Lagging price action? On the occasion of falling banks and gold attacking 2k USD

Gold has reached and crossed briefly 2000 USD on 20th of March 2023. It was 3rd time it has passed through this psychological barrier. All three occasions happened in our lifetime. All three occasions happened within last three years. This implies questions: What’s next? What now? Does 2k USD really matter?

As things keep changing and may deteriorate quickly (which is nature of bear market at the end of second stage of economic cycle), we need to state that all data presented in this analysis is for 20th March 2023 London AM. This is when Tel-Aviv Stock Exchange is open 2nd day in a row, Asian markets finished trading, Europe wakes up, but US remain asleep.

Mathematicians, art, philosophy and deities

Let’s start with very non-standard – from financial or investment point of view – consideration of implications lied above. We mean of course elevated price of yellow metal, breaching temporarily 2k USD again. Laying these out, only then we’ll focus on price action, comparison and general outlook.

Source:TradingView.com

There is certain beauty in mathematics, yet in most cases effectively it is being burnt to the ground by modern education system. Most people would only need natural numbers through their lifetime. Hence knowledge of integers, rational or real numbers diminishes in time among general population and is being considered highly specialised. Most won’t be able to discover beauty of fractals and Fibonacci’s sequence that exist in nature, being forever doomed to adding, subtracting, multiplications and divisions. Unless you’re using them in your work, or in technical analysis.

“Mathematics is the language in which God has written the universe”

These words attributed to Galileo Galilei explain how past generations appreciated its beauty, considering mathematics as an art. However Renaissance interdisciplinary approach – with a dash of romantism - presented by scholars and masters has been turned in time to be more specialised science. Progressing world didn’t need polymaths like Copernicus (astronomer, bishop, diplomat, governor, economist who obtained a doctorate in canon law) or Da Vinci (theorist, architect, engineer, scientist, painter, draughtsman and sculptor). It needed specialists focused in one domain, like 18th century scholars and researchers. This approach remained to our times and somehow deviated natural curiosity of how world works into deep and narrow specialisations. To the point when scientific researches may be even punished for too interdisciplinary approach on their field.

Based on the above, on first glance it may be something unusual to apply psychological knowledge to investment approach, however this trend was well developed already in 70’s and 80’s of 20th century. Financial psychology is the study of why we do what we do with our money. It is a broad field that encompasses the cognitive, social, emotional, and cultural factors that come into play when making financial decisions – whether that would be spending, buying high value goods or investing. Financial psychology is about the human side of financial trade-offs. Some financial decisions can be explained by cognitive psychology, which is focused on how the brain organizes, processes, and retrieves information.

Example is loss aversion. Human brain feels the pain of a loss as greater than the pleasure of a gain. We will remember all the losses, but not so much our return on investments. That’s cognitive approach. When it comes to cognitive psychology, much of the time the best thing we can do is to get educated about the ways we might unconsciously misjudge trade-offs and then consciously compensate for that misjudgement.

Sounds complicated? We’re about to wrap it all up. What is so important in 2000 USD per troy ounce of gold? Nothing. Our brains shaped by modern educational system work in environment of natural numbers and will appreciate round ones. It is always easier to work on them without necessity to round up, round down, use calculator or giving final values in ‘ish’. This last thing is something taxman definitely won’t like. So, our brains perceive ‘2000’ as expected, beautiful, round number. Like when over 20 years ago we celebrated beginning of year 2000 indicating new millenium. It applies to our subconsciousness on many levels and works on the same basis like golden arcs in logotype of one of the fast-food restaurants. The way they were designed, including curvature and colour makes our brains associate them with fresh bun, delicious food, overall something pleasurable. Even if it’s not.

Does it make ‘2000’ worth nothing? No, as at the same time it means a lot. With exception of automated trading systems, basically all human investors will perceive this number as important due to factors described. Hence it is being considered psychological barrier. Hence why breaking and staying over means to us so much. This is why we remain unhappy with 1997 USD or 1989 USD. It is so close to what we consider as important boundary, and at a same time so far away from perfection.

State your numbers in currencies and assets

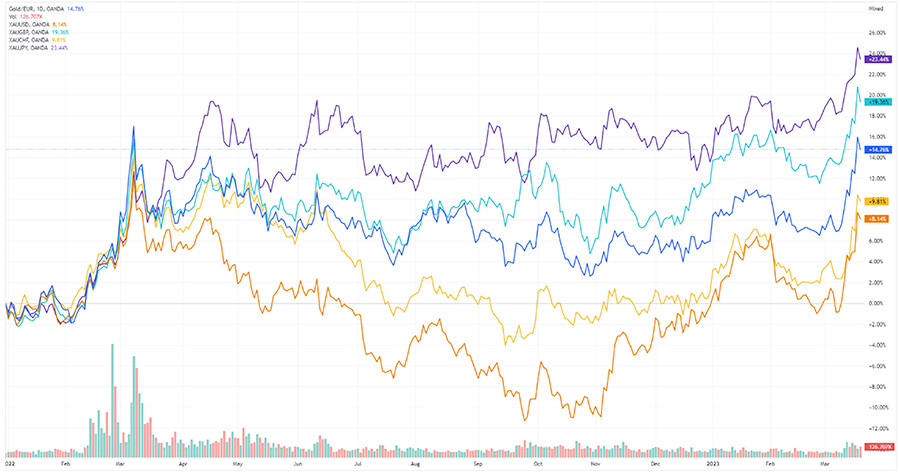

Would we focus on price action, gold has recently firmly established new all-time heights in most of the developed countries’ currencies. It is on record values in Japanese yen, British pound, currency of European Union and Swiss Franc. In similar manner gold treated currencies of commodity-based economies of Canada and Australia. Only previous historical highs in USD are unconquered yet, but it seems to be just matter of time.

Source:TradingView.com

Price appreciation on gold is firmly visible if compared versus emerging economies. Inflationary Turkish lira doesn’t seem to be best example, but in Indian Rupiah new all-time high levels had been recently established. In similar way gold set records in Saudi real, and Polish zloty. Although last one is formally considered as developed economy now, in perception of foreign investors it is still being East European market. Bit too close to the warzone, but still biggest regional market, secured by membership in EU, NATO, and important geopolitical ties with US. Nature of this relation may remain discussable, nethertheless Poland remains backbone of Three-Seas initiative, energy and logistics hub and one of the few import/export open windows for Kiev. Chinese Juan Renminbi is on similar path as USD, close to near all-time high. In this case needs to remember however, that Chinese currency is being one-of-a-kind type of currency, which is carefully managed entirely by PBoC.

Those having long positions open on gold, or simply holding physical volumes have reasons to be happy. Since November lows at approx. 1617 USD, gold made 4 green candles out of five in total in monthly timing. That gives approx. 23% upward movement in 5 months. On daily candles, counted from 28th of Feb’s recent lows, recent upward price action resulted in 10% plus from 1804 USD to 1988 USD. Of course, that would look slightly different in other currencies, yet as we established, it is American dollar that behaves as most resilient to gold. And as an informal reserve currency of the world nearly all the markets keep using it for valuations. Respectively, since beginning of March, gold vs PLN did raise up just by a mere 9.5% and since November just nearly 13%.

One of the most interesting indicators for PM investors - XAU/XAG – remains nearly at 1:90 ratio. It was over this ratio for a couple days of March, but dropped strongly on 13th of March. Right now, it remains firmly at 1:88, being tested daily upwards and downwards. It is because silver did raise by over 10% in a week commencing on 13th of March, and gold ‘only’ 6%. Needs to remember this refers to spot ratio. Would we apply premiums for an ounce applied by some dealers, we’ll get approx. 1:70 ratio or even less. Hence, we really recommend checking MetalMarket.eu offer – we believe kind customer will be positively surprised with our prices.

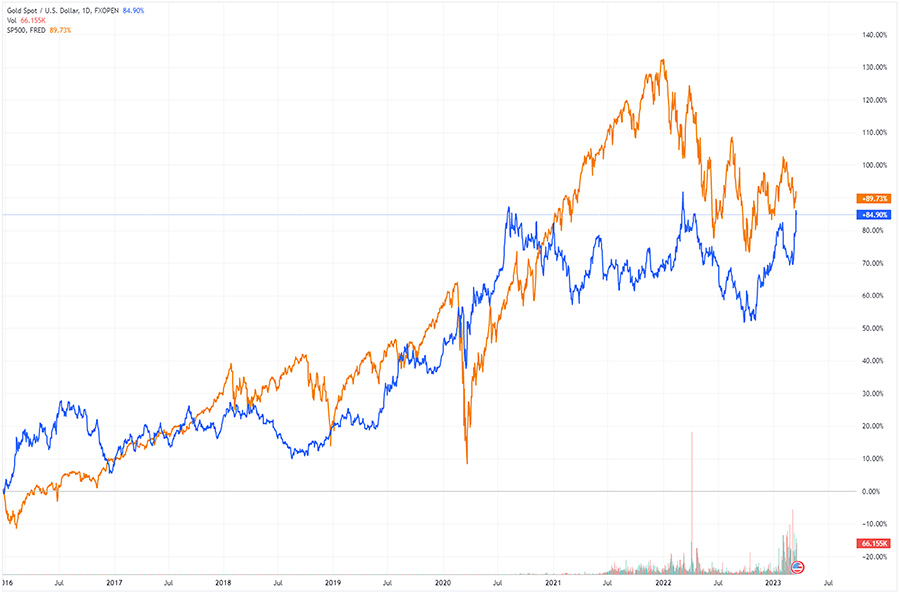

Source:TradingView.com

One last comparison, this time long-term in nature and large in market caps. With the end of 2015 and with beginnings of 2016 we have experienced lows on SP500 and gold itself, Since then we had many corrections, small or large in size but eventually experienced higher valuations. Counting since December 2015, SP500 did 88.26% upward move up to date. At the same time and in same conditions gold achieved 86.26% - just slightly less.

Source:TradingView.com

In this type comparison, there is always possibility of using timing and factors favourable for point of view author tries to proof. Have we done exactly the same?

- We have applied long-term approach as most favourable for both assets.

- Picked long-term lows for both assets as a starting point.

- Timeframe applied was environmentally supportive for most time to SP500, and only favourable to gold in few moments. After all, stocks were being supported by quantitative easing (considered as economic aberration), low nominal interest rates and real negative rates (considered systematic aberration).

- Generally speaking, environment described, entailed buying massive amounts of government bonds or other investments from banks in order to inject more cash into the system. That cash was then loaned by the banks to businesses, which spend it to expand their operations and increase their sales. Stock investors anticipated increased company revenue and did buy the stocks. Which were raising as being indirectly pumped up by liquidity as provided by quantitative easings.

- For most of a time, we had low cost of loans due to low nominal interest rates and real negative interest rates. Minus 0.75% from Swiss National Bank sounds like a good memory now.

- Both assets dropped in percentage in similar way due to initial Covid Shock, although SP500 gained more, due to unprecedented scale of financial stimuluses.

- We did choose 20th of March 2023 as our reporting point as stated at beginning of analysis.

About banking earthquakes and financial aftershocks

Let us now focus on nature of gold itself. It is defensive metal known as safe haven, former maker of financial systems, currently tradeable asset of high market cap. Who knows – maybe in future it may somehow become part of financial system alternative to US dollar debt-based system. For more of that, please stay tuned for second part of our ‘Gold in concept of common BRICS currency’ series. But for now, gold remains an asset. World-wide recognisable, defensive asset.

Gold doesn’t give right to share in the profits and it doesn’t generate interest like bonds, deposits or rents. Unless you are high market cap entity with access to LBMA market, where minimal tradeable lot equals 2000 ounces of 999 gold, lending gold on percentage in form of swap or collateral is outside your scope. In addition, it generates high storage cost. Of course, investor may position long or short on gold spot, option or future. Even leverage position, seeking to maximise profit (or loss). But in most cases, this type of speculative position on financial assets is not being secured by physical volume. Tradeable index may decouple from spot price.

Unexpected events may cause markets to cease trading and make capital withdrawals impossible. Broker may freeze withdrawal of profits, as it happened just recently with Robin Hood and traders shorting SVB. Even stop-loss may not work on time. In 2020 courts dismissed claims against a foreign exchange trading platform, seeking to recover losses it suffered as a result of the late execution of stop loss orders, following de-pegging of the Swiss Franc from the Euro in 2015. All of these happened within last 3 years scope - and we didn’t need global pandemic for them to occur.

Just mere days ago we’ve experienced problems in banking sector with SVB, Silvergate and Signature Bank on US market. Quickly it has been dwarfed by troubles experienced by Credit Suisse. It was one of the banks, crucial to worldwide financial stability. Long-term saga of CS was unfolded since last financial crisis of 2007-2008. By the end of it, Swiss international giant had market cap lower than our local PKO BP. Emergency takeover of Credit Suisse by its Swiss rival - UBS, was decided over the weekend. It had calmed markets, but just for now. Of course, not all claims being effect of the fall and acquisition will be meet. Saudi National Bank made purchase of Credit Suisse stocks at 3,82 CHF per share. Now UBS as a part of settlement will pay them 0,76 CHF per share. In this particular case Saudi bank lost over 1.5 bln CHF. Despite of that, some speculate that these were comments made publicly by Saudis, that triggered drops.

Saudi National Bank stocks remain stable despite losses and even raised. However, UBS stock valuation falls as we speak, despite of high credit lines provided by SNB. Seems CS became zombie-bank, a heavy burden. That triggers question of how many banks in Europe remain in reality on the brink of insolvency. And how close we were from banking weekends and domino effect.

Markets speculate, what bank will be next to fall and would it remain too big to fall. Mid-Size Bank Coalition of America (MBCA) has asked the US FDIC deposit guarantee fund to guarantee all customer deposits for two years. At the same time, US economists said in a studies that about 200 other US banks are exposed to the same illiquidity risk.

Now, all eyes remain focused on Wednesday 22nd of March, when Federal Reserve will make its decision of how much to raise interest rates (make credit lines even more expensive which removes liquidity from markets). And over the weekend, approximately 20 private jets identified as belonging to senior officers of US banks, had landed in Omaha, Nevada. Just where legendary CEO of Berkshire Hathaway resides…

Seems that perspective of bank runs and banking sector aftershocks remains strong.

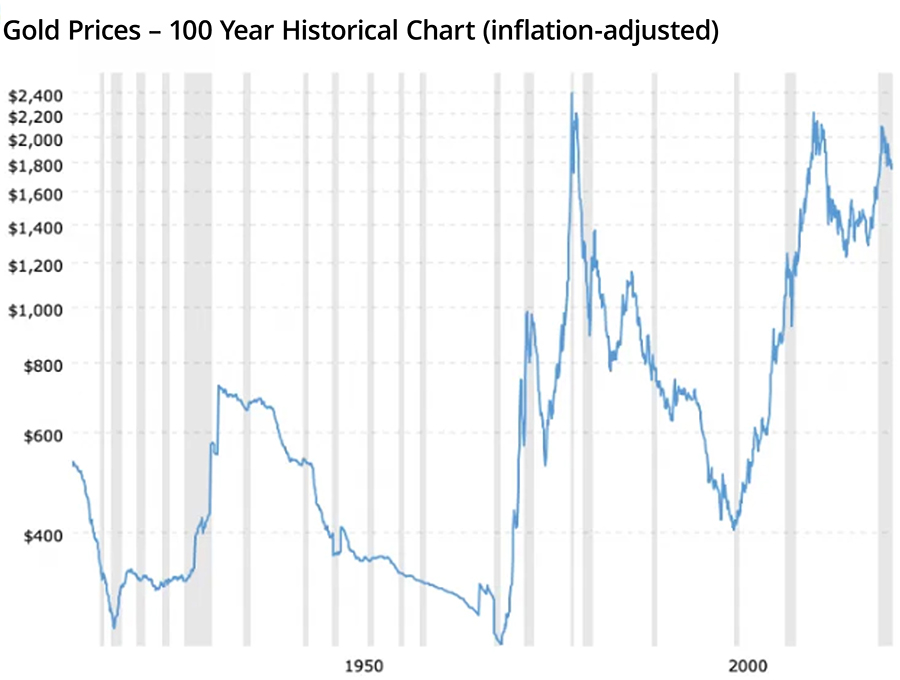

Speculations on reasons for price lag

In the uncertainty we experience shouldn’t gold price continue to rise? After all it is known as inflationary hedge, defensive metal and safe haven. Alas, price expectations are high, and percievment of inadequate growths unmatching to financial perils we experience irritates. Let’s just take very bullish gold inflation adjusted long-term price. 664 USD of Feb 1980 would we worth in 2021 approx. 2309 USD. 1970 USD we have started August 2020 with, should be 2078 USD. How much would be 2000 USD we attacked morning 20th March 2023? Definitely more. According to a studies provided by World Gold Council, over the last half a century, gold has returned 15% per annum on average when inflation is higher than 3%, compared to just over 6% per annum when inflation is lower than 3%.

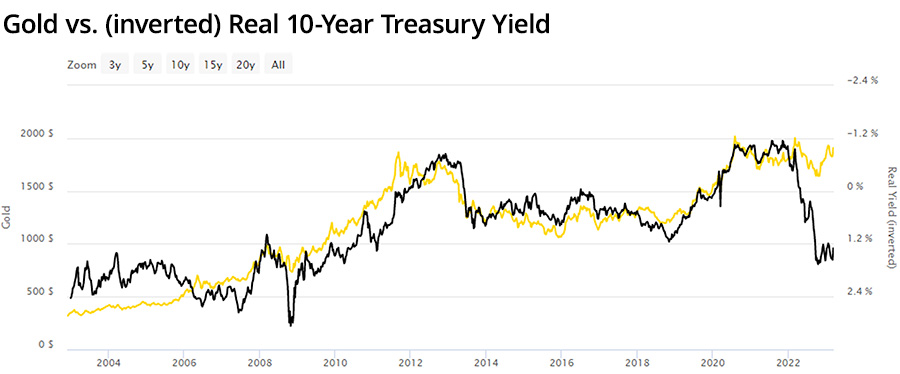

Source:TradingView.com

There is a trap in this type of thinking. Should a credit crunch actually occur, flight to cash could again lead to a massive sell-off of all assets. This is type of dynamic seen after the Lehman bankruptcy in 2008. After a surge in price of gold immediately after bank had collapsed, precious metal prices had fallen significantly for several weeks. Only then they started its march upward. So as peril, fear and mistrust fuel gold prices we still have to remember about all sorts of possible government and monetary policy interventions implemented in purpose of reinstating liquidity and confidence.

At this moment, we also need to remember about US treasury bonds, especially 10y. And that seems to be the most important factor to observe. It probably is no secret that gold price correlates with inverted 10y yield, and even more to real rates for these.

- Nominal interest rate equals real interest rate plus expected future rate of inflation.

- Real interest rate reflects true cost of funds to the borrower and the real yield to the lender or investor.

Just on spring 2021, nominal yield on US 2y bonds was just above zero. Recently it exceeded 5%, setting new heights since 2007. For US 10y recently we had just over 4% and experienced slight pullback. In theory, persistent CPI along with future expectations on it supposed to be supportive for higher yields. Inverted correlation would then imply further falls on precious metals.

Source:TradingView.com

How gold reacted? Yes, it indeed experienced price lag, but no the type we could expect. Sharp raise on yields we experience since 2022 supposed to pull prices of yellow metal down. Yet it showed showed unbelievable resilience, caused by overall macroeconomic situation and constantly appearing worldwide dangers either political and financial nature. It reached lows at near 1620 USD levels at the time financial markets were considering and pricing in Powell’s dovish pivot. Which never happened by the way. And we urge not to consider slowdown on raising interest rates as such, as market conditions are being tighten and probably remain tight for years to come.

Gold remained surprisingly solid against swift raise of yields and what was probably the fastest cycle of raising interest rates in US history. Not highest however as record belongs to Paul Volcker, who delivered total of 20% untill 1981. It seems to be pretty unlikely scenario to unfold these days, as debt levels are much higher now than 40 years ago. Market divagations are between 5.50-6.00%, but even this recently changed, as due to recent events unfold, markets consider rate cuts to occur in 2024. Just like Jerome Powell never ever suggested, that they’ll keep raising rates until something breaks.

Question remains would that make inflation to retract and at what pace. Base scenario is to keep within these frames, where inflation remains persistent for couple years, being slowly diminished by tightening, and destruction of purchasing power. These, with further instabilities on banking sector and raising unemployment, had to be considered as supportive for gold. However, would policy makers decide to reach higher levels on interest rates, gold as a non-interest bearing 'safe haven' could’ve lose its shine against the i.e. 10% yield on 10y Treasuries. We prefer to think of such as just theoretical scenario. Had it unfolded, would bring havoc, wreck and destruction to the world we live in.

Summary for consideration

This analysis has been created as a response on elevated, high expectations to the price action on gold in the context of recent events. ‘Now, now, NOW!!!’ doesn’t seem to be right approach to asset known for steady approach, solid foundations, patience and bit of historical dignity. Besides, past price actions proved, that gold loves parabolical raids when the time is right. Let us just look on how it unfolded in 2020 – 9 weekly green candles in a row ending in all time high. In 2011 these were 7 weekly green candles in a row establishing ‘that time high’. After gold has been moved to tier I in Basel III, it experienced 6 weeks of green candles in a row.

Zooming out allows to change perspective. So, what has happened just now?

⦁ Has any major bank crumbled beyond saving, causing on that occasion domino effect? (Not yet, but it seems to be clear, that it will happen sooner than later).

⦁ Was there massive bank run? (In case of falling banks yes, but it didn’t turn onto mass country-wide movement. Although some banks imposed daily withdrawal limits from ATMs due to concerns over runs).

⦁ Had sessions in US markets and others been suspended do to everyone selling or shorting but no one buying or opening long positions? (No, but stock pricing of certain banks is being suspended more often.)

We still seem to be in ‘unfolding banking crisis’ stage, very close to actual point zero. Analysis of previous banking crisis of 2007-2008 confirms, that covering losses and pretending that everything is all right may extend agony by couple months. However elevated credit default swaps on banking sector do confirm that something is off.

Let’s link that together with scenario of elevated but not raging inflation on US markets and balance sheet tightening, which lost lot of steam since its peak. In result we’ll get scenario very optimistic in long-term for gold. Of course, risk of banking problems remains elevated and that will affect prices of metals in short term, but that's exactly why we diversify with precious metals, to keep our liquidity, create profit and to prepare ourselves for inevitable.

Above is not an investment advice, as we may be wrong in our approach - after all we’re humans. But if we are wrong, then central banks were wrong, as big funds, investment banks and basically everyone in last decade of big net gold purchases.