Why have Chinese banks disappeared from the LBMA Gold Price Auction?

On 24th October 2023 precious metals analyst – Mr Ronan Manly – noticed that Chinese banks directly participating in LBMA Gold Price Auctions have disappeared of the list. This has not been commented in any way by LBMA and related authorities and for now reminds under shroud of mystery. As for now, this didn’t get sufficient media coverage. Also interested counterparts didn’t release any official statement. So in attempt to understand what happened, we’ll try to examine information and attempt to set it within wider background. Analysis may contain some speculative conclusions.

LBMA Gold Price Auctions in LBMA structures

The most important component on LBMA is the one performing price auctions. It is an element inherited after London Gold Fix. Nearly decade ago, above was composed of 5 banks – Deutsche Bank, Barclays, Bank of Nova Scotia, HSBC and Societe Generale. Twice a day prices were being set based on the order books. This this took place at 10:30am and 3:30pm London time, with the ultimate aim of creating price benchmarks influencing gold pricing of US and Asian markets. Considering role and size of LBMA in the world, that wasn’t meaningless. Especially LBMA’s PM fix was being considered as most important in the world. But due to variety of controversies around London Gold Fix, since March 2015, LBMA replaced it with LBMA Gold Price.

First notable change was that original London Gold Fix members were not included. Fifteen new members became accredited, with list including both banks and some notable dealers. They act as a market makers – basically most important intermediaries and entities on LBMA gold market. For the purpose of LBMA Gold Price, among the above, five are being rotationally chosen to set bullion price.

So session starts with a starting valuation based on LBMA’s algorithms. Let’s call it opening stock valuation. Algorithm is independently administered, but LBMA have ownership of intellectual property rights. So that sets daily starting point. Then usual trading occurs during the day. And again, benchmark price is being set twice during the day, at 10:30 am and 3 pm London time. Auctioneer takes under consideration starting price, and then market participating activity until said time. Market makers then import buy and sell orders according to volume. Price is expressed in USD although other currencies can be used as desired, with FX conversion to be made at the end. Once net sell/buy volumes are balanced with acceptable error range of up to 10k ounces, auction ends, and obtained average price becomes our benchmarked price. Considering that standard bar size on LBMA is 400oz, minimal lot is at 2000 oz, above 10k ounces equals 5 contracts. In comparison to average LBMA’s stock turnover, that is basically very close to full balancing.

According to the LBMA itself, price fixing system through the ICE Benchmark Administration (IBA) computer system operating on the LBMA has allowed for increased transparency in price fixing by reducing human involvement (face-to-face or teleconference contact) in favour of an electronic system. LBMA has therefore removed human factor that gave rise to accusations of price fixing at the Gold Fix and replaced it with algorithms. To administrate just-to-be-established LBMA Gold Price, LBMA had chosen ICE Benchmark Administration. The Intercontinental Exchange (ICE) is an American company that owns and operates financial and commodity marketplaces and exchanges. Then in December 2014, LBMA incorporated new body – Precious Metals Prices Ltd – to manage IP rights for above pricing mechanisms for gold, silver, palladium and platinum. In terms of regulatory aspects, LBMA Gold Price became regulated benchmark under UK’s Financial Conduct Authority (FCA). FCA is formally independent of UK Treasury regulator for market, services and products for entities providing financial services. In Poland, similar authority is being called Komisja Nadzoru Finansowego. So Bank of England is system custodian. To maintain its duties it appointed certain bodies, like Financial Policy Committee (FPC), Prudential Regulation Authority (PRA) and said FCA. FPC identifies risks, directs information to FCA or PRA, who act accordingly recalling flawed products, maintaining system stability and providing cushions in case of troubles.

On LBMA Gold Price introduction. Source: https://www.lbma.org.uk/articles/the-new-lbma-gold-price-successfully-launched-on-20th-march-2015

LBMA Gold Price Auctions – had been set up, and initially consisted of six direct participants. These were entities know from being involved in London Price Fix - Barclays, Bank of Nova Scotia, HSBC, Societe Generale, Goldman Sachs and UBS. Then list had grown to fifteen individual entities.

On LBMA Gold Price introduction. Source: https://www.lbma.org.uk/articles/the-new-lbma-gold-price-successfully-launched-on-20th-march-2015

Short story on how China came and left LBMA Gold Price

Despite of meeting formal requirements, no Chinese banks were being initially admitted to LBMA Gold Price Auctions. In June and October 2015, this finally changed. First to be admitted was state giant Bank of China. Then China Construction Bank. In April 2016 Industrial and Commercial Bank of China has been admitted to LBMA Gold Price. April 2016 welcomed Commercial Bank of China. June 2016 brought Bank of Communications. However, as on 25th October 2023, accredited list consists only two of the above mainland entities – Bank of China and Industrial and Commercial Bank of China.

Need to remind that 2016 was ‘a very special year’ in history of UK, as on June 2016 Brexit referendum happened. For the period of time there was lot of confusion, and basically both Britain and EU had to go through five stages of grief for the years to come – denial, anger, bargaining, depression, and acceptance. In 2016, no one knew what to expect for sure. Speculations were that Frankfurt was supposed to become centre for fleeing London’s capital, Ireland to accept share of industry and big share of banking. Same with Paris, Benelux etc. Besides, Paris openly looked for ways to become European Union’s precious metal centre and cut its pound of flesh of LBMA’s market. On the other hand, over 90% of Euro clearing was being made by London, so considering size of these operations there was no chance to change it swiftly. However straignt away, UK authorities (both political and originating from City of London) openly discussed ways and means of attracting Chinese and Arab capital inflows. As London wouldn’t be bound anymore by Brussel’s capital and investment regulations and restrictions.

Hence at a time, Chinese entities entering LBMA were more than welcome. Media and institutional coverage was, that introduction of Chinese entities will increase transparency, give better representation of market price, not only based on western entities, and as China is the largest gold consumer hence it will allow international price to better reflect supply and demand. Lot has changed since then, and it seems that initial optimism faded when geopolitics stepped in. Post-Brexit UK leans more towards traditional ally from the other side of the pond.

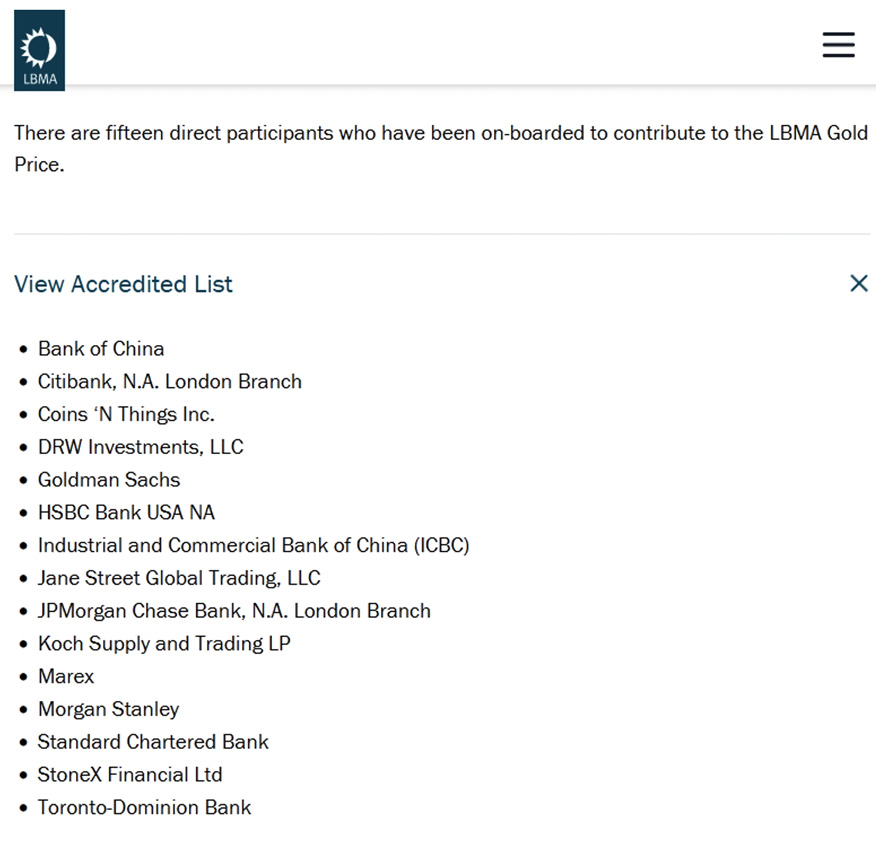

Fifteen direct participants to contribute on LBMA Gold Price as on 25th October 2023. Source: https://www.lbma.org.uk/prices-and-data/lbma-gold-price

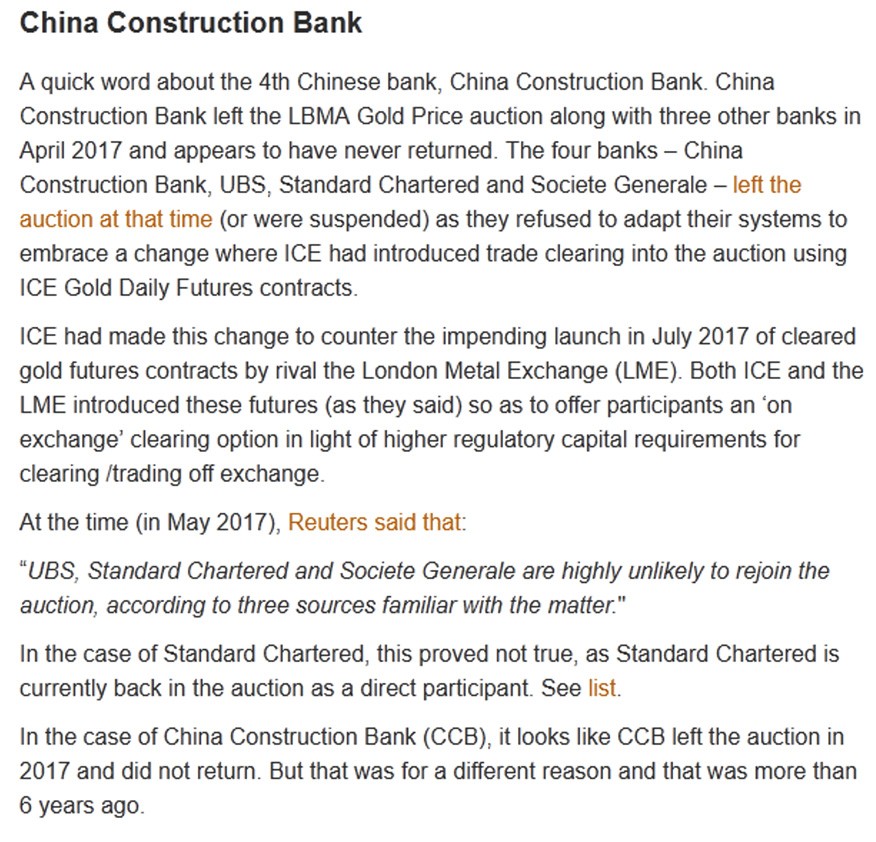

Above illustration from LBMA’s website represents fifteen direct participants to contribute on LBMA Gold Price. What is obvious, list is prone for changes due to market conditions, will to be involve and variety of factors. Let’s just bring up an example of Bank of Nova Scotia, who due to significant losses occurred in 2020 closed its precious metals division and left LBMA (moral of the story is, don’t roll over perpetual shorts on gold, as they may unexpectedly rip your hands off). Certain banks decided also to leave LBMA in 2017 due to infrastructural changes made by ICE. That was an attempt to counter London Metal Exchange made gold futures contracts. Among these, most notable example was China Construction Bank.

Skupmy się zatem bardziej szczegółowo na Stanach Zjednoczonych. Udział amerykańskiego PKB w światowym PKB w 2022 r. wyniósł 25,2%.

Certain banks decided also to leave LBMA in 2017 due to infrastructural changes made by ICE – an attempt to counter London Metal Exchange made gold futures contracts. Source: https://www.bullionstar.com/blogs/ronan-manly/why-have-all-chinese-banks-disappeared-from-the-lbma-gold-price-auction/

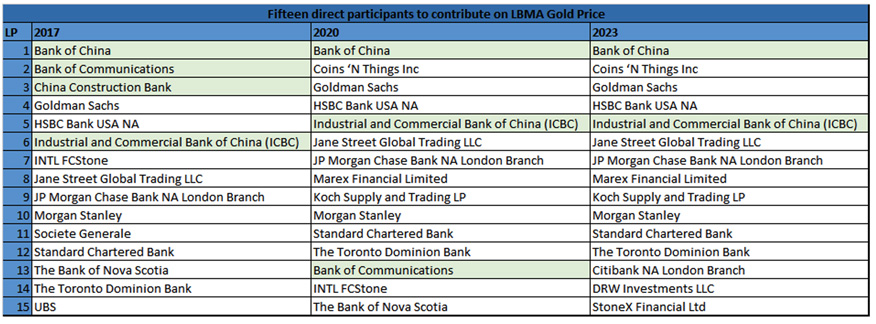

So, how list of accredited entities for LBMA Gold Price had changed? We have some historical data, highlighted Chinese entities, and presenting it below. Please bear in mind, that 2023 data had been acquired on 25th October 2023 - which is important for next paragraph.

2017, 2020 and 2023 list of fifteen direct participants to contribute on LBMA Gold Source: Compilation based on LBMA data.

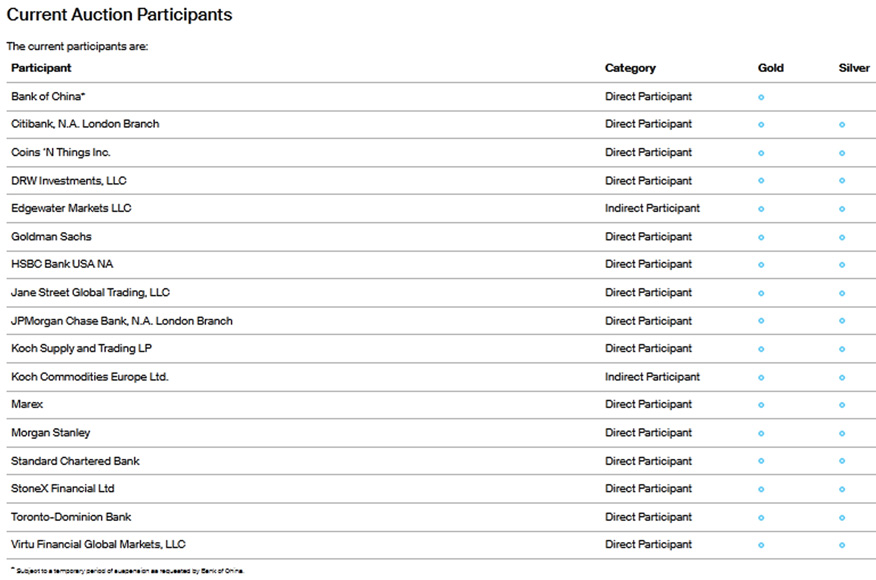

However list obtained at the same day from ICE, who is an administrator of LBMA Gold Price, shows that only one Chinese entity remains as a direct participant. That is Bank of China. Criteria for becoming and remaining direct participant, are: to be member of LBMA, be individual with appropriate experience, skill and training, act under suitable organizational and governance agreements, be able to settle Loco London Gold and / or Silver, and have ability to clear using ICE Gold and / or Silver Daily Futures contracts. This last point makes difference between direct and indirect participants.

Accordingly to ICE, of all Chinese entities, only Bank of China remains. Comparing to LBMA’s list obtained on 25th October, Industrial and Commercial Bank of China disappeared. But with regards to Bank of China, there is also an interesting footnote – ‘Subject to a temporary period of suspension as requested by Bank of China’. Something that according source quoted at the beginning, never happened before.

Current Auction Participants at LBMA Gold Price and LBMA Silver Price, according to ICE. Source: https://www.ice.com/iba/lbma-gold-silver-price

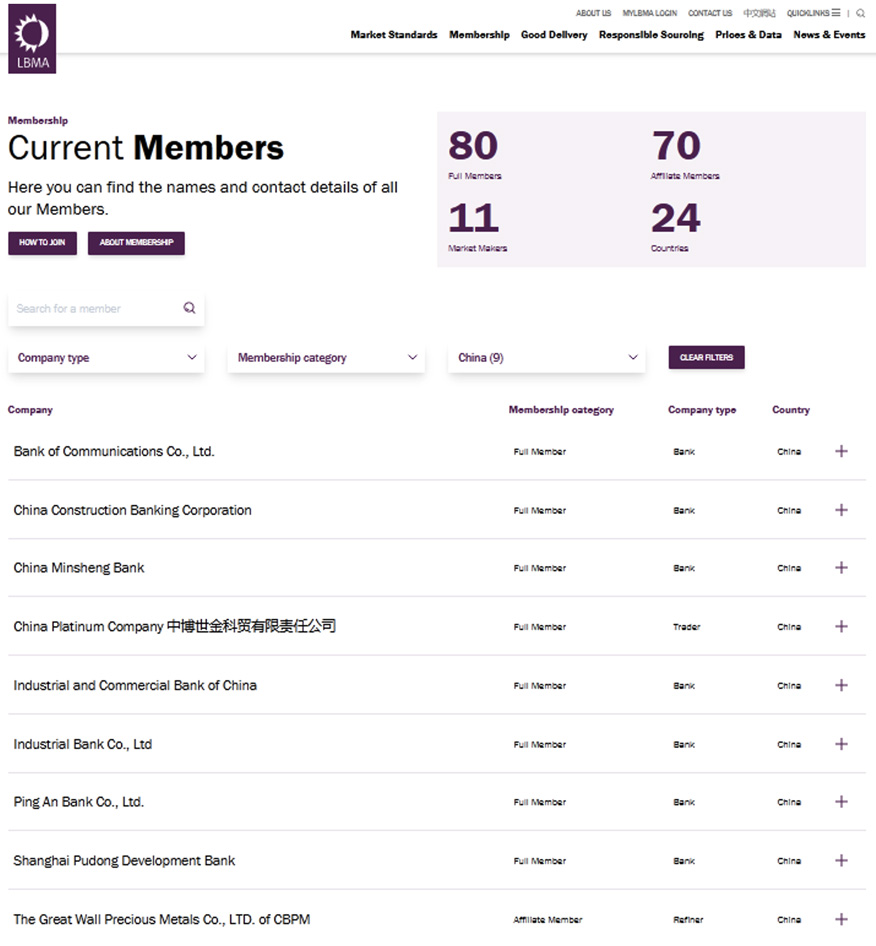

Chinese entities had therefore disappeared from LBMA Gold Price, however all of these entities still remain on the list of current members at LBMA. As per 25th October list consists 80 full members, 11 market makers and 70 affiliate members from 24 countries. Needless to say, that other Chinese entities are still listed on Good Delivery List for gold and silver. So exodus of Chinese entities seem to be related only to price mechanism, however they still seem to retain its market exposure.

LBMA Current Members originating Mainland China: Source: https://www.lbma.org.uk/membership/current-membership#-

On this occasion, have to mention that none of the China originating LBMA Current Members were listed on LBMA / LPPM conference in Barcelona held 15-17 October (which Metal Market visited). Lack of representation was especially visible from of Bank of China. Considering its CEO – Wenjian Fang is one of the members of LBMA Board, seem to be… unusual?

Few remarks on LBMA vaulted gold stocks

Problem with regards to departure of Chinese entities lies in the fact that no one knows what is happening and in scarcity of information. Of course we could just assume it is fault of geopolitics and decoupling world - thank you, end of analysis - but… that’s simply not true or just part-true. However most recurring opinions and comments regards to this matter were speculating that this could’ve been possibly caused by potential illiquidity of LBMA market. After all, so much is heard after all about Asian gold purchases…

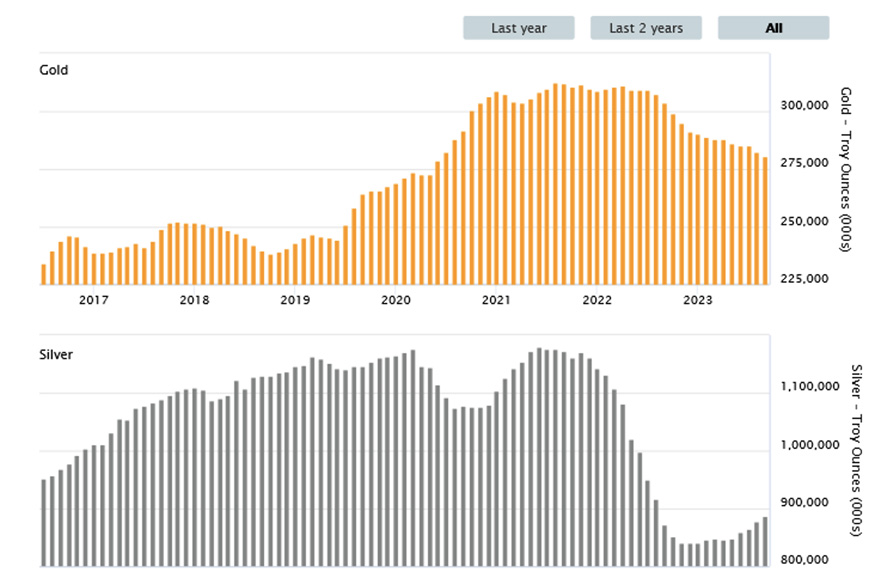

Vaulted gold and silver at LBMA 2016 – September 2023. Source: https://www.lbma.org.uk/prices-and-data/london-vault-data

LBMA started reporting its vaulted silver and gold in mid-2016. Chinese banks were joining LBMA Gold Price in between 2015-2016. At a time we stood at 250 mln oz in the peak. World was in relative peace, safe haven wasn’t in great need, liquidity was at sufficient levels, treasuries were delivering interests and not losing on value, and stocks were growing. Hence financial London warmly greeted China and China was keen to enter London.

On mid 2019 levels of vaulted gold started to raise. Growth on price, related to higher demand was attributed vastly to re-defining gold within Basel III agreement, hence making it zero-risk asset, just as cash and bonds. Besides we experienced first liquidity issues, i.e. on REPO markets. This made institutions to buy yellow metal more keenly. But to allow swift disposal in case of liquidity injection in form of currency, gold has to be kept near or at markets. So we could observe growth on vaulted metal stored within boundaries of M25 motorway, surrounding Greater London – where LBMA vaults are being located. At mid-2020 we experienced second demand wave, then we have entered 2021 and went past half of 2022 on elevated levels. Since then we observe decline in stock, which shows lowering interest in gold. Would it mean gold lost its glow? No – central banks do not sell, just opposite – they make new records on purchases – indicating that achieving financial stability is far away and anything may yet happen. But central banks are being led with different assumptions, and their end of the year profit and loss doesn’t really matter same way as it would for institutional banking dedicated to idea of ascertaining profits.

Could some of these volumes be directed to China? In our ‘120 USD Shanghai’s price arbitrage on gold’ analysis we focused on how Yuan-USD FX affected local prices of gold and triggered credit controls. Eventually at the end of September arbitrage has been lowered to levels just slightly exceeding seasonal premiums in between western and eastern markets. Periodical strength in demand caused by above factors pressured internal markets, but eventually was not translated onto significant growth on Chinese imports. Instead it created withdrawal pressures on Shanghai Gold Exchange. When writing this analysis on Chinese entities on LBMA, we did check certain available on date import/export data. These indicate lack on import growth by China in September 2023. Which confirms that import quota have been imposed and China didn’t contribute significantly to drawdowns on LBMA.

Of the LBMA stocks presented above, there is share of stock being under administration of variety of gold backed ETFs or locked by other long-term acting entities. That makes certain volumes simply locked for foreseeable future, fuelling of course speculation about what are the levels actually available. Still, with regards to physical volumes their availability seems to be higher than when Chinese entities had been welcomed on LBMA. So reasons for Chinese departure must then lie elsewhere?

Thoughts and speculations on why Chinese entities left LBMA Gold Price

There are couple points to be taken under consideration and not entirely excluding each other. However below has to be treated more like speculation and some hypothesis. It is as we stated before – above information comes from one, reliable source, but no involved party made an official statement regards to.

It seems there is a liquidity issue among institutional customers, who additionally experienced unrealised losses on treasuries. Liquidity had frozen, US M2 aggregate shrinks, risks are high, and it is hard to make profits (we did dive deeper onto data in our analysis titled ‘Recession outlooks’). With adverse market conditions, everyone protects capital and is afraid to make purchase. Chinese banks have additionally their hand tightened by credit controls, and periodical (although at this moment lifted) limitations on import of gold – as we stated in our recent analysis ‘120 USD Shanghai’s price arbitrage on gold’. In addition, Chinese banking sector seems to be domestically troubled by unusual event associated with Evergrande fears. And of course we have to mention about weakening of Yuan vs USD – strongest since December 2007.

We bear in mind that for certain economies, weakening on their currency may become supportive for import / export, however in this particular case we simply discuss relation between CNY, USD (as settlement currency on LBMA) and price of gold. And weakening of Yuan Renminbi price of gold strongly attributes to institutional liquidity crunch. That is of course with exception on situations when import quotas on gold and credit controls were being imposed, hence everyone searches for assets other than local currency. But this is still being perceived as extraordinary measures, hence liquidity crunch remains our hypothesis. In addition, US Treasury data shows China has been selling off US assets. They lost o value, but where are they putting proceeds? Then, on Tuesday Bejing announced plans to issue additional sovereign debt worth 1 trillion yuan. This will send the deficit to a three-year high, although pherhaps may provide some needed by markets liquidity.

Another point relates to geopolitics. In around-Brexit stable treasuries, Chinese capital was presenting willingness to buy assets that no one else wanted, and at a time it was more than welcome. But what has more weight, Chinese banks entered LBMA in order to align with current international rules and in attempt to integrate. At the same time, UK dreamt its sweet dreams about shackling EU chains and becoming independent centre for worldwide international banking and trade. City acted in bi-polar way. On one hand it feared Brexit related deterioration and disconnecting from EU markets, on the other it was aroused in perspective to welcome Arab and Chinese capital inflows. With deterioration of overall macro and micro-economic conditions, London might’ve become less interesting internationally market. Of course it still remains important euro-dollar, clearing, and metal market, but considering relations between main players on world’s chessboard, and UK traditionally leaning towards USA, UK might’ve simply become (or started being perceived) hostile for Chinese businesses.

Let us not forget of course about BRICS forum. We even made analysis dedicated to summarise BRICS Summit in Johannesburg, but since then so much had happened on markets, that it had to be pushed back in favour of different, more actual publications. For some time now, China and Russia have been working intensively to connect their gold markets through cooperation between SGE and Russian financial authority, the National Financial Association (NFA). The NFA is a Russian professional association representing the entire Russian financial sector, including local precious metals market. In view of Western sanctions, Russian gold exports to China have increased sharply since mid-2022. Since three Russian banks - VTB, Sberbank and Otkritie - are already members of SGE's ‘SGE International Board’, founded in 2014, this cooperation between gold markets of Russia and China is likely to intensify in the future. Swedish National China Centre published in July 2023 interesting publication regards to economic relations between Russia and China, and although it is un-balanced between counterparts, it remains prospectively interesting for both.

We lean towards liquidity issue, as it is currently being experienced all around the world. And intensification of cooperation between China and Russia regards to gold flows, may give China access to certain volumes that are banned to flow to west. We took this subject under consideration in the past in our two-part analysis ‘How sanctions affected Russian flow of precious metals’. And considering that China in this tandem is on position of strength, may even have ability to get yellow metal on lowered margins. Hence in current hostile climate between West and East, why not to choose better offer?

However for now, the only undeniable fact is that Chinese banks seem to leave LBMA Gold Price.