Everything you'd like to know about gold in Poland, but are afraid to ask p. 3

In our new series, we aim to focus on the subject of gold in Poland. We hope to cover all gold related aspects and try to answer important questions of who, where, when, why and how much. We aim to do that deeply, so our esteemed readers could use it as a compendium of facts for years to come. In first two parts, we have extensively covered subject of official polish gold reserves. Now it’s time to finally search for some yellow metal. Ladies and gentleman – to your pans and excavators!

On gold deposits in Poland

G old bearing ores were always present on the territory of Poland, and were subject of mining activities since 10th and 11th century. And even earlier, before Poland drawn its borders on a maps, as there are geological proves of Celtic originating ore extraction performed BC, and of 6th century gold panning been performed on Lower Silesian rivers.

When reading about history of gold mining in Poland we could find a lot of related geographical names like Złotoryja, Legnickie Pole, Lwówek Śląski, Kotlina Jeleniogórska, Kaczawa Mountains, Głuchołazy, Opawa Mountins, Gold Mountains with famous Złoty Stok, Pogórze Izerskie, and many more. Some of these names clearly indicate existence of yellow metal. Each of the above has its own fantastic history, which regretfully we can’t describe here, as it would extensively enlarge this analysis. However all of them together wrote history of gold mining in Poland through ages - just to mention some examples:

- At Złoty Stok, which effectively were active from 12th century until mid- 20th century, still providing in between 30-50 kg of gold yearly at that time. It had been closed in 1960. Documented in 1954 resources were estimated at 2-3 t, with average content of 2.8 g./t. (2.8 ppm, part per million). Of the above, approx. 25% has been mined between 1954-1960.

- It is estimated that in 1922-1933 in Kaczawskie and Jizera Mountains (at that time within German borders) 116k t. of ore containing average of 30 g./t. has been excavated.

Considering that couple years ago, average ppm (g./t.) for Barrick Gold (mostly open mine pits) was at 1.5 ppm from all its operations, and that mining sector considers these days i.e. grade 8-10 ppm from underground mines as high quality, should give us some interesting comparison.

Of the main geographical regions in Poland, gold was present in Sudety Mountains, Lower Silesia, in Carpathian Mountains with Podhale and Świętokrzyskie Mountains. Some findings were also made in Malopolska, but also central and northern Poland in river bed sands. Richness of local gold deposits at old times could be demonstrated by the fact, that in 16th century, Poland was responsible for supplying 8% of European gold. And that is, with gold abundant Silesia region being at a time outside of polish borders. This 8% bears additional strong meaning as it was happening exactly when Spanish Silver Fleet kept transporting vast riches from across Atlantic Ocean. Even now, some estimations regards to gold deposits in Poland would place them as 4th in size in Europe, after these located in France, Finland and Sweden.

Of course, with regards to that we have to mention about some historical trend. Gold has been excessively mined in Europe since ancient times. It was happening in ancient Roman Empire with remnants of centuries long mining activities are to be found i.e. in Las Medulas in Spain. Byzantium mined gold in Armenia and Balkan Peninsula, gradually loosing these to Arab Sultanates and Ottoman Empire who continued these activities. Carolingian Empire mined gold of its territories forming today France, Germany and most of Italy. Each of these three eventually formed independent political entities, developed and continued to expand mining operations, as precious metals were creating monetary system at a time. And it was based on weight, not on face value. However, as historical Poland has been established in 10th century on lands that none of the above claimed, it had possibility to explore nearly pristine and intact deposits, when most of continent had to search deeper or elsewhere.

"Gold is wherever, you look for it”

Even now – in 21st century - there is strong community of hobbyist gold seekers in Poland, who search for gold crumbs and nuggets in sand beds of streams and brooks. Polskie Bractwo Kopaczy Złota (Polish Brotherhood of Gold Diggers) follow tradition of gold panning and even organise international events, with latest edition being held on 17-18th June 2023 at stream Skora. According to this source, they are able to pan approx. 0.5 kg of gold per year. Panning enthusiast (as described on https://polskiezloto.pl/), confirm after many years of active research and activities, that Lower Silesian streams still bear gold crumbs or even occasional nuggets. Additionally southern-east Poland up to river Bug may also have a lot of potential. With regards to central Poland some founding were also made, but these regions remain poorly studied for gold occurrence.

Of course, some geological works had been conducted with regards to searching for gold deposits in Poland in 60’s and 80’s of 20th century, especially with regards to Lower Silesia and Sudety Mountains. Despite of conducting and continuing prospecting works since 1990 on several concessions, performed by both domestic and foreign entities (i.e. concession granted to Australian Silesia Gold Mine in 1996 or to US Amarante Investments in 2014), no new gold mining operations had been eventually established. In the mid 90’s we could even speak of local gold rush, as just in 1996 alone, 33 yellow metal bearing plots were marked in Lower Silesia. Most of the checked deposits were however either depleted or its extraction was below economic viability. On that occasion, Polish Geological Institute Chief at a time – Prof. Stanislaw Speczik (former KGHM, currently Miedzi Copper Corp) - confirmed differences in gold mining approach. According to his words, in 60’s and 70’s mines that failed to yield minimum 40 ppm (g./t.) were considered uneconomical. But in the 90’s and especially now, it is feasible to mine even at 1.5 g, especially if deposit is located in shallow depth. Of course in the meantime we have made enormous technological and chemical progress enabling above.

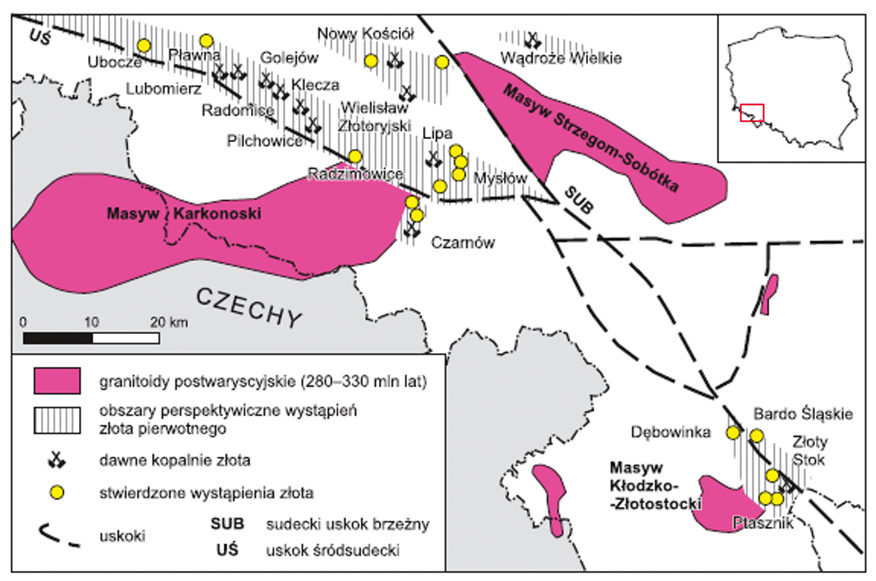

Prospective occurrences of gold in Sudety Mountains and Fore-Sudetic Monocline. Source: http://geoportal.pgi.gov.pl/css/surowce/images/2020/bilans_perspektywicznych_zasobow_kopalin_Polski_2020.pdf

Above gives some hopes that Poland still may be abundant in gold ore. In other words, as stated by PhD Edmund Rutkowski – legend of polish gold geology and lawyer:

"Gold is wherever, you look for it”

Although context matters, and it is very likely that PhD Edmund Rutkowski winked when expressing this thought, as we can’t lay our hence on it since decades, even if it remains around us on atomic or small occurrence level.

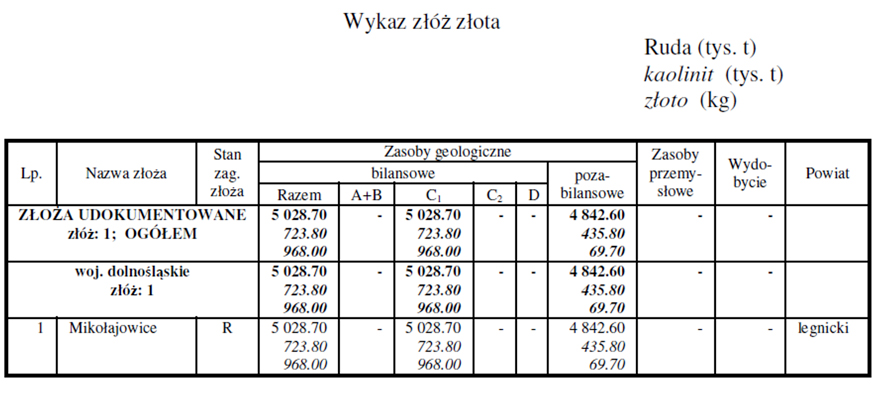

Occurrence of gold in Poland could be confirmed by KGHM, which managed to find deposit weighting 80 t. of gold in 2008 in one of its concessions. At a time it was announced to be richest deposit in whole Europe. However KGHM specialises mostly in copper and silver, and said deposit is located beneath said metals, so it has to wait. At that time, another issue was caused by low gold prices being at around 400 USD which made reaching this deposit financially non-viable. Then in 2020 another discovery of gold was being made at Mikołajowice, when price of yellow metal was at historical price heights. Estimated as un-balanced at 5 mln t. of ore bearing 968 kg of gold and out-of-balance at 4.8 mln t. of ore bearing 69,7 kg of gold. That means it would be respectively 0.17 g./t. and much less for out-of balance ore.

Poland still lacks great discoveries on gold, so unfortunately has to be assumed, that deposits remain either undiscovered, located too deep or simply remain highly dispersed. Considering that gold mining sector tend to search for more concentrated and therefore financially viable resources, it is possible to eventually find such in Poland, however there is a need to further study and seek for such.

That leads to another, unanswered and difficult question - should foreign miners and prospectors be allowed to obtain such licences in Poland? This issue is partially being addressed in mining legislation and its novelisation but also in Poland’s commodity policy of 2022. However spectrum of opinions is vast. Potentially that could effect in flow of foreign prospecting capital enable further discoveries and speeding pace. However that would mean giving extracting rights to potentially rich deposits to foreign entities. Poland is being considered as one of the European mining superpowers, being strongly present on i.e. on lead, copper and silver sectors. However on this occasion it is difficult to determine ‘friendliness’ or its lack towards international mining capital.

Long dispute over silver-copper concessions between Miedzi Copper Corp (belonging to Lumina Gold) and KGHM only proves, that in highly politicised and polarised country, there are no easy answers nor solutions. And the way above has been handled means, KGHM kept rights to strategically located concessions, but Poland still may have to pay penalties for mishandling, would international arbitrage judge that Lumina Gold rights had been affected.

Polish Geological Institute speaks on gold

There is possibility that there may be more deposits awaiting discovery. Persistently elevated price of gold would make extraction financially viable even on deeper depths. On this occasion we strongly recommend works of Phd Stanisław Zbigniew Mikulski, member of Polish Geological Institute who did some extensive assessments with regards to gold ores and its occurrences in southern Poland..

However, knowing a lot on occurrences past and present, it is finally time to focus on official data by Polish Geological Institute. Gold only occurs in Poland as metal associated to other metals prevailing in ores. Estimated prospective deposits in Poland are in between 419.2 – 431.8 t., and prognostic are only at 34.4 t. First category consists 366 potential tonnes located in Fore-Sudetic Monocline, 40 t. at North Sudetic Trough, and remaining volumes at Sudety Mountains, Lowers Silesia and pre-Sudetic bloc. Prognostic deposits fully fall under territory of Fore-Sudetic Monocline. Recognition between these types is based on depth and volume of g. on square meter and explained in ‘Regulation of the Minister of the Environment of 1 July 2015 on geological documentation of a mineral deposit, excluding hydrocarbon deposits’.

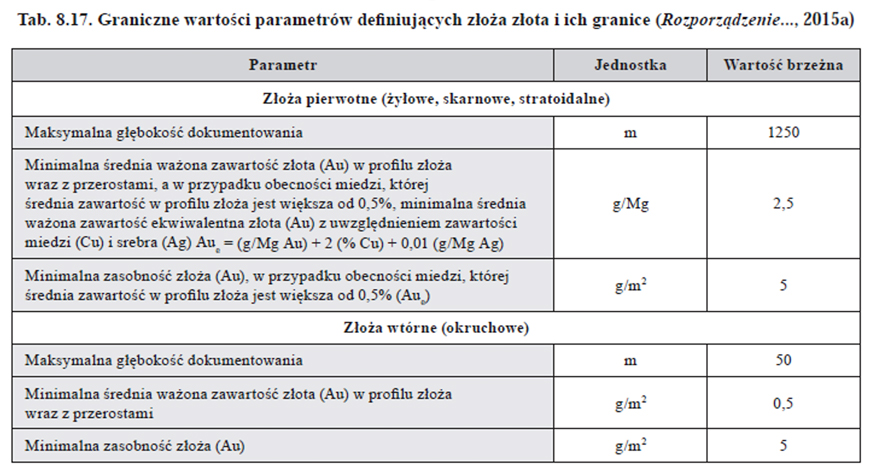

Parameters on gold resources defining categorisation. Source: Bilans perspektywiczny zasobów kopalin Polski wg. stanu na 31.12.2018.

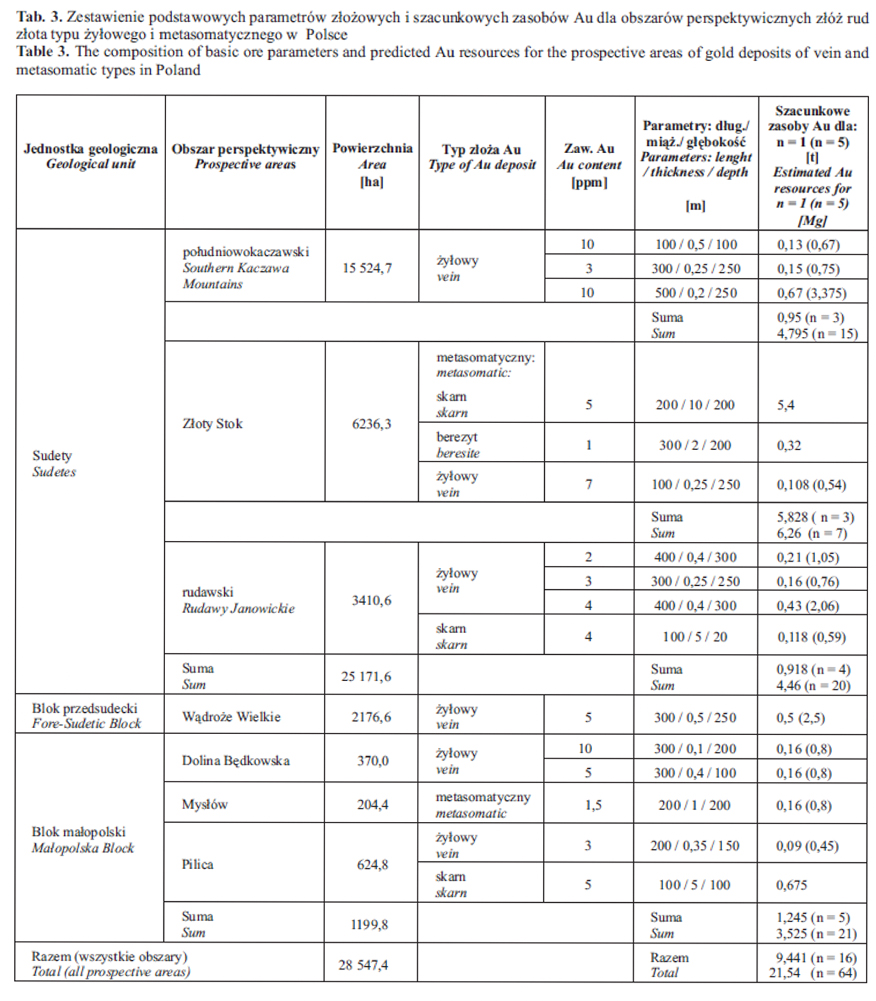

Following occurrences fall under prospective deposits as per table below. We could notice couple of locations with high ppm (g./t.) of gold, even reaching 5, 7 or even 10 ppm (gold occurrence in Będkowska Valley in Malopolska region even exceeds at some points 10 ppm), however size of estimated altogether deposits is small, between 9.4 – 21.5 t. depending on assumed density and other factors. Adding estimated resources from abandoned gold deposits and predicted resources in Kaczawa Mountains wouldn’t change these much.

Occurrences of gold in southern Poland. Source: S. Z. Mikulski, The prospective maps of metal ores in Poland at scale 1 : 200 000 – gold vein and metasomatic ores associated with sulphide mineralization in the Lower Silesia, Upper Silesia and Małopolska (Poland).

However with regards to recognised in details gold occurrences, we could only discuss below:

Gold resources in Poland. Source: Bilans zasobów złóż kopalin w Polsce wg stanu na 31 XII 2021 r.

Table presented above requires some explanations of how to read it. Categorisation of underground resources is subject of international standardisation. Of course, these will differ regionally based of the past approaches, as it is seen i.e. between former USSR countries and USA. Locally these are being regulated by appropriate mining laws.

In Poland, categories A B and C1 belong to the group of deposits recognised in detailed manner. According to the international nomenclature below would be ‘reasonably assured’ and in accordance to polish law have to be understood as follows:

- For A, it is estimated that error margin on deposit may be up to 10%, meaning that it up to 10% more or less. This is based on the results of the deposit exploitation.

- For B, same error margin is to be extended to 20% in both directions.

- C1 means that underestimation or overestimation may be up to 30%.

Deposits on C2 and D fall under ‘preliminary identified’ category:

- C2 are pre-identified deposits. International and US nomenclature calls them inferred. Possible size of error is at 40%.

- Deposits in category D, are known to exist as result of isolated workings, geological interpretation, and geophysical data using extrapolation. Hence, they had been preliminarily studied, and potentially its size is yet to be determined. Estimation error may exceed 40%.

All of the above (A+B+C1+C2+D) are to be treated as deposits in balance. According to Polish Geological Institute that is 968 kg, under or overestimated by 30%. Additionally with 69.7 kg not even being part of balance – both figures related to Mikołajowice.

Above figures may be considered as highly disappointing and confirming what we mention earlier - deposits are either yet undiscovered, located too deep underground or remain highly dispersed. However we shouldn’t lose hope, as PhD Stanisław Zbigniew Mikulski clearly indicated in 2015, there are seven prospective occurrences of gold in Poland, stating on this occasion that:

‘However, at the present very preliminary stage of identification, it is not possible to make more precise estimation on the gold resources (…)’

So it seems, Poland requires prospective capital and initiatives encouraging gold search. But for now, based on the available data, we can only have hopes.

KGHM as polish gold producer

KGHM Polska Miedź SA is polish based international miner, known for being one of the biggest copper producers and biggest silver producing entity in the world. Considering above, should come as no surprise that deposits they work on, also contain certain amounts of accompanying metals, including gold. Geological location discussed is known as Fore-Sudetic Monocline and it remains mostly within borders of Voivodeship Dolnośląskie and extends towards Zielona Góra in Voivodeship Lubuskie. These territories were subject of extensive studies conducted since 1957 when Lubin-Sieroszowice copper-silver ore deposit – largest in Europe - was discovered by team under Jan Wyżykowski. Currently, one of the current and most notable specialist on the subject is mentioned before prof. Stanisław Speczik.

On the very beginnings, it was copper and silver that were most interesting to KGHM. In the 70’s, company started to recover some small gold volumes from its production as well. However until end of 80’s, official doctrine was that gold in KGHM’s ores are just remnants in volumes not to be worried about. This has been opposed by chemist, Roman Farański, who was attempted to proof that gold concentration in KGHM’s ores exist and with appropriate approach could deliver tonnes of yellow metal.

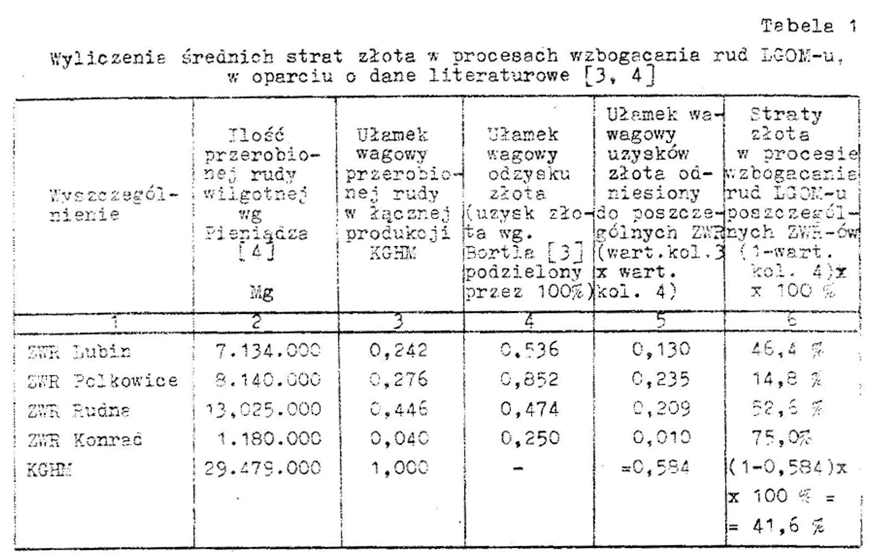

Roman Farański, The possibility of increasing of gold and platinium recovery from polish copper ores. Table presenting average losses of gold during KGHM’s process of ore enriching. Source: https://www.journalssystem.com/ppmp/The-possibility-of-increasing-of-gold-and-platinium-recovery-from-polish-copper-ores,80271,0,2.html

At the time, it became part of wider scientific-political-industrial conflict that has ended with Farański’s ideas to be eventually dismissed at a time. Discussions on potential of gold occurrences at KGHM’s concessions is nothing new and were subject of publications past and present. Among many who addressed this matter were Prof. Adam Piestrzyński, PhD Antoni Wodzicki and Andrzej Banaszak determined occurrence in KGHM’s ores. On this occasion, they also pointed, that some quoted occasionally in publications high values are based either on results of sampling made on very small and unique deposits or simply result of reader’s misinterpretation.

In 90’s, additional works have been conducted under prof. Adam Piestrzyński of Akademia Górniczo-Hutnicza (AGH University of Science and Technology) in Krakow. It has been proved, that under extracted copper of Polkowice concession, there is gold deposit in between 30-100 t. in size. However KGHM’s Polkowice mine was not suitable for mining such and size of investments required would put gold extraction close to a border of economic viability. At that time would be needed to create new mining shaft dedicated for gold. Additional investments in technological process had to be made, not even to mention, that KGHM’s financial position was much worse these days due to fall on prices on commodities it kept extracting. At the time, strategic decision has been made to prioritise copper mining, as it was and is main source of KGHM’s income until now.

But what of today? Poland via KGHM’s activities continues to extract gold, although in small volumes, delivering no more than 4 t. yearly. That makes it far behind golden superpowers like Canada, USA, China or Russia. KGHM obtains domestically gold from its mining operations at Polkowice-Sieroszowice, Rudna and Lubin. Apart of that, certain amounts of gold are being also produced from some of its foreign operations – Sierra Gorda, Robinson, Sudbury, and Franke. Need to be noted however, that Franke has been sold in 2022 and Sudbury is being prepared to be disposed of in same manner. As we report production data below based on integrated report for 2021 (2022 is not available when writing these words), we still have to report these production volumes.

KGHM’s gold production is entirely a result of copper ore processing (electrolysis process from gold bearing anode sludge) performed by Department of Precious Metals at Głogów II refinery. Apart of domestic, Głogów II also process its own imported copper concentrates. So what volumes of gold are to be discussed? According to KGHM’s own reports:

- • In 2021 KGHM Polska Miedz produced 81,3k ounces of gold from all of its domestic operations which is equivalent of 2.5 t. However this is being marked as TPM – total platinum minerals - hence platinum and other platinoids may be counted towards this volume, with prevailing share of gold.

- • Additionally, KGHM International (nearly all foreign based mines in portfolio) provided additional 51,3k ounces, which would be nearly 1.6 t. Need to be said, that Robinson in Nevada provided around 75% of said volume.

- • On similar basis gold is being reported for Sierra Gorda SCM which is treated as separate entity in KGHM’s portfolio. It brought additional 56.1k ounces (1.75 t.) of TPM in 2021.

Gold produced is responsible for generating 3% of sales value for the whole group. It is being refined to bars ranging in weight from 0.5 kg to LBMA compliant 12.44 kg (400 ounces). Type of buyer determines size of products, hence we could easily confirm that above volumes are being delivered to business and corporate entities.

However in January 2023, Tomasz Zdzikot – KGHM’s CEO informed that company made capital expenditures to enable production of smaller bars (and possibly bullion coins), more adequate for the needs of individual investors. That however would require establishing distribution channels. Considering that long-term industrial issues affect demand on copper, this business approach would allow KGHM to secure some small additional profits, as obviously premiums on retail products would be higher than i.e. in case of LBMA bar – after all 1 ounce is much more difficult and costly to manufacture.

On numismatic note – that wouldn’t be first release of retail gold made by KGHM, as in 1996 in cooperation with Mint of Poland it released limited series of 10 and 20 g. bars. They were 999.9 grade, had KGHM’s logo on reverse, Mint of Poland logo on front, and were released in certipacks, each bearing individual serial number.

1996 release of gold by KGHM and Mint of Poland for retail customers. Above is 10 g. Source: https://en.mennica.com.pl/investment-products/on-special-occasions/gold-bars-for-kghm

Summary on deposits

Some of our presented above considerations regards to polish gold deposits stand somehow in opposition to overall optimism presented by commentators. We do not deny possibility of major discoveries of Gold in Poland. However based on data available at half of 2023, we could determine following conclusions:

- At this moment we can only discuss approx. 34 t. of prognostic resources, dispersed around different locations and mining sites abandoned in past.

- There is potential for existence of financially viable gold deposits in Poland, however it requires further geological works and prospective activities, hence there is need for funding such works. Without that, we can only carry on assuming.

- Region of Lower Silesia is abundant in dispersed gold and was subject of mining in the past. Potential to mine on these occurrences has been checked in 90’s and was ditched in majority. Currently, with price of gold 4x – 5x times higher financial viability remains unknown.

- There are many occurrences of gold as an accompanying metal to much richer industrial metal deposits, so it is being or will be possessed during activities focused on other minerals, like copper (KGHM) or kaolinite (Sudeckie Kopalnie Surowców Mineralnych in Mikołajowice). But again, we have to face brick wall on lack of financing.

- There are some perspectives regards to different regions in Poland. At the moment bulk of polish mining is being conducted in Silesia, Lower Silesia, and then in Lubelskie Voivodeship and Łódzkie Voivodeship. Małopolska region seems to be interesting in this context.