What’s with price of platinum and palladium in 2024, and onwards?

-->

-->

Platinum and palladium - industrial precious metals. Predominantly used in industrial sector. Interesting option, to be treated not as store of value but form of exposure to above. What could become catalyst for their price growth? Condition of automotive sector, sanctions, mining and regulations on emissions. Following this logic, today predominantly on… catalytic converters.

On environmental related policies

Without what component modern car wouldn’t be able to perform its assumed duties? ‘Wheels’ would be one answer. Correct of course. When seeing car it’s its body and wheels we notice first. With no wheels we wouldn’t be able to move from point A to B and had remained immobilized. ‘Engine’. That’s good one as well. It is simply a beating heart of every combustion tech utilising car, making it alive and running. ‘Breaks’ - again, correct answer as ability to ‘stop or slow on demand’ is logically important from health and safety point of view. ‘Gears’, yet again good answer as gears shifting enables to utilise engine’s power onto movement, pace increase and eventually – quoting Jeremy Clarkson – ‘Speed!’. Truth is, every main automotive component has certain role and function and together they form firm and strong frame, on which manufacturers may install fancy cockpits, elegant bodywork, all electric components, heated seats and upholstery made of posh treated leather.

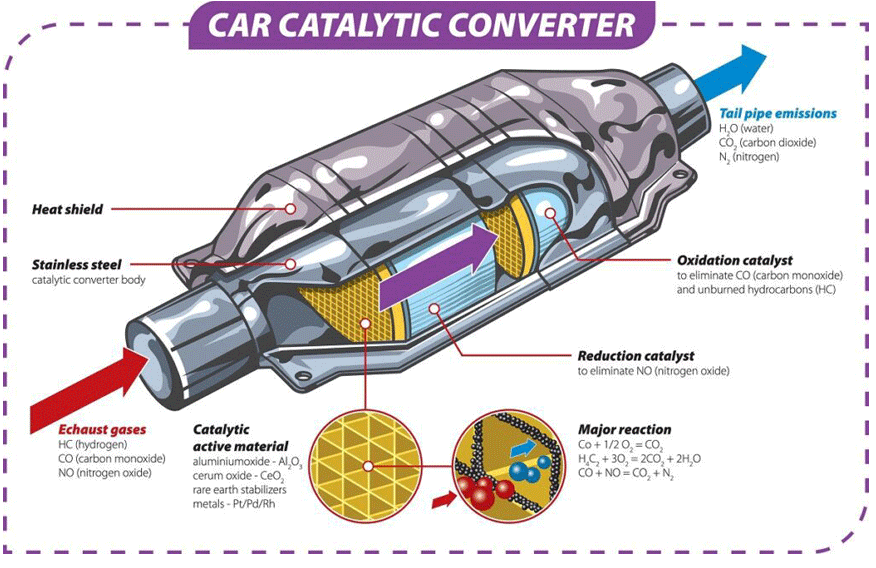

But in recent decades another component emerged, considered nowadays not just ‘important’ anymore, but essential - catalytic converters. Catalytic converter is a device used to convert toxic vehicle emissions to less harmful substances by way of catalysed, or accelerated, chemical reactions. Most present-day vehicles including automobiles, trucks, buses, motorcycles, and planes, have exhaust systems employing a catalytic converter. They convert over 90% of carbon monoxide and oxides of nitrogen into less harmful carbon dioxide, nitrogen and water vapour. Precious metal catalysts are very effective and stable at high temperatures, and they are durable enough to last lifetime of a car. Although inert as a solid metal, when finely divided as nanoparticles they become active catalysts, so only a small amount of precious metal needs to be used to remove harmful pollutants and particulates from the air we breathe.

From technical point of view, you can drive without catalytic converter. But doing so, would be illegal and punishable.

Catalytic converter was invented in the middle of the twentieth century to purify automobile exhaust. Technique uses relatively simple concept of combining platinum on base metal oxides with high specific surface area, then coating and sintering together on a porous ceramic carrier. Technology didn't really come into use until the 1970s, when the Clean Air Act of the United States required new cars to be equipped with catalytic converters. In Europe this entered serial production in 1985. Then by the late 90’s, social and legislative pressure forced changes in automotive sector in attempted to improve poor air quality. Lead in fuels, which in effect makes catalysts toxic, has been widely banned. Refineries began to remove more sulphur from the gasoline and diesel fuels they sell.

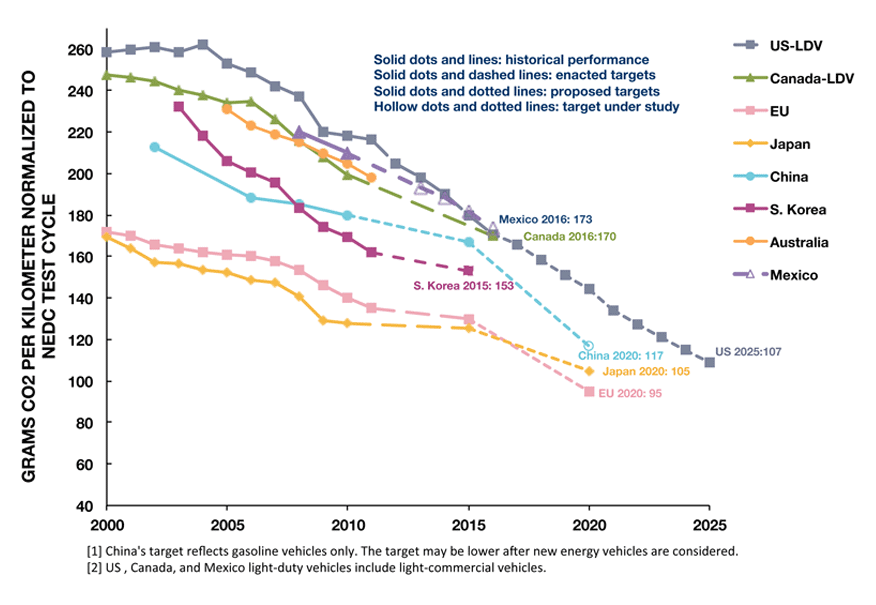

Grams of CO2 per kilometre normalized to NEDC test cycle. Source: https://www.automotive-iq.com/powertrain/articles/emissions-regulations-force-manufacturers-across-world-clean-their-act

Nowadays, it even has been within framework on international levels. United Nations Environmental Programme created Partnership for Clean Fuels and Vehicles, which recognizes that fuels and vehicles work together as a system, and that greatest benefits are achievable by combining cleaner fuels with appropriate cleaner vehicle and emission control technologies. And so, worldwide implementation of emission standards and effective inspection and maintenance programmes will ensure vehicles emit fewer pollutants. Main aim is to cut greenhouse gas emissions, protect environment etc. but – let’s be honest - that is also form of additional taxation supporting ballooned expenditures of heavily indebted governments.

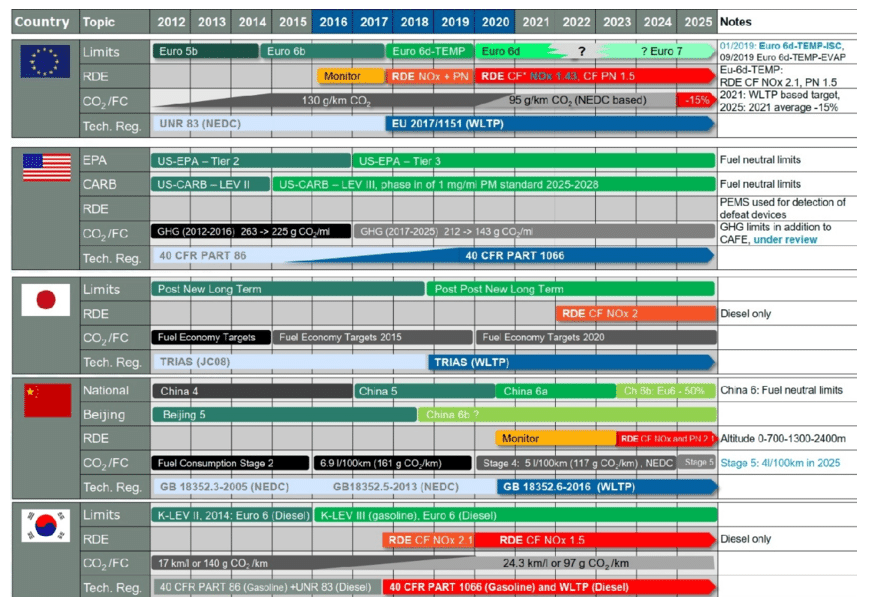

Pace implementation of said policies, along with certain policies are often perceived as controversial and inconsiderate, often illogical, unjust, affecting economical competitiveness of regions or countries. etc. However with appropriation of media by policymakers, there is no space for consensus, consideration or dialogue on the matter, unless mass protests occur. Even then, all it matters is ‘sustainability’. And so, European Union remains on this occasion a global leader of changes, implementing most strict emission rules, with European Commission remaining one of the main funds providers to United Nations Environmental Programme. Since September 2022, minimum emissions standards for EU and UK are Euro 4 for petrol vehicles and Euro 6 for diesels. But it’s not just EU with its Euro 6 and aiming for even stricter Euro 7. China has its CNES, Japan JES/PNLT, India has BS, which is based on EU norms, US is on Tier 3 as set by EPA and aims for Tier 4, UK s compliant with EU Euro norms, etc.

We are really tempted to discuss on this occasion how emission norms pushed automotive industry towards downsizing, which in effect shortens engine’s lifetime. We could also discuss on how many automotive giants managed to circumvent ‘issue’ on emissions, which effected in ‘diesel-gate’. Yes –many – as things had slightly escalated since 2015. Then we could discuss how certain parts of the world dealt with said manufacturers differently. We could discuss cases of certain automotive brands who manufacture combustion engines causing very low emission, but due to legislation based on weight have to be perceived otherwise. Same with ULEZ and other low emission zones and inequalities they cause. And development of hybrid, electric and autonomous vehicles. And trend reversals. And manufacturing costs crisis. And hidden, in-direct and semi-direct costs of new ideas. On fuels…

But instead let’s just focus on precious metals in catalytic converters. Here’s palladium and platinum (and ruthenium).

Timeline of emissions standards for passenger cars in different parts of the world. Of course developing economies also participate. Source: S.M. Ashrafur Rahman et. cons. State-of-the-Art of Establishing Test Procedures for Real Driving Gaseous Emissions from Light-and Heavy-Duty Vehicles

Let’s talk on history and reasons for catalytic converters

Rhodium, platinum and palladium are our three metals in two combinations, present in converters. What makes us to opt for one or the other variant? In usual circumstances manufacturers would have to consider certain factors related to technology used in catalytic converters. And here on example of palladium for platinum and platinum for palladium swap, as it is cyclical process.

- • Cost Considerations: Platinum tends to be more expensive than palladium, so substitution affects production costs for automakers. However, fluctuations in the prices of both metals can influence cost-effectiveness of using one over the other.

- • Technology Adaptation: Automakers have had to adapt their catalytic converter designs and manufacturing processes to accommodate platinum-based catalysts. This adaptation requires investment in research and development to ensure optimal performance and compliance with emissions standards.

- • Supply Chain Dynamics: The shift in demand from palladium to platinum has influenced the dynamics of the precious metals market and supply chains within the auto industry. Automakers must navigate potential supply shortages, geopolitical factors affecting metal production, and environmental concerns associated with mining and refining these metals.

- • Emissions Compliance: The substitution of platinum for palladium aims to maintain or improve emissions performance in gasoline vehicles while addressing cost and supply concerns. Ensuring compliance with emissions regulations remains a critical factor for automakers, and the choice of catalytic converter materials plays a significant role in meeting these standards.

- • Of a light gasoline vehicle contains about 3 g. of platinum group metals, mainly palladium but also a small amount of rhodium. Gasoline engines have higher working temperature than diesel. And so palladium requires higher temperatures for chemical reactions to occur.

- • While system of a light diesel vehicle contains about 4-8 g. mainly platinum, but also rhodium and may or not contain small amount of palladium.

- Impala Platinum, a major industry player indicates output from South Africa’s mines to decline over the next few years. New projects in South Africa would take years to develop, while those in neighbouring Zimbabwe may be stymied by political and economic uncertainty, according to a company. In addition company offers voluntary job cuts – as per February 2024 info.

- Sibanye Stillwater - South Africa's biggest mining sector employer - plans restructuration and therefore closure of four loss-making platinum/palladium shafts effecting with loss of 4k jobs.

- Anglo American’s CEO – Duncan Wanblad says that margins for mining companies face declining ore grades and sharply increased input costs and so, ‘evaporate quickly’. Company aims to cut capital expenditure by $1.8 billion by 2026, after reporting lower profits and returns for the first half of financial year.

Catalytic converter chemistry depends on whether you have a gasoline or diesel engine - each need different catalyst systems. Today typical exhaust system:

Let’s emphasize above: Gasoline = palladium, diesel = platinum. For knowledge seekers we have slightly detailed ranges, dependable on engine size: cars = 2-6 g., light-duty trucks = 2-6 g., motorcycles = 2-6 g., larger-engine SUVs = 6-30 g., trucks = 6-30 g. typically, amount of rhodium in catalytic converter is anywhere between 1-2 grams, while amount of platinum ranges from 3 to 7 g. and amount of palladium ranges between 2-7 g. Of course comparison to past date would show increase in weight of platinoids per converter, which is an effect of implementation of new emission norms. On this occasion however let’s also not forget about technological progress. In 2017 Toyota announced new, smaller FLAD catalyst that uses 20% less precious metals in approximately 20% less volume, while maintaining same exhaust gas purification performance. Another one – pride of German chemistry – BASF – announced in 2021 development of Tri-Metal Catalyst. Technology allows partial substitution of palladium with platinum and is being introduced in smaller vehicles from 2022 and 2023.

Yes - partial substitution - that's the key. Because despite the immeasurable similarities in properties, there is one fundamental difference. Chemical reactions that cause trapping of harmful substances occur at lower or higher temperatures - depending on the metal. Thus, for higher temperatures (gasoline), either palladium or platinum can be used, and specifically platinum for lower temperatures (diesel). So why not just focus on platinum everywhere? Well, because production and recycling of platinum has been stretched to the limits for years, so if you can find a replacement without losing quality and even at a lower price, then why not?

Car catalytic converter. Source: https://blog.olx.com.pk/autos/what-is-a-catalytic-converter-and-how-does-it-work/

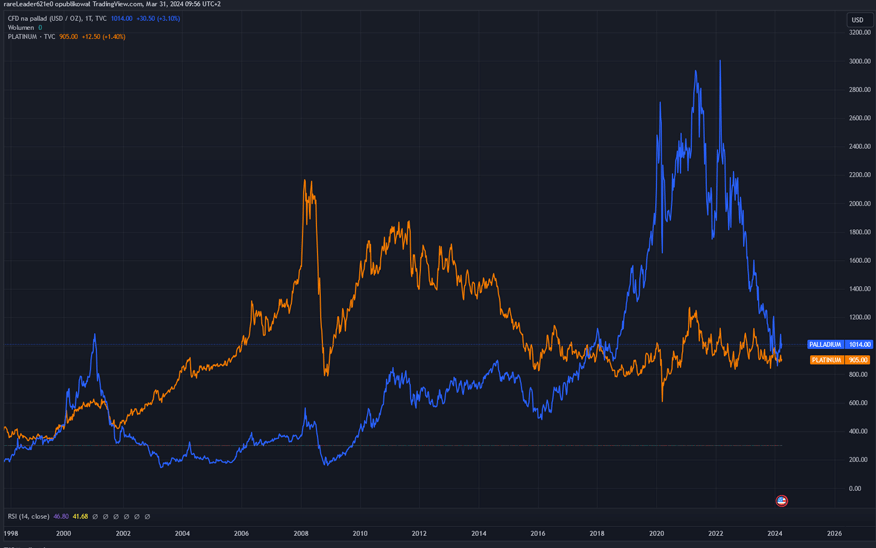

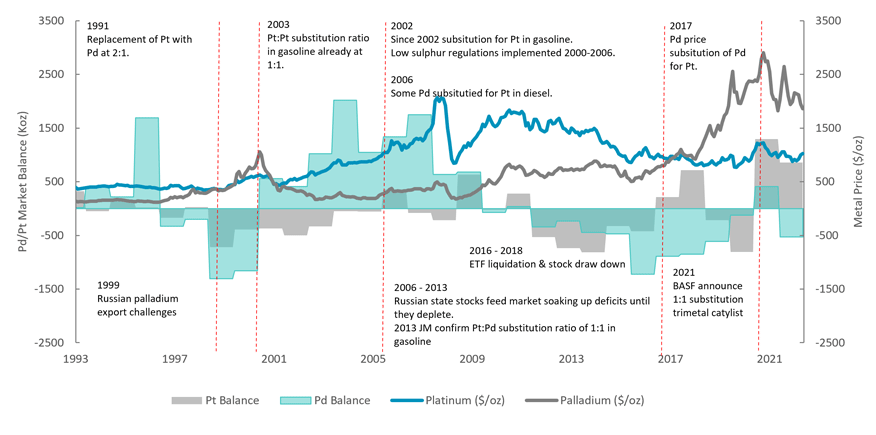

Coating amount of platinum group metals varies from region to region, which mainly depends on vehicle exhaust emission regulations of various countries, as well as vehicle size and engine type. Higher the coating amount of platinum group metals is, less the tail gas emission is, and better environmental performance is, so overall global trend is to gradually increase amount of coating. First generation of converters was based on mature platinum technology. However, late 90’s refineries started to remove lead and sulphur of fuels. Sulphur is particularly toxic to palladium-containing catalysts, so reducing its content meant possibility to apply palladium instead of platinum in gasoline engines. At that time, relatively low price of palladium meant its introduction and replacing platinum was economically incentivising. This gave birth to first generation of palladium based converters in gasoline engines. Due to technical reasons, platinum has been and still is main precious metal in diesel. Such rapid growth in palladium demand and supply disruption of palladium from Russia pushed palladium prices to record highs in 2000’s. At that time, car companies were sensitive to strong price of palladium and worried about not being able to buy it, so they changed palladium-rhodium technology in many catalysts to platinum-rhodium technology over next two years in order to control costs.

As could expect of tech-news sensitive metals, they remain affected by such. In 2004, Belgian company Umicore informed about its new tech that enables partial replacement of platinum in diesel engines with less expensive at a time palladium. Result? Increase of palladium price from 250 to nearly 350 USD per ounce.

Palladium and Platinum prices 1998 – 2024. Source. Tradingview

But of course change in technological process can’t be done overnight, changes in current projects are not allowed and swap of palladium for platinum or otherwise is being done on introduction of new models – which we’ll cover bit more in detail in last chapter of this analysis. And so, platinum price exploded with tops on year 2008, boosted additionally by increased demand coming from sector and from final customers purchasing four wheels. That’s on fundamental factors. But there is an event perceived as a trigger at a time. That was yet another recurring energy shortage in South Africa, which ended with few days long production cease. National supplier – Eskom Holdings – announced shortages, and as we know, stable electricity supply is necessary to mine and process minerals. But what differs past blackouts from current? After all, we deal with recurring occurrences. In 2008 few platinum producers were forced to cease production. Nowadays, Eskom announces blackouts on mobile app, which gives producers time to move or plan production to nightshift or weekends when general energy usage and supply remain more balanced.

Crisis of 2008 made platinum prices to dive down, however rebound made them to grow to 1800 USD levels within few years. But as its price had grown, car companies and catalyst designers gradually reversed back to cheaper and similar in effects palladium. During this period, two important events occurred. One was introduction of norms Euro 6 on new cars in EU, other was diesel-gate – both incentivising to use more industrial precious metals in catalysts. And so, palladium started its price growths, surpassing platinum.

Historic substitution between platinum and palladium in gasoline and diesel vehicles. Source: Bloomberg

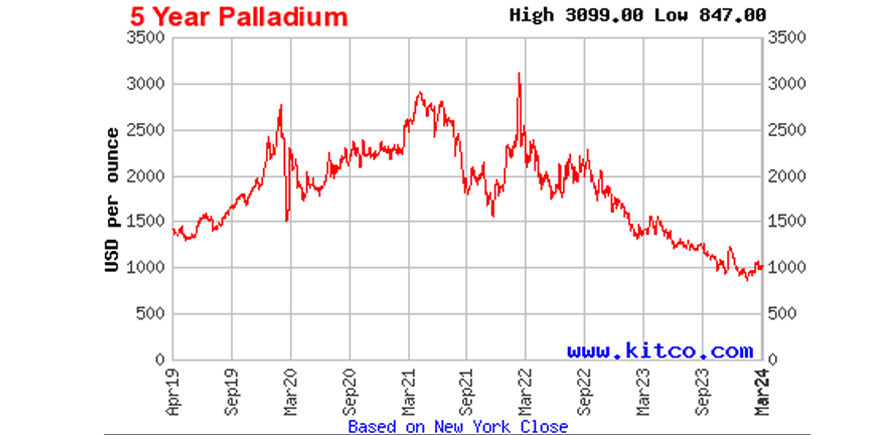

And yet again we experience reversal, although not that obvious and fast. One reason was pandemic in 2020, which affected automotive sector and overall demand. This restrained manufacturers from making capital expenditures to replace more expensive palladium with cheaper platinum. And so, we had trend continuation. However In 2022 Russia attacked Ukraine. Initial effect was sharp growth on price of palladium in London, but also panic among European automotive, as Russian made palladium was being delivered to European manufacturers working under principles of just-in-time by airplanes. Meanwhile flights from and to Russia had been suspended.

But perceived as long-term effect, is late reversal towards platinum. If delivered from Russia, both metals are subject to 35% import tariffs. Additionally we have sanctions preventing entities to deal with Russian industrial sector etc. However Russia’s share on palladium supply is being partially nullified by South Africa.

What’s in my catalytic converter?

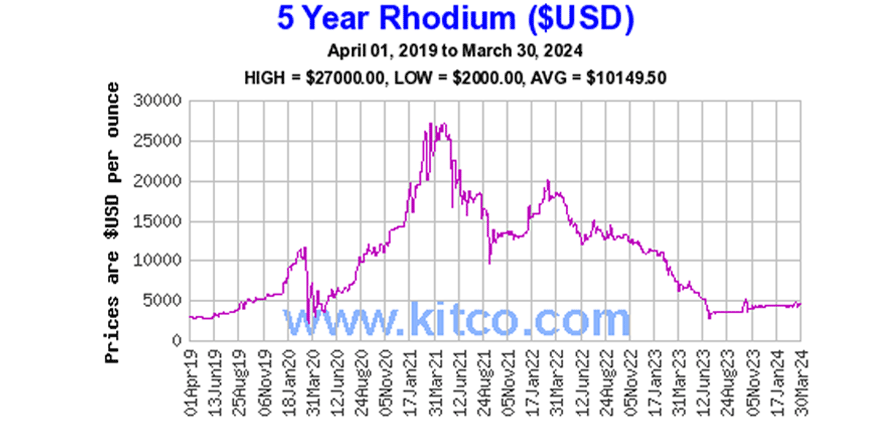

And so we’ve got three different metals in two combinations, which we may find in converter. It is rhodium considered as less abundant and most expensive component of catalytic converter. Approx. 30 t. flat per year is being supplied from South Africa (80%), Russia and Canada (combined 20%).

Catalytic converters that have the most rhodium are typically designed for vehicles with large engines or automobiles with multiple catalytic converters. These vehicles are usually on the higher-end side, meaning they contain more rhodium due to the high standards of the manufacturer. In addition, larger catalytic converters will also require extra rhodium as it is needed to help ensure fumes are cleaned effectively. It remained at price range of US$20-25k per pound (0.45 kg) for a very long time. Rebound of the industrial demand we experienced in 2021 raised its price to approx. 450k USD per pound, before stabilizing at 200k USD levels. Below chart shows price per ounce.

Five year rhodium in USD price. Source: Kitco

We assume our kind readers know well other two precious metals of predominantly industrial usage, which are platinum and palladium. Although we mostly cover gold and silver in our analysis, we focused on those two in our previous publications ‘How sanctions affected flows of Russian precious metals’ and ‘Platinum deficit and possible breakout’. Just to remind quickly:

According to World Platinum Investment Council, supply of platinum tallied up for 2023 at 221 t. worldwide, of which approx. 46.5 t. had been delivered from recycling. Main manufacturer responsible for nearly 2/3 f deliveries is Republic of South Africa who struggles with electricity blackouts, brownouts, poverty crisis, political instability, strikes, and labour unrest. And let’s not forget about politically sanctioned racism towards remaining minority of white farmers.

Five year platinum in USD price. Source: Kitco

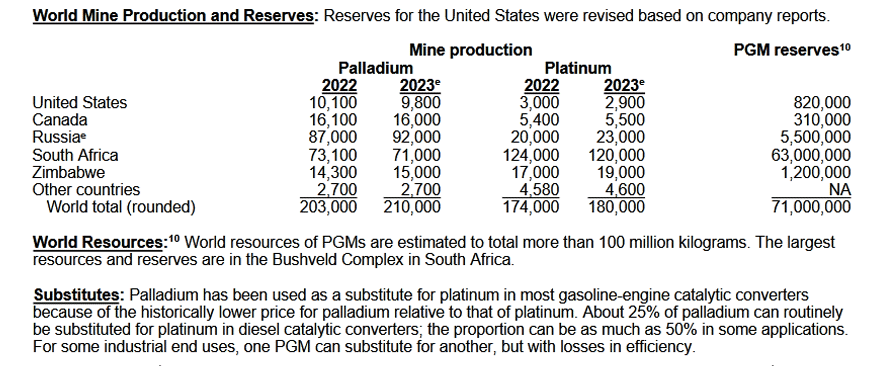

Palladium suppliers both primary and secondary delivered in 2023 approx. 210 t. Based on data from United States Geological Survey, it seems approx. 50% of the above came from recycling, especially automotive recycling. Palladium has been predominantly produced in Russia by Nornickel and South Africa, who together cover approx. 80% of mining output. Other notable suppliers are Zimbabwe and USA. In majority palladium is being mined as a by-product of nickel (Russia) and platinum (South Africa) mining. Imposed in 2022 sanctions blocked at a time flights from Russia to EU, affecting way palladium is being transported to European automotive customers, and therefore skyrocketing its price to records. In addition 35% import tariffs had been applied.

Five year palladium in USD price. Source: Kitco

Roughly 75%-85% of palladium demand comes from auto catalyst sector while application of platinum is more evenly spread with jewellery and industrial uses making up 40% each. For rhodium percentage wise range is higher, at 85-90%. Now, knowing production figures and with pricing wrap-up, time for some quotes. Toyota Prius is one of the most targeted vehicles for catalytic converter theft because it contains more rhodium, palladium and platinum than any other vehicle. And so its converter is worth approximately 2k USD. Other vehicles that are often targeted include: Ford F250 (3.3k USD), Dodge Ram 2500 (4.1k USD) and Ford Mustang (1.8k USD). Most expensive catalytic converter of 2020 belonged to the Ferrari F430. Legendary Italian beauty requires two catalytic converters at 4.5k USD each. That is based on 2022 prices.

World mine production and reserves of palladium and platinum. Figures provided by USGC, so may differ from those from World Platinum Investment Council. Source. USGC

Palladium seems to be more diversified in terms of numbers, even considering sanctions on Russia. Platinum seems to be dominated by South Africa. Country that may implode due to internal issues. We already know on how things look like in South Africa. Let’s check on some local miners.

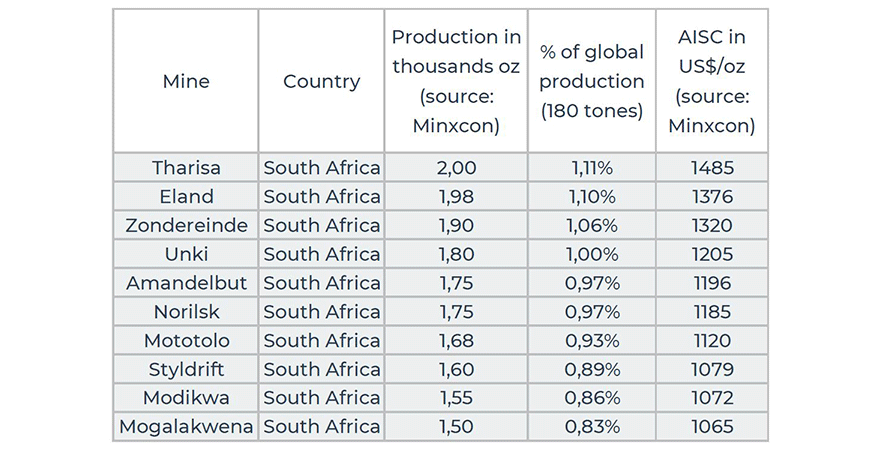

2022 AISC for platinum mines in South Africa. Source: https://bunker-group.com

Increase of fuel prices and inflation, lesser ore saturation and all the local issues troubling South Africa affect local miners. Suddenly we experience all in sustaining costs on platinum, for 2022 as above, while spot price averaged through year at 1000 USD. In all in sustaining costs of 2020 top five listed mines were below 800 USD per ounce…

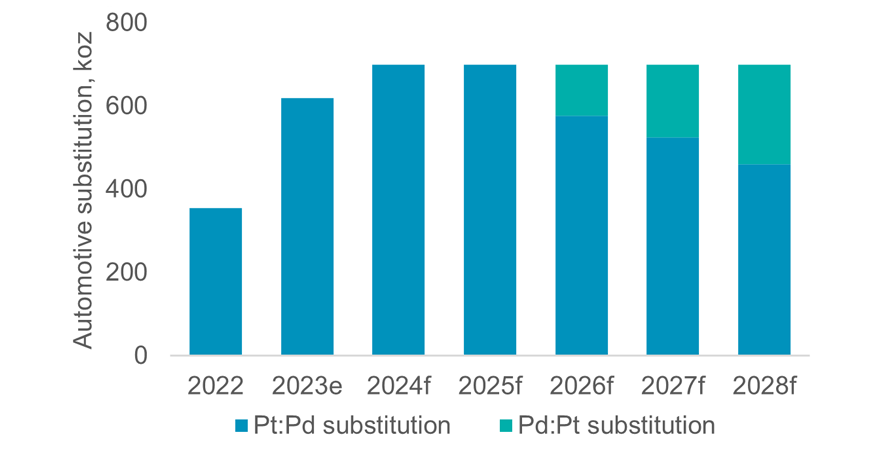

Platinum substituting palladium in near future. Source: https://platinuminvestment.com/small>

In 2023, platinum-for-palladium substitution in catalysts rose from 391k ounces in 2022 to 669k ounces. Significant change y/y but not that much for overall market. Let’s refer to Metal Focus – 9.7 mln oz of palladium demand, of which 80% goes to catalysts and 8.1 mln oz of platinum, of which 43% goes to same sector. Seeking for substitution helps to an extent, to balance market over time, with the automotive sector historically switching between PGMs when imbalances arise. However substitution is slow process and occurs on new vehicle models and typically only 15% of vehicles produced a year are new models.

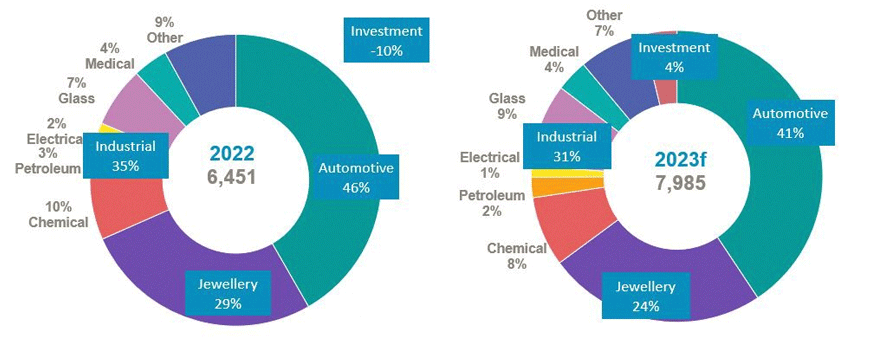

Platinum demand by sector 2022 and 2023 forecast, so approximate figures. Source: https://auctusmetals.com/

In gasoline vehicles this rate is interchangeable on a 1:1 basis. To achieve regulatory certification, setting the relative ratio of the platinum group metals in catalysts occurs during the development of the emissions controls system for the engine of a new vehicle model, or in response to new emissions control limits being imposed. At this point, those ratios are locked in for the lifetime of vehicle generation, typically seven years. Even though subsequent price movements might move the economics of the catalyst in an unfavourable direction, it is unlikely that redesigning the emissions control system and going through the certification process again will justify the cost or risk, particularly in passenger cars. Besides, price spread between these two metals at less than 20% makes research and development aimed at platinum for palladium (or opposite) substitution less attractive.

In time of uncertain demand, EV’s carving out its market share and trend change, many auto makers would normally be reluctant to do capital expenditure to change production process yet again. But world is not only USA, Australia, Japan and Europe - highly saturated markets. World also consists developing nation, who would like to utilise benefits of four wheels for travel or transportation. And so, i.e. record 2023 global sales results for Toyota – worldwide recognisable giant dominating in Asia.

And somehow related, domestic and foreign expansion of Chinese cars that achieve now five stars on NCAP tests in 2023 (certain models of BYD, Nio, Xpeng). And that is why industrial powerhouse - China - does its part as well – builds safety stock. One thing can be said on China for sure – they understand necessity of owing commodities over paper price exposition or future promise to deliver. In 2018 Chinese platinum imports broke over the yearly average. In 2021 China platinum imports peaked at 85.4 t. and in following years just slightly less – approx. 10%. But general trend is – if there are spare volumes of platinum on the market, China bids for them.

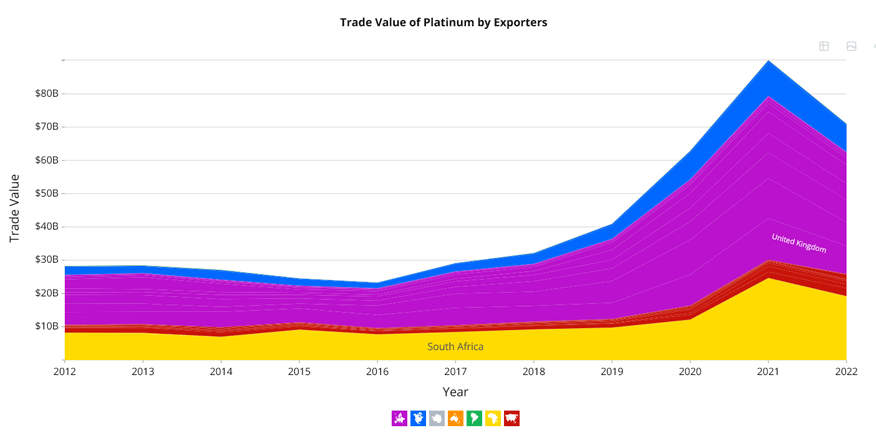

2012-2022 export of platinum to China. Source: OEC

Since 2017, when palladium price began to exceed platinum price and so price differentials started being supportive for platinum for palladium. Such was not always the case, as we tried to explain.

It seems for the first time ever, such phenomenon occurs due to sanctions and security of supply concerns, and not mainly due to regulatory and price factors. Considering that ‘trend is your friend’ would it suffice to create price incentivising differential for platinum in next few years?