Commentary on the occasion of US debt downgrade and ongoing PM’s correction

O Ongoing correction on prices of gold may soon come to an end due to fundamental reasons, cyclicality but also because of new and old but refreshed factors, which we’ll try to describe below. One thing is certain – despite of horizontal moves many assets experienced last months – we do not have reasons to be bored.

Wrap up on financial markets

We present below gold and silver price movements in 2023 in percentage terms. Gold remains still below its all-time high levels while we are in the middle of Q3 2023. Nominal all-time highs had been re-established during Q2 2023, upon troubles on banking sector in US and Europe. At the same time silver seems to be lagging, being outpaced by yellow metal in terms of price growth in percentage. It remained on higher levels in 2021, however not even 2022’s dawn of war on Ukraine helped to re-achieve previous levels. In the moment of writing these words (6th August 2023), XAU/XAG ratio is at 1:82, which shows strong gold (although still being in correction) and underperforming silver. Prices of precious metals remained elevated in March, April and May, only to fall in recent months, marking temporary comeback in July. It is therefore possible we had experienced and partially still do, buying opportunity, with window slowly closing down.

Changes on gold and silver prices since beginning of 2023. Source: Tradingview

Recently we could see good reports on jobs, both in EU and USA. There are however still present strong signs for shift and oncoming job reductions – already visible in some sectors, mostly IT related. Some jobs require however certain set of skills and it seems certain market sectors are in deficit of skilled labour force. Just recent example of US job market – Intel had to postpone opening of its US based semiconductor fabrication unit, due to lack of skilled force. Apparently in a sector so important do national defence, competitiveness etc. Another question remains on quality of jobs available and would they (and remaining savings coming from government benefits issued in the near-past and present) allow to cover growth on costs of life. As growth on payroll doesn’t equalise growth on cost of living.

Fed decided to pause growth of interest rates, however inflation is not definitely defeated as US government keeps pushing on fiscal expenses. Strong CPI readings we had experienced in 2022 and partially of 2023 impacted quality of many lives. That is visible especially in US and Western Europe including UK, troubled constantly by strike actions and demands for pay rises. Overall, inflation seem to be partially supressed at the moment, however base effect, ongoing and planned US fiscal expenses (including war related) are something to keep an eye on. US official CPI being down from approx. 9% to 3% could be vastly attributed to lowering energy prices. Hence question remains of how CPI may mis-behave when oil prices will start growing again. Which by the way already happens, as king of crude indices – WTI – did 16% up in July and is currently at 82,59 USD on 06th of August. Why is that?

- Exhibit A: USA want to re-build its SPR reserves being drained in 2021 and 2022 to supress oil prices. That means purchases on international markets.

- Exhibit B: with further escalation in Black Sea, Ukraine declared to expand its attacks onto Russia’s Black Sea ports. That includes Novorossiysk, which serves as important export point not only to Russian oil but also Kazakh. And Kazakhs oil was indicated already in the past as important to shift from Russian, curb down Russia’s oil profits and overall oil prices.

- Exhibit C: northern hemisphere enters heating season in couple months. And although risk of blackouts had been mostly curbed, question remains on final costs we may see on bills.

Overall market consensus seem to be, that strong economy will lead to higher interest rates, which will effect in tightening liquidity and spending, which in effect should impact jobs. Question remains about timing and scale. And speaking of market consensus – we went (at least in US) from ‘imminent recession’ expected in 2021 and 2022 to ‘hard or soft landing’, then to ‘soft recession’ and then to ‘no recession’. Markets tend to fed itself on positive news, and often treats lack of bad news as such. Hence against all odds we believe, recession is certain. Question remains when and at what scale – would it be severe or shallow. But it will come.

Recession will affect first and foremost industrialised economies. Prelude to that could be seen already on various PMI readings. Swiss PMI for July 2023 is at 38.5. Spanish Manufacturing PMI at 47.8, Italian at 44.5, French at 45.1, German at 38.8, Polish at 43.5 and US at 46.4. Any reading below 50, means production management sees or expects contraction of industry (less orders available i.e.). And what is expected to happen in developed economies, may be even more drastic in scale on developing and emerging markets.

What would it mean for precious metals and especially gold at this moment? Volatile August may bring anything and everything, that means re-testing 1870-1920 USD, or attacks on 2000 USD, or just horizontal movement in between these levels. Overall trend on gold, but also financial markets is very choppy. However outlook for mid-term and long-term gold remains bullish. And again, with gold still remaining on near-record prices, this makes us question what levels to expect upon real troubles re-appear.In the meantime new factors emerged. Time will tell if that is just canary in a coal mine, or magnificent royal black swan.

On Fitch’s US debt downgrade

A real shocker – although to be honest, not entirely unexpected – came from credit rating agency Fitch, who downgraded its rating of US debt from highest triple AAA to AA+ with stable perspective. Why ‘shocker’? Because downgrade happened to most developed economy in the world, bulwark of democracy and most developed so called free market. In addition, USA issues de facto reserved currency of the world. But why it is ‘not entirely unexpected’? Fitch signalised possibility of such move since at least May 2023.

As a reasons for such move, rating agency mentioned expected fiscal deterioration over the next three years, a high and growing general government debt burden, and erosion of governance. Fitch also mentioned repeated debt-limit political standoffs and last-minute resolutions, which could’ve erode confidence in US fiscal policy.

Said reasons are of course valid – within next 18 months USA will have to roll approx. 1/3 of its massive government debt. With government’s expenses surpassing budget incomes, it is expected for US to have deficit on 6.3% in current year. This means, Washington will continue issuing debt on faster pace and soon deliver on markets bonds worthy 2-3 trl USD. That means – According to Bank of America – US debt will keep growing by 5.2 bln USD daily for the next 10 years. Unfortunately, fiscal policies prevail over tightening monetary policies of local central bank, hence markets may now experience lot of mixed signals. On one hand, government will continue spending for variety of social and political programs. That includes financing Ukraine’s war efforts by keeping open credit lines. Which of course is supportive to US military complex. On the other hand however, Federal Reserve continues on credit tightening policies and weakening consumption. Which of course eventually will effect in growth of unemployment. Hence duality of dollar, where expansionary fiscal policy prevails over monetary tightening.

With regards to other aspects mentioned by Fitch – we experience ongoing aggravation on US political live ahead of 2024 political elections. It is nothing unusual across the Atlantic to start campaign at 1.5-2 years ahead of elections, however this time it seems we experience continuation on Biden – Trump conflict, escalated to a new heights. Additionally, general public again had doubtful pleasure to observe political theatre over raising debt limits some time ago. We call that ‘theatre’ as not doing so, would immediately cease US ability to pay its debts, technically defaulting USA and causing strong downgrade on US debt papers. Considering that approx. 45% of debt worldwide is issued in USD, this would mean perfect global financial catastrophe.

Of course US Treasury disagreed with said decision, with Secretary Janet Yellen strongly stating that decision has been ‘arbitrary and based on outdated data’. This comment was expected and should come as no surprise at all. After all she is the head of the debt issuing institution and it is within her responsibility to ascertain that interest paid on issued financial product remain as low as possible.

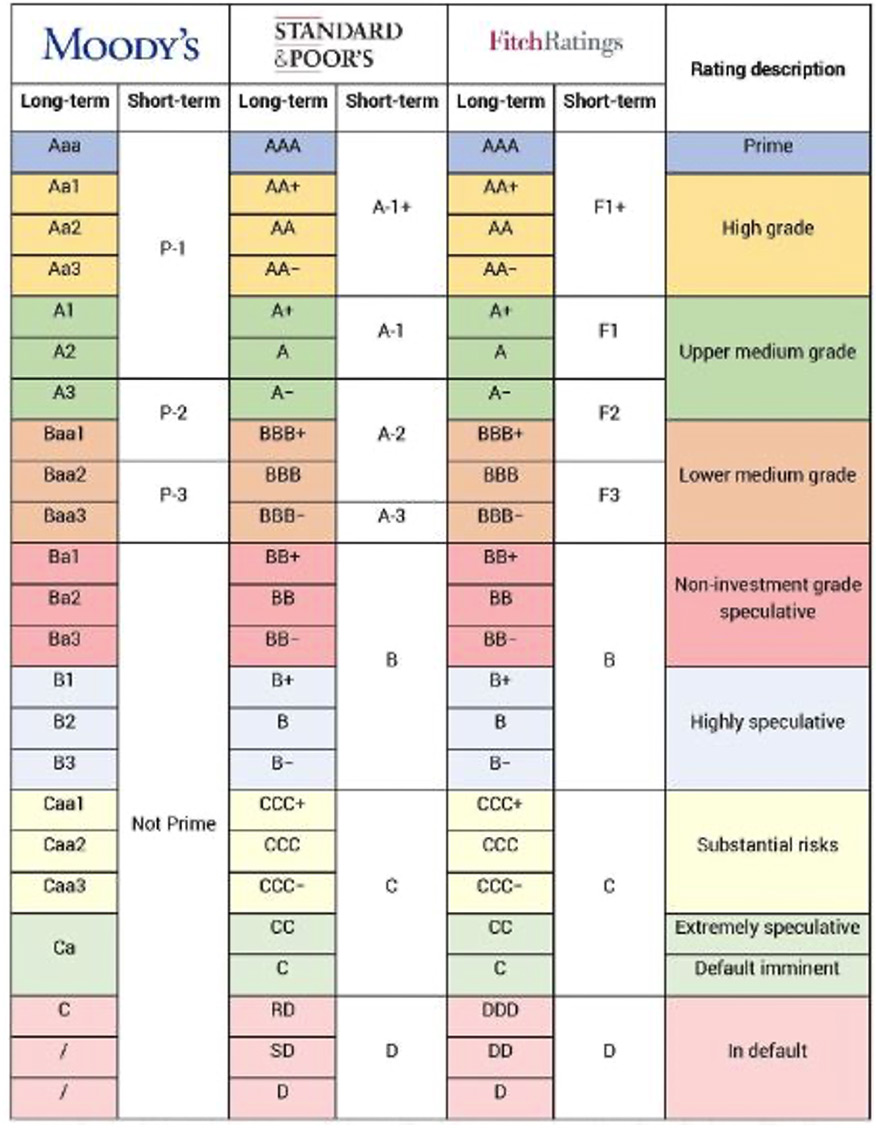

It is not first US debt downgrade in our most modern history, as in August 2011 S&P downgraded US debt to AA+. Word is, that on this occasion head of S&P received call from Treasury straight from Secretary’s office. And apparently it was very unpleasant, loud and long monologue. As it is no easy task to gain on ratings - i.e. Polish debt is being considered as upper medium grade by all agencies, but it struggles to go higher (and been even temporarily downgraded by S&P couple years ago). One of the reasons for that lies in the fact of technical default in the 80’s. Different era, different government, different political system, but markets remember. In case of USA, its debt is considered as prime quality by Moody’s and DBRS rating agencies, and 2nd best by S&P and Fitch. While downgrade from Fitch came just recently, S&P keeps its rating for US debt on AA+ unchanged since 2011. .

US 10y yield breakout from long-term trend. As on morning 07/08/2023. Source: Tradingview

As a result of downgrade, yields on 10y US government bonds had grown to 4.04% and on 30y to 4.2%, with potential to reach approx. 5% during next months. Stocks reacted in red, precious metals as well delivered losses. What made growths, was US dollar that made 101.90 from 99.3 on DXY. Downgrade on US debt means, US Treasury will have to pay more on interests to encourage to purchase newly emitted US debt, as currently certain corporate bonds may have better credit rating than debt issued by US government (!!!).

Growth on yield affected market value of already issued government bonds, hence all its owners – i.e. retirement funds, banks, central banks have been affected by loss in value of assets held. It means after period of initial shock, market participants will try to figure out, what to do with capital. Majority may want to move from bonds to stocks, adding some fuel to growths (although still very choppy ones). This may be tricky, as SP500 doesn’t look as green as may expect. Recent growths were fuelled by ‘AI’ trend. And when having a closer look on earnings, most top companies’ just experienced 3rd consecutive quarter of negative earnings. By the way, have you noticed that Apple is no longer 3 trl USD market cap company??

So what may be interesting to some investors, are dividend delivering assets, as some of them already deliver better percentage than US bonds. Dividends may have a chance to become ‘real thing’ during such market conditions. Considering certain mining stocks - assuming they will keep up with price of gold and won’t be too heavily slowed down by liabilities on balance sheets, dividends delivered may become even higher. Apart of that, some investors most definitely purchase precious metals as a defensive assets, anticipating growths and expecting further deterioration on market conditions.

xHistorical example of how gold reacted to 2011 US debt downgrade by S&P. Source: Tradingview

Downgrade of US debt sent negative signals around the world. But would it has a chance to turn onto strong green for gold? Some commentators already considered how gold reacted to US debt downgrade in 2011 and try to make interpolations to modern market. However with much different economic conditions between now and then, we’d be careful in expecting imminent 1:1 scenario between 2011 and 2023 to occur. However, with deteriorating economic conditions around the world, precious metals seem to be doomed to rise.

Rating agencies and gold

Fitch is smallest of “big three” that also consist S&P and Moody’s. Altogether, they control approx. 92% of market for such services with Fitch being responsible for approx. 16-17% of market share. Recently, ‘big three’ is being extended to ‘big four’, due to rise of DRBS. What is credit rating agency? It is company that rates lender’s ability to pay loans and interest of loans. Whether we discuss government, corporate or instrumental debt. Let us imagine example – US banking investor would like to have exposure precisely on Slovenian government debt issued in EUR (however most common would be just to get exposure on Central-East Europe region). It will most likely do its own study and research, but its final decision will be most likely backed by proper report and rating of said instrument, made by professional credit rating agency. It will tell him if said instrument is sound, which means if Ljubljana is capable to pay IOU in assumed time perspective. Same with corporate debt, as companies may acquire funding by issuance of stocks, but also bonds.

Although no one said, these ratings may be 100% solid – as example of MBS (mortgage backed securities) had shown during previous crisis. In other words - credit rating scores impact the loan decision and decision on the interest rate of the creditors. Thus, the borrowers will try to obtain the highest credit rating score possible, while the rating agencies attempt to have honest and objective view of the borrower's financial condition that affects their ability to handle debt settlement. In theory that should be un-biased, un-influenced and fully independent rating. In practicality, we have strange feeling that certain, less than 3 minutes long scene in 2015’s ‘Big Short’ explained everything on rating agencies to non-market savvy viewers.

Moody’s, S&P and Fitch – ‘Big three’ and its rating scale. Source: https://1.bp.blogspot.com/-LxyGhmEw8wQ/XZw1O5CkDhI/AAAAAAAAANo/Q4Ct2GaPqwEOavMnqgtXP_bfMfhRJZdegCLcBGAsYHQ/s1600/credil%2Bblog%2B2.JPG

To ascertain understanding, agencies use ratings – each one has its own, although certain similarities are clearly visible. Instruments rated as triple A are being considered as prime, top quality. Then there are other lower ratings indicating assets good for investments, some better than the others, some worse. Eventually we reach category of Ba1/BB+ which are non-investment speculative assets, which are considered as best of junk bonds. These, and below are not suitable to buy and hold strategy and bear substantial risk to a parked capital.

That brings a question – can we credit rate gold? Gold is an asset, commodity, not being issued by any institution and not being used as part of monetary system - hence has no rating. That is despite some optimists who say that ‘lack of rating is an indication of highest possible rating as it bears no counterparty risk’. The only way and place gold is being used as subject of loan or collateral, happens in closed environment of certain gold markets like LBMA. However, it is simply a closed circuit.

Yet, credit ratings on debt may affect price of yellow metal – as described couple paragraphs before.

And why does it matter at all?

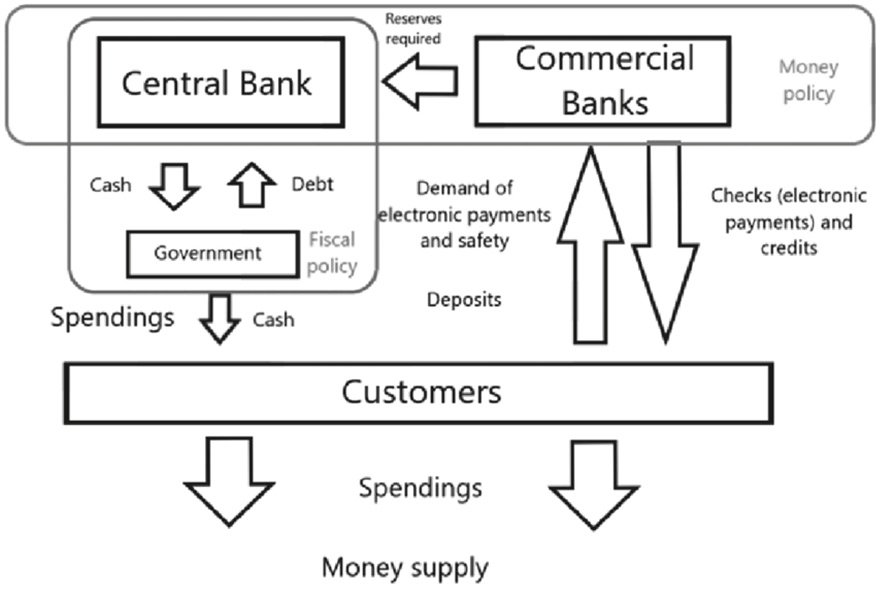

Reason lies in construction of modern monetary system. Since de-pegging of US dollar and gold in 1971, we exist in financial environment that could be characterised in three words – fiat, debt and expansion. All these factors combined together are foundation on which gold, silver, palladium and platinum function on commodity markets, forming group known as precious metals and perceived as a form of defensive assets.

It is system based on fiat money. ‘Fiat’ in latin could be translated as ‘so be it/let it be done’. Example for better context - usage of above in prayer in latin, where words ‘fiat voluntas Tua’ mean ‘let Thy will be done’. In financial word that is type of money, not bearing promise of exchange to any commodities of goods and therefore not being backed by gold or silver. Its recognition is promised by issuing government and indirectly by other governments that acknowledge existence and rights of the said government. However, more appropriate term for such type of money would be ‘fiduciary money’. Again we have to derive to language of ancient Romans – ‘fides’ means ‘faith’. Hence money based on faith (or form of social contract) where issuer and user agree that ‘this bears value and that not necessarily’. Of course eminent sets all the rules and user’s opinion doesn’t matter much. After all, based on historical examples – everything can be money, as long as buyer and seller agree on that.

Another element describing modern financial system is fact, that it is debt based. Government collects money in form of taxes, trade agreements, and many other. It spends them more or less accordingly as per budget. However it usually happens for many reasons that debit and credit side of budget are not balanced. In most cases it is due to higher spending. Hence governments seek for loans. They issue via local central bank (which use other local banks aka prime dealers as market distributors) debt papers with face value and determined maturity date. They bear promise to pay extra interest to the buyer. Initially this is determined by markets, as i.e. seller may offer 2%, and buyer will say ‘there is too much risk, I’m willing to buy for 3.25%”, so counterparts have to find consensus. Government may issue said bonds with different maturity dates, i.e. 1 year, 2 years, 5 years, 10 years, which are considered as one of most important financial indicator. 30 years, which are long-term. Some government even decided to issue 100 years bonds in the past years. Today, considering recent years of inflationary environment, that leaves us just speechless. So, coupon will pay percent of its face value for said period of time, and after it, issuer will buy it back for face value. That is assuming buyer won’t decide to sell it earlier for market value, which may in the meantime go up or down. Bonds are often being called IOU papers, which is short of ‘I owe you’.

Simplified chart presenting basics of modern monetary system. Source: Patryk Kaczmarek, Central Bank Digital Currency: Scenarios of Implementation and Potential

And here comes another element – expansion – as government borrowed 100 USD and paid back 103 USD, where does it has this 3 USD from? By issuance of more debt – aka will print money. But had you – kind reader – put money on saving account, and it delivered certain interests after year, where do they come from? Apart of monetary policies of central banks, answer lies in fact that commercial banks are able to generate money, hence expand monetary base. This could be measured by various M aggregates, where M0 stands for monetary base created by central bank and M3 includes all forms of crediting and flows commercial banking is capable of. That is how our financial system has been designed – to constantly expand, hence to be inflationary. And that is reason why banks are afraid of deflation. From the perspective of currency user, it makes purchasing power stronger. However from the perspective of other market participant, it destroys economy by shrinking availability to create new money aka delivering liquidity, which is basic ingredient of modern financial system. In addition, too strong currency breaks ability to compete against other countries who may deliver services and goods at cheaper prices.

Summary

Hence monetary system developed in such way, encouraged monetary expansion over decades, which resulted in debt surpassing GDP in developed countries many years ago. Even despite attempts by local central banks to keep inflation within certain thresholds (i.e. 2%). So debt is good (as it builds liquidity) and debt is bad (as inflates and therefore currency’s purchasing power in our wallets is going down).

Hence, long-term necessity to keep some assets, recognised since millenniums, as a part of investment wallet. That should help to keep ‘our ship’ safely anchored.