History of the US silver dollar

History of silver in the monetary system of the United States is turbulent and interesting from both historical and numismatic point of view. It is worth to outline and introduce it to our readers. Especially since at Metal Market we recently had pleasure of adding Peace Dollars, straight from the Royal Canadian Mint, to our range of products. Bullion inspired by classic, historic American design.

A brief overview of the 18th and 19th century history

of the silver US dollar

The last country where silver maintained its position in the monetary system was the United States. Although there was no continuity in this process. Beginning with the Declaration of Independence in 1776, US existed in bimetallic system. The Mint Act of 1792 confirmed that gold and silver remained the medium of exchange in the young republic. Of course, representative and pledge-bearing notes were also in use, but it was the two precious metals that formed basis of US monetary system. Fluctuations on precious metal market prices meant however, that one or the other would likely be overvalued in relation to the other, leading to hoarding and melting for its metal value. Decades after 1792 proved that such a fate usually befell silver coins. Therefore in 1806, President Thomas Jefferson ordered a halt to the minting production of silver dollars, as they were flowing out of the US in significant quantities to other countries, where they were being melted down.

As the United States was still in the process of developing its statehood at this stage, Spanish silver dollar was widely used as currency both then and in the first half of the 19th century. As it happened, both during the time of the thirteen colonies, early independence and actually up until the 1840s, United States suffered from bullion shortages. Currency gap was being filled among other things with barter trade and illegal smuggling of Spanish silver dollars from the Caribbean, which remained legal tender in the USA until 1857. And since original American minted dollars were leaving country as part of the international trade, thus ending up in China or the Caribbean, the earliest American emissions such as the Draped Bust Dollar or the Flowing Hair Dollar remained small in number and quickly disappeared from circulation.

For the next quarter of a century, silver used at the domestic market was minted in the form of half-dollars. Situation changed, in 1831, when production restrictions on silver dollars were lifted. It was not until 1836 that it was decided to release a trial batch of the Gobrecht Dollar, named after the then chief engraver of the US Mint. Production continued until 1839 and the coin itself is remembered as averaging 26.8 g. with a silver content of 90% and a copper content of 10%. With some small changes from the original, resulting in the above parameters, silver dollar was accepted for circulation and additionally maintained balanced between face value and intrinsic value (the price of silver used to struck a coin corresponded to its face value). As a result, it did not lose against silver Spanish dollar, which was the most popular currency of the continent.

Gobrecht Dollar. Source: www.wikipedia.pl

In the 1840s., some words started to be spoken in USA more often than the others. Usually with glowing eyes, often breathlessly and in various combinations. They were: gold, California and fever. And since where there was gold, there was also usually silver, supply of both metals soon improved. However, this unsettled the price relationship between two metals, causing silver prices to rise. Silver coins soon began to disappear from the domestic market, being melted onto bars or hoarded, or simply exported. A classic example of the Gresham law stating that inferior money stays in circulation and superior money is kept out of the market. It was also during this period, following the success of the Gobrecht Dollar, that US Mint introduced one-dollar Seated Liberty, production of which lasted from 1840 to 1873. Considering above, some changes had to be made to prevent mass melting due to excessive bullion content. Ratio of 90% silver and 10% copper was retained while weight had been lowered to 26.73g. It was crucial to keep the silver price at 1.29 USD, so that silver content of a one-dollar coin would be priced at exactly one dollar. New model was used on the domestic market as well as in foreign trade.

Seated Liberty. Source: https://www.pcgs.com/news/1859-s-liberty-seated-dollar

And then the Civil War (1861-1865) broke out. And as happens during wars, money of value are being saved for better times and inferior remains in circulation. And its monetary base can be increased as required. As a result of such actions of the government of the 'North', notes not backed by bullion - the greenback - came into circulation. The promise of 'payment in metal on demand' was removed and replaced by the statement 'legal tender'. New banknote was therefore not convertible into bullion at the time of conflict, its value lied in pledge, belief in an unshakable Union and the credibility of the US government. Despite their partial withdrawal from circulation in the second half of the 19th century, they remained legal tender used at the same time as silver exchangeable certificates.

However shortage of bullion coins continued after the end of the Civil War, mainly due to the large war debt incurred by the federal government. As a result, silver coins began to be sold at a significant premium to the ubiquitous green and paper dollars. In such circumstances, US government was reluctant to issue any new silver dollar coins, but the mint nevertheless continued to mint them, with the aim of storing them in vaults until market circumstances would be improved, so coins could re-enter the market.

It was not until 1878 that the country's financial and economic situation improved enough for the 'greenbacks' to be exchanged again for their full bullion value.

War of ideas - yes to silver and no to silver - late 19th and early 20th century.

PBeginning in 1859, large quantities of silver began to be found in Nevada and the wider West. This gave rise to the naming of Nevada as the 'Silver State', which is still in common use today. In 1869, Henry Linderman, director of the US Mint, advocated the end of accepting silver for the mintage of dollars. At the time, silver dollars were not minted in large quantities, but increased mining activities in the west could cause this to change. And indeed this is what happened, as construction of the east-west rail route facilitated the logistics of equipment, personnel and goods, so that domestic silver production doubled to 22 million ounces a year. Linderman expected silver producers to turn to the Mint and the federal government to sell the ore. And the wealthy owners of Nevada's mines could afford influential lobbying. Linderman feared that monetising cheap silver would cause currency inflation and drive gold out of trade.

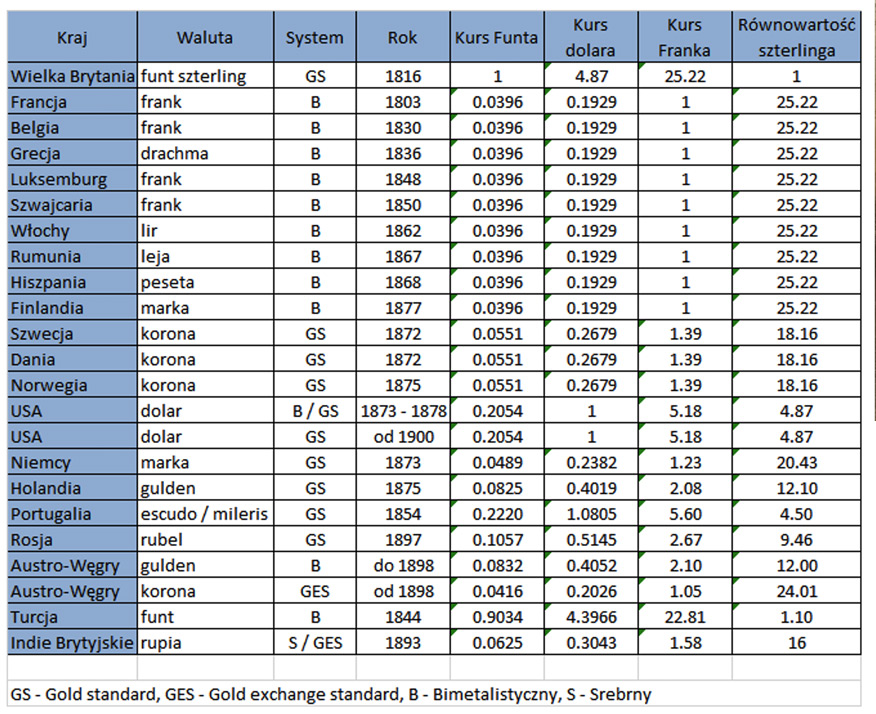

Gold Standard in a nutshell with fixed exchange rates and accession date. Source: own compilation.

Thus, an interesting nexus of cause and effect took place. In 1873, USA passed the Coinage Act, the outlines of which Lindeman was partially responsible for. This made the country join the strict core of the international monetary system, known as the gold standard. This was linked to the displacement of silver from the system of international settlement between members. The US therefore ended the production of silver one-dollars for the domestic market, and instead introduced the so-called Trade Dollar - silver trade dollar - widely used for trade with Asia and especially China - traditionally 'silver' countries and then highly dependent of European colonial powers. And although silver supporters later called the resulting bill 'the crime of 1873' and claimed that the legislation had been passed by fraud, it was debated during five different sessions of Congress, read in full by both the House of Representatives and the Senate, and printed in full several times. The signing of the new legislation resulted in price falls for the white metal.

There was immediate pressure from the powerful producer lobby from the 'Silver State'. Miners protested against the 'crime of 73' and fought for the inclusion of silver back into the system. Same could be said about agitated pro-silver part of society, unhappy with current state of affairs. As a result of the pressures, according to the letter of the Bland-Allison Act passed in 1878, US government began to buy back domestically produced silver (it was legally obliged to spend at least US$2 million per month) and mint silver coins from it, co-existing in the monetary system with gold. These were Morgan Dollars, which we’ll focus on in couple paragraphs. It was also promised to exchange paper dollar certificates for silver on demand. As a result, the US withdrew from the gold standard.

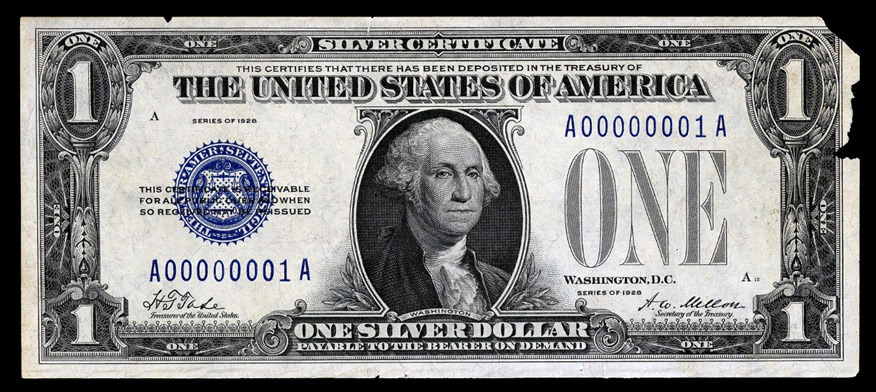

At a time, government released in circulation first ever silver certificates – banknotes pledging exchange to silver on demand. Initially only as 10 and 1000 dollars, since 1886 it authorised introduction of 1, 2 and 5 USD. Bland–Allison Act recognised them as “receivable for customs, taxes, and all public dues,” and that they could be included in bank reserves. However they were not explicitly considered legal tender. Only in National Banking Act of 1882, congress clarified the legal tender status of silver certificates by clearly authorizing them to be included in the lawful reserves of national banks.

In 1890, Sherman Silver Purchase Act was enacted requiring the federal government to purchase 4.5 million ounces of silver per month, which was equivalent to purchasing all domestic production at a time. However, provision was repealed 3 years later. Reason lied in unleashed war on bimetallism waged by US politicians. Division was mainly along the lines of political sympathies - the Democrats of the time were in favour of the bimetallic system. They were often referred to as populists and socialists, as they gave examples in favour of the bimetallic system by arguing that a larger monetary base would allow small farmers to more easily repay loans for land and equipment purchased, at the expense of profit for banks and large landowners. Proponents of bimetallism argued that the gold dollar undercut the price of agro-cultural products expressed in dollars, affecting lack of purchasing power in the local market. And to a financial system based on gold alone, they responded:

"You shall not crucify mankind upon a cross of gold"

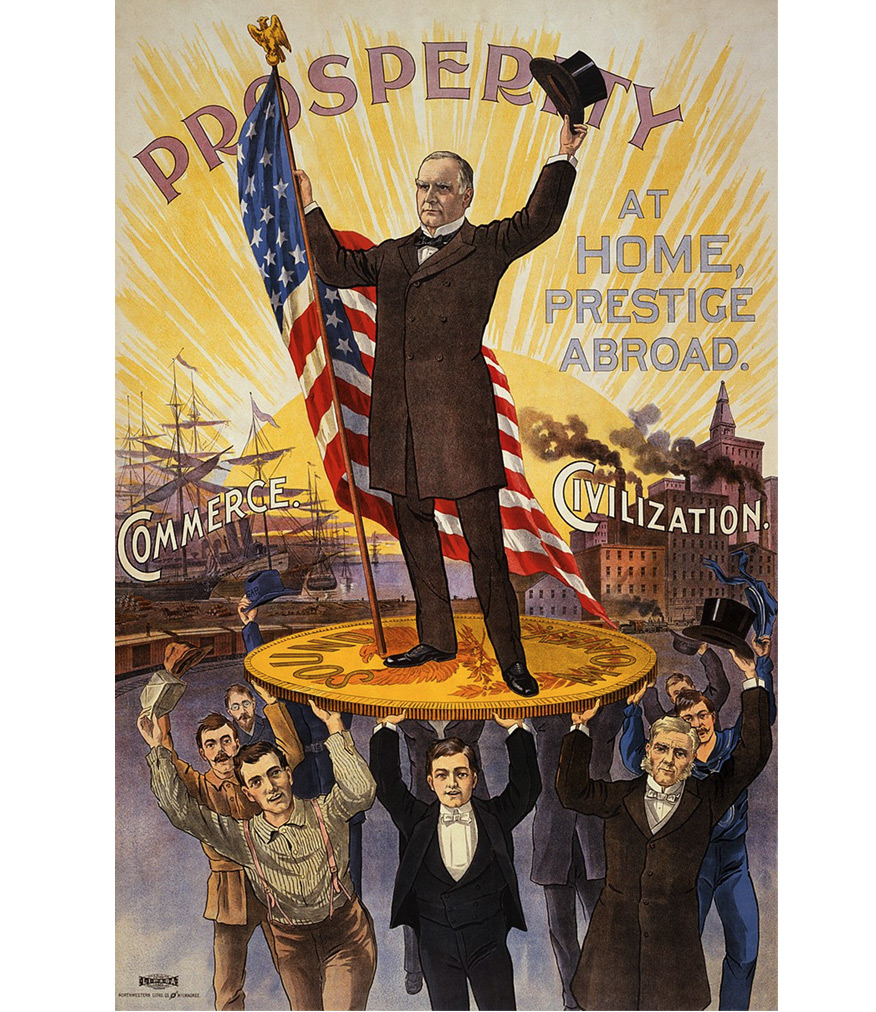

The Republicans, on the other hand, opted for a gold standard tying strong currency to the basis of the international financial and trading system. They argued that a strong dollar meant representativeness and branding in the markets.

Each side referred its opponents with the most insulting of insults, each was convinced that it was right, printing presses were turned hot red from amount of prints, public debate turned into shouting at each other and suddenly developed inability to listen to the other side. And example from political elites was going down the social ladder.

This is when term 'goldbug', has been coined. To refer supporters of the later Republican US President William McKinley. In order to demonstrate which side they stood on, they wore gold pins, or elements of clothing sewn from gold-coloured material. This was a demonstration in defence of the gold standard and in opposition to the 'silver threat', as radicalised opponents of bimetallism called the idea of using silver at the time. Eventually, supporters of the said William McKiney prevailed and their president pushed through Gold Standard Act of 1900 incorporating USA back into the full gold standard system.

Election poster of William McKinley, President of the United States from 1897-1901. His term of office was prematurely ended by assassination. One of his points of agenda was to oppose incorporation of silver into the US gold standard system. Source: https://en.wikipedia.org/wiki/Gold_standard#/media/File:McKinley_Prosperity.jpg

Gold Standard Act lawfully pushed silver out of the “legal tender” definition. However minting of silver coins continued, as the US had reserves purchased from manufacturers under the Bland-Allison Act and later the Sherman Silver Purchase Act. From these reserves Morgan Dollar was minted - 26.73g with 90% silver and 10% copper. Finally, in 1904, last batch of previously purchased silver was used. When this was done, production for the domestic market was halted.

Morgan Dollar. Źródło: https://www.pcgs.com/coinfacts/coin/1879-1/7084

During First World War, German government hoped to destabilise British rule over India by spreading rumours that the British were unable to convert all their printed paper currency into silver. These rumours and hoarding of silver drove up price of silver, which could harm British war effort. British therefore approached USA, asking if they could buy silver to increase supply and hence lower the price market price. In response, Congress passed the Pittman Act 1918. This act gave the US the right to sell up to 350 million silver dollars to the British government. Ultimately, only 270 million coins were melted down, but this represented 47% of all Morgans minted to that point. Under the terms of the Act, the Treasury was required to mint new silver dollars to replace the missing coins and then to mint them from silver purchased from US mining companies. Hence, the minting of Morgan Dollars was briefly resumed in 1921.

More contemporary silver story - 20th century.

As we have entered the twentieth century, we would like to remind our esteemed readers – this analysis is not intended to discuss history of the US or the world's precious metal-based payment system in full. Our focus in this analysis is on the history of the silver dollar. Therefore, discourses on the creation of the Federal Reserve, causes of the Great Depression, history of the Great Depression, Second World War, Bretton Woods System, or Nixon Shock will be cited here only in the form of a historical narrative and specifically in relation to silver.

Pre First World War and between the wars, in the US market, banknotes displaced the silver dollar in form of coin. As for types, they functioned in parallel:

- Government-issued banknotes (greenbacks),

- Government banknotes promising exchange for silver used only in the domestic market,

- Until 1930, banknotes and silver certificates of various national banks,

- And over time, banknotes issued by established in 1913. Federal Reserve.

As you can see, it was a market rich in numismatics. As for the 'silver notes', they functioned now, as denominations of US$1-10, but over time only one-dollar notes were left in circulation. This was confirmed in the 1928 reform, primarily reducing physical size of the banknotes to the one we know today. At the same time, monetary reform was introduced and issues were made in accordance with its guidelines. Country was on the eve of the Great Depression, Federal Reserve was just about to acquire a large part of its prerogatives, bullion convertibility was in operation and in addition, local bank issues were in place to help de facto monetise the country.

And so an American in 1928 could encounter types like the following (we strongly recommend reading the descriptions):

Fed-printed Abraham Lincoln $5 promising to exchange for gold on demand. Green stamp signified Treasury stamp. Source: https://www.wikiwand.com/en/Federal_Reserve_Note

American silver certificate of 1928. The appearance changed over the years, but up to and including printed series in 1957, it carried the promise of being exchanged for silver. The design closely followed 1923 version. Source: https://www.wikiwand.com/en/United_States_one-dollar_bill

American 'greenback' of 1928, produced in a short run as market was already saturated with 1-dollars. More common were 2 and 5 dollar bills. 1-dollars with a red stamp were released in 1933, but only in a small batch. They remained in vaults until 1948. It was then that they were issued in Puerto Rico. Source: https://www.wikiwand.com/en/United_States_Note

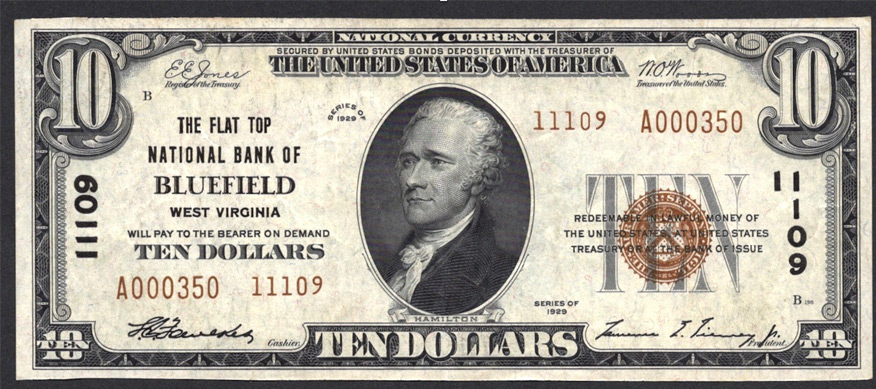

A 1929 10-dollar note from one of the nation's commercial banks. In this case, the National Bank of Bluefield, West Virginia followed design of official banknotes emitted at a time. Source: https://www.wikiwand.com/en/National_Bank_Note

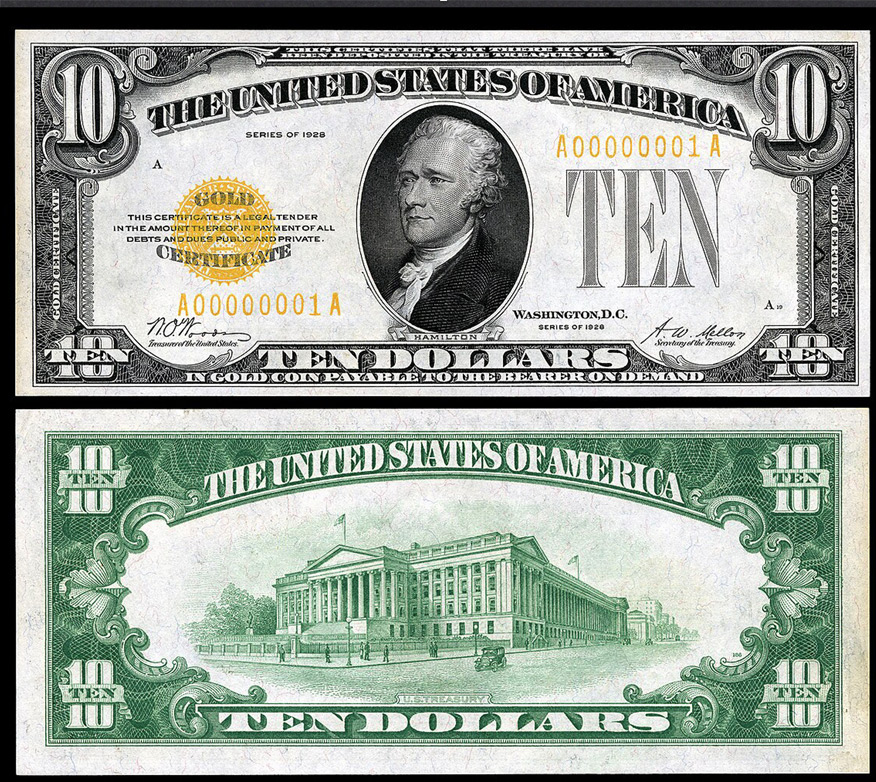

And finally, gold 10-dollar certificate of the 1928 series. The last issue of this type before the gold confiscation and the Great Depression. Source: https://www.wikiwand.com/en/Series_of_1928_(United_States_Currency)

Thus, we have presented main types of notes carrying the promise of exchange for bullion of one kind or another. It’s worth mentioning that as early as 1930, during the Great Depression, US currency was consolidated in the arms of the Federal Reserve. United States banknotes and certificates of silver and privately issued notes were eliminated. Passage of the Gold Reserve Act created an accounting gain for the Treasury, part of which was used to redeem all bonds, in exchange for which private banks could issue notes.

Meanwhile, as part of the Pitman Act of 1918, US Mint was obliged to mint millions of silver dollars and starting in 1921, resumed production of silver bullion, initially using the old Morgan dollar design. However, there were suggestions that a coin should be issued to commemorate the peace that followed World War I - the war to end all wars - as the general public of contemporaries desired. And although it was not possible to get Congress to pass a bill requiring a redesigned design, steps were taken to prepare the issue. The Peace Dollar was approved by Treasury Secretary Andrew Mellon in 1921.

Peace Dollar. Source: https://www.etsy.com/uk/

Peace Dollar circulated mainly in the western states, where coins were preferred to paper money. After all, the zone of great influence from Nevada - the 'silver state', able to use its lobbyists in the past so as to secure the purchase of silver ore by the federal government. In the rest of the US, banknotes were preferred. Peace Dollar was also widely available on state banks, forming part of their reserves as legal tender. It was popular during holiday periods as a commemorative gift. From a legal point of view, a one-dollar paper certificate entitled holder to exchange it for a silver Peace Dollar with a nominal value of 1 USD, weighing 26.73 g and containing 90% silver. Which meant that in order for the bullion value of the coin not to exceed its face value, market price of silver had to be maintained at or below 1.29 USD per ounce. Just like in the past.

Minting of silver Peace Dollars was discontinued as a result of legal changes in 1928. Issuance then resumed in 1934, thanks to another congressional act. This one required US Mint to purchase large quantities of domestic silver, a commodity whose price was at historic lows at the time. This act provided manufacturers with a ready market for their products, and the Mint gained profits through exclusivity and by monetising the cheaply purchased silver.

In 1934, the Americans began process of forcibly divesting themselves of gold. Federal government requisitioned yellow bullion from citizens at a price of 20.67 USD and soon later raised its market price to 35 USD. This created a dualistic system, as dollar notes convertible on demand into silver were still in place in the domestic market, while international obligations were covered in gold. Position of silver on the home market was sanctioned through the Silver Purchase Act of 1934, which nationalised US silver mines. To cover the increased demand for silver, Roosevelt administration also increased its imports from China. As stated in the letter of Secretary of State to the Consul General in Shanghai:

‘The Policy of the United States in the Purchase of Silver will be guided by the following considerations: The Silver Purchase Act of 1934 declares it to be the policy of the United States that ‘the proportion of silver to gold in the monetary stocks of the United States should be increased, with the ultimate objective of having and maintaining, one-fourth of the monetary value of such stocks in silver.’

Sharp increase in demand from USA caused silver price to increase. As a result, this led strong deflation in Republic of China in 1912 - plagued by civil war at a time - suffered deflation. Hence it was forced to move away from silver standard.

Again, silver certificates promising exchange began to be printed in denominations of US$1, US$5 and US$10. Further issues were made in 1934 and 1935 and another was being prepared for 1936, however, as commercial demand for Peace Dollars died down - after all, the Great Depression had hit Americans' pockets dramatically - 1935 marked the end.

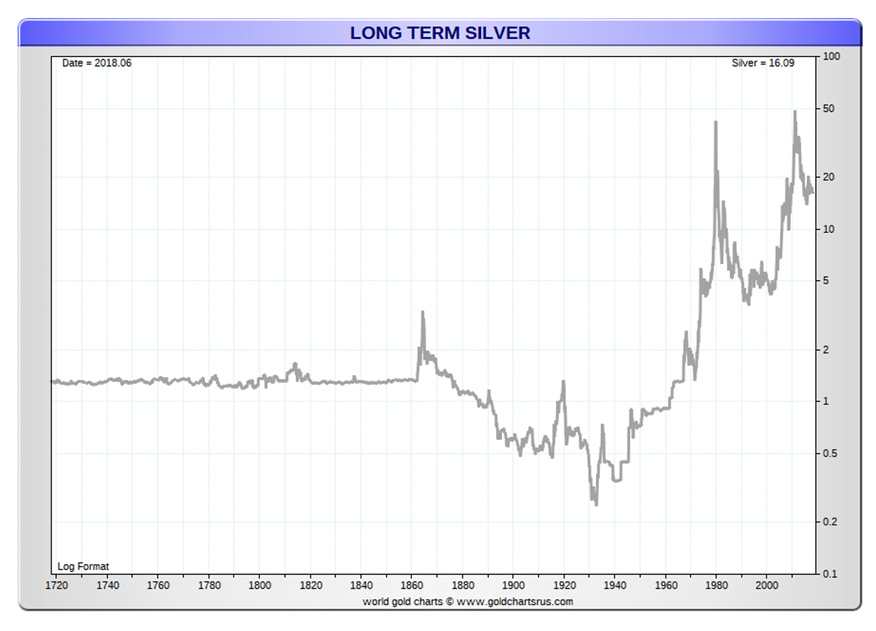

Historical silver prices by London Silver Fix PM session expressed in USD. Source: www.goldchartsus.com

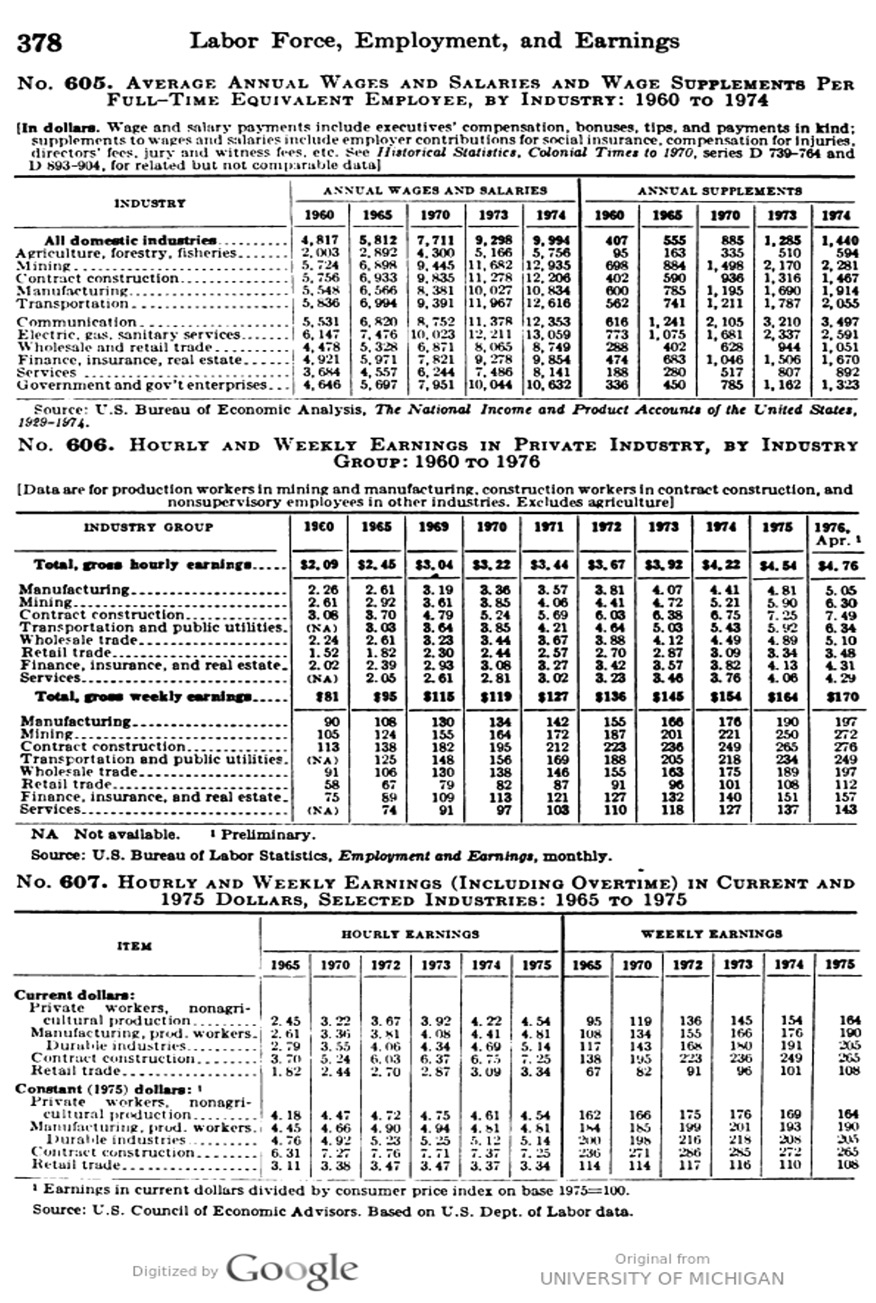

After the Second World War and introduction of the Bretton Woods system, pre-war silver certificates in the form of 1 USD notes continued to circulate alongside Federal Reserve notes. What is more, a further series of them was issued in 1957. Idea behind the certificate was to provide exchange mechanism in an environment of a dollar firmly pegged at a ratio of 1:35 to gold, but with no silver being involved in the monetary system. And as (in theory) amount of dollars in circulation was dependant on amount of gold held, upon exchange to Peace Dollar paper note was destroyed at the same time. For a 1 USD certificate, silver dollar with a nominal value of US$1 and minted before the Second World War was still obtained. These were usually Peace Dollars, less often Morgans. Coin’s weight remained at 26.73 g., which, with 90% silver content, was equivalent to the value of 1 USD. Was this a lot? Let's find out by looking at official US statistics for the period 1960-1974 on wages....

Averaged salaries for the period 1960-1974 in the USA. Source: https://babel.hathitrust.org/cgi/pt?id=mdp.39015021301612&view=1up&seq=406

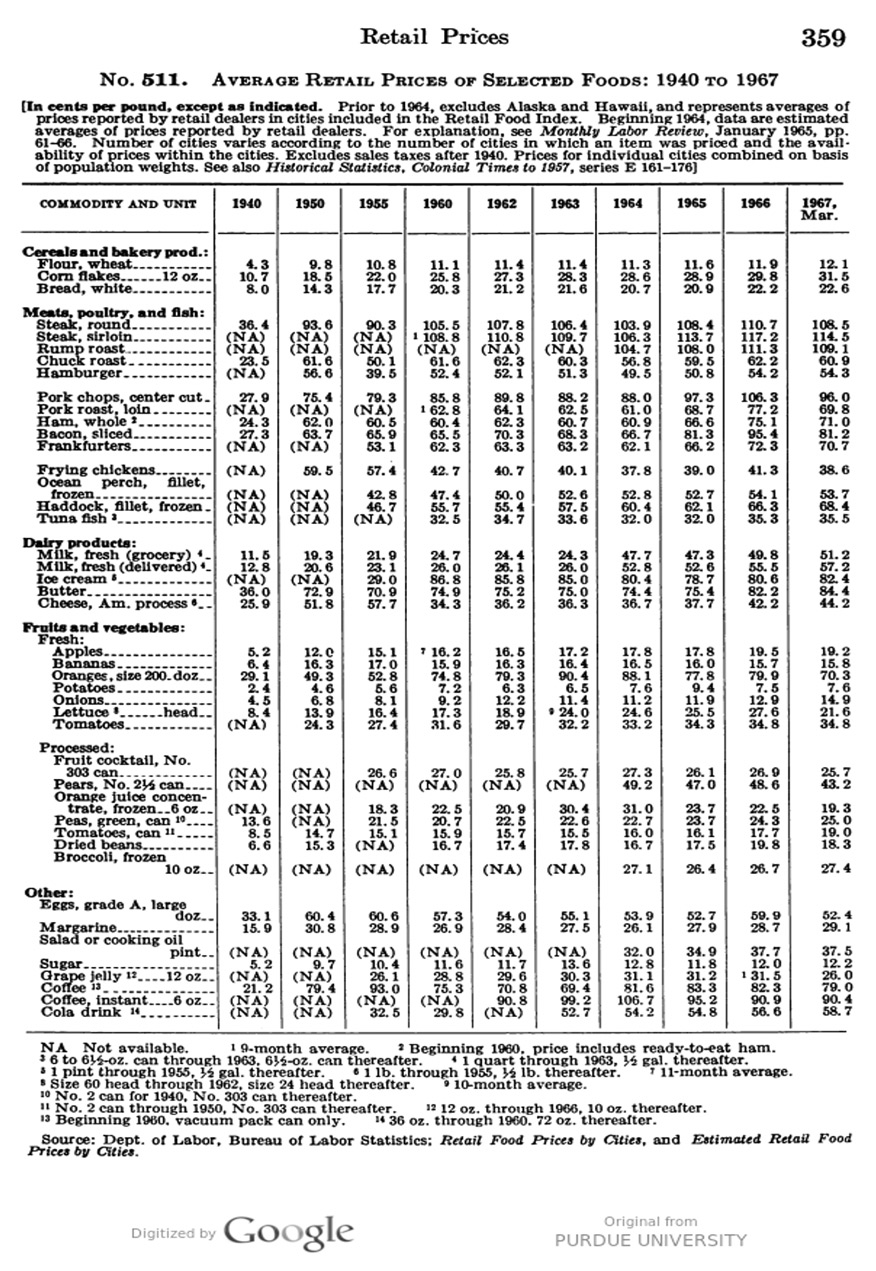

… and prices for 1940-1967 period.

Averaged prices for the period 1940-1967 in the USA. Źródło: https://babel.hathitrust.org/cgi/pt?id=pur1.32754070461268&view=1up&seq=377

Meanwhile, post-war silver production held steady but world demand was increasing, particularly from the European direction. US Treasury Department therefore carried out a silver sales programme. Its aim was to keep the price per ounce below 1.29 USD - level equivalent to the bullion value of the silver

However, in the early 1960s, market price per ounce of silver began to rise and broke through the historically established price barrier. This meant that value of silver coins was greater than their face value. This resulted in an increasing outflow of bullion from US treasuries due to the exchange of paper certificates for more valuable silver coins. Huge volume of silver coins thus entering circulation disappeared being hoarded, remaining had been turned into bars. Consequently, possibility of exchange was restricted to older dollar notes only, deleting the possibility of exchange for higher denominations carrying such promise.

In 1964, there was yet another issue - 1964-D Peace Dollars. New coins were to be used mainly in the west of the country, where 'hard money' continued to enjoy increased popularity. This came with some controversy and turnover among the government camp. Indeed, both then Treasury Secretary Dougas Dillon and Mint Director Eva Adams, were opposed to project and expected that minted product has strong potential to quickly disappear from the market and reappear in form of silver bars. And indeed they did - first batch, described as a trial was bought up on the stump by numismatic dealers at a price far in excess of face value. As a result, D Peace Dollars did not make it to the public market. Due to that, decision to suspend production was taken very quickly. Finally, in 1964 government concluded that it was time to end the programme of exchanging silver certificates for physical silver. This was approved by congress in 1967 with exchanges ceased from 24 June 1968. At the same time, all silver coins were removed from circulation.

To conclude

To this day, silver dollar certificates can still be found in circulation. However, they cannot be exchanged for silver on request anymore and simply have face value. Depending on the series they retain certain numismatic value. Same could be said on silver dollar coins – they have a value based on the content of silver and no longer remain legal tender.

Peace Dollar -Peace Dollar - most famous of the US one-dollar silver cons, lived to see its special version commemorating the centenary of its first issue. This was done in 2021, and this time it was adjusted in weight and silver content to suit contemporary needs. In addition, famous traditional US design of Peace Dollar has been recently honoured with a commemorative issue made by The Royal Canadian Mint. New and refreshed bullion version may compete against modern designs without a shame, and is definitely something interesting. Metal Market Europe has these in its store and kindly invites to check our range of products.