention as a trivia, that Indian population is estimated to hold gold surpassing 25k t. (including precious metals for stored in various temples). That is x3 of US FED official gold holdings. However, some portion of above figure is being stored in ancient jewellery or religious artefacts and ornaments. Hence value cannot be counted just as price multiplication of volume, but has to be multiplied due to historical and cultural significance.

However India mines gold volumes not surpassing 15 t. That is excluding any illegal and artisanal activities, as it is impossible to asses any numbers. In addition, internal market supplies approx. 100 t. of gold from recycling. Adding these together would leave us with significant imbalance in volumes between domestic supply and demand. Should be no surprise that such high demand was supportive to illegal imports coming mostly from Arab peninsula. These were estimated at 115 t. in 2019. As a result of above, New Delhi tightened its policies on jeweller’s sector, trying at the same time to regulate internal market and to prevent illicit flows. Hence India imposed its own BIS hallmarking system.

And here comes CEPA, not only easing legal flows to India but also from subcontinent. Year after India-UAE CEPA, India launched India Jewellery Exposition Centre (IJEX) in Dubai. Considering that Middle East accounts for 40% of India’s gem and jewellery export, that seems to be logical development. And it finds confirmation in trade statistics. CEPA went live in May 2022. Nearly year later (India’s fiscal year ends on 31st March) New Delhi reported growth on gems and jewellery exports by 8.2% (2.4% in dollar terms). Just gross exports on gold jewellery grew by 11.13% (3.22% in US dollar terms). In case of silver that was 16.02% (8.03% in terms of USD). With Indian government providing a 1% discount on gold import duty and even more on silver, and UAE government treating Indian jewellery as zero duty products, it allowed Indian jewellers to benefit on taxation and market expansion. And suddenly it appears, that purchase of gold of unknown origins is less profitable and in addition it bears even more risk.

Summary for gold and silver markets

Trade deal allows New Delhi to impose more import control on gold and silver arriving to country, make smuggle less incentivising. CEPA has to be considered as beneficial to country’s jewellers – after all it provides cheaper base materials. Hence it may be considered as crown jewel of sectoral reforms maintained in recent years, aimed to impose government control over profitable sector and to break grey zone and any related illegal activities.

For UAE, CEPA opens wider gates leading to vast Indian market, allows to benefit from cheaper costs of manufacturing by India’s famous jewellers, and creates strong incentive for local gold and silver refining sectors. Considering volumes, India’s jewellers presenting and selling goods in Dubai shouldn’t affect much, profits made by local jewellers. In addition they could gain as intermediaries. At the same time, presence of Indian jewellers in UAE may drag attention of more potential customers of South-East Asia and Middle East. Hence it makes UAE position in the precious metals market stronger.

With regards to gold, CEPA has to be considered as having certain impact on local gold flows gold and in certain scale to global flows as well. After all UAE doesn’t has any gold mines, hence must import gold. Its main import locations are African countries, tallying up to 70% of volume. UAE imported 46 bln USD worth of gold in 2021, which weighted 17% of total imports. Considering that race for African gold commenced some time ago, that gives UAE good position ahead of competitors.

Need to mention, of course, that above are official volumes. And we also have to consider certain illicit flows of gold to UAE from countries like Mali, Zimbabwe, Niger or Sudan. A lot of these later find its way to India. Hence trade cooperation between Abu Dhabi and New Delhi affects smuggle and bring additional profits to counterparties.

With regards to silver, shift in India’s import mix does very little to impact global silver market as UAE is not a silver mining country. White metal also bears lesser significance in UEA imports, weighting 0.057% worthy 154 mln USD. What may be changed is, silver that was coming to India from UK, Hong Kong, China and Singapore will now make its way after undergoing VA in the UAE for importers to benefit from the duty differential.