In the silvery light of Diwali – on India’s seasonal silver demand

-->

-->

Year of great contrasts – such could be said on Indian silver figures in 2023. On one hand we had seen predictions on lower yearly demand and lowered import figures, being laid as far as in May 2023. On the other, we’ve just concluded traditional Indian festive season – Diwali / Deepavali – period characterised by sharp growth on demand. And just for 2023 this did set up historical records. So what is exactly condition of Indian silver market and should it concern us?

Concerning India’s love for silver

To write that Diwali is a big thing is like to write nothing. Rule of thumb is whether you are Sikh, Jain, Hindu, Newar or Buddhist you celebrate Diwali, as generally it commemorates victory of light over darkness, good over evil and knowledge over ignorance. That is what celebrations have in common, however they consist slightly different traditional and religious protagonists of vast pantheon of Indian deities. In southern India, Diwali celebrates Krishna’s victory and destruction of demon Naraka who is said to have imprisoned women and tormented his subjects. In northern India it honours triumphant return of Lord Rama along with his wife Sita and brother Lakshmana, from a 14-year exile in the forest. And by the way – correct name is ‘Deepavali’. Diwali is just English aberration of original term, which is commonly used around the world.

Diwali celebrations. Source: https://utsav.gov.in/major-festival/diwali

Considering size of India, its vast ethnically and culturally diverse population and large international diaspora, you could imagine that it brings number of unique traditions which vary regionally. In addition, November to February is also a traditional wedding season. This brings even more reasons for joy, celebrations, praying and sharing gifts – traditionally made of precious metals. What all the above festivals have in common are celebratory lights and fireworks. After all, Diwali is commonly known as Festival of Lights. And it will be just minor exaggeration to say that 2023’s festive season in India shun with a bright silvery light. However, we need such comparison to smoothly move from pointing cultural significances towards seasonal silver demand and supply trends.

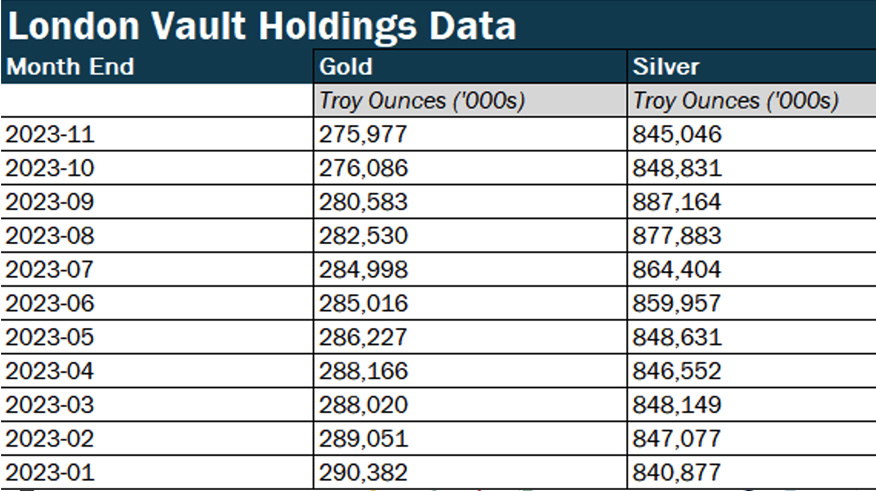

‘India’s Massive Silver Demand Cutting World’s Warehouse Stocks’ – that is an actual title of an article published on Bloomberg in November 2022. There is no mistake in a date, as statement on impacting silver stock levels during this period is applicable to Indian market on the cyclical basis. And we could’ve seen such impact just recently on fall of LBMA silver stock data.

Effect of 2023 Divali visible in LBMA silver stocks drawdown in October. Source: LBMA

And so, year after year in a period of October-November, India experience significantly higher import expenses, foreign held silver stocks are being drawn down and inhabitants of subcontinent rush in purchases of precious metals. Transactions made then are usually attributable for majority share of silver jewellery sales during calendar year, as well as silver imports made.

One of the main reasons attributing to seasonal silver demand in India is jewellery industry, which just in 2023 was valued at market cap of over 43 bln USD. Should come as no surprise then, that with over 10 mln weddings taking place yearly and record 3.5 mln weddings achieved just in November-December 2023, demand for gold and silver jewellery in Q4 is usually astounding. However, demography determines type of gifts. Gold may be preferred by middle and upper class, while silver - also popular choice – is a metal of choice due to its cultural significance and price affordability.

Let’s not forget, India remains predominantly rural society. This group represents 70% of overall sub-continent inhabitants. It is not only percentagewise significant, but also quite large in absolute terms. There are 8 bln people globally, of which 1.4 bln inhabit India, of which 70% are rural inhabitants. That would be 1 bln people add or take with demographic pyramid looking rather healthy at a time, however signifying potential problems in future. Hence, even if considering enormous financial disparities among heavy-class Indian society, number of populus remains supportive to volumes of seasonal silver demand – whether it would be jewellery or for investment related purposes.

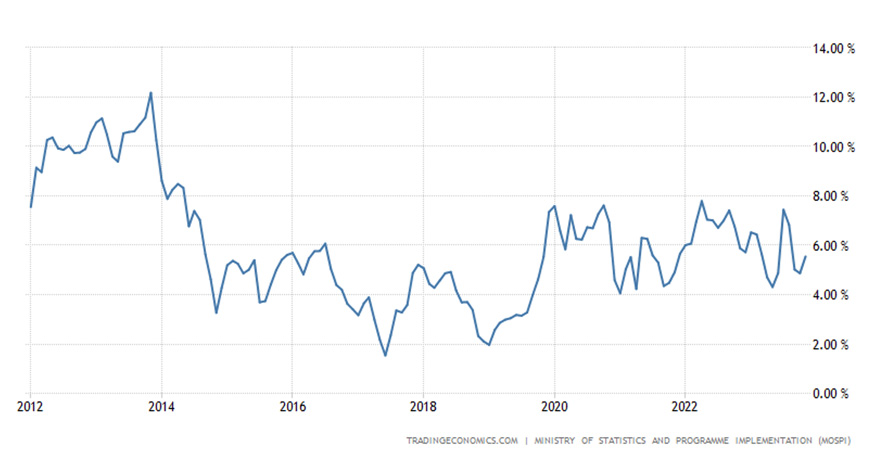

Another silver supportive aspect lies in lack of, or short list of viable alternatives. Of course, local stock and bond markets grow and experience periodical booms. However, 2022 research shows that only 2% of the Indian investors invest in the stock markets. Reason for this is lack of awareness, anxiety about risk, often lack of education on financial markets and predominant defensive approach supporting need for risk-free investments that give stable returns in long term – like precious metals.

Country develops and chase technological advances – just recently managed to deliver moon rover onto Earth’s only natural satellite. However, in all aspects India is still being considered as emerging market, struggling to minimise financial disparities among its population. New Delhi aspires towards geopolitical chessboard and aims to be considered as active player. However, with strictly controlled rupee, it also remains heavily exposed to significant role of USD in its trade balance and doesn’t obtain international investments in a pace it would like to. In addition, INR itself is prone to inflation - 2007-2013 over 9%, 2014-2019 average 4-5%, 2020-2023 average 5.5-6.5%. These are just nominal and official values, which tend to be much lower than inflation that could be seen as on market shelves.

India’s CPI. Source: https://pl.tradingeconomics.com/india/inflation-cpi/

Another point to consider lies in long ongoing corruption allegations on central and local governments. In corruption perception index, India ranks on 85 on 180 positions. That places it at same level as Kosovo or North Macedonia, slightly above Belarus and slightly below Hungary. However as ongoing and rather common phenomenon this also fuels distrust in standard financial instruments, including government bonds. Such approach accompanies India since years. Hence land, precious metals etc. – tangible traditional physical assets remain in high esteem, despite of class, caste or depth of a pockets.

Related to the above, comes another aspect supportive to silver demand, which may not be that obvious for us, inhabitants of ‘global west’. About 1/3rd of India’s population has no access to any form of bank account, not even to mention similar statistics regards any form of physical or digital ID. This number vary depending on source – i.e., World Bank indicates 130 mln adults in India itself live without access to any banking services. Despite the difference in numbers, fact is there is a significant part of society affected by digital and financial exclusion. Hence yet another point for strong attachment to physical and traditional goods retaining or growing in value in time.

All that supports strong effect of cultural traditionalism and trust lied in precious metals – so clearly visible in majority of Asia.

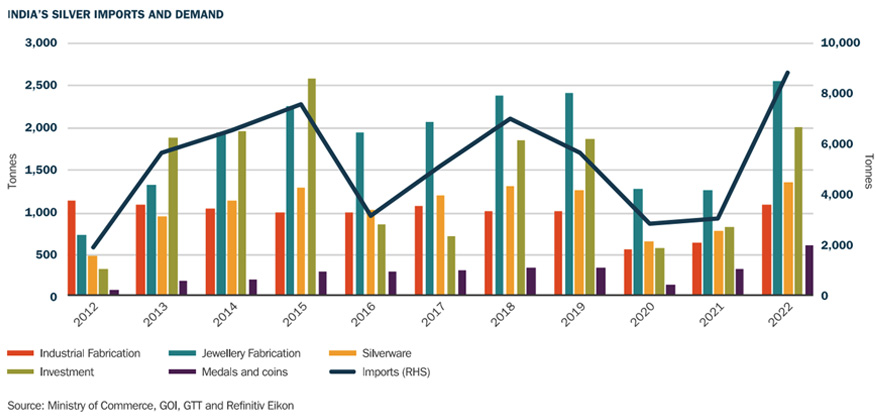

Detailed look onto India’s silver imports and demand 2012-2022. Awaiting for 2023 data. Source: LBMA

With magnifying glass on 2023 India’s silver flows

Considering preliminary data concluding silver performance in 2023 and our own observations, it seems that recent Diwali was the best thing that happened to global silver market in months.

It was rather expected that overall global demand for silver is likely to drop y/y. By the end of December 2023 loose expectation materialised onto figures indicating less 10%. In terms of volume that would indicate global demand at approx. 1.14 bln oz overall for tech, investment, jewellery, silverware etc. Let us not forget however, that recent years consisted post-Covid demand rebound and war on Ukraine, which increased demand for safe haven assets. Hence it seems, we’re simply back to more standard levels now.

Silver also seemed to underperform in terms of price. In comparison, gold had finally breached 2000 USD resistance, turned it onto support and even temporarily reached much higher prices on intraday basis. Silver however had been repelled in 2023 at 26 USD levels several times. In slightly wider time perspective, this marks consolidation on silver price at 23 USD, with recent tops marked at 26-27 USD. For most of the past year, gold to silver ratio was over 1:80, with lows at 76 and heights at nearly 92. This ratio usually indicates silver underperforming or being undervalued to gold..

XAU/XAG 2023. Source: Tradingview

How above translates from USD related values to rupees? Indian market experienced 165k-167k range resistance being breached on gold, while 2050-2100 range on silver withstood attacks. For vast part of 2023 INR remained nearly strictly glued to USD at 1:83 while dollar clearly fluctuated and eventually lost some steam. Considering past INR depreciation trend towards USD, if below chart doesn’t indicate fx interventions made by Central Bank of India, we don’t know what else could. Fact is, that such artificially established temporarily peg between INR and USD is a part of wider policies relating to China and USA. But in the interesting us context it had certain effect on white metal. Despite of recent attempts to internationalize rupee, India’s trade balance remains very much dependant on USD, with 86% of transactions being invoiced in dollar. It seems that by fx interventionism New Delhi indirectly subsidized prices of imported goods invoiced in USD. Including silver.

Longterm USD/INR exchange rate. 2023, especially on H2, seems to indicate interventionism. Source: Tradingiew

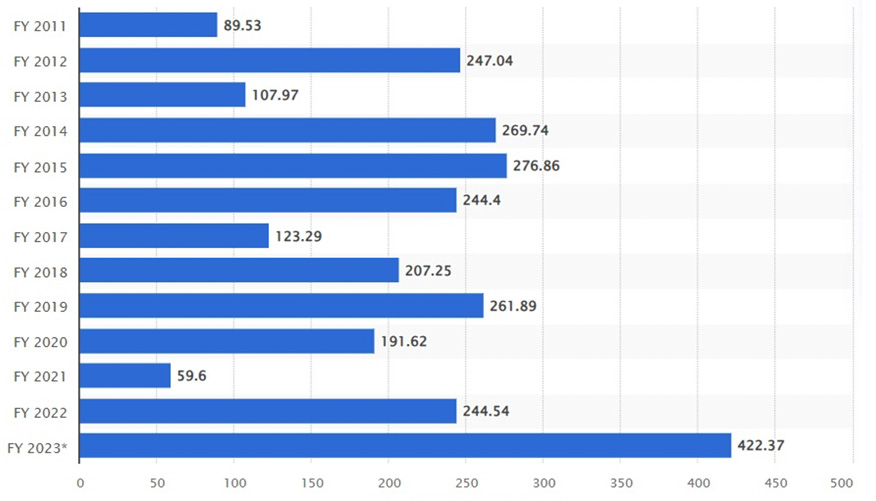

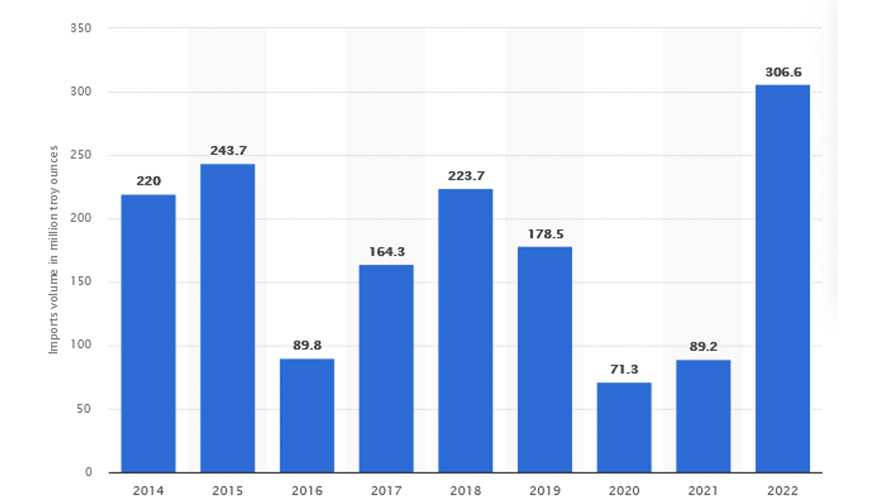

For the last 10 years (2012-2022) average yearly silver imports stood at 203 bln rupees. However, this cannot be fully indicative without some explanations. Value of purchases made in 2020 and 2021 was historically low, as supply chains and demand were hit by Covid-19 outbreak and variety of administrative restrictions. When they finally eased, this pushed sales to all-time high levels, with silver demand up by approx. 25%. However, since mid-2020, we also must consider higher silver prices, on 20+ USD per oz. Before pandemic, India experienced year 2017, with strong silver demand in H1 and poor H2. Such unusual shift was a result of introduction of the goods and service tax, which pushed importers to restock ahead of usual time and just before new tax introduction. This drop had also been projected towards part of 2018. And yet another demand gap, more in the past - lower demand in 2013 was caused by prolonged financial crisis and significant drop on silver prices.

Indyjski import srebra w mld INR. Źródło: https://www.statista.com/statistics/625825/import-value-of-silver-india/

Ale wartość to jedno - jak wszyscy wiemy, siła nabywcza naszych pieniędzy może łatwo ulec niekorzystnym zmianom, przy czym w niektórych okresach może to nastąpić szybciej. Sprawdźmy więc również, jak wartość importu srebra wyrażona w rupiach może być porównywalna z faktyczną ilością importowanego srebra?

India’s silver imports in bln INR. Source: https://www.statista.com/statistics/625825/import-value-of-silver-india/

And speaking on purchasing power – it should be no surprise to our kind readers that in recent years, precious metal prices reached all-time highs in many currencies – including INR. And it is not only applicable to emerging markets, but also to developed nations. Silver in rupees consolidates since year 2020 on support at 1600’s and resistance at 2100’s range, near nominal records set in 2020 on 2222 INR. However, in 2023, with exception of March, when prices dropped to approx. 1650 levels, silver averaged at approx. 1950 per ounce through the year, making it most expensive since 2nd half of 2020.

XAG/INR for 2023. Source: Tradingview

But this is just spot price, to which we must add import tariffs, logistics, fabrication costs, premiums added to price – basically everything to make purchase or sale of ready product on local market. According to Hindu business portals this should bring us to 66-78k rupees for 1 kg of silver (bear in mind that for kilobars, 65k INR is important psychologically barrier), which turned onto ounces will set us at 2050-2450 rupees price range. That is 24.6-29.5 USD range at INR pegged to USD at 1:83. Higher figure of that range was attributable through majority of 2023. But during Diwali shopping spree, Indians could enjoy prices below 70k for majority of October

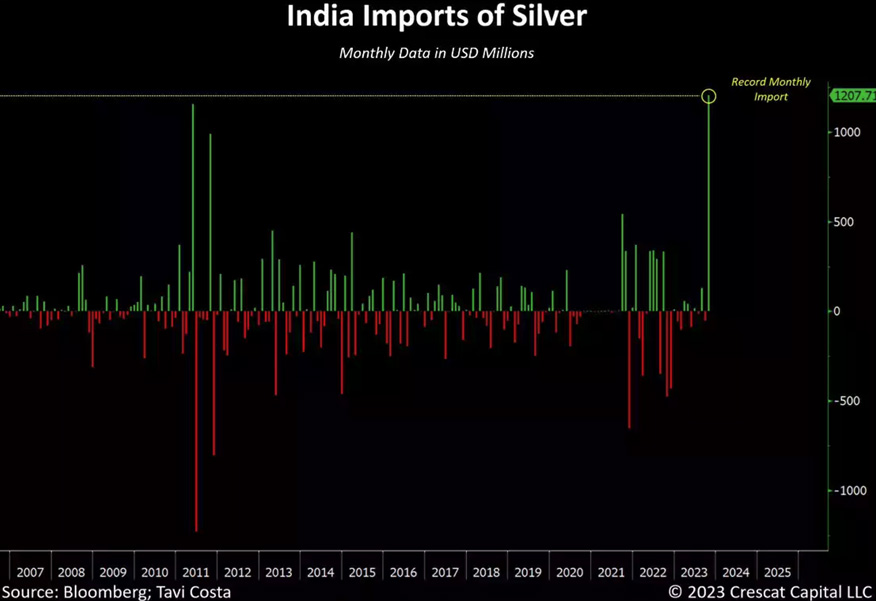

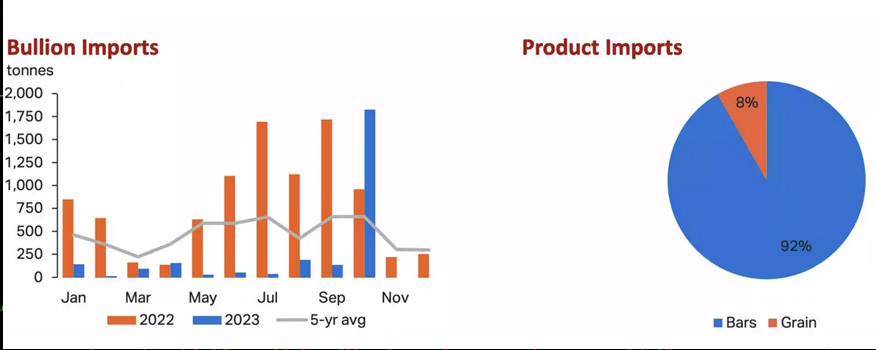

It is well known fact, that India is one of the biggest consumers of silver in the world. Just alone accounting for around 1/8 of all global demand. Data for October 2023 shows an all-time high volume of imported silver at over 1.8k t. in just one month! In terms of value, monthly imports surpassed record so far levels achieved in 2011. However, with exception of late Q4, 2023 figures were rather disappointing. While 2022 figures still included post-pandemic-restrictions re-bound on demand but also need for safe haven and inflation hedge, we experienced 9k – 9.5k t. of silver imports over calendar year. Estimations for 2023 expected imports to remain at around 6.5k t. so as an effect of ‘normalisation’ we are prone to experience 15-20% fall due to raising prices and lesser demand onto ‘safe haven’ and inflation hedge assets.

Detailed look on India silver imports. Source: Bloomberg

Let’s compare that to domestic mining production, which remained between 600-700 t. during last few years. Above volume is mostly obtained as a by-product of industrial metals mining. Figures consist of course official volumes only, as volumes of illegally mined silver remain simply unknown. In addition, we may add volumes of recycled silver. As recycling is responsive to price, its volume fluctuate along with silver market price. Due to that, realistically we have to consider volumes recycled since 2020, which come as average approx. 480 t. yearly. Both volumes are being absorbed by domestic market but are unable to fill demand, hence may only be considered as supportive. Hence India needs to rely on international markets and foreign volumes to purchase.

Change in imported silver type. Left graph shows silver imports comparison 2022 vs 2023. Right graph presents form of silver imported in 2023. Silver grain, has been surpassed by bars in October 2023. Source: https://ainsliebullion.com.au/News-Resources/Article/Record-Indian-Silver-Import-Support-Silver-Squeeze-Breakout/ID/4159

In October 2023 – aka Diwali related - silver imports had been now absolutely dominated by silver bars (92%), in comparison to of silver grain (8%), usually dominating in imports as preferred by many manufactures. This may indicate that industrial silver demand was lowered, and jewellery / investment demand surpassed it highly. Officials confirm that big jump silver imports were likely due to a surge in domestic demand. Could speculate if grow in demand had been later turned onto re-exports after converting silver into jewellery or ornaments. However, such similar increase in the exports of gems and jewellery didn’t occur. Just the opposite - gems and jewellery exports were in fact down 9.8% on year to 2.9 billion USD in said month.

Excuse me, I’d like to purchase 1.8k t. of silver at once, please?

In attempt to obtain bigger picture, let’s discuss New Delhi’s imports / exports and trading imbalance with regards to precious metals. Overall, year 2023 wasn’t best for India’s export and import figures, which remained rather flat through most of the year. October 2023 indicated change, as export had grown 6.21% y/y and imports by 12.3% y/y. In terms of USD, October 2022 imports stood at 57.9 bln USD vs 65 bln USD in October 2023.

W październiku 2023 r. silny popyt na metale szlachetne oraz niższy niż oczekiwano eksport spowodowały przekroczenie oczekiwań dotyczących deficytu handlowego, który początkowo miał wynieść 22,8 mld USD. Całkowity eksport wyniósł 33,5 mld USD, a import 65 mld USD. Z tego import złota wzrósł o 95%, osiągając 7,2 mld USD w październiku 2023 roku. Import srebra w tym samym miesiącu osiągnął 1,3 mld USD i oznaczał skok o 125%.

In October 2023 strong demand on precious metals, plus lower than expected exports exceeded trade deficit expectations, initially expected to be at 22.8 bln USD. Overall exports were at 33.5 bln USD while imports at 65 bln USD. Of them, gold imports were up 95% reaching 7.2 bln in October 2023. Silver imports in the same month reached 1.3 bln USD and marked a leap of 125%.

India’s yearly silver imports averaged at around 6k t. annually in the five years preceding pandemic. Let’s skip 2020 and 2021 data, as it was unusual period of dump and pump. In 2022 India imported 9.5k t. of silver, establishing highest imported volumes in at least decade. And as mentioned already –expectations for 2023 figures are at 6.5k t. In normal circumstances, silver import is being conducted among others from UK (50%), Hong Kong & China (34% in 2022), Singapore and UAE. And it is UAE which should be considered as a rising star, or at least prospectively important silver provider. However, it didn’t happen this season yet, for reasons we describe below.

Indian import duty on silver imported from UAE under recently signed CEPA, will gradually decline and eventually reach zero at the end of 2032. As for 2023, rates stand at 9% and are to be lowered to 8% in 2024. That is significantly lower than 15% applicable when importing silver from other countries (i.e. UK). As a result, for majority of the year we have seen increased share of silver imports from UAE. However, upon Divali, India had to reach to markets able to provide much larger volumes at once - like LBMA. Hence UAE responsible in months preceding October for 50%+ of silver deliveries, provided in 7% of said 1.8k t. of overall imported volume, which is be approx. 128 t.

Such duty incentives should in theory improve levels of silver imports from UAE. But they remain applicable only to silver grain, as import of bars is excluded from preferential tariff. This may be an obstacle to use UAE as a main direction for silver straight away. This is because Dubai (yes, we know that capital of UAE is Abu Dhabi, however Dubai remains main precious metal centre) is mainly focused on its gold refining capacities and only develops those related to silver. Hence, limited capacity along with import quota made Indian importers once again to turn towards traditionally known suppliers, like UK. London’s LBMA silver vault holdings data for end of September were at 27.5k t. and concluding October at 25.9k t. Vast majority of 1.6k t. silver withdrawals (purchases) is to be attributable to India. And discussing LBMA means, we discuss its standard good delivery 1000 oz bars. Which would of course explain why October imports saw silver bars regaining its position.

There was one more issue reported on UAE direction, which were discrepancies on applying normal or concessional duties and also unclear procedures on claiming back duty differential. This has to be sorted in between counterparts if they want to maintain smooth import/export operations.

And to summarise…

Time to conclude:

India remains important market for silver flows and Indians still value and cherish silver – nothing has changed in the matter.

As an effect of massive drops in demand, India’s yearly imports simply returned to standard levels.

Pegging INR to USD after recent years of depreciation helped in subsidising import prices (not discussing here costs of such solution). However, they remain elevated on local market, although not as much as they could if not such mechanism. However high prices could become higher as silver remains undervalued towards gold. Especially since, yellow metal had grown in price.

Upon lower import volumes it is incentivising for Indian companies to do so from UAE. However, upon cyclical need for large volumes, it is traditionally UK that plays main part. Which causes drawdown on LBMA’s stocks, visible on basis of cyclicality.

Good to know that despite all the ups and down and changes, some things remain unchanged.