Platinum deficit and possible breakout

According to some commodities sector commentators, there is a strong potential for positive price action on one of the precious metals that lagged it for the past years. Classified as precious, it is silvery white, lustrous, has strong fundamentals… Yes - that is platinum.

Platinum fundamentals wrap up

On the chemical look, platinum is a dominant metal of the subgroup called platinoids, that consists platinum itself, but also iridium, osmium, palladium, rhodium and ruthenium. It is at the same time part of precious, industrial, strategic / rare metals group. Chemists also consider it to be noble metal, which usually are corrosion resistant and to be naturally found in raw form.

As a commodity its main usage is in automotive sector in catalytic converters for diesel engines, which helps to convert carbon monoxide to water and carbon dioxide. Platinum is being used there in ratio of approx. 3-12 g. per engine depending on its size, age of technology, vehicle weight and make. Considering shift to EVs on personal vehicles, this makes platinum to be increasingly important for commercial, heavy-duty vehicles, vans, lorries and buses.

Apart of that, platinum is also used in other industries, as presented in the table later in this chapter. In electronics industry, it is being used in components for measuring devices which are often platinum made. Since the late 1950s, platinum catalysts are being used in petroleum refineries to support processing naphtha into high octane blending components for gasoline. It also has applications in green energy. Considering sector is heavily subsidised directly by various governmental incentives (or in indirect way, by introduction of various restrictions against combustion engines and hydrocarbon fuels), and subject of various international agreements aiming to lower CO2 emissions, this may be considered as supportive factor for platinum usage. And here comes another, very modern very modern application, as platinum is also used in hydrogen cells (i.e. in fuel cell electric vehicles - FCEV), where it covers hydrogen cells and works as catalyst, supporting conversion of water to hydrogen.

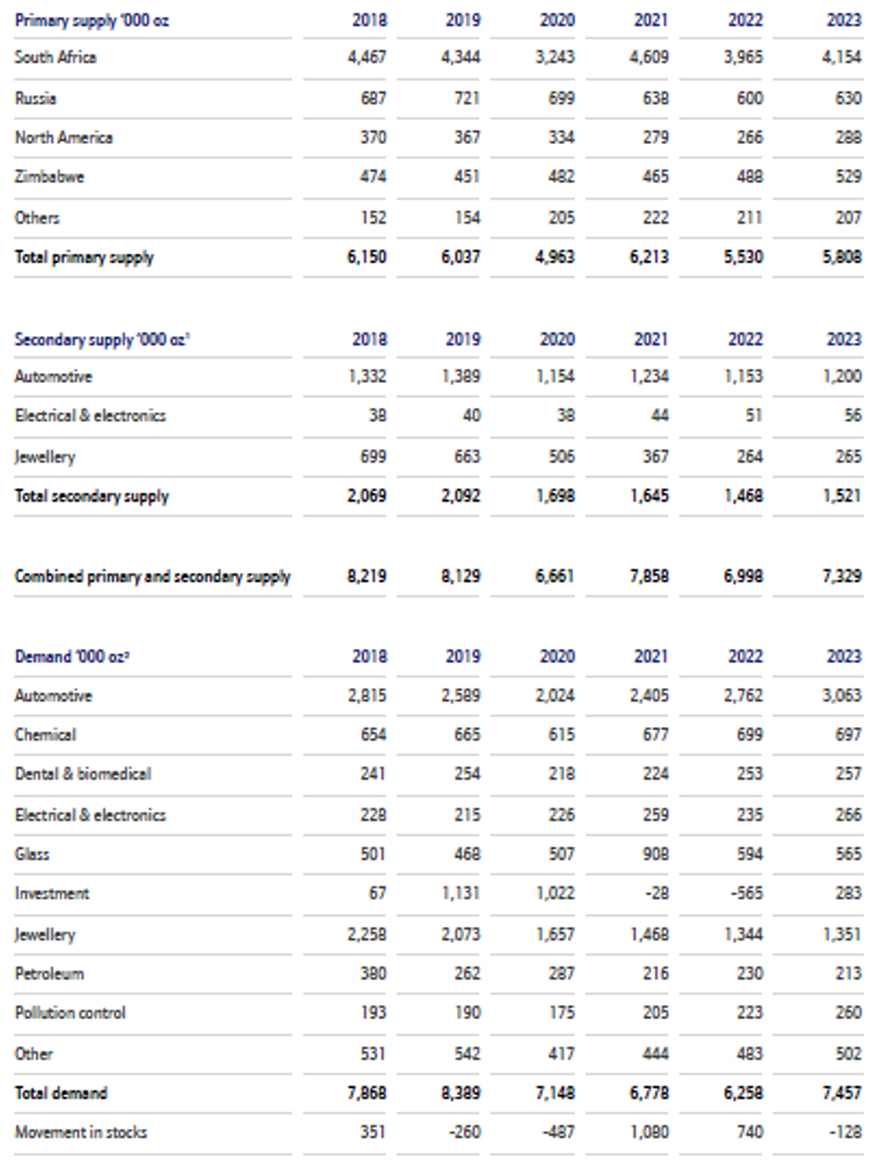

Platinum was being mined in 2022 in volume of 5530k ounces Yes, it’s not mistake - supply from global primary sources was at 172 t. South Africa absolutely dominated sector, providing approx. 123 t. Russia was accountable for additional 18.6 t. Rest of the world – notably Zimbabwe, Canada and USA delivered 30 t. altogether. With above figures for primary production should come as no surprise that on such tight and single-country-dominated supply market it is of great importance to recycle metal. In 2022, about 47 t. / 1468k ounces were recovered globally from scrap off all types – technological, automotive and jewellery, with main sure of secondary platinum being scrapped catalytic converters. Hence, platinum recycling sector is an important addition and will thrive.

At the same time, demand for platinum was at 6258k ounces, which translates to 194.6 t. in total. Dominated demand coming from automotive sector at 85.9 t., followed closely by industrial demand (in below table split in more detailed categories) at 84.5 t. and then needs of jewellery on 41.8 t. Market tightness has been slightly eased by investment sector that made overall net sales of 17.5 t. during the course of 2022.

Platinum demand and supply figures for 2018 – 2022 and estimations for 2023 made in 2022. Source: PGM market report, May 2023

On the price factor, if we would just to follow price charts, platinum seems to be highly volatile asset. It reached nearly 2200 USD in February - April 2008, then dropped to 800 USD levels jest few months later in November. Then topped to high 1700’s and low 1800’s USD keeping these levels for most of 2011. Then slowly declined to 830 USD per oz with the end of 2015. In the following years, platinum was moving in horizontal channel of 850-1150 USD with Covid made bottom at approx. 620 USD. Then its price increased above 1200 USD during the course of 2021 upon demand recovery. That was first serious attempt to make breakout since many years. Year 2023 platinum started at 1000-1100 USD levels, only to bottom in February to nearly 900 USD. April and May 2023 brought two attempts to breach resistance set around 1125 USD, but so far were unsuccessful.

What’s also worth mentioning, is fact that in the last decades, platinum’s price highly outperformed gold. This started to change only in 2011, but again, platinum continued outperforming gold in 2013-2014 period. Eventually gold took a lead with 2015 and since then performs much better in terms of price.

Long-term platinum prices. Source: https://www.macrotrends.net/2540/platinum-prices-historical-chart-data

Automotive sector trends

We discussed how platinum historical price tend to outperform gold in the past. But what happened that it eventually lost versus yellow metal? Diesel gate happened. In 2015 it was discovered that software in diesel engines of certain brand (and later brands) was simply adjusting engine performance upon checks or service, so it would emit less and therefore meet high European emission norms. Of course, we could use this opportunity to discuss subjects of ‘ethics’, ‘different approach to compensate customers in USA an EU’ and subject of ‘would downsized, turbocharged diesel engines were ever capable to meet more and more restrictive emission norms of Euro 6 and soon Euro 7’. However, that would be on totally different subject, and we’re here today to discuss potential platinum breakout.

Cannot discuss platinum in automotive without palladium. Latter is more prone to refine, more abundant in earth’s crust, can be used in catalytic converters, and for most of the time was much cheaper than platinum itself. It’s just one ‘but’. Russia is responsible for mining 40% and refining 30% of palladium worldwide. Considering war in Ukraine, price shocks on palladium created (in addition to supply shocks of 2021 which occurred on LME), exchange of diplomatic hostilities, 35% customs on import of Russian industrial metals and many other factors which we covered in our two-part analysis ‘How sanctions affected Russian flows of precious metals’. We highly recommend this lecture on this occasion as it covers subject deeply. Prognosis for Russian platinum and palladium production are, that output may fall in 2023. However, Norilsk Nickel – main producer of these metals in Russian Federation - can mobilise unsold stock and saved inventories and effectively fill the gap. With market and political cons outweighing pros of palladium, especially Russian made, and considering that since late 2017 palladium tends to be more expensive than platinum, automotive producers switch out the other way.

Of course, despite of certain similarities between these two metals, they cannot be used in 1:1 scale. About 25-50% (depending on sources) of palladium can routinely be substituted for platinum in diesel catalytic converters, with proportion at 50% in some other applications. Also, on technical side, upon such technical change, there is necessity to change production lines for the purpose of using platinum. That of course generates additional costs to automotive sector, troubled by variety of issues over last few years. Just to mention subject of transition from combustion engines to electric, issues on supply of semiconductors, often more than five-fold growth in electricity prices, Covid related demand destruction, then inability to meet sharp growth of demand, and eventually supply shocks caused by Russian attack on Ukraine. So, when capital expenditure is being authorised to switch towards platinum, we can be sure trend will be irreversible for years or even decades to come. And in long-term perspective that is supportive to platinum price and weakening for palladium..

But would demand on platinum coming from automotive sector persist? It suffered in recent years because of many issues affecting its performance, capability to deliver finished product and affecting potential buyers. Despite of that it persists, with certain interesting trends in development. In developed countries number of new registered countries is lower compared to pre-pandemic levels. Many customers decide to make a purchase of second-hand cars, over brand-new models from dealer. Main factor to consider here is related to price and loss of purchasing power. That extends average usage length of vehicle, which effects with less cars being scrapped. And that means, lesser supply of platinum from secondary sources.

Another trend lies in emerging numbers of new registration on hybrid and electric vehicles. Also, among “liberal, young and progressive” members of society inhabiting vast metropolis, another trend emerged. That is moving away from ownership for sharing vehicles. It looks different in emerging, industrialising economies, where ownership of vehicle is considered as somehow necessity and helps to underline owner’s status. Hence drops in sales in developed countries are being offset partially by growth in sales in emerging economies.

On a global scale some sort of contraction in new registrations was being made, or using business language ‘weaker growth occurred’. However, it’s not the case for commercial vehicles as sales of lorries, vans and heavy-duty vehicles declined in China for Q1 2023, however US, EU and Japanese markets delivered each 10-15% growth on sales.

Also, it seems we live in technological transition period. We’ll continue to observe growing market share of EV and at the same time slow decline on combustion engines. EV’s are estimated currently to hold 10-11% of worldwide market share and it is growing. According to Arab commentators of crude oil market it means, that around 2050 we may witness market share of approx. 50/50 between EVs and combustion engines. However, due to scarcity of certain metals, it is doubtful would EVs gain higher market share. At this moment however, that means - 10-11% of vehicles already do not require platinum. On contrary note this will be strongly offset by further upgrades on Euro 6 emission norms and Euro 7 expected in couple years. And it’s not only EU that implements such changes. That means, automotive will require more platinum in catalytic converters to meet legislative needs. In this context need to remember that 2035 ban on new combustion engines in EU has been approved in different than proposed initially form, allowing usage of e-fuels. Which again makes lot of question marks.

Considered about pace of changes and availability of stock, some automotive giants, decided to step in onto metal markets, investing heavily in mining sector in attempts to secure metal deliveries. It happens with regards to lithium, copper and nickel, however leaves potential to step in in similar way onto platinum. Problem is, that considering where platinum is being mined, that gives choice between instable economies of South Africa and Zimbabwe, ostracised and sanctioned Russia or Canada and USA which have high entry points. .

Couple words on inventories

We have mentioned ‘inventories’ twice already. First time, when discussing supply and demand trends for 2022, with regards to outflow of net inventories from investors. Second time, when mentioned Nornickel’s capability to fill in the gap caused by drop in production. Now it is time to focus on the subject of inventories – held above ground, refined, and stored in the form of bars and coins.

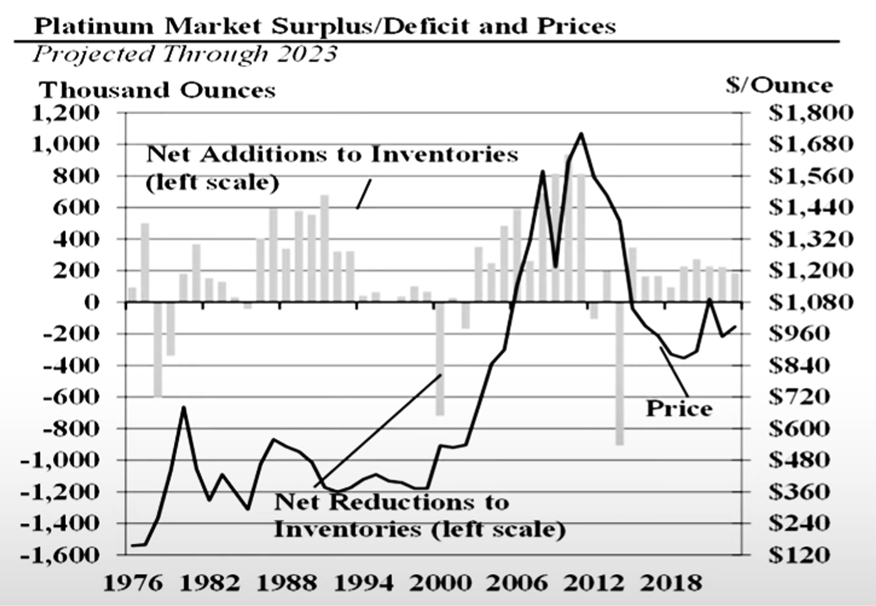

Needless to say, that they have to be taken under consideration, same as in case of other metals or commodities. So how possibly demand and supply affect inventories (or opposite)? Need to apply simple equation: total supply (mine production + recycling) less fabrication demand. That will show us, platinum market is on persistent surplus of inventories since decades. In this case credit goes to recycling sector as without it, maintaining balance would be extremely difficult. And that is why many charts will show deficits on platinum – as they won’t take secondary supply under consideration. At this moment, platinum commentators confirm, that for 2023 they would expect ‘production & recycling less demand’ effecting in a deficit of 983k ounces (30.5 t.), so drawdown on inventories held above ground may be significant.

So, what we could tell about inventories? That changes on them cannot be treated same-wise, each seems to be caused by different factors. High inventories made in 80’s and early 90’s was largely absorbed by South African producers to support platinum’s price. After government change in 1993, South Africa stopped that, so we experienced decade of relatively balanced market. With beginning of new millennium, we have experienced again large surpluses, yet this time it was caused by investors aiming to raise price higher. High surpluses in 80’s was causing price to go up a little bit, but in general terms price flatlined. Then low surpluses caused price to be flatlined or move generally lower. But when investor’s demand appeared, it generated large surpluses of 2002-2012 which resulted in price breakout. And that is scenario we should hope to achieve.

Platinum market surplus / deficit and prices. Source: CPM Group

We currently have certain levels of inventories, but there is high possibility these will be diminished in the next years. One of the main factors behind it relates to South Africa’s supply – or should we rather say - declines in production. As a main global miner of platinum, country is prone to production declines in the next several years, with severity of these still being subject yet to be determined. That – along with shift away from palladium towards platinum - has to be considered as a factor supporting prices. After all it will be tighten supply and increased fabrication demand. Considering lack of unexpected events, and drawdown of inventories, we may experience breakout in price in the next 2-3 years.

Has to be noted, that platinum availability in western markets tightened as surplus metal was delivered to China, with Shanghai Gold Exchange sales reaching a record 2 million ounces. Currently it is China who holds highest stocks of platinum globally. It has to be partially accounted to a change on supply routes for Russian metal.

China holds nearly 4 mln ounces of platinum. That is 124.5 t. Source: https://www.ft.com/content/01352385-372f-4b79-9446-a03c518ba28a

Need to mention about two large drawdowns on inventories, that occurred in the last 3 decades, as they meddled with overall trend. These are being related to specific force majeure events causing production to cease. In 2014 such event was caused by mass strikes over wages in South Africa’s mining sector. Effectively five months long strike action caused 450-900k ounces (again, depending on sources) to be taken out of production. In another example, in 1999 decline on inventories was related to Russia, as its officials from Ministry of Finance and Russia’s Central Bank debated on export policy. Bill has been passed in December 1998 and effectively stopped exports as loose wording had made it impossible to identify an agent authorised to carry out exports. Of course, we’re focusing on official version, without speculating about who could profit of such. This has been eventually sorted out, but no less than year later.

Trip to a Bushveld Complex

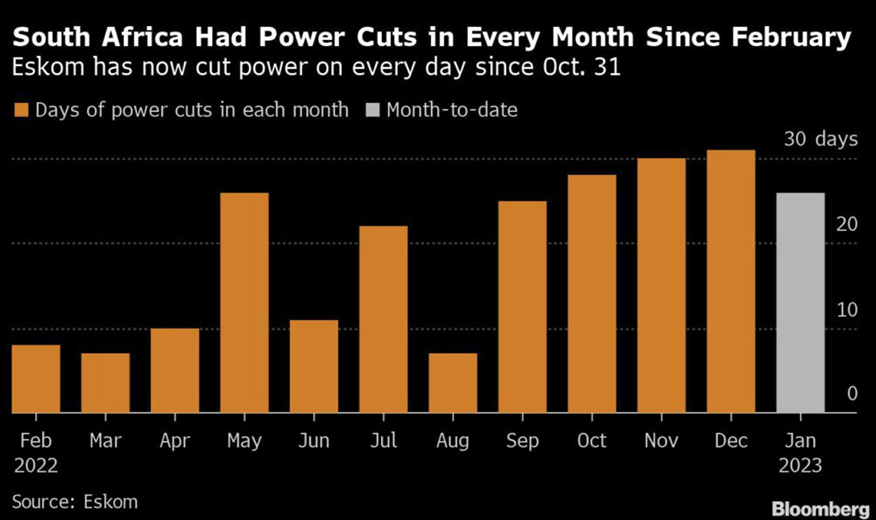

After an exceptionally strong 2021, South African supplies contracted sharply, reflecting lower contribution from the release of pipeline inventory, along with planned maintenance at processing operations, ongoing operational challenges at many mines, and an increase in the frequency and severity of load-shedding (programmed electricity outages to protect the national grid). Fears that wage negotiations might trigger another industrial action were ultimately unfounded, with new five-year agreements reached at a number of major mines during 2022.

South Africa’s two largest platinum producers, Anglo American Platinum and Impala Platinum, both undertook furnace overhauls last year, creating smelting capacity constraints that resulted in a build-up in stocks of semi-processed platinum group metals. These capacity issues were exacerbated by load-shedding, especially during the second half of 2022. Producers often manage their load curtailment obligations by reducing electricity consumption at their smelters. That means, some energy heavy activities in various sectors tend to be performed now during the nights or weekends, when power supplies are less tight than during a day. Sibanye Stillwater also reported a temporary increase in work-in-progress due to electricity shortages. Although it was able to treat the backlog in December, it was unable to deliver all the resulting refined metal before the year end. Combined impact of these stock movements on 2022 platinum supplies was just over 300k ounces. This represents production that has been deferred rather than permanently lost.

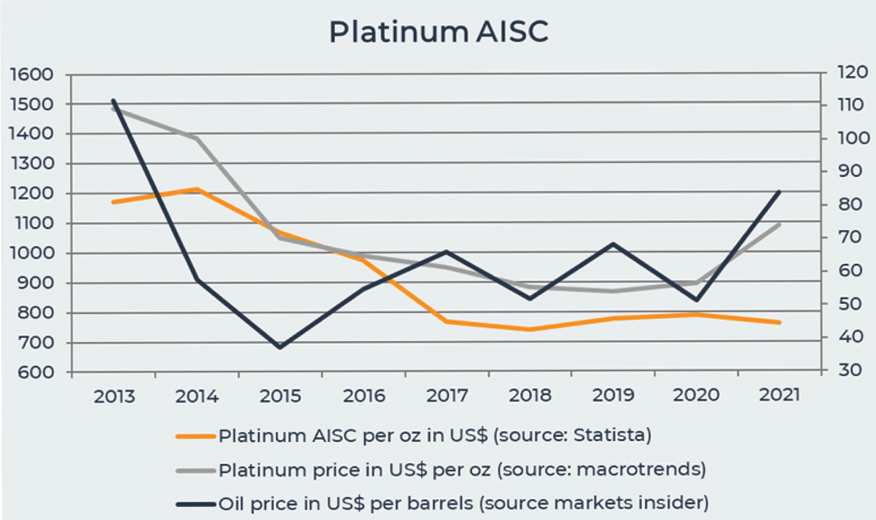

All in sustaining costs on platinum. Source: https://bunker-group.com/en/blog/platinum-production-cost

South Africa is the heaviest player on the platinum mining market. However, both sector and country are being troubled by problems. Apart of internal instability, rolling energy blackouts cause troubleshooting in industrial and mining sectors, affecting production. That is an important local factor that affects overall global trends. In addition, assuming obvious price correlation on precious metals, since we expect a positive price breakout on gold later this year and in 2024-2026 period (not financial advice), that means, platinum has a lot of price performance supporting factors.

We mentioned about energy crunch. It slowly but persistently affects South African mining industry and agriculture sectors. Blackouts are expected for at least two more years, threatening output in Africa’s most industrialized economy. They were the case in the past years. However, number of blackouts had increased dramatically since September of 2022. Reason lies in inability to produce enough power from old and poorly maintained plants under management of state-owned Eskom Holdings. Just in 2022, blackouts occurred for more than 200 days a year. That effectively causes production issues and cancelling of shifts.

Number of power cuts in South Africa Feb 2022 – Jan 2023. Source: https://www.mining.com/web/south-africas-blackouts-threaten-platinum-supply-in-top-miner/

Canary in a coalmine

In the past times, miners used to take cages with canaries to the shafts to detect potential methane or carbon dioxide leaks. Would bird act weirdly or fall unconscious for no reason, that was a sign of a leak. Reason for that lied in metabolism of canaries, which is several times faster than human. So higher respiratory rate made birds first to react to toxic gases. Of course, cage came with a tank of oxygen, to save life of poor bird.

Mining early warning kit used in 19th and on beginnings of 20th century. Source: https://museumcrush.org/this-device-was-used-to-resuscitate-canaries-in-coal-mines/

Automotive sector acts today as a canary in a coalmine for industrial production sector. Would customers seek for savings, firstly they decide to postpone upgrade of current fleet or make a purchase on second-hand market. Hence, would we see further declines in sales, it is possible that recession / crisis is just behind a corner. Of course, we cannot predict in 100% would correction occur, when, and how heavy would it be. Assuming that correction will be non-catastrophic in size, 800 and 900 USD spot per ounce of platinum seem to be interesting resistance levels developed in past years.

Platinum has capacity to rise in price in the next few years, and therefore to leave persistent horizontal channel, as gold did in 2019. On its way to a top, first important resistance are to be found at approx. 1400 USD per ounce. That is when many investors will turn their eyes on shiny silvery white metal, and these purchases will be supportive for price. As for now, strong fundamentals for this move are being laid. Commodity investors should seriously consider positioning, especially since it is very likely that in Q2-Q3 2023 we’ll experience best purchasing opportunity in the years to come. Although, need to clearly underline, that it is not an investment advice.