Everyone interested in gold mining knows that main producing countries are China, Russia and Australia. It’s also common knowledge that it is Africa, Asia, and Central & South America who dominate analysis on geographical gold distribution. But there is also one region, which usually doesn’t receive enough coverage, or at least not enough to what it deserves. This is Central Asia.

Introduction

Our kind readers may be surprised, why we decided to present such mysterious region of Asia in our analysis. It’s obscurity, difficult history, but also unique local traditions and natural beauty, which dragged our attention. We also like challenging analysis. But must admit, main reason is simple – there is gold in there. With history of regional gold mining reaches ancient times. And with prevailing sectoral underdevelopment, it seems to be certain there is more than just officially confirmed underground reserves.

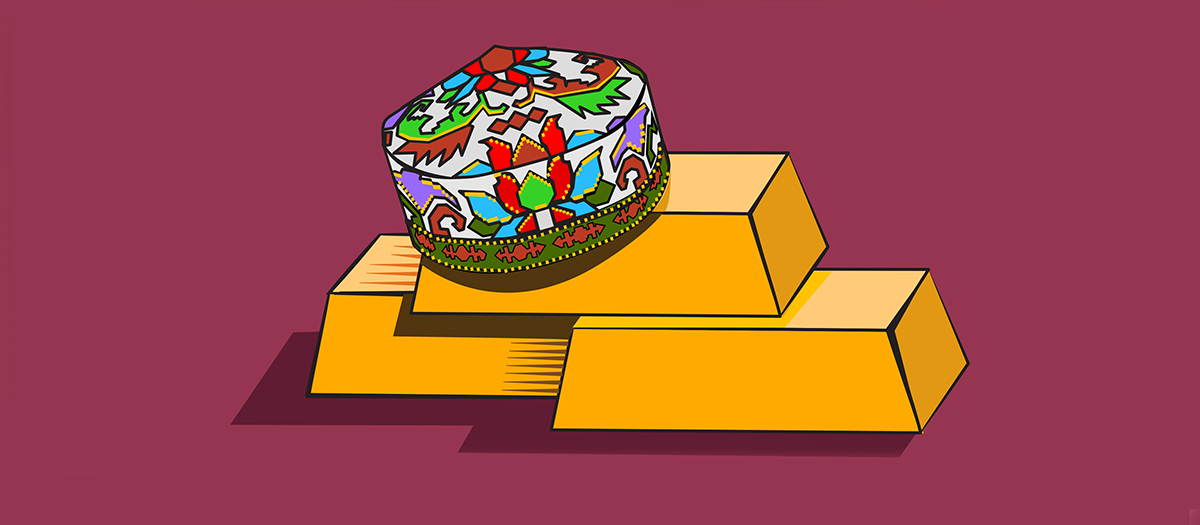

Gold reserves (proved) in Central Asia. Source: https://daryo.uz/en/2023/09/22/gold-rush-central-asian-countries-bet-on-gold

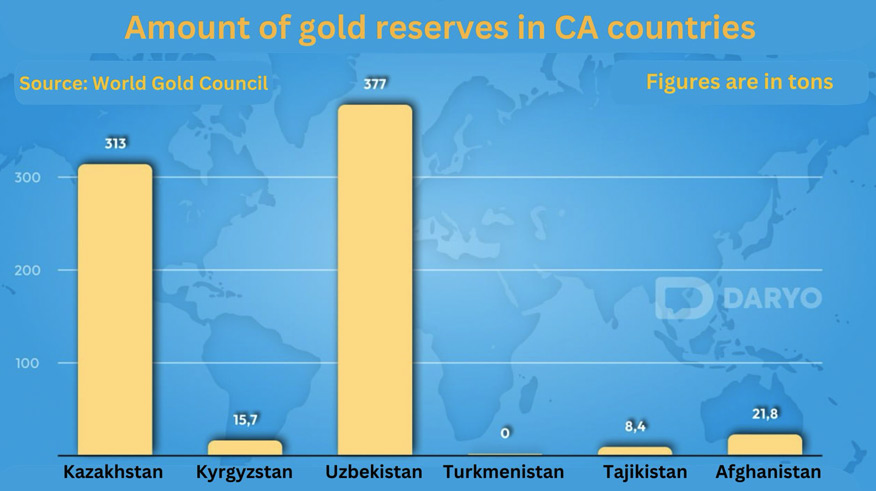

According to World Gold Council, Central Asia delivered combined volume of 240 t. in 2022, which is nearly 7% of total global mine output (in the moment of writing these words, we do not have access yet to 2023 detailed output figures). That is just 40 t. less than Canada and Mexico combined, but at the same time, please bear in mind how well above are covered in sources. Everyone focuses on China, Russia, Australia, Canada, South Africa, USA, South and Central America. Even Africa received more coverage in recent years. However, analysts and commentators usually touch subject of gold from Central Asia briefly, just upon listing top 10 gold mines in the world. ‘Oh, and second largest world mine in the world is Muruntau, but we’re unable to verify its reported production figures’. And so, Central Asia remains like in the times of Marco Polo – land unknown. Terra incognita.

Brief introduction on Central Asia

This and next chapter were designed to provide some general facts about Central Asia. However, diving too deep would make this analysis much longer than assumed. So, we kindly request kind readers to consider it as just as general introduction before we’ll discuss subject of regional gold mining.

Central Asia on map. Source: Nations Online Project

Concerning Central Asia, we will use this term as a generally descriptive to Kazakhstan, Kyrgyzstan, Uzbekistan, Tajikistan and Turkmenistan - ex-members of Soviet Union, and since 1991 independent states. Although, sometimes regional maps would also include Afghanistan and even Caucasus states of Georgia, Azerbaijan and Armenia. Discussed countries are in majority Muslim, usually with one dominating at 70-86% ethnic group. Unique ethnicity, vastness and wilderness of step and mountainous Asia cultural aspects, historical heritage blend of local traditions and historical empires (vast world of Islam represented by many past empires, Mongols, Tzar Russia, Chinese influences), makes them fascinating to perceive and experience. In addition, important historical trade route – Silk Road – which linked Europe with China used to go through Central Asia. In past years, region benefitted from Chinese investments under attempted reinvigoration of above under Belt and Road initiative, or via New Development Bank. But with power struggle between world’s superpowers, Bejing seems to change stance towards low profile.

At the same time, we discuss region perceived as authoritarian or even totalitarian on some occasions, which remains between political and economic influences of China and Russia. They are known multiple cases on violation of human rights, including freedom of speech, assembly, tortures, arbitrarily locking up government opponents, shooting to protesters etc. And although some form of liberalisation has been achieved in comparison to 90’s, above remain in place. Additionally, region is perceived as one with high levels of corruption. In corruption perception index, Kazakhstan with lowest regional corruption level, remains on 93rd position out of 180, while Turkmenistan – perceived as regionally most corrupted - at 170th.

Kazakhstan, Kyrgyzstan, Uzbekistan, Tajikistan and Turkmenistan are often considered as whole in publications, as Asian part of CIS - Commonwealth of Independent States. Commonwealth of Independent States is regional intergovernmental organization in Eurasia - formed following the dissolution of the Soviet Union – with task to encourage coordination of trade, finance, security etc. between ex-soviet republics. They are also, among many, members of local organisations such as:

- Shanghai Cooperation Organisation (with exception of Turkmenistan, which remains guest attendee), perceived mostly as Asian NATO but also strongly embedded in ascertaining local economic cooperation.

- Organisation of Turkic States (with exception of Turkmenistan, which remains observer), promoting comprehensive cooperation among the Turkic people.

- Economic Cooperation Organization, platform to discuss ways to improve development and promote trade and investment opportunities.

- Eurasian Economic Union, (with exception of Tajikistan and Turkmenistan), which effectively works as integrated single market.

After 1991 region experienced multiple tensions over shape of borders, weaponisation of water resources, internal balance of power and political successions. Despite of all above, authoritarian regimes predominantly managed to preserve peace in between nations, even despite local civil wars and presence of armed militants. And so, Central Asia avoided faith of Yugoslavia, or Caucasus. However certain tensions are clearly visible. New strong leaders were usually members of old communist regime. They based their power on soviet-originating family structures, security apparatus and business elites associated, creating oligarchic-autocratic form of management. On some occasions either they or their successors ascertained introduction of certain liberal (including release of political prisoners) and economic reforms. However, each case of established ruling dynasties and systematic reforms requires separate studies.

While Russia used to have political and military patronage over region, Chinese economical influences were more visible with every year. Peak point of Russian influence was visible in January 2022 with its military intervention in Kazakhstan, however since then, Russian influences are generally perceived as eroding, especially on the benefit of China. However, geography determines Central Asia’s close links with Russia. Central Asian states became part of the Tzar Russian Empire in XIX century and then remained in USSR during basically through whole XX century. This, along with difficult historical relations with Iran and presence of fallen state of Afghanistan on the south, determined communication and trade routes both regionally and internationally. In recent years Chinese regional investments in roads, energy sector and other, made Beijing to replace Russia as a main or key trade partner in i.e. Uzbekistan and Kazakhstan. However, it is Russia’s (mostly soviet era made) oil pipe/gas pipe system which remains necessary to deliver energy commodities to western customers.

We discuss predominantly landlocked nations, some bordering with landlocked Caspian Sea which due to its flicker nature makes local maritime trade dangerous and unreliable (although periodical tests were and are being conducted). Central Asian states are predominantly located in mountainous region, where insufficient number or quality of communication routes remains an issue. It is deepened additionally by regulatory obstacles and insufficient local international level of cooperation. And although some progress has been achieved during last decade, it is uneven. In Uzbekistan and Kazakhstan, improved connectivity is driving increased trade and investment, while Kyrgyzstan, Tajikistan and Turkmenistan are lagging and could only hope on Chinese sectoral investments. Which come in price. One problem lies in relative regional desolation of above states, other in simple geology, as investment in roads made in mountainous level and at high elevation, requires economic justification. May 2023 inaugural China–Central Asia Summit pushed forward plans on construction of China–Kyrgyzstan–Uzbekistan railway. Advancements are also underway along Central Asia–China gas pipeline, intended to transport more Turkmen gas through Tajikistan to China.

Major gold deposits in Central Asia. Source and higher resolution at: https://www.srk.com/en/publications/interactive-map-of-central-asian-mineral-resources

At the end, quick word on sanctions against Russia. Considering that sanctions prevent entities to trade with or obtain certain commodities (includes gold or industrial machinery) from Russia, interested counterparts take extensive usage on intermediaries. We discussed Russian gold exports in the past, pointing out UAE and Hong Kong as export gates. However European export to i.e. Kyrgyzstan and other Central Asian states had grown recently, both in value and percentage-wise terms. This revived regional significance and build requirement for local educated workforce of mid-level and lower. At the same time regional position as Russia’s intermediary escalated tensions with USA and EU. According to a European Bank for Reconstruction and Development report, a resumption of international trade and tourism, as well as high levels of migration and remittances from Russia, bolstered Central Asian economies’ strong growth in the first half of 2023.

In the footsteps of Silk Road merchants - briefly on regional commodities

Region is considerably rich in hydrocarbon and mineral resources. Just to provide some examples - Kazakhstani Kazatomprom is considered as most important miner of cheapest uranium, bound in long term contracts with China, USA and France among many. Uzbekistan delivers uranium to Japan, China and USA. Kazakhstan and Turkmenistan produce and export crude oil at total capacity nearly 2.5 mln barrels per day, with Kazakhstan remaining active member of OPEC+. Above two, along with Uzbekistan also produce approx. 15 bcf of natural gas daily, with Turkmeni being considered as having one of the largest nat-gas deposits in the world. Both energy fuels are being delivered either to China or via Russia-Azerbaijan-Turkey routes to the West. .

Map presenting top export commodities of main Russia’s neighbours. Source: https://www.eca50.com/post/50-largest-listed-companies-on-tashkent-stock-exchange

Kirgizstan specialises in coal, precious metals, nonferrous metals and minerals. All of the described states have to be considered as coal rich. Other important regional sectors are energy exports, agriculture and fertilisers, as it is a case in Kazakhstan. Speaking again on Kazakhstan – recent years lot has been written on Kazakhstani deposit potential on rare earth metals and lithium. Both are perceived from geopolitical point of view as important to soften Chinese sectoral dominances.

And what about local gold – you might ask? After all, throughout history, no mineral has enjoyed more universal appeal than gold. Gold is a leading export commodity of both Kyrgyz Republic and Uzbekistan. It is also mined in Kazakhstan and Tajikistan, but in case of these two, export of other types of commodities prevails. Region’s largest deposits are in the middle and southern Tien Shan gold belt in Kyrgyzstan and Uzbekistan. Other major deposits are to be found in Makmal gold mining complex and the Sary-Dzhasskiy, Soltan-Sary, and Terek-Sayskiy gold mines. Uzbekistan’s open pit Muruntau gold mine in the Central Kyzylkum area contains one of the largest deposits in the world. Other significant are in the nearby Amantaytau goldfields, and Zarmitan fields in Samarkand.

Deserts and irrigated areas in Central Asia. Source: https://www.flickr.com

Region is mountainous, desertous and steppe with predominantly small share of arable area up to 20% in case of Kazakhstan and even up to 4% in Turkmenistan. In comparison – Russia and Ukraine’s share of arable land is in between 60-80%. Problem lies in diminishing water resources and imbalanced water policy, which in effect causes occasional regional tensions and frictions.

Tajikistan’s mineral potential remains mostly undiscovered however country contributes from aluminium production, which we’ll mention later in the analysis. Tajikistan’s economic base is dominated by production of cotton and aluminium. Cotton production has also an important economical aspect in Uzbekistan and Turkmenistan. This is reminiscence of Soviet policies, which in arbitrary way decided on introduction of cotton to local agriculture due to its high salt and drought tolerance. Improper cropping and extensive irrigation practices caused water levels in Syr Darya and Amu Daria rivers to drop significantly. Unbalanced water economy resulted in Aral Sea disappearance which is considered as greatest man-made natural catastrophe so far. As it destroyed some traditional branches of economy and led to salination and further desertification of Uzbekistan.

Gold production 2010-2022 in Russia, Uzbekistan, Kazakhstan, Kyrgyzstan and other members of CIS. Source: WGC

Mineral and metal mining remains important aspects of economy, with precious metals are among them. However international miners do not seem to perceive Central Asia as great investment opportunity. In Fraser Institute’s Survey of Mining Companies region appears unfrequently. Last time in 2021’s edition, and it has been described as ‘least attractive jurisdiction in the world of mining investment’. Reasons mentioned were: taxation regime, socioeconomic agreement / community development, trade barriers and security issues. Best and only of local surveyed jurisdictions – Kazakhstan – has been described as performing ‘poorly in its legal system, its taxation regime, labour regulations, and geological database’. In addition, there are concerns on country’s lengthy permitting process.

At the end of this chapter – trivia. As a cultural heritage of USSR, local population still perceives gold teeth and gold implants as… fancy. Initially they were symbol of owner’s status. Then, fashion became popular among all social groups and nowadays it is difficult to judge who is who on this basis. Especially since gold teeth are to be spotted among all sexes and age groups. Interestingly, pre-2019, presidents of Turkmenistan and Tajikistan banned inserting gold teeth, stating among other things that in countries with such a high level of poverty, it is just not being right. Unofficially however, that was one of many elements distancing countries from Russia’s current and past influence. Let’s face it – if to exclude Soviet infrastructural and communicational influences, then Central Asian ex-soviet republics have more in common with heritage of nomadic and settled Turks, vast world of Islam, Chinese business and influence. And this division – not that much seen right after USSR’s collapse, gradually increases.

Giant of Navoi – Uzbeki gold mining

There are two government-owned gold mining holdings in Uzbekistan- Almalyk GMK and Navoi GMK (NMMC). Latter is responsible for 80% of state’s gold mining. NMMC is in possession of 13 different deposits, all subject of extensive modernization works. It also plans to open further mines, which should allow holding to secure stable gold supply levels for the next 40 years.

But Navoi owns crown jewel of regional and even global gold mining. Developed in Soviet Union in late 60’s, started production in 70’s, and by late-70’s surpassed gold production of Magadan Oblast, which used to be until then most gold-bearing region in USSR. That is Muruntau gold mine, which just alone supplies 80% (53 t. in 2022 excluding heap leach operation) of the country's gold production. It bears significant economic importance to Uzbekistan as gold mining contributes substantially to the country’s economy and export revenues. Gold is used to stabilize its own currency on FX markets, maintain central bank reserves and for the needs of the internal market. Its export is an important aspect of state budget revenues. In 2022, Uzbekistan exported USD 5.18 trillion USD in gold, of which over 80% went straight to Switzerland.

Uzbekistan natural resources. Source: https://abmec.org.uk/wp-content/uploads/2020/07/2020-07-EECAN-Uzbekistan-Mining-Sector-DIT.pdf

Muruntau frequently appears on the list of top 10 gold mines in the world by gold production volumes. However, there is certain controversy as its yearly production is in theory un-verifiable. However, analysis of historical production levels, along with gold export volumes seem to validate if not all then vast majority of reported production. That’s enough for Muruntau to ascertain its position as second biggest gold mine is ascertained. And speaking of, we have bit of a problem with position one on the list. It is Nevada Gold Mines with its output at 3.3 mln oz, which is joint venture between Barrick Gold and Newmont. Reporting it as one means, inputting all operations in the past reported as separate - Carlin, Cortez, Turquoise Ridge, Phoenix etc. – to one basket. Joint venture helped to lower local production costs by finding local synergies and avoiding infrastructural duplications. Soon, US gold sector quickly started to report above as one big operation, making it biggest and indisputable by volume of gold single mining operation in the world. Even despite higher than in similar cases distance between some of the mines. Seems someone really needs everything largest…

Look on Murutau gold mine. Source: https://www.capellaspace.com/gallery/muruntau-gold-mine/

Back to Muruntau and Uzbeks. Upon USSR collapse, its gold sector was already in terrible shape. However, US and Canadian miners were aware of its potential and technological backwardness. They had capital that ex-soviets needed, and ex-soviet republics had commodities at low all-in- sustaining-costs, which miners required. End of Cold War, economical & political collapse of communist states, and dominance of USA’s USD was incentivising to take a risk. And so, first representatives (including geologists) started appearing in Moscow already in 1990, seeking for opportunities.

In February of 1992 Newmont signed 50/50 joint venture with NMMC. Deal allowed Americans to purchase part of the extracted ore rubble mined since late 60’s, which Soviets called economically unsustainable to process. Heaps of which were 30 m high and extended several kilometres in radius from Muruntau. Soviets were unable to process it effectively and focused on the most gold-bearing ores. However, Newmont had access to heap leaching, which is chemical separation technology. Newmont started investment and soon, in 1995, its local chemical processing was operational. Muruntau was also supported by loans worth 135 mln USD from the European Bank for Reconstruction and Development and later other banks, which was yet another prove that introduction of ‘Western’ entity incentivised capital inflow.

Initially Americans purchased 245 million tons of gold bearing rubble, with potential gold content of 8.7 mln ounces, from which 4.8 million ounces of gold could be obtained by chemical leaching. In 2001, US giant purchased rights to another 150 mln t. of unprocessed ore, which turned out to have a gold content average of 1.44 g per ton. This means, tailings from Muruntau were more gold bearing per tonne than average of all Newmont’s operations! And so, for next decade Newmont continued pouring cash into joint-venture, And they had all the reasons in the world to do so as:

- In between 1996-2005 processing local gold rubble delivered from 245k to 430k oz per year.

- Local all-in-sustaining-costs were at 162 USD per oz, against Newmont’s average 278 USD.

- Tech introduced by Newmont enabled gold recovery rate from rubble to increase to 95.4%, in comparison to soviet ‘economically unsustainable’.

Unfortunately for Newmont, scenario typical for authoritarian states started to unfold. In 2005 Uzbeki military opened fire against Islamic rebels and civilians in Andijon, causing hundreds of casualties. This caused outrage around the world and severe sanctions against Tashkent. In the sectoral context, above occurred in a time when share of enterprises privately owned topped at 90% in construction material, ferrous and nonferrous metallurgy sectors. Even despite the fact, it was state who held monopolies on some investments, and foreign capital had to form joint-ventures with its local counterparts.

In need to secure funds and reciprocal action, authoritarian government turned their eyes onto one of the most profitable foreign investments in the country. First, Uzbeki government demanded payment of so called ‘overdue taxes’ at 48 mln USD. Americans took it to local court which judged against them. Uzbekistan quickly ‘secured’ Newmont’s assets and ceased its gold exportation. Newmont written-off Muruntau of its ledgers in 2006 and opened international arbitrage against Uzbeks. Eventually, parties signed deal in 2007, with Tashkent paying 80 mln USD to Americans (value already reduced by ‘overdue taxes’) in exchange for its Uzbeki assets.

To sum it up, Uzbeks acquired prime quality chemical separation object, needed tech and local cadre trained and specialised by Americans. Newmont received partial return of costs incurred, but lost production output future budgeted, access to prime source of revenue and its stock valuation dived on stock exchanges.

Turkmenistan - where streets are paved with marble and gold (imported)

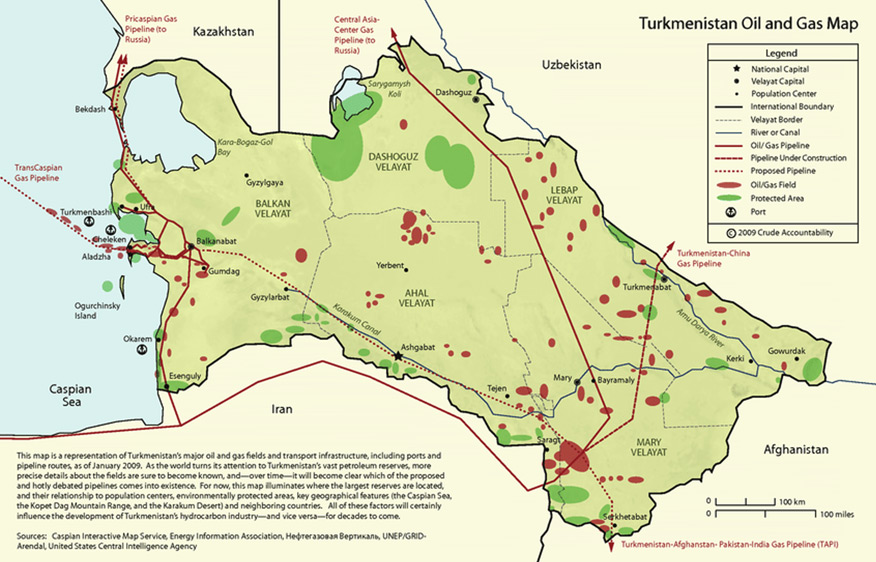

In addition to its substantial oil and gas reserves, Turkmenistan has a broad range of industrial mineral resources that are unevenly dispersed throughout the country. In 2005, all mineral production entities were still state owned. Development of deposits was undertaken by enterprises under the jurisdiction of the state and its ministries. However, state at that time had recently allowed some foreign involvement through joint-venture arrangements.

Turkmenistan predominantly excels in oil and gas, with no gold underground reserves. Source: I. Jumayev, I. Uca, Foreign Trade of Turkmenistan: Trends, Problems and Prospects

Lot could be said about Turkmen totalitarian system and violations of humanitarian rights, its self-imposed ‘Neutrality’ principle and cult of leader. Lot could be found on cessation on providing free of charge utilities (gas, water, energy) to country’s inhabitants in 2018, after 25 years of doing so. We also could find lot on regional historical and cultural marbles attracting tourists. Even more has been written on its vast natural gas reserves. But with regards to gold country produce none.

Capital of an authoritarian or even totalitarian country is filled with gold-plated monuments and statues of leaders. Media often compares Turkmenistan to North Korea. Difference is, Turkmen Republic is abundant in energy commodities. Golden domes, illuminated fountains, white marble ministries, roads in perfect condition - this is how centre of Ashgabat looks like. But subject of gold mining in the state seems to be non-existing, either in specialised or general, private or public, sectoral or geological sources. As according to Nasdaq and World Gold Council's data, Turkmenistan is among countries with literally no gold reserves.

This may change in the future, as among recent mining projects in development is Chagyl Gold Mine, near city of Gyzyigaya in North-West part of a country. However, there is lot of obscurity regards to subject of yellow metal on this occasion and reports on local geological activities predominantly focus on iron ore necessary to produce high strength brands of cement.

So far, we have covered two extremes – world class gold abundant Uzbekistan and Turkmenistan characterised with lack of reserves. We will continue subject of gold mining in Central Asia, discussing abundant yet underdeveloped resources of yellow metal in Kazakhstan, Tajikistan and Kyrgyzstan in second part of our analysis.