Merry Crisis and a Happy New Fear - 2024 outlook, part 1

New Year – new opportunities, expectations and challenges. Considering its 2019 which could be considered as last rather normal year, we’d expect economic, financial, political and geopolitical roller-coaster to continue. And this will continue to impact our lives and investments. However, world didn’t end since and it doesn’t seem to it in the nearest future, and so we must carry on thinking forward. So, what to expect from precious metals in 2024?

"Merry Crisis and a Happy New Fear". Slogan that appeared as graffiti in Athens during December 2008 protests in Greece. Source: https://streetartutopia.com/2021/12/23/merry-crisis-and-happy-new-fear/

Below, we present our outlook on what factors and in what way may affect prices of precious metals in 2024. We won’t limit ourselves just to that, as besides of variety of macro indicators, stocks and bonds it is also condition of energy sector which affects general outlook. Due to a size of analysis and variety of factors to consider, we decided to divide it in few parts. It will be US markets end economy we’ll focus especially, as whether USA sneezes, Europe gets cold. However, we won’t limit ourselves just to that.

Although we apply our analytical macro skills, at the end of a day we’re unable to predict future. Hence please bear in mind, below content is no financial advice whatsoever but simply an opinion on outlook, which may or may not take certain risk factors under consideration.

Expectations on interest cuts

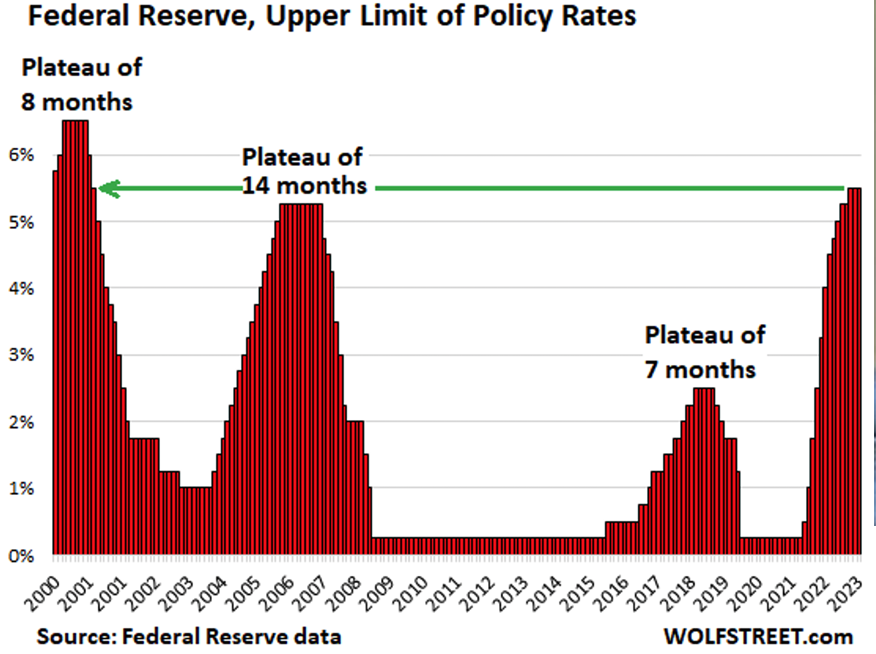

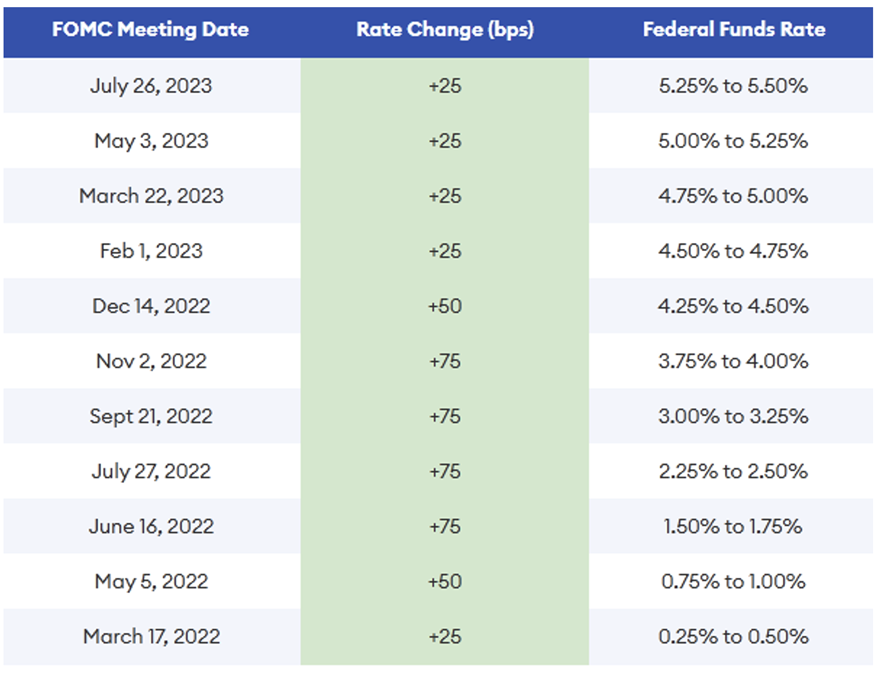

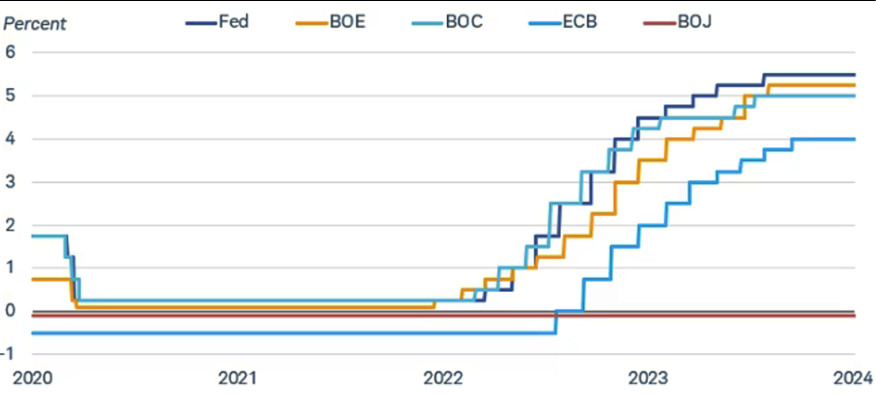

Raising interest rates makes credit costs more expensive, which effectively slows money creation, circulation and liquidity, which in result should lower inflation, as less money is being produced (this could be measured by financial aggregates). This affects both creditor and debtor, as one has to pay more interests on loan and other has to figure out if loan taker will be able to handle such burden in less favourable, tight market conditions. Hence for financial markets, cuts on rates are a sign of normalisation, optimism and improvement on liquidity and profits. And markets crave such optimism as between March 2022 and July 2023, we have experienced fastest in US history pace of rates hike, elevating cost of credit from 0.25% to 5.50%. And such is a case regards to central banks of main developed nations. Many developed economies followed FED steps, currently being just slightly behind FED interest rates, and so crediting conditions deteriorated in record fast pace. Since then we’re plateauing and it is actually length of this phenomenon, which concerns markets now.

How long we plateaued with rates, since last interest hike? Currently with the end of January 2024 we close sixth month on pause. Source: https://wolfstreet.com/2023/11/01/another-hawkish-hold-with-tightening-bias-fed-keeps-rates-at-5-50-top-of-range-rate-hike-still-on-the-table-qt-continues/

Based on December minutes Federal Reserve’s FOMC may not be so keen to drop rates immediately or sharply. We’re ‘at or near its peak’ in this cycle and aim to cut ‘well before' inflation falls to 2% - they said. However FOMC made it clear, it doesn’t completely take the idea of further hikes off the table yet, in case of deterioration of economy. All of this in effect gradually lowered market expectations on first possible rate cut in March 2023 from nearly 80% to 63% and later up again to 74%. And market has its expectations, just to mention consensus regards to possible May cuts which is at around 100%.

FED rate hikes 2022-2023. Source: https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Wall Street seems to be too keen for a cuts in comparison to FOMC’s stance. Just an example - market stance on fast and soon pace of cuts is very much supported by Goldman Sachs, who expects even five 0.25% cuts to occur during 2024. At the same time expecting ‘soft landing’. And it seems that there are many other entities presenting similar approach, expecting first rate cuts to occur in March or May, forecasting overall 1.50% down in total in 2024 and further 1% in early 2025. Optimistic market expects first cuts to occur sooner than later, and more frequently.

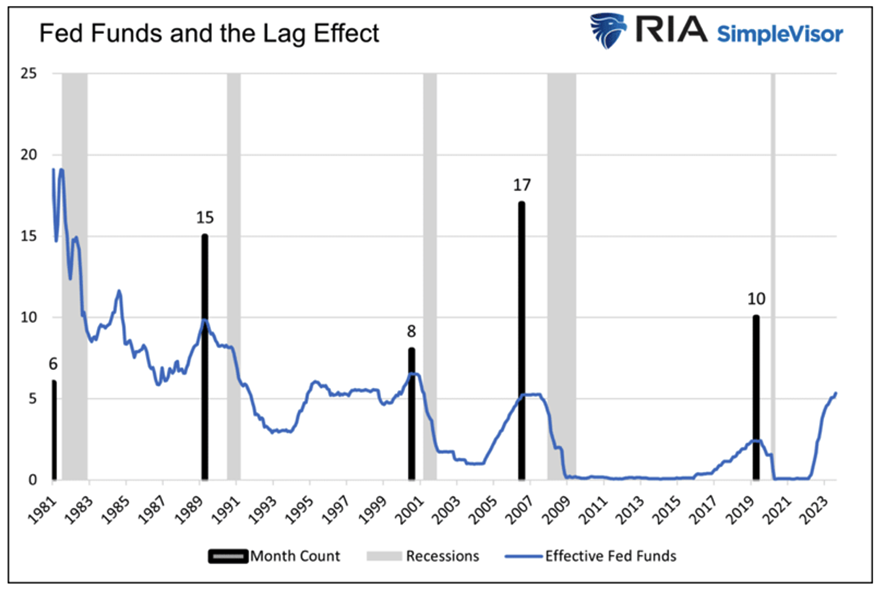

But on the other hand there is also contrarian approach presented by certain entities. It expects no more than three 0.25% cuts in 2024, which should start no earlier than closer to the second half of the year. Slower pace is something to pay attention to, as based on historical examples, every time rate cuts were sharp or often, it happened in response on deep and sharp worsening of economic conditions or market crash. Hence fast pace of cuts has to be considered as a response to a strong need to inject liquidity onto system. Considering then strong soft-landing expectations among market participants, more careful – contrarian - approach seems to be more applicable in here.

FED funds and the lag effect. Recessions = fast pace of cuts. Source: https://realinvestmentadvice.com/the-lag-effect-unveiled/

Besides, FOMC decisions are data driven. This means they are based on past readings on economy, not predictions. That is why FOMC actions often seem to be perceived as late or not adequate to loudly expressed market expectations. But acting in such way FED protects itself from making dreadful mistakes like the ones occurred during Paul Volcker’s time as a Chair.

Assuming ‘business as usual’, we lean towards contrarian approach here, expecting FOMC to start cutting interest rates June/July 2024 and during 2nd half of 2024. We would therefore expect three cuts in 2024, each of 0.25%, as faster pace would be indicative on deteriorating shape of economy. This cannot be fully excluded as we observe certain liquidity and low-profit related problems.

Bonds on highway to hell or stairways to heaven?

US Treasury yield went up again, with US10y yield bouncing from 3.8% in late December 2023 back to over 4.1%. Main factors contributing to lows were FOMC minutes reducing chances for cut. Data on low unemployment and jobs added also affected the way yield moved. Hamas attack on Israel didn’t make investors to rush towards US bonds in panic, but Yemeni Houthis caused increased interest with US debt. This remains on the table as inflation-making factor, directly if prices of oil would go up, and indirectly as detours, insurance and freight costs may fuel inflation. Yields remain above 4% in expectations for data from US economy. That is preliminary Q4 GDP and personal consumption expenditures.

US10Y yield is long-term growing, although 2024 may give investors moment of breath. Source: Tradingview

There are two main fundamental factors applicable to US debt, one supporting and one unfavourable.

Unfavourable is that US national debt reached and surpassed 34 trl USD now. Of the above – 27 trl is being held by the public (person or entity that is not a U.S. federal government agency) add 7.1 trl intragovernmental holdings. Bearish expectations for national debt at end of the year are in between 37-38 trl USD.

Rating agency Fitch expects grow on government deficit in 2024 at 9% of GDP (2.09 trl). One of the reasons for that lies in ballooned US spending, which can’t be ceased due to US position in the world and fact that it is an election year. In addition, there is an expected fall on US government tax revenues in 2024 which is not that straight obvious but very bearish signal. Of course in proposed budget for fiscal year 2024 there would be deficit cap, this time at 1.59 trl USD. For 2023 that was 1.7 trl USD. And of course upon reaching this level, it will be raised again. Let’s face it – party that will ‘lock’ country by executing debt ceiling, shall be a subject of mass accusations and shall be marked responsible for all the chaos caused. And doing so in year of presidential elections is simply political suicide.

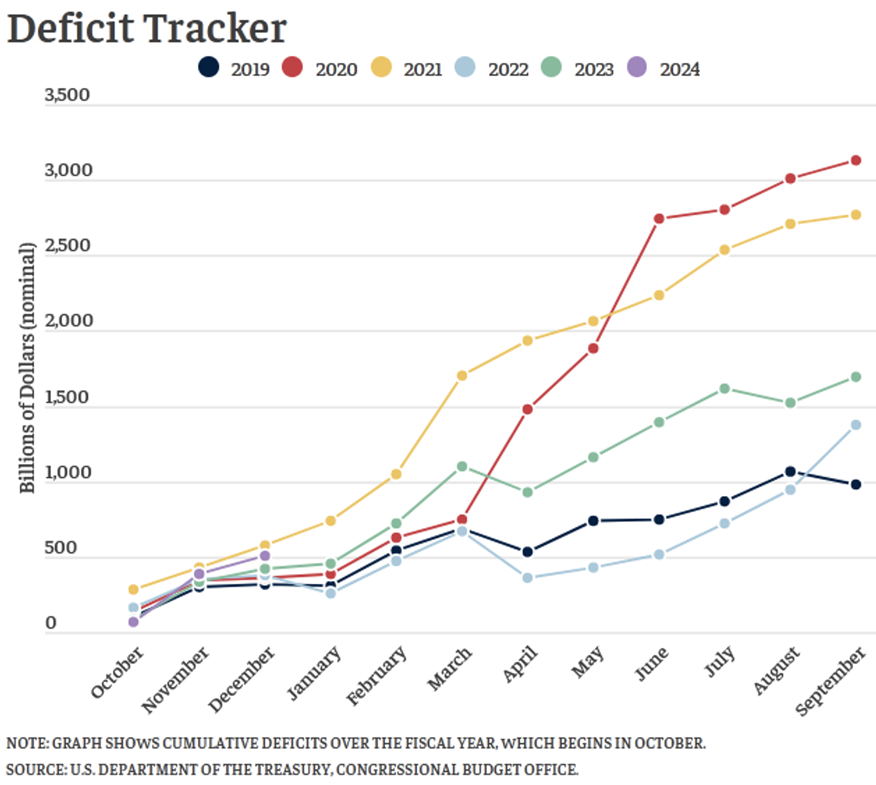

US deficit tracker. Purple line indicates not the best start of fiscal year. Source: https://bipartisanpolicy.org/report/deficit-tracker/

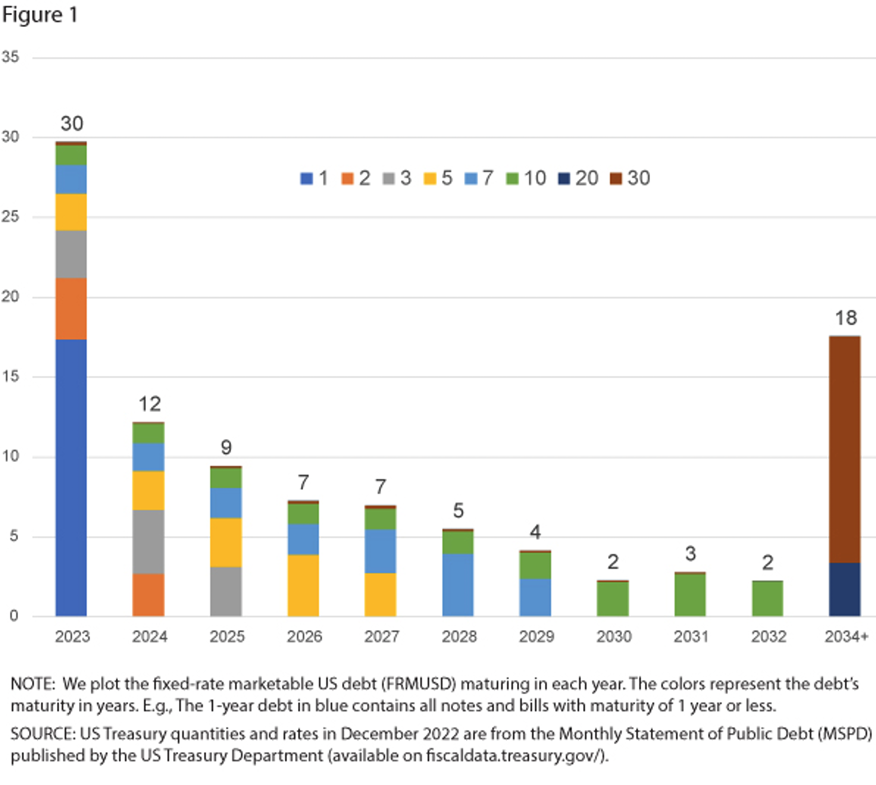

Issue lies in necessity to re-purchase debt issued over the last decade at near zero interest rates. In addition there is also a debt issued in 2020, which has been released with actually negative yield. On the other hand we also have rollovers of debt issued at higher percentage, like August 1993 30y with 6.25%. And so, within 2024, US Treasury will have to repurchase 7.6 trl worth of debt coming due according to Yahoo Finance. Treasury Bulletin for December 2023 shows for 2023 7.4 trl debt with up to 1 year maturity and further 7.2 trl to be re-purchased within 1-5 years. Lot on the debt structure comes from St. Luis FED.

Above chart is from December 2022 and shows pattern of bond maturities in the coming years, albeit with no new issansce. 2023 was the toughest year in terms of maturities, 2024 is lower in volume but markets are still watching with concern. Source: https://research.stlouisfed.org/publications/economic-synopses/2023/06/02/assessing-the-costs-of-rolling-over-government-debt

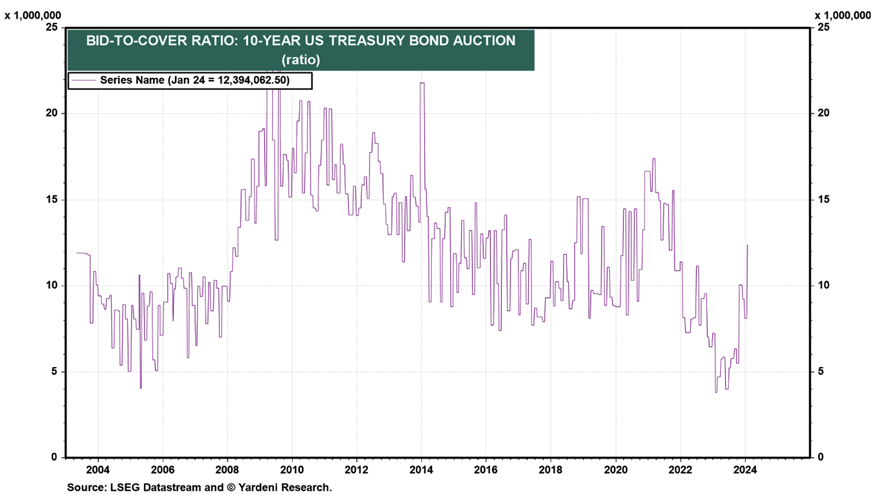

Considering yields that we’re at right now and continuation of newly established long-term channel, this means US will now have to roll this near-zero interest bearing debt at in between 4-5%, depending on maturity date. This will happen after some shocking disinterest on auctions of US Treasuries which occurred in 2023. It must therefore be perceived as supportive to Primary Dealers and their position to negotiate better rates.

For majority of 2023, bid-to-cover ratio on US 10y was at historically low levels. Only with issues in Middle East region interest went up. Source: https://yardeni.com/charts/us-bond-technicals/

On the other hand, factor supporting to US debt is of course its position in the world. Is it possible US bonds may lose its position as a main asset held by central banks? To be honest we can’t see any other recognisable, acceptable alternative. Pardon us – of course there is gold - hence this sentence should be: ‘To be honest we can’t see any other recognisable, acceptable alternative so vastly supplied to the markets’. Although we expect gold price appreciation, which should help us to ignore costing issues like storage fees and lack of interest generation, problem lies in a fact it is easier to generate money ‘out of thin air’ than mine an ounce. Let’s assume yearly production and recycling rounded up optimistically altogether to 5k t. and let’s sell it at 2100 USD per ounce. We’ll get 337.5 bln USD. That is nice figure – comparable to GDP of Columbia or Hong Kong. But in comparison to just USA fiscal needs as in previous paragraph, this simply won’t suffice. Besides to get gold, producer must incur some costs. Treasury papers occurred costs in form of interests is many times lower – unless we’ll roll debt in time like dozen times.

Possible outlook on US 10y yield. Source: https://s3.tradingview.com/n/NKttR50U_mid.png

And here comes mixed outlook, as galloping debt issuance may trigger further deterioration on US debt quality by rating agencies – like Fitch did in August 2023 and S&P over decade ago. Such may not occur exactly in 2024 however has to be considered seriously for foreseeable future. Even with above in mind, one must understand simple lack of alternatives at a time to US dominance in the world of bonds. Which are sizeable, liquid, generally trustworthy and worldwide recognisable.

With all that in mind, our market expectations on US 10y yield for majority of 2024 are at and around 3.5%. With plateauing interest rates and expectations on cuts, soft landing narrative is being generally perceived as supportive to lower yield on bonds – although please bear in mind that near zero yields as seen last decade won’t come back. That is basic scenario in which we exclude grey or black swans that would made institutional and international strong rush towards US bonds. However long-term trend on low yield had been broken, and so long-term growth on yield is rather certain.

‘To boldly go where no one has gone before’

‘To boldly go where no one has gone before’ this citation from original Star Trek could be in our case easily applicable to SP500 outlook for 2024. At least for part of the year. In the moment of writing these words (26 Jan 2024) SP500 surpassed now former all-time heights established in January 2022 and did set new temporarily heights.

SP500 on new heights. Source: Tradingview

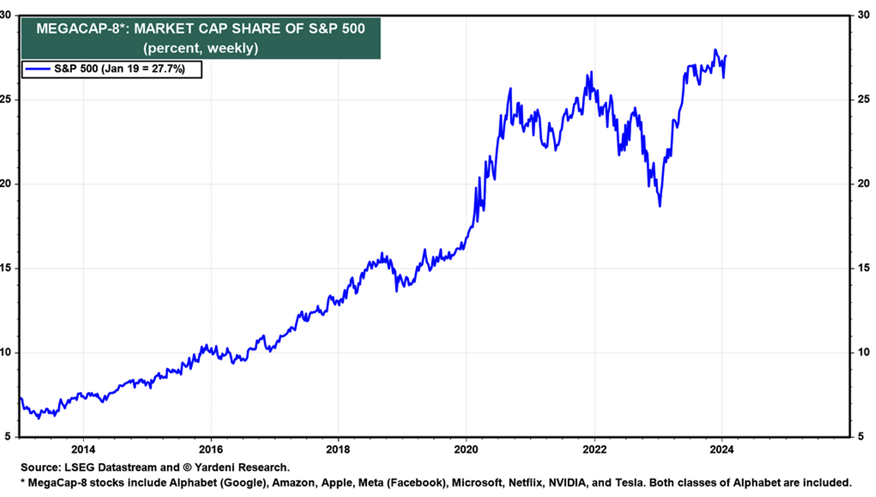

Weak dollar, expectations on rate cuts and relatively good updates on US economy fuelled hikes on SP500. Overall wagons in this train become more and heavier due to economy slowdown. However, SP500 (and to some degree NASDAQ) are being pulled forward by the ‘Magnificent Seven’. The ‘Magnificent Seven’ tech stocks are Apple, Alphabet/Google, Microsoft, Meta, Amazon, Nvidia and Tesla. That is slightly different composition than famous FAANG / FAAMNG, however principle remains the same – high concentration may be supportive, but also may turn dangerous and trigger large scale falls. Just like it happened at some point of 2022, when Top SP500 companies corrected by approx. 40%, making index to fall by 20%.

The Magnificent Seven + Netflix market cap share of SP500. Source: https://yardeni.com/

SP500 in 2023 was initially down due to strong dollar. Eventual weakening of US currency, along with strong AI narrative supported growths on index. However, growths are now basically fuelled by above corporations who dominate it in terms of share and size. What scale we discuss? In between 22nd December 2023 and 22nd January 2024, just Nvidia and Microsoft were responsible or 57% of growths on SP500 – and that’s just a part of top seven tech stocks. And that leads to interesting conclusion – as fund manager would like to maintain yearly returns at like SP500 or higher levels, ‘The Magnificent Seven’ in variety of proportions must form vast majority of his portfolio, in effect affecting demand for other stocks.

Nvidia and Microsoft were recently responsible for 57% of growths on SP500… Source: Bloomberg

It doesn’t mean SP500 will crash straight away but may be prone to pullbacks or breaks to catch a breath. However, in the year of elections, when ruling party and president want to avoid crisis or market crash on their watch, we’d be expecting it to reach new very important from psychological point of view levels in Q1. This seems to find confirmation in the charts, as when writing these words, SP500 beaten all records and greeted 4900 levels. Therefore we wouldn’t be surprised to see 5000 points soon. Yearly average consensus of market participants for 2024 is at 4835-4850 points. Certain US investment entities see even higher levels at 5200 (Oppenheimer - 5200, BofA – 5000, Citigroup and DB – 5100), however lows are also taken under consideration (JPM, Morgan Stanley, Wells Fargo) even as low as 4200 points.

What could affect overall optimism? In the eyes of Wall Street that would be ‘this mean FED’ who ignores consensus on early cuts and may extend plateauing. Another item are earnings and profits. Due to strong concentration around ‘Magnificent Seven’, lowered demand for their goods and services due to inflation, cost of living crisis and household debts, we’d expect low earnings, profit withdrawals, periodical financial results that could be generally considered as disappointing etc. Basically all signals on readings which market could consider as negative. Would tensions on Red Sea trigger lower estimates of Q1 earnings due to risk and higher rates on tankers?

And so, it may be year of two important levels for US stock market – important all-time heights in Q1 and then corrections.

Is return of the king-dollar possible in 2024?

Expectations that FED will reverse policy tightening and start to cut interest rates, along with a weaker USD should also provide some tailwinds to commodities. But why exactly to expect weaker USD?

A weak dollar occurs during a time when the Fed is lowering interest rates as part of an easing monetary policy. Considering we’re at near-peak or peak and awaiting rate cuts, seems we’re in a starting blocks. General idea of ‘cuts’ seems to be priced in, but as devil lies in the details – what is the pace, frequency, and how would money managers react to such or the other scenario.

Lot of space for cuts, but what’s most notable, is alignment on hikes. Source: https://www.schwab.com/learn/story/where-us-dollar-may-be-headed-2024#:~:text=We%20expect%202024%20to%20be,currencies%20will%20likely%20vary%20widely

Key factor to observe here is again pace of rate cuts, but this time we can’t be limited to USD. 2022-2023 main central banks around the world rushed in rate hikes following FED. FED leads the pack among G10 nations, however its hikes were basically shadowed by BoE and ECB. USD started to lose its steam upon announcing that the end (of hikes) is near’. In 2024, central banks around the world are poised to cut interest rates. Consequently, the dollar will likely continue to fall moderately as the yield differences between the U.S. and other countries shrink. However, said central banks will again follow FED, with some may even speed up process in the middle. This means, dollar should weaken, but same should happen to main currencies of the developed world (and majority of emerging markets). And here come economic factors to consider – cuts should make currency cheaper, improve availability of credit, support economy and therefore made it to speed up. Which economy is relatively in better shape in terms of CPI, PPI, production, services, unemployment, new jobs opening etc.? And we didn’t even mention yet on deepened Europe’s dependency on energy commodities imports, and possible repercussions of Red Sea crisis (which we’ll cover in later parts of our predictions).

End here comes important relativity, upon cuts dollar could likely regain some of its lost ground against British pound and Euro - as US economy remains more resilient than those in EU or UK and is perceived as such by markets. That basically translates on either ’to grow faster than others’, or ‘to experience less deep recession in comparison’. However, would EU and UK had to retain higher interest rates for some reason and USA had executed cut, and indicators would show that US economy is in much better shape, then despite of initial drop, perception of economy strength could be perceived as positive for USD. But again – this is theoretical assumption, as we’re certain on collaboration and coordination of main central banks upon subject.

Until now we discussed currencies, now let’s treat them as a FX package – one of components in world’s economy. Now, whole package of rate-cutting currencies (with varying performance) should start losing ground against class of assets that cannot be printed – and have to be priced in such weakening currencies - commodities. Of course, with strong emphasis on demand levels.

Lower US interest rates should also act as a stimulus for the global economy, help to reduce high debt burdens, and make investments in EM countries to look more attractive. That has been the case over past six months, just when FED signalled turn from tightening to neutral stance. But yet again, upon theoretical crash on Wall Street or most social medial expected recession, result will be capital to flock towards USD.

DXY – main but one of many indexes measuring strength of USD. Source: Tradingview

Unemployment as economic factor

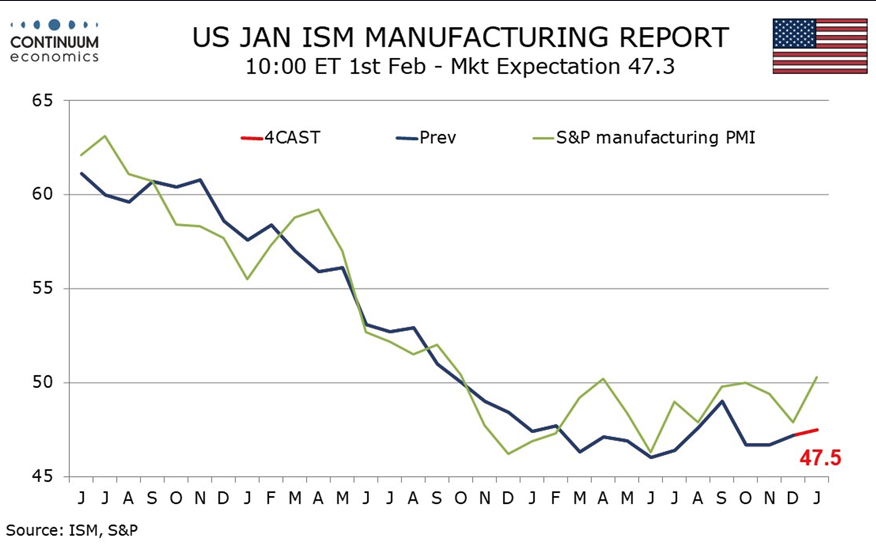

Wall Street repeats with religious zealocy its mantra on ‘soft landing, no recession, lowering interest rates’. Although we personally approach them with high dose of moderacy. Consensus on US economy growth is at 1.3% versus 2.3% in 2023 and 1.9% in 2022. Before 2020, such figures could be concerning, now they are considered by markets as optimistic. View on 2025 is growth at 1.7%, which is perceived as supportive for ‘soft landing’ narrative. But whether worst is nearly behind us, or if it’s just postponed, that’s another story. Additionally, above figures are supported by government spending, which is a problematic in size, and deserves point for its own. Industrial production (ISM) is in a 15 months in a row down trend, although there are expectations on some, very moderate growth.

US ISM. Source: https://continuumeconomics.com/a/434030/preview-due-february-1-us-january-ism-manufacturing-remaining-marginally-negative

But what is this soft landing we read about all the time? That is inflation being lowered to assumed or near assumed FED targets without affecting employment levels too much. This enables interest cuts in controlled manner. It is in opposition to hard landing, which occurs when FED policies are too successful in cooling down overheated economy, choking it to near death. And this is when a medic is required with big syringe, making liquidity injection in form of mass-asset purchasing programs, lowering sharply interest rates, or both.

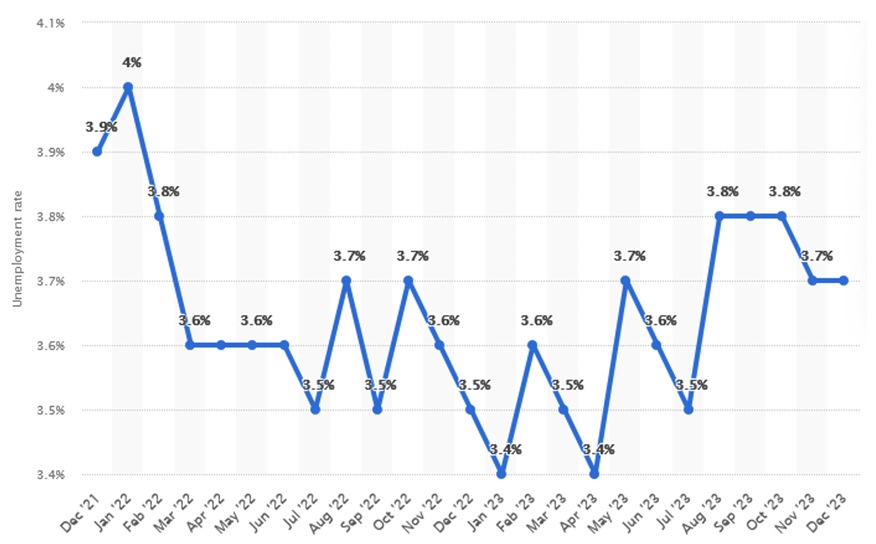

With regards to unemployment, it had grown to 3.7% in December 2023 from 3.4% in January 2023, which is just above 30-year lows. However expectations for 2024 are unemployment to reach 4.2% and 4.3% in 2025. However picture will lose some of its bright colours if we check these figures more in depth. As for now, US labour market surpassed expectations on subject, showing market resilience against cooling economy. According to latest January data slightly over 200k jobs had been added. However 1/3rd of the above is created by government (58k per month in average for 2023) and considering sectors are perceived as low income jobs.

US unemployment rates. Source: Statista.

And there is another yet pattern we observed in the last half a year. Initially good results are being reported (market cheers), and later are being revised quietly (market doesn’t reacts). And so, reported 150k jobs added in November turned now onto 105k jobs (with government made remain on level as above). Considering that 2024 is presidential election year, we may expect more positive news on strong labour market (and then revisions). Although, in comparison to other economies in the world, with regards to employment numbers, wage increases and unemployment levels, even revised USA data seem to look much better.

Subject of consumer spending, inflation, crude oil, swans, and finally gold along with other precious metals will be covered in following parts.

To be continued…