Coup d’état in Niger – debunk on alleged ‘ban on gold exports’

OIn recent weeks new tensions emerged, occasionally even temporarily pushing war on Ukraine off the first pages of newspapers. That is military coup d’état in Niger and risk of potential intervention aimed to restore previous government. Allegedly junta threatened to ban gold and uranium exports to France. Which was soon proven to be fake news. But we think it is worthy considering what we have just witnessed and ‘what if and if at all’ effects on precious metals markets

In the eye of a storm - on Niger’s related geopolitics

Currently unfolding situation in Niger need to be examined in a more comprehensive context, including geopolitical approach. Ever since Russia's emergence as an active player on the world stage, underscored by its military interventions in Georgia (2008), Ukraine (2014), and Syria (2015), it has been re-establishing old Soviet channels of influence as part of a strategy for geopolitical expansion. This approach targets Arctic, Eurasia, Caucasus, Middle East, and Africa. In Africa it falls on fertile soil. Considering that local inhabitants most often consider French, British or “European” as colonists, exploiters and occupants, Moscow only had to step in USSR shoes prepared in 60s and 70s. That means loudly speaking and supporting ‘liberation’, ‘fight against neo-colonialism’, and ‘need to overthrow western influences’. Point about introduction of Marxism-Leninism has been removed of current agenda.

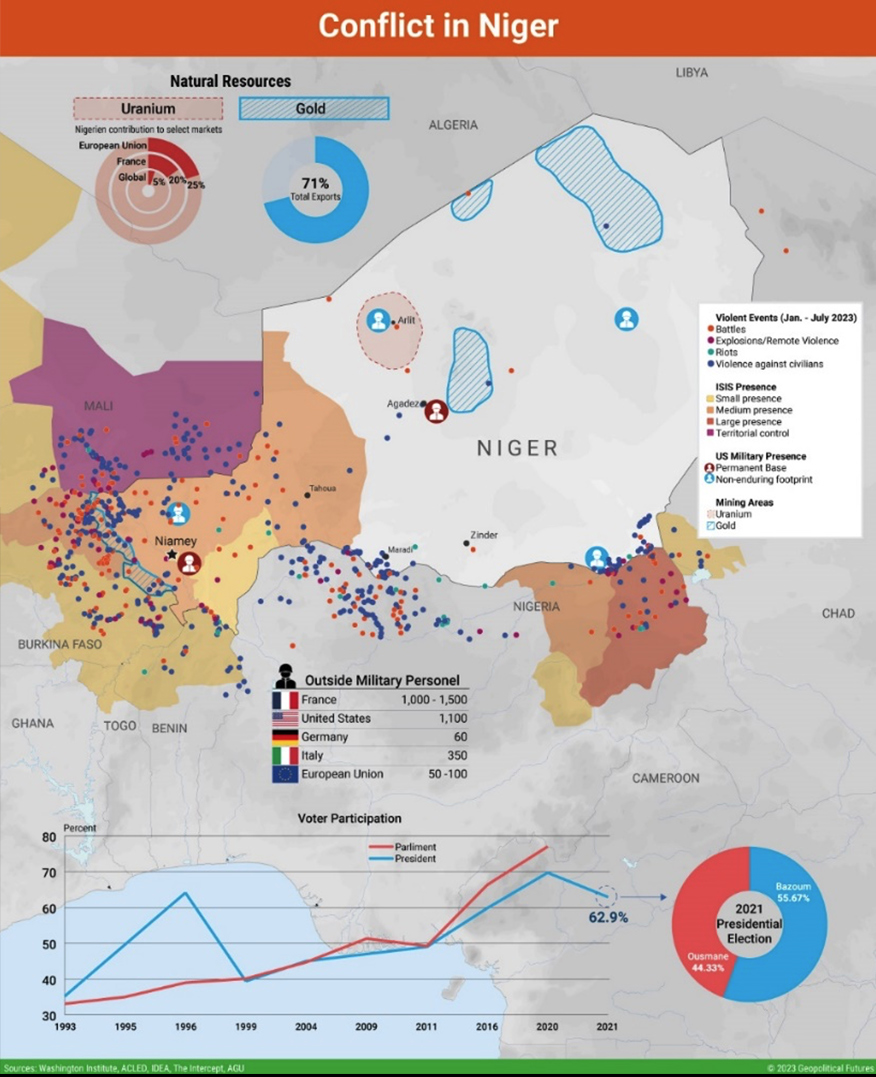

Geopolitics surrounding Niger. Source: https://geopoliticalfutures.com/tumult-in-niger/

And hence, ‘anti-colonial’ Russia has signed military cooperation agreements with several countries of Sahel region, including Chad, Niger, Nigeria, Guinea, Burkina Faso and Mali. Now Moscow promotes anti-French narratives in Africa and boost its soft power at France's expense. With Mali and Chad under military rule, Niger's strategic importance to Paris and Washington has grown exponentially for several reasons. Firstly, country boasts vast uranium reserves. Secondly, France, USA and Russia were and are actively involved in counterterrorism efforts in the region. Niger was one of the hosts to international military mission - Barkhane. Thirdly, Turkey and UAE view Niger as a crucial player in their ongoing rivalry in civil war-thorn Libya. And finally, due to implementation of allied policies directed to curb Chinese influence in Africa. As part of approved in July 2022 package of sanctions, allies committed 600 bln USD to infrastructural investments around the world (predominantly in Africa), focused on securing Europe’s energy security but also to curb Russian and Chinese influences.

Development in Sahel (continuous loose of influence by France, pro-Russian coup’d etats and shifting towards Moscow and China) have turned Niger into the central hub of European counterterrorism efforts in the Sahel. Burkina Faso and Guinea, despite their military regimes, have avoided sanctions that Mali received from the Economic Community of West African States (ECOWAS), as they have been granted extra time to negotiate. However, Niger experienced a coup attempt in March 2022, refugee influx, and a rise in terrorist attacks, enhancing its geo-strategic importance. Wagner Group's activities in Mali, which Chad and Niger oppose, may have influenced this disparate treatment. However, at the end of 2022, Russian media highlighted potential for Wagner Group to be deployed in Niger. After Bakhmut, raid on Moscow and appearance in Belarus, this seem to be unfolding now. Although, at least at this moment seems that mercenaries remained leaderless, and no one really knows what to expect next.

It is clear, Russia's long-term goal in Niger is to prevent uranium mines from being kept in French hands. Considering Bejing’s strong share in local crude oil market, securing flows of local gold could be considered as interesting addition to whoever controls it. And Moscow & Wagner have a history of ascertaining exports of African gold to Russia. Although, assuming Wagner Group's return to Africa and past experiences in Burkina Faso, that suggests they face a challenging road ahead in Niger.

Recent coup in Niger has been a topic at recent Russia-Africa Summit. Pro-French Niger’s president’s Mohamed Bazoum's absence from the summit was interpreted on Russian media as indicative of Western pressure on Africa. Intriguingly, the coup appears to have been driven more by local dynamics, such as the allocation of resources to the military and disagreements between Bazoum and the military over counter-terrorism tactics, rather than external influences.

Niger’s commander and chief - General Abdourahmane Tchiani. Source: https://www.rte.ie/news/world/2023/0809/1398867-niger-coup/

In the aftermath of the coup, Niger finds itself under a new regime. Bazouma has been overthrown, with General Abdourahmane Tchiani resuming power on behalf of the army and security forces. Military now holds power, controlling key administrative buildings in Niger's capital. Amid these events, in a calculated gesture, Putin offered free grain to African countries, especially after blocking Ukrainian exports and targeting Danube and Black Sea ports and grain facilities.

In this evolving scenario, Russia seeks to leverage food dependencies in Africa to build political capital, potentially influencing votes in vital organizations. Putin can also indirectly pressure the West, which needs to make more concessions to prevent a severe food crisis. Furthermore, Putin has leveraged the situation to locally blame Western sanctions for the precarious food supply situation. Outragous view? Highly shared in Africa and among those unhappy with US dominance in the world. Besides, let’s remember, that Russia works to be perceived in Sahel as liberator against western-neocolonialism. With Niger being part of the vestiges of the French sphere of influence in Africa, the stakes are high.

Lost in the desert

Niger is a landlocked African country located in Sahel belt. Its name derives from Niger River, which is 3rd longest in Africa and passes through west part of the country. On the north Niger neighbours with Algeria and Libya, on the east with Chad. On the south predominantly with Nigeria and towards south west with Benin. On the west it neighbours with Burkina Faso and Mali. It is politically instable country, but it should not be surprising, considering state of affairs in most of its neighbours. It is composed predominantly of Hausa (53%), Zarma & Songhay (21%) ethnic groups, with 99% of inhabitants practicing Islam, predominantly in Sunni version.

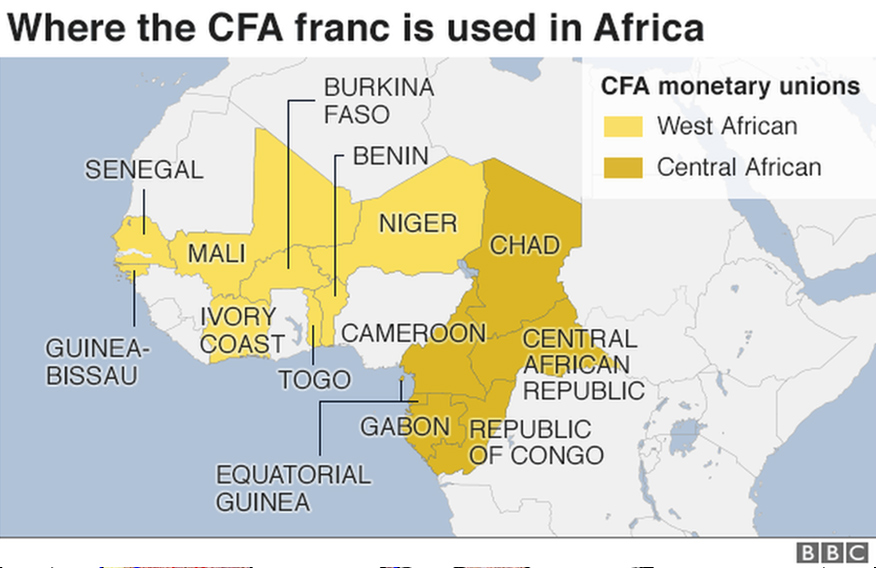

Franc CFA in two versions – monetary and economic tool of preserving control by Paris. Source: https://www.bbc.co.uk/news/world-africa-46960532

Country gained its political independence from France in 1960, as a part of greater movement of decolonisation. However nominal independence doesn’t mean economic independence, as Niger (and other countries of a region) remain bound to French economy or entities. Assuming that having control over currency is one of the conditions to consider economic independence, then for the former French colonies it is not a condition fulfilled, as they remain bound to Paris by Franc CFA in 2 versions. Its exchange rate to French Franc and then Euro, has been adjusted multiple times, to preserve Paris’s role as main trading partner. And it is Paris that maintains local currencies, via fix to EUR or past depreciations or requirements and restrictions for local central banks. One of them is that the Central Bank of West African States and the Bank of Central African States must maintain min. 50% of foreign deposits with the Bank of France in an operational accounts. Long-term existence of system led to reduction in regional trade, high dependence on the production and export of a limited number of primary commodities, maintenance of a narrow industrial base and high vulnerability to external shocks. On the other hand, this gives party controlling CFA tools, to expand its export influence. Hence the increase in French exports to Africa, and sectoral investments.

Niger remains abundant in natural resources. Predominantly three main commodities are being explored - uranium, oil and gold. Despite of their presence, country is being ranked on the very bottoms of Human Development Index, and on 132/180 position in Corruption Perception Index. Its credit ratings are being considered as non-investment highly speculative, bearing substantial risks. Garbage. There are a number of concerns surrounding mining in Niger including lack of transparency on revenues and taxes from mine operating corporations, how these are spent, and environmental concerns including soil and water contamination. Investing in Niger’s commodities is high-risk high-profit task, which often requires having armed security on site.

Uranium remains most important commodity Niger exports. However influence of French companies – dating mostly to pre-independence period - determined unfavourable contracts. Hence country is bound to deliver uranium at prices lower than market’s. In addition Niger’s sectoral share stands at aprox. 33% with the rest belonging predominantly to French Areva. In recent years, Chinese capital appeared as well, which only proves, why G7 is so concerned and motivated to curb Russian or Chinese influences in the region.

Crude oil exploration started in Niger in 70s, however sector exploded no earlier than in 90s – with discovery of new abundant oil-fields at Agadem. Algeria’s Sonatrach, British Savannah Energy and Chinese CNPC are main players in local crude sector. Especially interesting are Chinese plans, as they extend existing infrastructure (oil pipe from Agadem oilfields to Ollelewa refinery) to the west, reaching Chinese terminals in Benin. More natural export route to Niger’s oil leads through Chad and Kameron, however multiple factors made this direction inaccessible. Not only terrorist presence of Boko Haram or local militias and rebels, or national hostilities, but also fact, that similar pipe from Chad’s Doba oilfields was being constantly damaged in successful attempts to steal black gold.

Apart of the above, country produces and exports oily seeds, wheats, vegetables. Pastoral and related (meats, cheese, hides, wool, cotton, used to be strong branch of economy). In the early 2000’s Niger was even responsible for production of photo lab equipment and certain types of machinery being later on exported to South Korea, Czechia or France. However all of these are in long-term decline now.

What’s behind Nigerien gold rush

And now speaking of Niger’s gold. Country officially delivered 34,5 t. of gold respectfully in 2021 and 2022. Nearly whole volume comes from mineral rich Liptako region which stretches between Mali, Niger and Burkina Faso. In Niger, that would be Tillabéri region with great significance of Téra area, located in south-western part of country. Of course gold panning was nothing unusual in the region where river Niger flows. Country was however always focused on uranium, hence focused on gold just since early 2000’s. However it is not entirely true, as gold rush appeared 1974 and then in mid-80’s, when draught caused famines caused mass migration to gold bearing region. Internal migration had been at a time promoted by Niger’s government. Since then, population of Téra doubled every approx. 15 years, and retain great share of population in productive age - 61% of people are being under 20 years old. Who managed to get employment in the sector, could’ve consider himself lucky. Rest turned onto illegal mining or gold panning.

And here’s the main reason, why gold attracted that much Niger’s inhabitants – poverty, famine and crisis. Let us explain. Niger was predominantly pastoral-farming country, with 86% active population engaged in the sector, as per 2016. Agriculture accounted at a time for 40% of Niger’s GDP. This has been however affected in couple different ways.

- First problem was caused by significant devastation of tree stand for the purpose of extending farms, as increase in agricultural production have been achieved by extending areas than by extending yields.

- Another reason lied in devastation caused by fights in between warlords and supporting militias. Unfortunately, region doesn’t belong to most stable regions in the world – just to mention civil wars in Libya, Mali, jihadists including Islamic State and Boko Haram insurgency in Nigeria, chaos in Chad, Sudan and Burkina Faso – all that just within last 15 years.

- Extensive usage of food resources is caused by exponential growth of population and migration. 25 mln in 2021 vs 21.5 in 2017. 50% (if not more) of inhabiting Niger lives in extreme poverty. Niger’s population growth for aged between 15 and 29 will peak around 2050.

- ‘Quantitative’ farming and fishery caused by population growth, but also mass migrations effecting from variety of reasons. This effects with exploitment of fisheries and usage of scarce water resources. Of course even more extensive farming attempts attributes to above. In other words – resources consumption highly prevails local production.

- With less water, and less trees stand stopping winds from Sahara, farms and pastures are being more prone to desertification and draughts, as water balance becomes extremely delicate. 2011 draught (21% decline in rainfall) affected crops by negative 28% and cattle stocks by 8%, triggering mass internal and international migrations. This effected in internal conflict between farmers and nomad pastures over scarce water resources.

- In effect it is observed receding waters of many regional lakes, including Lake Chad, which Niger has access to from south east.

- W efekcie obserwuje się cofanie się wód wielu regionalnych jezior, w tym jeziora Czad, do którego Niger ma dostęp z południowego wschodu.

- And on the final note - Great Green Wall project. Forest in between Sahel and Sahara, stretching from Atlantic to Red Sea, preventing desertification and flow of sand and dust. Such monumental project requires time, peace and bit of focus. In instable, prone to conflicts region, chances to conclude it are zero.

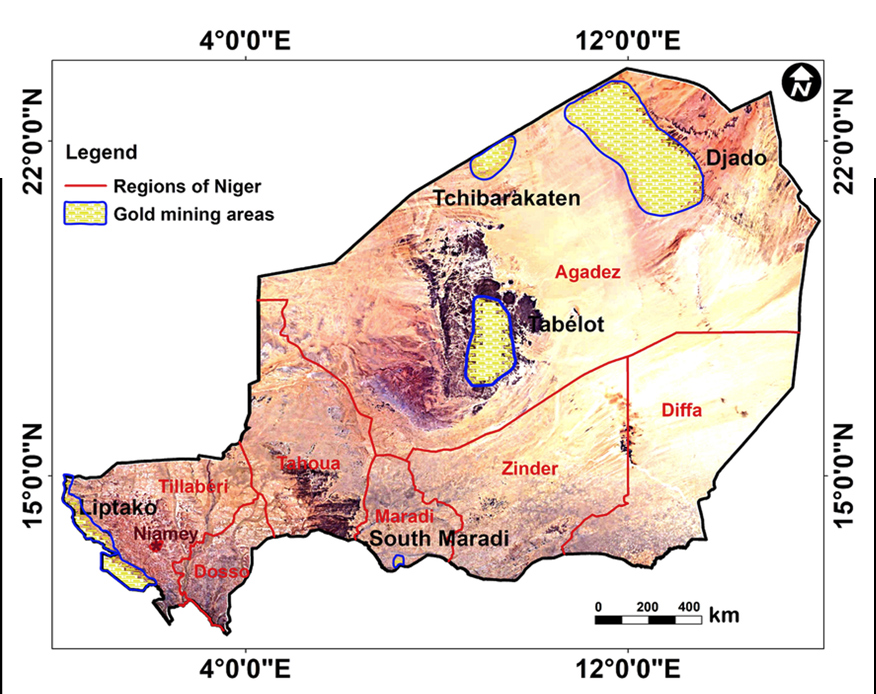

Altogether factors described above attributed to local gold rush. We discuss predominantly two main locations where gold is being mined in Niger. Open pit Samira Hill gold mine was created in 1999 and opened 2004. Funding has been provided among many, by African Development Bank. Project had been run by joint venture of Canadian Societe Semafo (40%) and Etruscan Resources (40%), with government in Niamey representing by SOPAMINE remaining 20%. In 2014 local government acquired foreign shares, owning 100% in project. In 2016, 75% has been acquired by Agroup international, but disposed in couple years. In 2019 80% has been acquired by Ghanian Nguvu Mining – African independent mid-size producer. Initial estimations made on reserves at Samira Hill were estimated at 10 mln tons of ore at an average grade of 2.21 g. per t., from which nearly 20 t. could be recovered over an initially estimated six-year mine life.

Other location is… basically whole Téra area in Liptako, where dispersed artisanal mining and gold panning flourishes. One of the notable locations is Tchibarakaten - the largest functioning artisanal gold mine prospect in Niger. Just in the last two years approx. 35k people had flocked just to this one location – result of internal and external migrations - due to reasons described above – and government’s incentives. Number of artisanal miners was being estimated in 2018 at minimum of 450k. Today, it easily surpassed 500k. . With wages as much as 110k CFA francs (approximately 150 EUR) per month in comparison to national minimum wage of 43k CFA francs (60 EUR) many are willing to take the risk. Especially if consider that this turning onto desert and sanctioned by ECOWAS market is also subject of growing inflation. Sack of rice costs 15k CFA, as per mid-August 2023. That is 30-40% growth on price within just few months.

Gold mining areas in Niger. Source: A. Abass Saley, D. Baratoux, L. Baratoux, K. E. Ahoussi, K. A. Yao, K. J. Kouamé, Evolution of the Koma Bangou Gold Panning Site (Niger) From 1984 to 2020 Using Landsat Imagery

Apart of the above, gold deposits were also found in other regions of country. Loose estimations say, there are approx. 100 (sources vary in numbers) artisanal gold mines in Niger. Only small number of the above exists with valid permits. Unfortunately, government is unable to contain influx of Sahelean and Sub-Saharan migrants, in most cases keeping just nominal control over most mining operations. Of mentioned estimated number artisanal gold mines, no more than five are being subject of government’s supervision, taxation, training, providing equipment or at least ensuring some rules of law and order. In reality, in Niger we could however discuss over 1000 individual sites and that is just considering 31 provinces of 45 that government has under control.

But where government cannot reach, someone else does. Flow of masses resulted in quick establishment of smuggler networks and organised crime groups. In addition, in south-west part of Niger there is also presence of jihadist groups, troubling neighbouring Mali, Burkina Faso and Nigeria. Extensively armed, they either offer money or use force labour, including child labour.

Alleged export ban – boom or bust?

In late July, Niger military overthrew President Mohamed Bazoum who was considered as pro-western, suspended the constitution, and dissolved all institutions. Officers in power ‘lean’ more to Russia-China tandem, seeing France as colonial and economical oppressor. On 31st July multiple headlines suggested Niger along with supporting Mali and Burkina Faso threatened to stop or stopped uranium and gold exports to France. News had been also populated on social media. However, with beginnings of August, Reuters debunked that as false information, quoting no such intentions or confirmations from its sources in Niger. French sources also confirmed it was fake news. Areva representatives did so as well. As on 23rd August, exports are being continued as normal.

But let us just assume for a moment, Niger threatened Paris with export ban on gold and uranium – let’s pretend that General Abdourahmane Tchiani – known for keeping low profile and avoiding public speeches – either attempted to hit French interest in region or just renegotiate current deals.

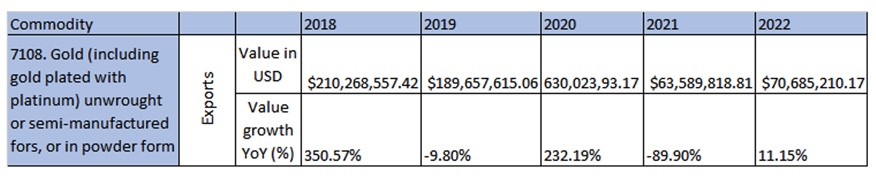

Niger’s gold exports 2018-2022. Source: https://trendeconomy.com

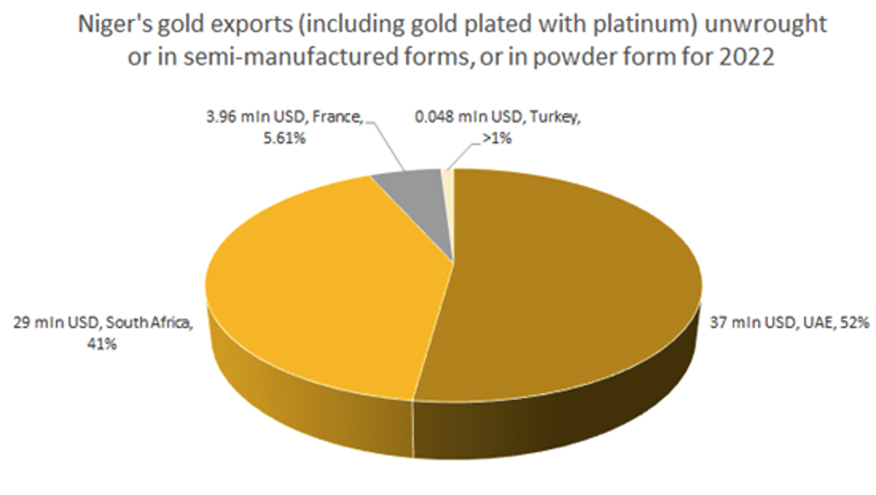

Based on the data acquired from World Bank’s World Integrated Trade Solution and backed up by Trend Economy, with regards to gold exports made by Niger in 2022, they were worthy 70 mln USD. That was 11% more in value than in preceding year, although on this occasion have to take under consideration strengthening of USD to CFA and partial growth of gold price. Above value equals 16.6% of total export country made during course of 2022 (totalled at 423 mln USD). If compared y/y, that is 4.14% growth on role of gold, as total exports Niger made for 2021 were on 506 mln USD. As country delivered similar volumes of gold to the markets in 2021 and 2022, deterioration of Niger’s economy and growth of gold’s share in it is even more visible.

On Niger’s gold export map there are but few locations. Majority of gold was being directed in 2022 to United Arab Emirates (52% worthy 37 mln USD), that serves as trading hub for most of African gold. South Africa with 41% share is another location. In 2022 Niger exported 29 mln USD worthy of gold there. France is on 3rd position, being responsible for 5.61% of volume worthy 3.96 mln USD. So, even despite of large share of France import/export in overall Niger’s economy, this does not translate to gold flows.

Niger’s gold exports 2022. Source: Based on https://trendeconomy.com

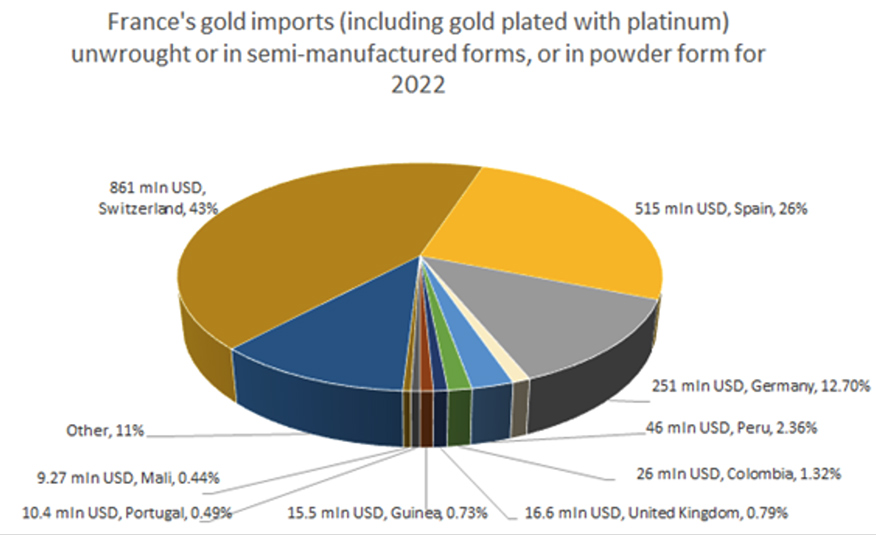

And what about France? Gold volumes France imported in total in 2022, made Niger outside of top ten. Prevails Switzerland with 43% share worthy 861 mln USD. Niger’s neighbour – Mali is 10th most important location worthy 9.27 mln USD, which is less than 0.5%. Hence Niger’s direct gold exports to France are in this scale nearly non-existing.

France gold imports 2022. Source: https://trendeconomy.com

In conclusion – would Niger put such ultimatum to France, such decision most certainly could be an attempt to renegotiate contracts from position of force. However just with regards to gold, due to low volumes exported to France, that would be near to none leverage on Paris. Unless of course being part of larger package containing uranium. After all 25% of this commodity used in Europe comes from Niger. On this occasion we can’t deny possibility of creating and propagation of fake news vi a Arab and Russian information networks, to push Paris to open renegotiations at the table. But that would be pure speculation, fantasy, or geopolitical chess 5d. So let’s stick to the fact.

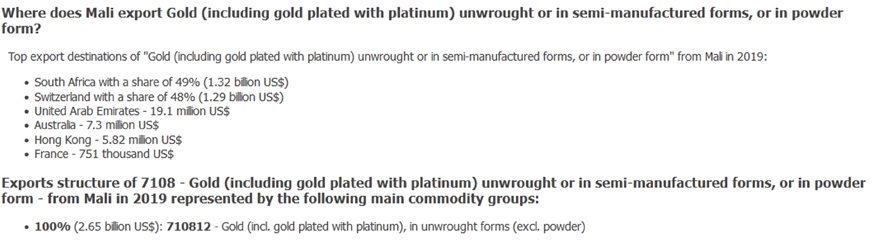

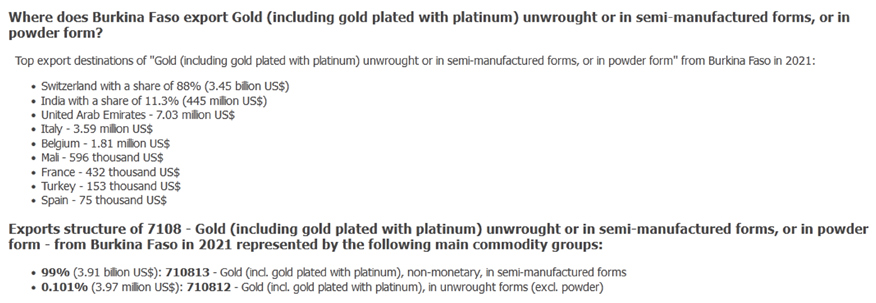

Because, when expanding our assumptions regards gold export ban on Mali and Burkina Faso, we’ll try to find out if situation could change just a little. Both neighbours visited new Nigerien government to show solidarity. Which again some media reported as attempt to widen export ban. Well… gold in Mali and Burkina Faso are main export commodity for both. Without yellow metal, both countries loose over 70% of export income, at least 50% of taxes, and 10+% of GDP instantly. Additionally they sell its gold in vast majority directly to UAE, Switzerland, Singapore and India. In both cases gold exports to France are under 1%.

Mali gold exports 2019. Source: https://trendeconomy.com

Burkina Faso gold exports 2021. Source: https://trendeconomy.com

So considering subject of a export ban on yellow metal to France... this would be no change for Paris at all. Of course, we are aware of the existence of the Swiss intermediary, but as already mentioned - export ban would apply to France. If only it was real.