What to expect of 2024 US presidential elections for gold

USpresidential elections set for 5th November are cherry on the top and grand finale of 2024 – year tightly packed with local, parliamentary and presidential elections held worldwide. But none are perceived as more important than those in US. Especially in times of such extreme polarisation and geopolitical turmoil.

‘Welcome to the jungle, we got fun and games’

Today we’re going to discuss on how yellow metal may react to potential win of Donald Trump or Kamala Harris in US presidential elections. But apart of impact of having ex-president or vice president as a new head of state, let’s not forget about ‘current set of build-up macro issues’, which are geopolitical tensions, ballooning US federal deficit, deficit on individual state level, central bank asset diversification (and they just recently indicated intention on continuing purchase policies for one or the other reason) and hedging against relatively high inflation, that contributes heavily to cost of living crisis. Unfortunately, issues mentioned seem to be persistently resistant and will most likely will remain, despite of which of these two mentioned would remain POTUS (acronym ‘President of The United States’).

Best of the best that US politics has to offer? Source: https://www.theguardian.com/us-news/article/2024/sep/08/kamala-harris-trump-presidential-debate

But it’s not the end. Next to the presidential elections, a total of 468 seats in the US Congress (33 in Senate and all 435 in House) are also up to election on the same date. Hence, personal discouragement or support of voters most likely will result in red or blue hurricane over United States. Currently, ‘reds’ – colour attributed to Republicans – hold majority in House, while ‘blues’ – colour attributed to Democrats – keep majority in Senate and have head of state.

And so, November 2024 elections will have a lot on stake, as potential winners ‘may have it all’.

Should not be surprising that soon to be US elections are accompanied by extreme bi-polarisation, both on the streets and media. In addition, both candidates are surrounded by variety of controversies. We prefer not to list them in here, as we don’t want to be perceived as biased against one or the other. Also, application of non-US point of view onto US matters often leads to misunderstandings and inability to understand what drives ‘Americans’ and what really matters to them. Valid point to also emphasize, is that according to surveys approximately seven out of ten candidates seemed to be dissatisfied with both candidates. Such results were persistently present in polls since a long time. However with elections looming closer, Democrats have new candidate while failed assassination attempt on Republican candidate shook the ‘reds’. Besides, we’re here to talk about gold and silver.

Yet, on this occasion we’d like to invoke opinion of Velina Tchakarova, who is an expert in the field of geopolitics with over twenty years of professional experience and academic background in the field of security and defence. She served as the Director of the Austrian Institute for European and Security Policy (AIES) in Vienna, and shares her expertise as an instructor at the Real-World Risk Institute. She also remains member of the Strategic and Security Policy Advisory Board of the Science Commission at the Austrian Federal Ministry of Defence and serves on the peer board of the Austrian publication Defence Horizon Journal.

Mentioned geopolitical analyst indicated, in her opinion none of the Biden-Trump duo will remain next president of United States.. This prognosis has been published in January 2024, at that time, everyone was convinced it will be Biden & Trump to the very end. Rumours on Joe Biden’s health issues basically just started to emerge in mass media. Although to some commentators, these concerns were more than justified at least as far as 2021. Above prognosis had been lied long time before appointment of Kamala Harris as a Democratic nominee and before Donald Trump’s trial finale. It also has been released long time before attempted assassination on Republican nominee – Donald Trump. Which - by the way – resulted in one of the most iconic photos in modern US history.

Seconds after attempted assassination - one of the most iconic photos in modern history. Source: https://edition.cnn.com/interactive/2024/07/politics/photographers-trump-shooting-cnnphotos/

Since then, President Joe Biden decided not to fight for re-election, Democratic leaders endorsed current vice-president (which wasn’t the easiest consensus) and Donald Trump was literally just mere centimetres from… full fulfilment of prediction. Nice one!

Cyclical and historical approach on gold during US elections

It’s not a surprise at all, that in perception on gold’s reaction, one have to avert its gaze towards dollar.

US dollar has a dual character meaning it has a cyclical nature, while also being the ultimate safe haven currency. Dollar tends to rally when growth is strong and rising faster than inflation if real rates are positive and/or improving and an improving fiscal and current account balance is often also supportive. However, it times of extreme stress coupled with a liquidity crunch, dollar switches to becoming a safe haven. On the other hand, gold loves chaos and rate cuts which seem to be likely before year’s end. Gold generally does well in an environment of lower interest rates/ bond yields and the weaker dollar that usually accompanies them.

Above could be attributed to certain cyclical repetitiveness. But let’s take a look via ‘red and blue’ magnifying glass on how gold behaved in the past.

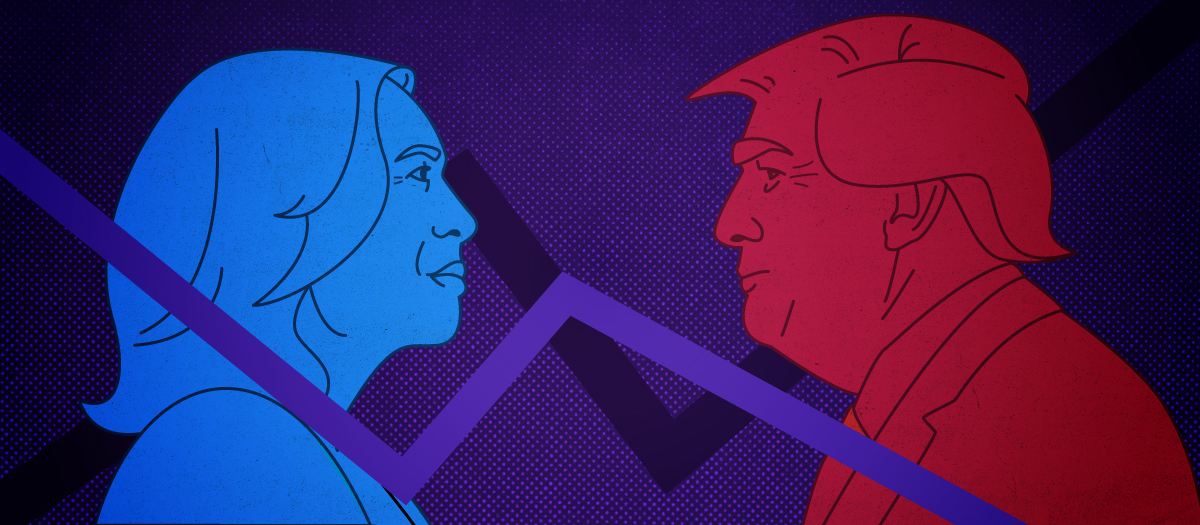

Historically, gold delivered higher returns under Democratic congress - by an average 20.9% under the Democrats but only gains an average 3.9% under the Republicans. That is due to Democrats tend to have more ballooned spending (among many, on social programs i.e. Llyndon Johnson’s Great Society), which adds to deficits and the debt, and in effect weakens the US dollar. During Trump’s presidency there were tax cuts, however he also spent lot of money and added to the national debt. Which made him somewhat of an anomaly among Republican presidents. Let’s not forget however circumstances accompanying his presidency – during so called Covid-19 QE, FED kept purchasing all classes of assets, saving market from crash and pumping liquidity to the system.

Gold rose in the lead-ups to both the 2016 and 2020 elections. During Trump against Hilary Clinton, yellow metal ran up about 50 USD and peaked just above 1.3k USD before the vote. Following Trump’s victory, gold fell to around 1,128 USD by mid-December, then rebounded above 1,200 USD in January, upon his inauguration. While Trump was president, gold rose from 1.2k USD levels to 1.8 USD. Factors included trade wars, geopolitical tensions and the Covid-19 pandemic. Trump’s protectionism and MAGA rhetoric incited BRICS nations like China and India to move away from the US dollar as the global reserve currency, and increase their gold reserves, pushing gold higher and somehow affecting USD.

During Trump’s previous presidency, dollar slid by 10%, while gold’s spot price rallied by 60%. Of course, not all of percentage-wise values can be attributed to actions of republican ex-President. However currently he runs on platform of tax cuts, tariffs and weakened regulations, which are being perceived by Wall Street as inflationary. In theory, these may even force Federal Reserve to increase interest rates instead of making long awaited cuts. Unlikely scenario but cannot be entirely ruled out. So should United States experience ‘red wave’ this may be perceived as positive for gold.

Gold under various US presidents. Source: Bloomberg

Said 60% gain during Donald Trump’s presidency isn’t the biggest gain experienced during single presidency in United States, as gold also performed well during George W. Bush and Jimmy Carter. First term of Barrack Obama was also very good period for yellow metal, although it was 2007-2009 financial crisis that occurred then, so on the other hand it wasn’t best period for markets generally. However, for majority of his second term, gold lost lot of gains made due to introduction of quantitative easing programmes.

Then in the week before the 2020 election, we have been already on a different price levels for our beloved precious metal. Gold traded around 1,900 USD. After Biden’s victory over Trump, it hit 1,951 USD then dipped below 1,800 USD amid vote recounts and legal challenges. Gold started climbing again in December, after Biden’s victory was confirmed, and after the infamous 6th of January attack on the Capitol in Washington. Under Biden, gold prices continued their upward climb, reaching a record-high of over 2.5k USD. Although they were horizontal or majority of his presidency, and went highly up since Q3 2023. While Biden made efforts to mend relationships with allies, he presided over sanctions against Russia for invading Ukraine. The US and its allies also froze 300 billion USD of sovereign Russian assets, prompting many developing countries again to buy gold, as it is worldwide recognisable and neutral asset. After all it cannot be just ‘printed’.

Central bank gold buying acceleration occurring under Biden and this, along with physical gold purchases in Asia, has been the main driver behind the gold price, despite a high dollar and elevated US Treasury yields. Both resulted from the Federal Reserve hiking interest rates to reduce inflation, which accelerated rapidly following the easing of lockdown measures implemented during the pandemic. Biden continued Trump’s policy of pressuring China. His Inflation Reduction Act and Chips Act aimed to distance US dependence on China and seek to build Western supply chains for industries including electric vehicles and semiconductors. In response, China has accelerated de-dollarization, dumping 50 billion USD worth of US Treasuries and other bonds during the first quarter of the year.

On top of that we experienced ‘events’ like war in Ukraine, Israel’s pummelling of the Gaza Strip following Hamas’ attack, Israel-Hezbollah conflict, and Houthis in Yemen effectively ceasing maritime logistics via Red Sea. Although it had nothing to do with Biden, yet has to be consider supportive for gold prices in 2024.

During ongoing Joe Biden’s Presidency, gold mostly experienced sideways moves, which finally turned into move up initiated at the end of 2023. This was approximately 30% move, attributed to general macro environment, and escalated demand shown by central banks.

Reds and Blues under the star-banner

But what’s the possible short-term approach? Most likely volatility is to be expected – that’s for certain. But generally, all views are not free from political bias, which in recent years escalated highly along with political polarisation.

According to World Gold Council’s recently released report, US elections had not historically impacted significantly or even immediately gold performance. Of course, in short term there is space for certain volatility to occur, but most likely it will signify fears of market participants rather than general macro direction. It is because gold doesn’t respond to political affiliation of candidates, but rather to specific long-term policies and macro factors. Hence it is direction of US dollar, interest rates, risk perception, economic, fiscal and monetary policies of a specific administration.

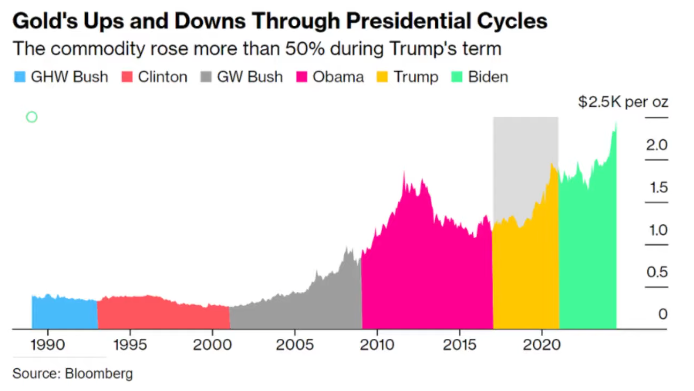

In somehow contrary opinion comes U.S. Money Reserve, one of the nation’s largest distributors of government-issued precious metals. Since 1980, in the two-week periods following a presidential election, Democratic victories saw an average gold price increase of 0.5% while that same period for Republican victories produced an average price drop of 1.1%. The impact is even greater during the period between Election Day and Inauguration Day. Democratic presidential election wins led to an average gold price increase of 1.5%, while Republican wins brought a 5.5% decrease on average.

Short-term after elections, gold favours Democratic presidents. Mostly due to less conservative in size and very progressive in size budget and promises. Source: U.S. Money Reserve analysis of gold spot prices

This effect may be attributable to gold buyers associating fiscal conservatism of Republican presidents with lower rates of inflation and a stronger dollar. On the other hand, progressive fiscal policies that favor increased government spending may be perceived by gold buyers to produce higher rates of inflation– wrote Brad Chastain, U.S. Money Reserve director of education.

According to Bloomberg survey, gold seems to be considered as nearly perfect safe haven asset in case of potential Republican candidate win. Interesting that on late June 2024, exactly same approach has been advised by Goldman Sachs. On said survey, participants indicated on gold in 53% while 26% pointed at dollar and remaining 21% on Swiss Franc. Effectively, of 480 respondents, 74% would bet against dollar. In yet another survey, 2/3 respondents had shown believe that second Trump presidency will undermine dollar’s status as informal world’s reserve currency. Generally, Trump’s policies are being perceived as aiming towards weakening of USD and therefore boosting up gold as a side effect.

Above is not entirely free from political bias of individuals and entities expressing, so let’s check what to expect of gold upon different outcomes.

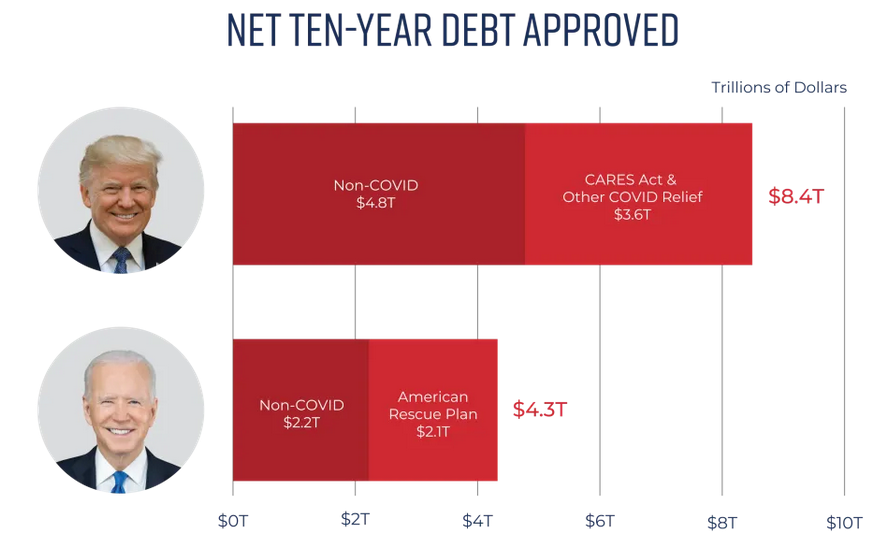

Both candidates have big fiscal plans that could blow out deficits and add to the already substantial 35.4 trl USD of national debt. Biden has so far approved 6.2 trl USD of gross new borrowing, while Trump approved 8.8 trl USD of gross new borrowing during his term. If Trump wins, he could take a wrecking ball to Biden’s greatest legislative achievements: four laws containing 1.6 trl USD in loans, grants and tax credits meant to subsidise, incentivise and force green the economy, revive the country’s manufacturing base, repair significantly neglected infrastructure and challenge China for technological supremacy.

Trump would go the other way with taxes, seeking to make his 2017 tax cuts permanent. However, most of the tax cuts expire on with beginning of 2026, and under possibly divided government they are unlikely to be renewed. While estimated 6.1 trl USD cost of Trump’s tax plans may be partly offset by higher tariffs, Trump’s tariff raises could be inflationary and lead to a fresh round of interest rate hikes to hold inflation in check. Yields and the dollar would therefore both move higher, creating headwinds for gold.

Debt in making by recent US presidents. Source: https://www.crfb.org/papers/trump-and-biden-national-debt

Republican victory may probably result in a stronger dollar, but the dynamics seem to be more complex. This is especially if we’d dive onto US politics. If Trump is to become President of the United States, would have control over the Executive branch. Then very soon he would be able to input his candidate to Federal Reserve, as Jerome’s Powell second term ends in May 2026. In addition, Republicans already own Supreme Court. He would appoint a new Attorney General to lead the Department of Justice. With very likely possibility to maintain majority in House and strong chances to gain one in Senate, therefore his Presidency would be fully weaponized.

If there is a Democratic Victory (partial or full) we think implications for the dollar would be limited. Of course inflation is expected to persist and possibly to come down, but policy rates are to decline faster than inflation. As a result real rates will decline as well and this is negative for a currency. Growth developments also may likely have neutral impact if the president is a Democrat. Under Democratic victory, continued deterioration of fiscal balance which could weight slightly on the dollar. However in such modelling we have to assume constants – that is continuation of general trends and not adding new hot spots.

If the Republicans win the elections, it is likely that the dollar will move in an erratic manner. Volatility is mainly the result of the shifts in sentiment but ultimately, we would expect the dollar to strengthen. Under a full Republican Victory (the Hose, the Senate and the POTUS) trade balance could initially improve as result of the trade policies/trade tariffs. In addition, the US would be subject to higher inflation compared to other countries and US interest rates would rise faster than elsewhere. With the Fed raising rates just as the ECB continues to lower rates, the widening interest rate differential is likely to weigh on the euro, most likely to below parity. Given the upward impact on inflation stemming from a significantly weaker euro, we think the ECB would be mindful of the policy divergence with the Fed and would seek to balance the need to support the economy via lower rates against the need to hedge against upside inflation risks via currency weakness. Related to this, a weaker euro would by itself do some of the easing work for the ECB, as it would (partially) offset the competitiveness hit from higher trade tariffs. This in turn lessens the need to cut rates. Given how iterative the various macro-economic, financial market, and policy interactions are, there is naturally significant uncertainty around the precise policy path central banks would adopt. A weaker euro than we posit here could mean fewer ECB rate cuts, while a more limited FX market reaction could give the ECB more room to lower rates than we describe here. These developments play out in the coming months and years. But later during the presidential term we expect the dollar to weaken and more than offset the initial strength based on developments in the macro-economic picture.

ABN AMRO projected outcomes on GDP growth, CPI, unemployment and FED rates, depending on the elections outcome. Source: Abnamro

Not only could the dollar be supported by the pricing in of initial positive dynamics the dollar could also strengthen on safe haven demand (for its liquidity) if markets were to turn risk averse or even panic. While if sentiment calms down the non-favourable policies will start to weigh on the dollar again.

Will it shine? Oh, shine it will, only timing is a different matter

What we experienced in recent years is evolution of the gold market from classical, book-based safe haven and jewellery market to a market where investment decisions play a more crucial role is important. Indeed, since the introduction of gold ETFs (far away in the distant time, since March 2003) gold has developed more into a speculative asset and behaved less as a safe haven asset. Of course, there are still investors buying physical gold for safe haven purpose but the flows into non-physical gold have often been of great significance. Still however, gold is perceived as cure for developments in US dollar, monetary policy and real yields, which have become dominant drivers over time.

And by the way – considering ‘sustainability’ is such a fancy and often invoked word, it is pity politicians cannot apply it to monetary policies and instead decide to indebt future generations.

This view has somehow changed in central banking perception as establishing gold as tier 1 asset, made it an important part of central reserves, which had been confirmed by pace of gold purchases made by central banks occurred in recent years. Especially due to these developments, gold had grown in prominence as independent, recognisable and trustworthy asset.

And so, yellow metal remains not only securing asset, but also versatile. Comparison of gold and SP500 in 2024 made return on investment ratio only proves this.

So what is the general outlook of markets on gold when USA would become Kamala-land or Donald’s playground? Upon Democratic victory, markets believe gold prices could be very modestly supported because of modest decline in or a neutral dollar and some lower real yields. However upon Republican victory all depends on severity of tariffs and therefore we have complicated dynamics. In the scenario of a full tariff implementation, first years of the presidential term inflation may increase, Fed would be forced to hike and the dollar to rally because monetary policy divergence and weakness elsewhere. After all, we experienced already some cuts by ECB and BoE. As a result, gold prices could initially suffer. However soon after that, dollar could weaken and real rates come down. This will give room for gold prices to rally again and move beyond the highs set in 2024.

Both outcomes are however just outlines, and reality may easily verify them, especially since we experience such geopolitical dynamics. So outlook for gold in the long-term seems to be persistently good.

At the end, please bear in mind above is not financial advice whatsoever, but only author made considerations regards to subject.