Comment on occasion of latest price growths on gold and silver

G old: on 3rd of April 2024 closing price at 2299 USD. On 4th of April, intraday high at 2305 USD. On 5th of April closure at 2329 USD. Breached resistances, full price discovery in nominal values, parabolic movement. Silver: on 3rd April 2024 closing price at 27.1 USD. On 4th of April intraday high at 27.3 USD. Next day closure at 27.4 USD. Breached 26 USD resistance, attempts to move up..

Everything grows, and so PMs

‘May you live in interesting times’ – says old Chinese curse / proverb. Following simple market cyclicality should prove us these will eventually come, even if wait was prolonged. And if in doubt, since 2020 we really shouldn’t be. Even with application of unusual financial containment solutions and extraordinary actions, with the end of 2019 but especially since 2020 we’ve crossed certain point of no return. Covid pandemic, Covid QE, ongoing shock therapy on logistics, gas and fuel crisis, outbreak of wars on Caucasus and Ukraine, Middle East being close to explode yet again, mini-banking crisis in US and EU - all of that only proves, relative calmness of second decade of second millennium is now over. And what is it we experience nowadays? Persisting inflation and currency debasement? Check. No return to near-zero interests’ rates? Check. Physical goods, including commodities on rise? Check. Extreme polarisation? Check. Governments spending like there is no tomorrow? Check? Defence spending to be handled with more leniency if they exceed the EU’s deficit rule that limits member state budget deficits to a maximum of 3% of GDP. Check or check soon to be. On this occasion, financial system based on rolled-out debt and dominance of US dollar showed great resilience and made us absolutely curious on things to come.

Esteemed reader - please don’t take us on this occasion as fearmongers, apocalypse prophets or panic spreaders, as our conclusions are simply based on comparisons, historical analogies and financial analysis. And we listed all of that for a reason, which we’ll going to explain later. Anyway – for now world didn’t end, sky did not fall on our heads, and we’re her to live yet another day.

Among old Chinese proverbs there’s also another one, apparently Chinese, probably old, but most likely forged in modern times – ‘If you don’t know what to say, say old Chinese proverb’. And as we have couple things to cover, it’s time to get straight to a case. And it is very heart-warming case, as it is our pleasure, to provide comment on recent price growths occurred on yellow and white precious metals. And that is something pleasant for the eye, as:

- Gold: on 3rd of April 2024 closing price was at 2299 USD. On 4th of April, intraday high at 2305 USD. On 5th of April session closure at 2329 USD. Gold had breached resistances, is in price discovery mode in nominal values, and continues its parabolic momentum.

- Silver: on 3rd April 2024 closing price was at 27.1 USD. On 4th of April intraday high at 27.3 USD, although day ended with modest drop. Next day session closure was at 27.4 USD. White metal breached 26 USD resistance, attempts to move higher.

XAU and XAG in percent wise growths in 2024. Silver surpassed gold jus very recently. Source: Tradingview

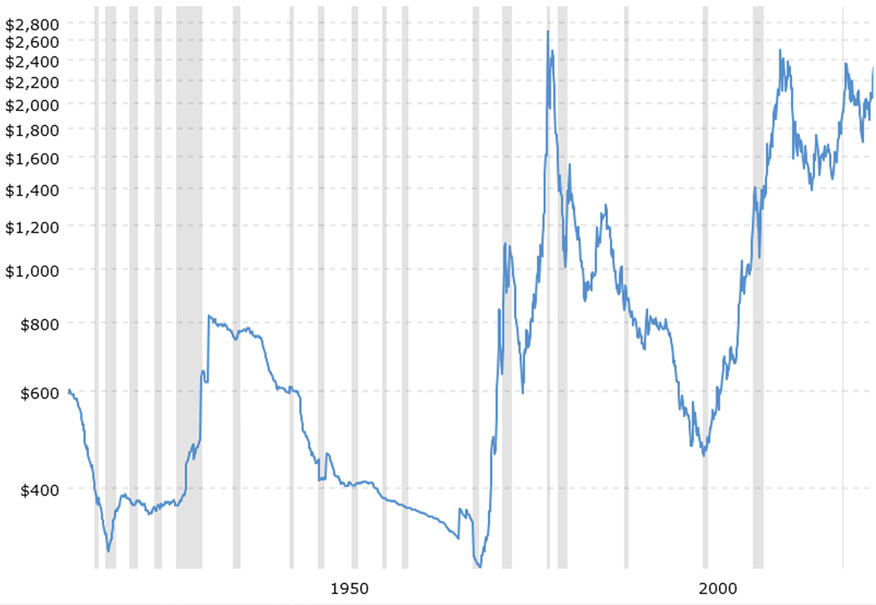

If we need to find important resistance levels for silver, we should turn our eyes onto 28-30 USD range now and observe momentum and price action against above. For gold matters seem to be simpler, as horizontal resistances are breached, psychological barrier of 2000 USD is breached, same with trend lines based on nominal tops. So there’s clear blue sky and nominal price discovery ahead for gold. Unless we’d check gold price inflation adjusted (so not nominal, just artificially calculated), only to discover that approx. 600 USD of nominal price reached in 80’s, would be now over 2500 USD. But let’s just make thing simpler and enjoy price growths and profits made, without unnecessary malcontency.

Gold prices CPI adjusted. Source: Macrotrends

On other commodities worth mentioning, we also experienced modest growths on platinum and palladium, while doctor copper recently started moving higher in stronger manner. Same with nickel’s price which joined inflationary party. We also experienced growths on oil – both WTI and Brent – which are most important benchmarks to us locally. However, at this very moment these are soft commodities that dominate on returns. Prices of cocoa futures recently dominated commodity and financial landscape, reaching 10k USD per t. This price action is being followed by orange juice - market of constant, ongoing and permanent crisis. And it seems coffee may become hot as well.

All of that happens while vast majority of investors present optimism and sanguinity on the market conditions. At least officially. And so, we have strong economic growth which should be restraining for gold. We have relatively strong dollar, usually that is bad for gold as well. Global demand for US Treasuries – again. Even generally declining inflation. So all the market positives, usually in normal conditions perceived as adverse for safe haven metal. And yet they continue to grow. As we experienced important technical breakout on silver, and continued momentum on gold, there is a need for situational update. So we strongly recommend to read this market update along with our previous analysis ‘Ladies and Gentlemen, we got it! - all time high on gold’ which covers recent price action on gold in more technical approach.

Short-termers and speculators joined the game on gold

Breakout from 2000 USD occurred in February and since then we had two-stage price growth occurred in March and April 2024, that is end of Q1 and start of Q2, so basically on borderline or past of typical cyclical good period for precious metals – as it is usually Q4 and Q1 providing price growths. So why? Answer lies in expectations. With geopolitical, political and financial tensions, imbalanced fiscal policies, end of Bank Term Funding Program and many other, certain type of recession seems to be imminent.

Over 2300 reasons to be long-term bullish. Even with red hot daily RSI. Source: Tradingview

For all the reasons listed so far and macro environment sketched in 1st chapter of this analysis, even despite of prevailing market optimism, we’re seeing that long-term gold investors had been joined by short timers, making purchases based on positive price action and attempting to jump to the pace increasing train. And just recently we’ve also seen investors being increasingly interested in silver, which is widely considered as undervalued in relation to gold. Strong safe haven investment in times perceived as economic strength means, some investors present anticipatory approach with regards to current state of affairs, expecting supportive market conditions to become more turbulent if not adverse. After all, US KPIs and indicators are not that hot as they used to be, UK seems to be in technical recession, Germany in shallow recession. Despite of ‘success propaganda’ investors seem to notice that interest rates will remain ‘higher for longer’, soft landing may be turbulent and ‘no recession’ slogans were slightly overrated.

And so, investors purchase US dollar, US treasuries and gold as a risk aversion asset in expectation on political and financial (especially fiscal as we described already in the past) factors to worsen in near, not set in stone to the day and hour future. Apart of that they are in fear of production costs which leads to supply/demand imbalance, and issues on commercial estate market, worsening quality of corporate and national debt, market ability to sustain growths, etc. Speculators and short term investors decided then on at least partial capitalisation of gains made on i.e. stock markets, and to purchase safe haven assets. Popular professional investment wallet of 60/40 proportion of stocks and bonds simply cannot deliver stability anymore, and so there is a need to have some sort of exposure to safe haven or at least assets perceived as value holding. At what size? This is entirely individual decision based on individual assumptions and risk aversion.

US dollar (cash) is one natural as it enables quick re-investment and is perceived as ultimate recognisable asset. It is being affected by fiscal policies of United States, but at the same time it acts like a magnet for investors upon market issues. US treasuries provide yield, but also their market value upon necessity to sell may be questionable. Big question is – whether current yield is going to grow even more in short term or remain stable at least for certain period of time. However yet again -recognisability and liquidity behind US treasuries are important. And finally gold, considered as ultimate defence - safe haven.

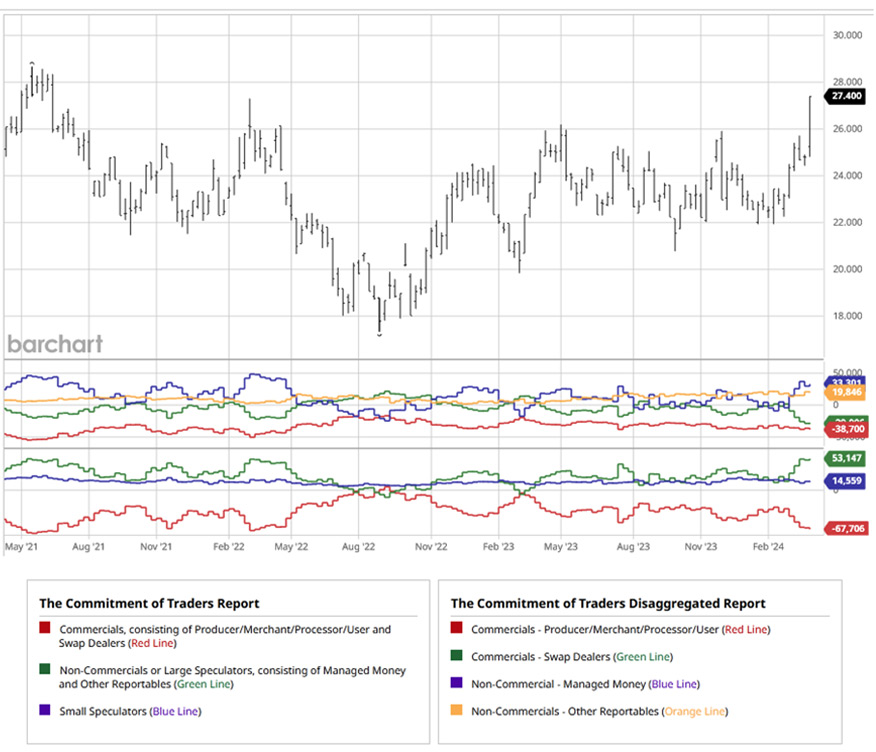

So, gold had benefitted from uncertainty. In the last few weeks, world of precious metals had been visited by large flock of speculators and short-term investors. Hence, we see 6 mln oz increase in non-commercial institutional long positions on Comex in March. These are short-term investors, who saw price growths based on what had happened to long-term gold investors and decided to participate in strong price momentum. Whether for personal benefit or simply to maintain certain targeted commercially return on investment – reasons vary. At the same time not much could be said on commercials - net shorts of market makers had risen, simply due to increase in longs made by said non-commercials. Market always acts on balanced basis – would someone plays longs, market makers cooperating with exchange must issue similar net number of shorts. Conclusion – sectoral growths had been magnified by short-term capital seeking profits and / or safety.

Non-Commercials or Large Speculators, consisting of Managed Money increased net longs, however still far from record levels. Source: Barchart

But on the interesting note – we also have certain changes on behavioural patterns on ETFs. During first part of the month ETF holders decided to sell shares of ETFs yet another consecutive quarter, starting in 2020 and continuing trend through Q1 2024. Trend seemed to grow in strength in first part of March, while gold prices were going up. So they simply decided to realise profits, liquidating ETF shares. Let’s provide quick reminder on ETFs on this occasion. They give price exposure on gold and silver, their shares are backed up with physical gold or silver, but they do not deliver physical metal on demand which remains stored in Comex or LBMA vaults. As de facto ETF is form of financial product, it bears counterparty risk and even with its best performance, remains part of larger portfolio of issuing financial institution. Of course we’re far from declaring i.e. VanEck, Vanguard or Blackrock insolvent due to potentially adverse market conditions. But it seemed due to safety reasons investors preferred to have exposure on gold and silver price via physical metal hold in personal ownership.

Then, in second part of the month we have experienced this trend to reverse, but most likely just as short-term phenomenon. During second part of the month, short-term investors and speculators encouraged by growing gold prices, rushed to gold ETFs, in attempt to obtain price exposure and in result contributed to growth of assets under management on various gold backed ETFs. However this is nature of momentum, when speculators simply seek price exposure. This move is widely perceived as to persist for a short period of time, and then yet again we should experience ETF outflow benefitting physical volumes. Relation between these two, but also historical comparison m/m and q/q will definitely be something interesting to analyse.

Important price breakout on silver occurred

Silver – next to copper - remains main industrial metal, used for electronic purposes. In addition it is metal treated with high esteem on Asian markets and had its global rebound in jewellery’s sector in 2023, as we pointed out in our analysis on 2023 silver trends. Typical cyclicality implies higher demand for physical silver to occur in October-November, before Indian festive season – Divali. Then right after, demand for physical metal is yet again increased, this time by the needs of customers celebrating Chinese New Year. So as it is in case of gold, Q4 and early part of Q1 usually benefit prices of white metal. Such occurred and has been followed by its decline during January and February However March indicated positive price action which has been prolonged to April. Recent price growth indicates two factors. First is of course surge in industrial demand. Second would be increased speculative investment demand. In addition, fundamental factors as described above benefit inflationary price re-bound on metals and assets. Let’s not forget on this occasion on expected easing of monetary policies in EU and Eurozone along with UK. Even if small in size due to ‘higher for longer’ policy is expected to support cyclical commodities like silver.

2024 price action on silver. Source: Tradingview

Same could be said with all possible political and geopolitical tensions. On Friday 5th April, May silver contracts reached high and nearest-futures Apr silver posted 2-year high. Precious metals rallied on heightened geopolitical risks between Iran and Israel. Iran has threatened retaliation against Israel for launching airstrikes on Iranian military officials in Syria, boosting safe-haven demand for precious metals. Like we had not enough reasons for growths.

Additionally, fund buying of silver supported white metal’s prices, after assets under management in ETFs rose to a 7-1/4 month high on Thursday. Silver’s price movement tend to lag gold, however this had changed in recent days, as silver finally moved higher. XAUXAG remains high as growths on gold were simply first. Silver will continue to lag gold for now, as investors are currently focused on most obvious safe haven, but there are definitely some upsides for silver bulls on short-term basis.

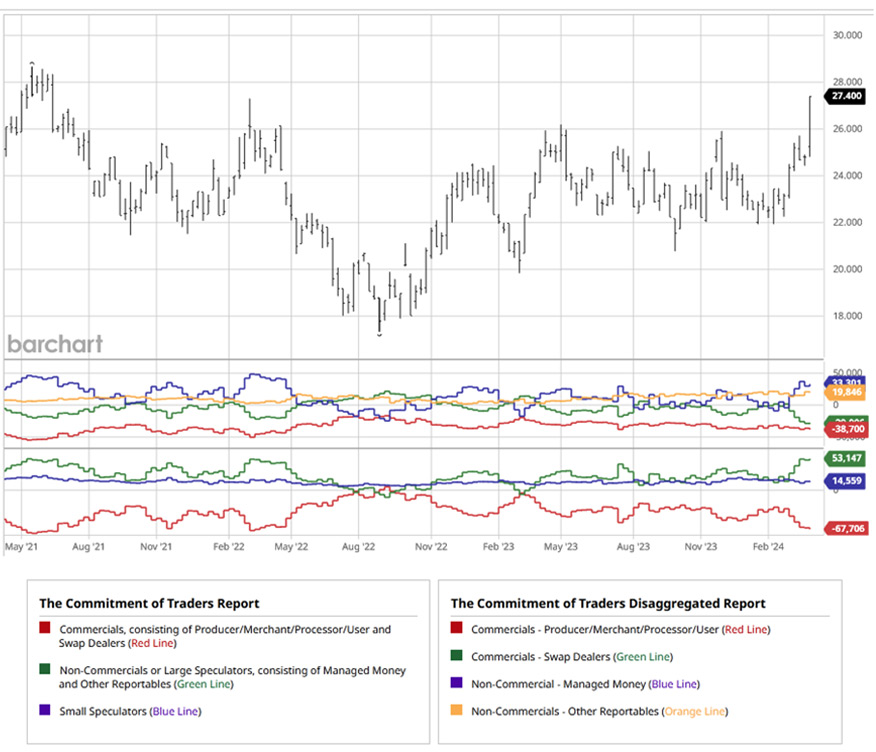

Silver has historically been a highly volatile precious metal that attracts trend-following and speculative activity when significant trends develop. While standard deviation (a measure of volatility) in gold price in between 2006 to 2022 was at 13%, silver has reported 26.5%. That is a reason behind lack of perception on silver as typical ‘safe haven’. However, as a more cyclical commodity that works as a tactical bet rather than a long term investment, silver may give a bigger and better return on investment, but will also likely bring higher volatility in its wake. So with general perception on silver s investment as above, many market participants remained relatively inactivate. However recent price break on gold naturally triggered price movement on silver and growing interest on white metal. This finds confirmation in COT on May contracts, where Non-Commercials and Large Speculators clearly increased net longs to 53k contracts. This is highest number since April 2022.

Non-Commercials or Large Speculators, consisting of Managed Money increased net longs. Source: Barchart

With regards to price action, long-term we had breakout to above 20 USD levels in 2020, then consolidation with several attempts to break above 26, 28 and 30 USD. However with every year, silver’s trading range was narrower. That is with exception of 2021, due to post-covid demand rebound when prices simply remained high and less volatile. So silver remains more and more consolidated. Let’s hope we’re dealing now with permanent price breakout, which would lead us to 30+ USD levels.

- 2020- $11.735 to $29.53 = $17.795

- 2021- $21.459 to $30.16= $8.701

- 2022- $17.32 to $27.32= $10.00

- 2023- $19.83 to $26.20= $6.37

- 2024- $21.925 to $27.42 = $5.495

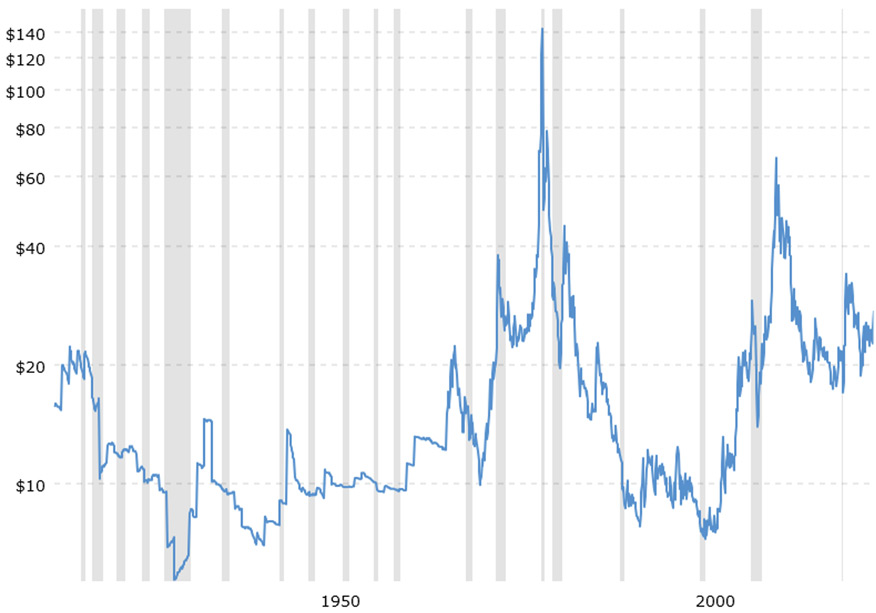

Year 2011 brought very brief moment when silver reached 50 USD price. Similarly it happened in January 1980, when price of white metal topped at 48 USD. These two are being considered as nominal all-time highs, although absolute tops occurred during trading days just for a brief moment. But as we did previously for gold, let’s take a look on silver prices inflation adjusted. On the chart below, both records seem to be much higher. With currently persistent inflation on food, WTI on 86 USD and variety of logistical and production issues around the world, CPI should persist troubling, although not as much as recently.

Silver prices CPI adjusted. Source: Macrotrends

Of course, all above prices are Comex and LBMA. However, should be not surprising, that China value silver (and gold) higher. Normally such arbitrage is nothing unusual, but with regards to Asia-USA it remains elevated since good couple months. White metal is nowadays (8th April, Monday, before European markets opening) at 30.68 USD I China.

However, with regards to international futures world sticks to NYMEX/Comex valuations. And so what we see on charts - in example at 6am Monday Morning - are actually these prices. Tel Aviv opens first (already works on Sundays), then we have Far East Asian markets, then Europe, then eventually America. On Monday 08th April 2024 on Asian markets, before European opening, silver initially reversed to 26.8 USD and then within 100 minutes firmly ascertained 28 USD price levels, only to correct shallowly.

On this occasion, Shanghai Futures Exchange silver futures already hit 7% limit up on Monday morning, while gold rose 3%. Such move of course affected valuations of local silver (and gold) miners. What that means is, market believes that after breaking through four years consolidation, we may finally have gates wide open for new heights.

With recent growths, silver yet again had been surrounded by lot of… misinformation. Yet again we experienced growth of propagators presenting long-term AT chart with cup and handle formation in development, which is now being build up for over 40 years. Unfortunately, some people don’t live that long. However, what is good of such chart, at least they show we’re on the verge of break trough. There are also other as well, who claim that silver is key to break bankers and banks and that said institutions are being afraid of white metal. Silver’s global market cap is at 1.5 trl USD, exceeding nowadays Bitcoin’s market cap by over 200 bln USD. It could send some shocks to financial markets and even break bones, but definitely not set fire under whole banking sector. So, on this occasion, please be aware of conspiracy theorist.

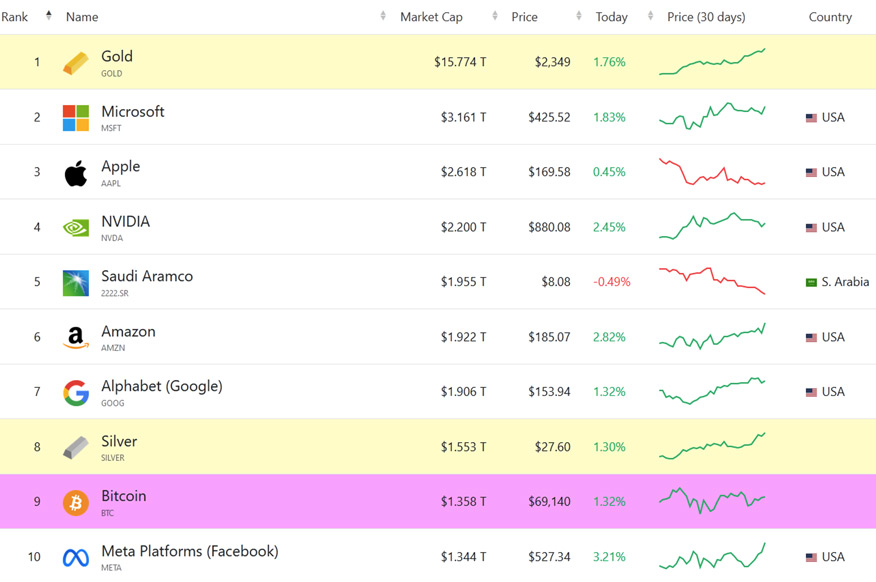

Top 10 assets by market capitalisation. Source: https://companiesmarketcap.com

Summary

Both precious metals provided us recently with reasons for joy. Price action is being supported by momentum, fundamentals, pricing in recent developing global tensions. Possibly also looming possibility of rate cuts, which we believe won’t occur at least until June/July. However, on daily RSI, silver remains over 70 and gold over 80 marking them technically overbought. So there is possibility of technical correction, however assuming fundamentals won’t change, there is possibility it may be shallow. Of course, this is not financial advice in any way, however it seems that current pros of owning and purchasing gold and silver definitely outweigh cons. Even after such price growths.

After all, ‘trend is your friend’.