Is new gold standard or revaluation incoming?

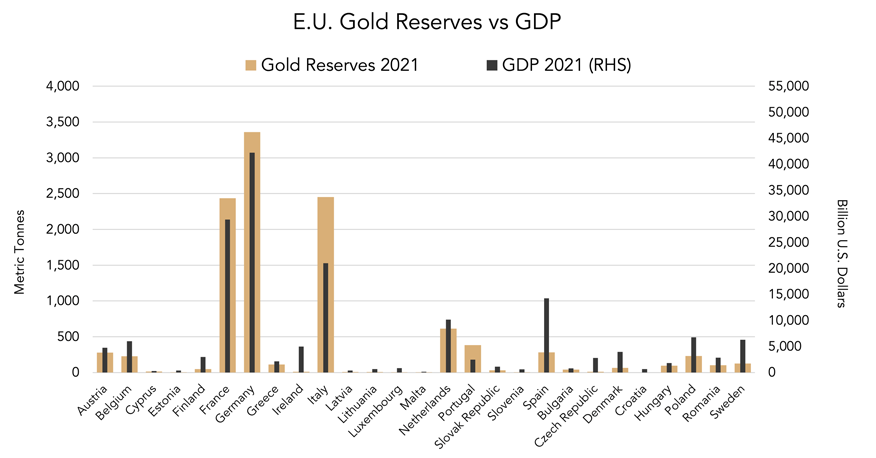

In an interview held in November 2023, Mr. Aerdt Houben – Director of Financial Markets Division of Dutch central bank (DNB) shared some interesting remarks on how DNB equalized its gold reserves, relative at a rate to Dutch GDP, to other countries of Eurozone and outside of Europe. According to his statement, official gold reserves can be used as foundations for new gold standard. Considering occasion, we’d like then to present two interesting approaches on theoretical gold revaluation.

Aerdt Houben on equalizing policies

In the years preceding second decade of 21st century it was unusual to hear central bankers speak of gold in positive manner, if at all. Usual narrative was focused on stability of financial system, and how coordinated actions within frames of unusual monetary policies (QE1-4) saved markets from crash and fuelled growths. Gold was being predominantly mentioned in neutral or negative way. With few exceptions, usually western central bankers were to criticise it and advocate for treasuries and other assets. This stance was usually changing upon central bankers’ retirement or vacating official position. Suddenly bound with no obligation towards former employment, they did tend to admit gold may be considered good form of hedge considering potential for financial troubles of any sort. Just like Alan Greenspan, Chair of Federal Reserve until 2006. This had changed in recent years, to the point that photos of central bankers holding repatriated gold bars, became something absolutely normal.

Considering above however, remarks on possibility of gold being re-introduced to the monetary system are – to be honest - unusual. Past years made us used to the fact that such thoughts (and other remarks on ‘imminent collapse of financial system’ and ‘how we’ll going to pay for everything with precious metals’) were coming from… let’s call that ‘different sources’. However, voice about possible re-introduction of gold towards monetary system coming from high officer of notable in terms of AuM (assets under management) central bank, simply bear different weight.

In an interview held in November 2023, Mr. Aerdt Houben – Director of Financial Markets Division of Dutch central bank (DNB) shared some remarks on how DNB equalized percentage of its gold reserves, in relation to Netherlands GDP and in line to other countries in the Eurozone and outside of Europe. This has been part of the podcast made for Financieel Dagblad – Dutch equivalent of Financial Times - conducted by Anna Dijkman. Interview transcript and translation has been provided by precious metals analyst Jan Nieuwenhuijs. Mr. Nieuwenhuijs analyses subject of ‘monetizing’ gold back into financial system since many years.

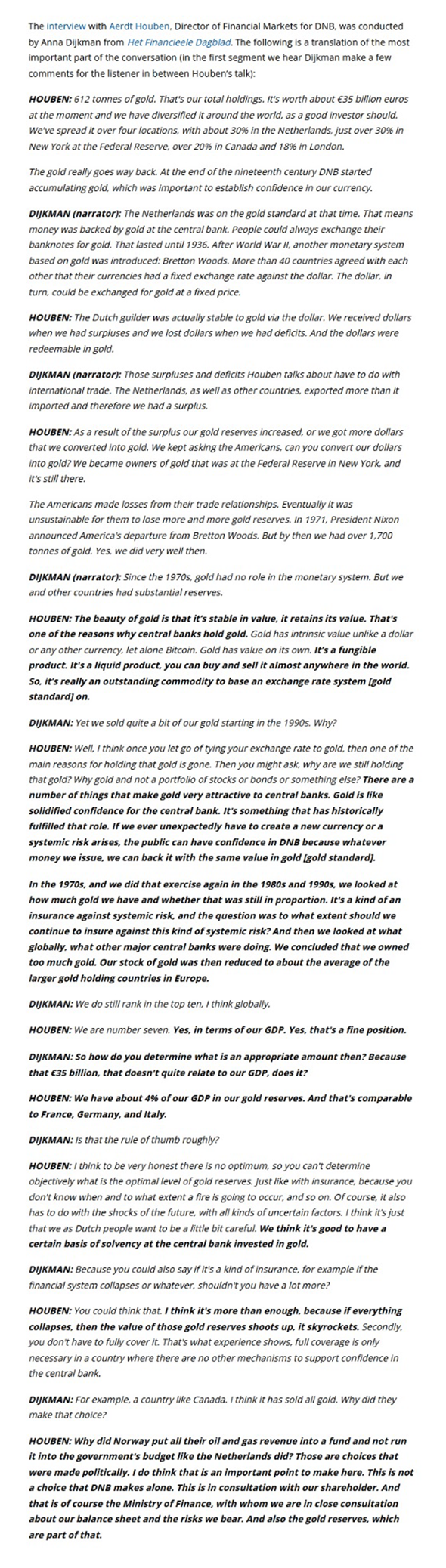

Transcript of part of an interview conducted with Aerdt Houben, Director of Financial Markets for DNB. Source: https://www.gainesvillecoins.com/blog/dutch-central-bank-admits-prepared-new-gold-standard

To avoid repetitions of what Mr. Houben said, let’s simply wrap up the above. We’ve been told of DNB’s gold volumes and its allocation. We’ve learned on modern gold history from a perspective of Netherlands. We’ve been reminded that gold has strong intrinsic value, fungibility and liquidity. Then, Mr. Houben mentioned that upon unexpected events, DNB prepares itself for a situation in which it would be forced to issue an entirely new currency. Importantly, this currency would have to enjoy confidence of users since beginning, which may be very difficult to achieve in a crisis environment. This however could be achievable with gold, reinstated to its monetary function to cover hypothetical bullion-pegged currency.

Aerdt Houben also mentioned about periodical exercising after Bretton Woods’ fall, which at some point resulted in comparative analysis against gold holdings of other developed economies. Netherlands adjusted down its gold stocks to 4% of its own GDP by selling approx. 1.1k t. in the years after 1993. This was done on markets and via Bank of International Settlements. Remaining volume was at 4% ratio of Netherland’s GDP. Simillar moves had been done by other major European economies, with 4% to GDP ratio in mind. Buyers of disposed volumes were emerging nations whose international reserves were work-in-progress at a time or which historically had small gold stock. . In addition, some large volumes had been also acquired by Chinese banks. We mentioned in the past on several occasions, that especially since Asian crisis of 1998, Asian central banks made significant efforts to grow its liquidity, often acquiring anything available on the markets. Pace of such was the reason, IMF created ‘unallocated reserves’ category for assets purchased by emerging central banks. As they knew the whole value, but proportions and shares were evolving on nearly daily basis.

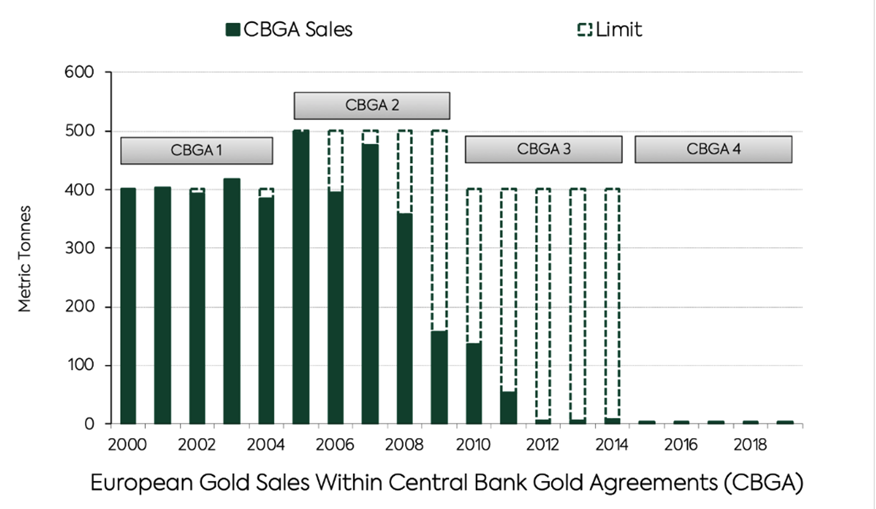

Sales conducted by European central banks were partially done under CBGA programme, which just itself resulted in disposal of over 4k t. from the vaults of predominantly European developed economies - Switzerland, Netherlands, France Spain, UK and Portugal among many. Majority of commentators stipulate, that EU made sales had at a time potential to destabilise market and push price of gold down, hence CBGA yearly volume limitations had been imposed.

CBGA sales. Source: World Gold Council

However, Jan Nieuwenhuijs stands on long-expressed position, that this move has been an effect of EU main central banks comparing their gold holdings against each other and coming to a conclusion to bring their gold holding more in line with other important gold holding nations. Potentially to create monetary mechanisms including gold? Hence considered since 70’s and executed since 90’s process of equalisation to 4% started and is being continued until nowadays. Purchases made by ‘East”, but also Hungary, Czech Republic or Poland are part of it.

Apart of the golden thread, Mr. Houben also stated that gold will be safe haven of choice during a financial collapse. History proves this was and is to happen. However in such way he somehow admitted, Euro may not be suitable for the role. We’re aware of that. You – kind reader - probably are aware about pros, cons and flaws of common currency. But considering Mario Draghi’s ‘Whatever it takes’ stance, and later actions of Christine Lagarde… Mr. Houben’s statement has to be considered as potentially questioning faith in common currency.

Lot has been said recently on gold pegged currencies. In the past we covered subject of such mechanism proposed on BRICS forum by Russia. For now it has been shelved due to expressed concerns by India and rather neutral position of China However idea has not been entirely denied. Zimbabwe issued gold backed digital currency. Russia attempts to circumvent sanctions using digitalised gold-backed tokens. China created mechanisms circumventing SWIFT and enabling receiving payments for oil in yellow metal. Fact it may not leave China is another matter – counterpart simply has to either acquire goods on Chinese markets, leave debited accounts for later, dispose gold for currency or decide for investments on Chinese soil. Similar voices on need to reinstate gold-backed currency also came in the recent past from certain institutional entities.

However, in this particular case we’re discussing one of the top world’s economies, located in our neighbourhood, one of the clear beneficiaries of Eurozone, core member of European Union and major European trading hub. In addition, we can’t depreciate Mr. Houben as ‘propagator’ or ‘goldbug’. Even considering that his statement doesn’t sound like something central banker would normally say. Who exactly is Mr. Aerdt Houben? He is Director Financial Markets at De Nederlandsche Bank, covering DNB’s market operations, asset management, risk management, market intelligence and investment operations. Prior to this, he headed DNB´s Financial Stability Division, its Supervisory Strategy Department and its Monetary Policy Department. He has worked at the IMF, in the Policy Development and Review Department. He currently chairs the Committee on Financial Markets at the OECD and is a member of the Committee on the Global Financial System and the Markets Committee at the BIS. He has been a member of the Basel Committee on Banking Supervision, the Financial Stability Committee of the ECB and the International Organisation of Pension Supervisors as well as numerous other policy committees in the context of the IMF, Financial Stability Board, ECB and the ESRB. Mr. Houben is professor of ´Financial Policies, Institutions and Markets´ at the University of Amsterdam. He has a PhD in monetary economics and has published broadly on financial issues.

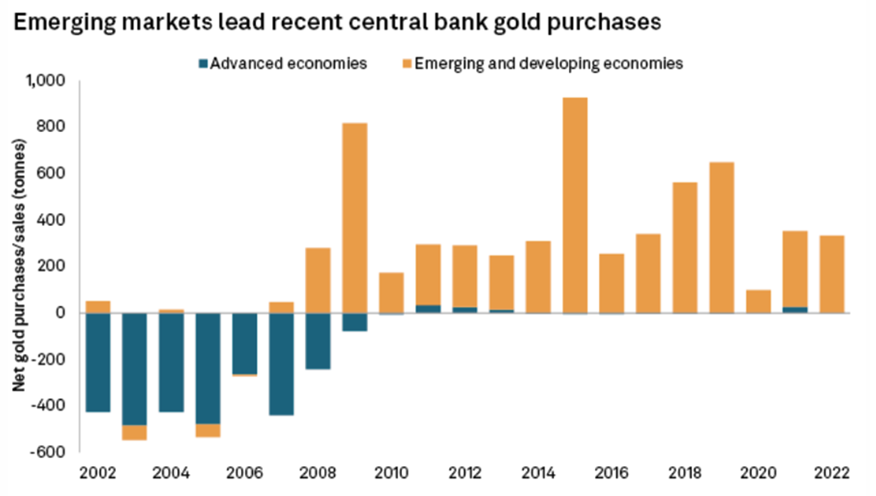

Emerging economies are on gold purchasing spree since consecutive 16 years now. Source: https://www.mining.com/web/gold-revaluation-the-hidden-motive-behind-central-banks-gold-buying/

It’s not first time when he expressed such revelations. More vaguely way he did so in 2016 on mentioned before Financieel Dagblad. DNB at some point published some serious analysis of the subject of re-introduction of gold to monetary system – unfortunately already removed from its website. To the equation we could add significant gold repatriations undertook by leading economisies during last 10 years, purchases made by East Asia and Central Europe, that may be at least indicative to idea of balancing gold reserves in relation to each economy’s GDP in non-centralised, dispersed form. In addition to ‘hard’ and ‘semi-hard’ data, we also have ‘soft’ data. And that would be recent softening on stance towards gold, and 180 degrees reversal on the way opinions on it are being expressed. Just recently we could hear and read positive voices on gold coming from central banks of Germany, Poland, Italy, France and Hungary.

We have to admit possibility that something is brewing behind closed door. And this may serve purpose of gold re-implementation towards monetary system in more equal way and to create certain gold based mechanisms of balanced stocks and flows. Possibly in form of supranational and regional gold-backed currencies serving as an ultimate class of assets for balanced payments between sides.

According to Mr. Nieuwenhuijs, Europe aims to equalize gold to GDP ratios, not gold to monetary base ratios. As a consequence, gold standard they envisage is more likely a system of gold price targeting rather than the classical gold standard. In the latter system people can exchange bank notes for gold at a fixed price at central bank. With gold price targeting, institutions may however exchange gold to acquire new version of currency at a price that is stabilized through central bank monetary policy.

EU gold reserves vs GDP in 2021. Source: https://www.gainesvillecoins.com/blog/europe-preparing-gold-standard-part-2

Structural gold revaluation via Basel accords

Emerging economies started purchasing spree for yellow metal since 1998 and continue until now. We could even say, they started purchases much earlier, as European central banks started selling its gold in higher volumes since 90’s. And it’s no secret that since 2009 central banks became net buyers, with majority of flows again predominantly being directed east. Of course, this brought some speculations if central banks were preparing for something – like consequences of exponential monetary base expansion or losing faith in US and USD capability to protect the world against adverse market conditions. Pace and size of purchases made was dependant on individual policies presented by buyers. We outlined some of these approaches in the past on several occasions.

Narrative on gold was changing and in 2019 due to decision on re-accounting physical gold towards tier 1 class assets. This was one of the changes happening under Basel III updated banking regulations and applicable since 2021 (in UK since 2022). However, it was February 2018 when i.e. Swiss National Pension Fund switched out of gold derivatives into physical volumes. According to Basel III, gold is defined as ‘physical gold held in their own vaults or in trust”.

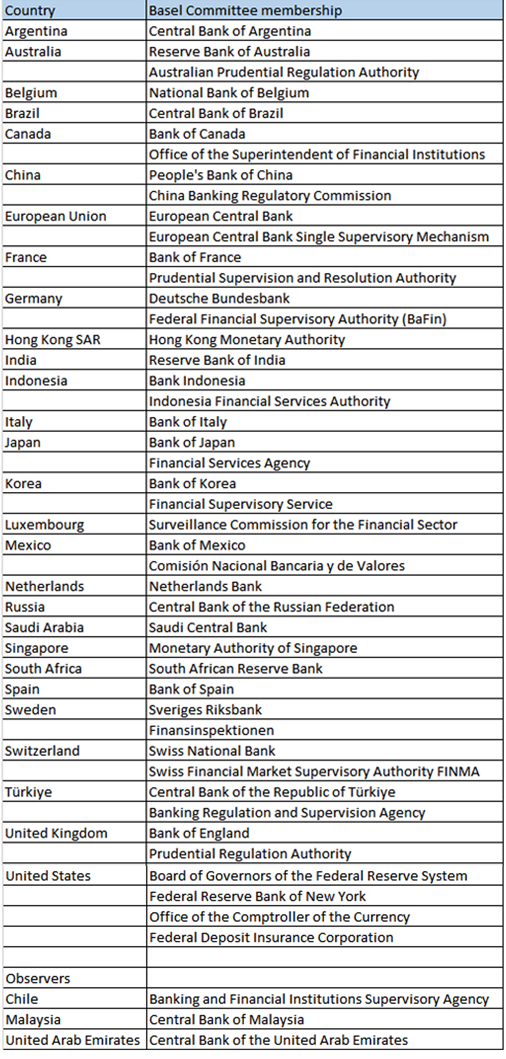

Its maker - Basel Committee - comprises 45 members from 28 jurisdictions, consisting central banks and authorities with formal responsibility for the supervision of banking business. Need to mention, that Mr. Houben has been member of Basel Committee representing DNB. Although Basel accords are not being considered as binding, majority of participants’ (and designers) voluntarily implement designed policies. Besides, even if considered as advisory, there are tools enabling implementation. In EU that would be Capital Requirements Regulation on Capital Requirements and Capital Requirements Directive, in force in all EU Member States since 2014.

Institutions represented on the Basel Committee on Banking Supervision. Source: https://www.bis.org/bcbs/membership.htm

With 2019 updates, yellow metal in its physical form has been moved from tier 3 to tier 1 and became one of the fully recognisable assets, accountable in books in full value and hence significantly improving liquidity. Tier 1 capital is a core capital and includes disclosed reserves—that appear on the bank's financial statements - and equity capital. This money is the funds bank uses to function on a regular basis and forms the basis of a financial institution's strength.

Basel Accords changed the way central bank may account and perceive gold among assets held. Source: https://en.rattibha.com/thread/1569024186563297282

Tier 2 capital is a bank's supplementary capital. Undisclosed reserves, subordinated term debts, hybrid financial products, and other items make up these funds. Previously there was also tier 3, but it has been abolished and absorbed predominantly by tier 2. Need to remind that under new rules, gold is defined as ‘physical volume’, so gold certificates became no more than book entry tied to the price of gold and applicable to lower tier. As a tier 2 asset, its origin and continued existence is entirely funded by the creation of bank credit, as ownership of certificates requires higher rates of collateral and is limited by established proportions between tiers.

As banks operate actively on credit markets or simply remain affected by constant changes in value on assets and liabilities, some of their assets under management are safer than the others. Hence above division in between tiers. And to avert some risks, there are certain established proportions in between them. Hence mechanisms like Capital Adequacy Ratio (CAR), and Risk Weighted Assets (RWA) among many - presenting below, as they relate to our gold holdings within Basel III.

CAR pozwala obliczyć i przygotować poduszki zabezpieczające odpowiedniego rozmiaru, tak aby zaabsorbować rozsądne straty. Rozsądne jest tutaj słowem kluczowym. Zakładając, że jako bank mamy 15 mln USD w tier 1 i 10 mln USD w tier 2, ale nasze kredyty zostały zważone i obliczone na 30 mln USD, podsumowujemy dwa pierwsze i dzielimy przez ostatni. Nasz CAR wynosi 83%, co oznacza, że jesteśmy w stanie spełnić nasze zobowiązania w 83%.

- CAR allows to calculate and prepare adequate cushions to absorb reasonable losses. Reasonable is a key word in here. Assuming that we as a bank have 15 mln USD at tier 1 and 10 mln USD at tier 2, but our loans had been weighted and calculated at 30 mln USD, we summarise first two and divide by last. Our CAR is at 83%, which means we are able to meet our obligations in 83%.

- RWA shows at what value certain asset from non-tier 1 class could be reported. In example, gold at 50% of value, bonds of war-torn country at i.e. 5%. It was also used to present proportion of assets in tier vs risk weighted assets. For tier 1 this proportion should stand at minimum 10.9%. So if our tier 1 assets (bonds of proper rating, cash and gold) are at 2.5 mln USD and our risk weighted assets at 18 mln USD we divide one by another and multiply by 100 to have our percentage – in this case 13.88%, which is adequate as over 10.9% required.

- However tier 2 assets are considered more risky, so minimum total capital ratio at 10.9% on tier 1 needs additional 2% for tier 2. So if the bank from bullet point above has 2.5 mln as tier 2 assets, we divide that by above risk weighted assets at 18 mln and multiply by 100. For tier 2 we’re at 5.55% 13.88% + 5.55% equals 19.43%, which his higher than required 10.9% + 2%.

- In addition let’s also mention about abolished tier 3, which Basel III signatories considered as contributor to last financial crisis. It was mostly composed of unsecured debt banks held to support market risk in trading activities. As a lower quality capital, it was demanded by Basel accords that this capital to be at maximum x2.5 of tier 1, and has maturity longer than 2 years.

Of course in above example we operate on made up numbers, but true percentage points. In reality, RWA and proportions of tier 2 to tier 1 are… on more risky levels, closer to borderlines.

Above was not even a deep scratch on the surface of Basel III regulations. However, this should suffice us with regards to gold. Same gold which has been effectively moved from tier 3 class to tier 1. What it means – among many things – is that before 2019, owning exposition on gold required having appropriate capital of tier 1 type and therefore was limited by levels. In addition, gold had RWA at 50%, hence ownership of one tonne allowed to report 0.5 t. in value for purpose of solvency requirements. Revaluation of gold towards tier 1 moved it to highest of now two classes. Gold ownership is not being limited by ratios, can be reported as 100% in value and hence it is now considered as healthy and recognisable asset. Revaluation increased CAR of banks owning gold, turning it at the same time from passive asset with value dependant on higher tier, to active. So now, gold contributes to determination of tier 2 class valuation and size. Liquidity, liquidity, liquidity.

Hence, pre-2019 policies as on Basel III were contributory to perception of gold as unnecessary. This had changed and in effect had been considered as supportive to the market price of gold. Considering however how our world had changed since, question remains on effective proportions between actual Basel III impact and ‘sum of all fears’ we experience since 2020.

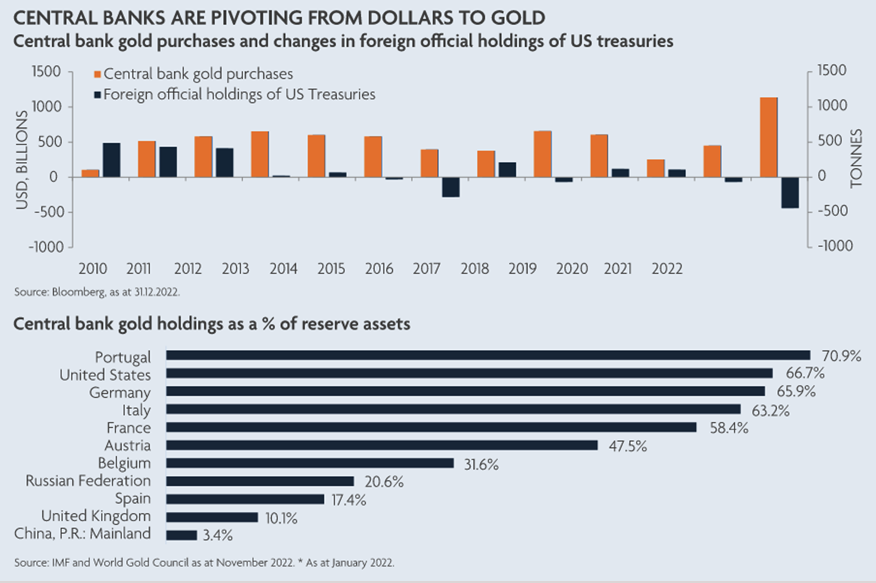

Well, maybe not entirely pivoting from USD towards gold, but some trends are visible. Source; https://www.jupiteram.com/uk/en/professional/insights/what-central-banks-are-saying-about-gold/

Considering that central banks of the ‘West’ own approx. 2/3 of official gold holdings, this move improved their position. It did the same to banks from the ‘East’ – main buyers of yellow metal.

Basel III is not definite version of said regulations. While still being implemented, Basel IV is being currently developed. Question remains on global implementation, as there are many jurisdictions that prefer to be either un-bound to Basel III or just see their implementation unnecessary for individual reasons.

In the past we mentioned, that with growth on treasury yields, central banks experienced unrealised losses as market value of bonds they keep has diminished. And no official growth on value of gold holdings at current prices could fill gaps arisen this way on balance sheet. Since yellow metal price on rise, value of gold on the asset side of the balance sheet increases. But to balance out increase in gold’s value, accountancy rules imply an equal increase must be recorded on the liability side.

To do that, central banks can use what’s referred to as a ‘gold revaluation account’ (GRA), to register unrealized gains. However, according to current legislation within EU, netting of unrealised losses on asset A against unrealised gain on asset B is impossible - it has to be same asset. In other words, unrealized gains in gold can only be used for unrealized losses in gold, not for losses in bonds.

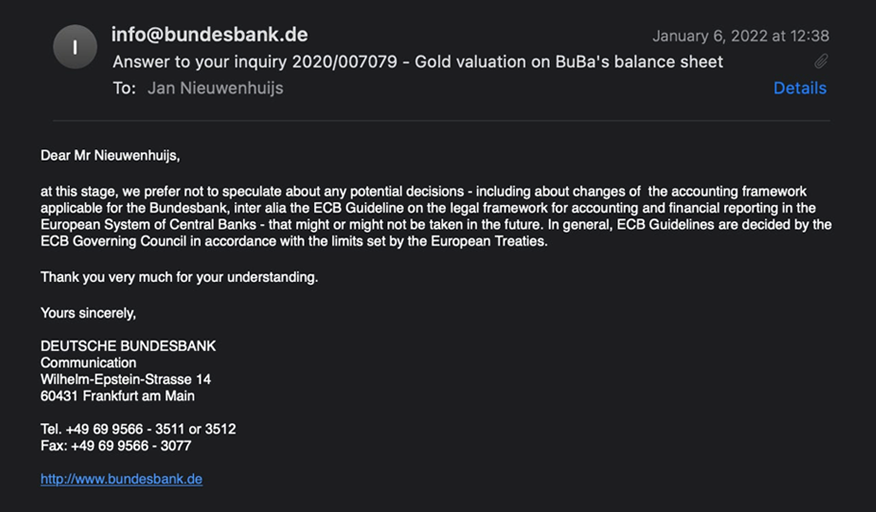

However outside of EU there is an existing world as well. In 2021 Caribbean Curaçao and Saint Martin used portion of GRA to equalise losses. And according to answer to a query on a subject, precious metals analyst Jan Nieuwenhuijs forwarded to German Bundesbank… they didn’t say definite ‘yes’ or ‘no’ to theoretical possibility of making such move. It rather looks more like ‘no comment’ and ‘we’re bound to current guidelines’. However they also signal that legislation is never being carved in stone, and could be adjusted accordingly if needed by legislators. However, as Bundesbank ceded its privileges on ECB, and ECB remains close to BIS, question may need to be forwarded elsewhere.

Bundesbank answer to query regarding use of GRA to write-off unrealised losses arisen on different assets. Source: https://thegoldobserver.substack.com/p/german-central-bank-doesnt-rule-out

Final Thoughts

We tried to cover some aspects of possible monetisation and / or revaluation of gold. This has been triggered by recent interview with Mr. Aerdt Houben from DNB – Dutch National Bank. His stance and our own remarks do not have to mean any of the above will happen for sure. However considering change of environment around gold and fact that central bankers ecently tend to speak of it in positives, lead us to conclusions that bright years for precious metals may be ahead.

We assume on this occasion, that central bankers around the world, and especially associated in BIS, do attempt to find solution to problems caused by liquidity injections, which was initially a solution to 2007-2008 financial crisis, and later by exponential growth of monetary base in response to global pandemic. Their own policies, and fiscal policies of politicians they work with, we might add.

Hence, theoretical gold revaluation may be one of the answers – if not definite, then at least partial.

- Whether this would happen by creation of supranational top capital tier within international banking accords like Basel III.

- Or by creation of regional currencies pegged to gold being top currency tier used for trade, non-available to normal citizen in usual circumstances, being treated as superior to other national or international un-pegged to gold currencies. Which would be beneficial to gold-pegged supernational currencies in either inflationary or deflationary environment.

In both cases considered, appreciation in the value of precious metals can theoretically be assumed. This is because significant increase in the monetary base or liabilities that has taken place in recent decades makes a return to familiar Bretton Woods peg of 1 ounce for 35 fiat rather impossible. Now ratio would have to be revalued at different levels. Without being able to peg all the currencies issued until today to gold (how many zeros would be in an ounce of yellow metal then...), a certain option is to create another internal system operating a few levels higher than typical Smith and encourage him to dispose his gold in the process.