Consolidations among gold miners p. 2

I n the past we didn’t have many opportunities to discuss subject of gold miners on Metal Market Europe blog. We’d like to address this matter, as since couple years we witness strong trend on great sectoral mergers and acquisitions. Some could be even considered as tectonic in size, as relating to biggest names in industry.

To own copper or not to own copper – on gold mergers and acquisitions of 2022

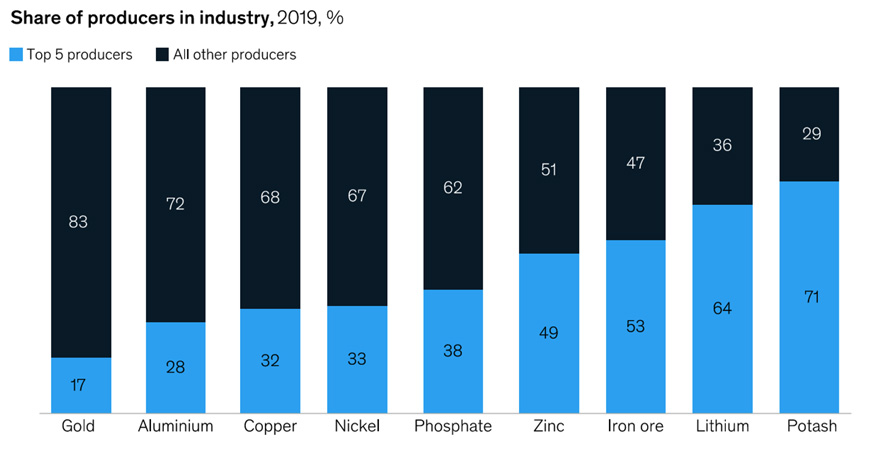

Gold industry remains one of the most fragmented industries in the mining sector. Top five gold producers contributed in 2019 to less than 20% of the world’s total gold production from primary sources. In contrast top five producers in other metal sectors make up between one-third and two-thirds of global production, making these markets significantly consolidated. Gold mining sector has remained heavily fragmented due to lower barriers of entry for the industry. Even at a small scale, companies have been able to sustain themselves given the underlying economics. Also, processing techniques in the gold industry are less complicated in comparison to other metal sectors, which helps companies sustain themselves at a small scale.

Gold sector remained in 2019 one of the least consolidated globally metal markets, which bears great potential possibilities for mergers and acquisitions. Source: Mckinsey

One of the most interesting developed trends in gold and not only mining sector is chasing copper. Some of the market participants experienced with past sour events of 2013-2016, this time made decision on diversifying towards base metal necessary for technological progress of civilisation. It has additional meaning especially when would realise, that copper is to be commonly found in gold-bearing ores. Main reason is however in a fact that it is essential metal required for technological development, as will be mentioned further in the text of the We underline that now, as later in analysis we’ll present some of the great acquisitions of 2023 that gold sector experienced.

Year 2022 passed under the shadow of war and growing inflation as two main shaping aspects. It was influential to sector and flows of metals. High profile acquisitions were at 24.5 bln USD, which was 12% less y/y. Three out of four major deals were focused on copper, with one on gold. Overall, it was first year since gold price breakout in 2019, when base metals deal value outperformed gold deal value. In terms of value, gold focused mergers and acquisitions of 2022 were worthy 9.8 bln USD which was a drop by nearly 50% if compared to 2021. Copper related takeovers were responsible for over 14 bln in worth transactions. It was a 100% growth from 7 bln in 2021. So it seems, that copper was responsible for half the 2022’s value.

Total mergers and acquisitions value in mining sector 2013-2022 with division between base metals and gold. Seems that gold rush need to catch a breath. Source: S&P Global

On the geographical note, majority of deals were related to Canada and Australia – well developed, mining friendly, predominantly Anglo-Saxon in language and in law jurisdictions. Next in podium was China, which remained far distant from top two. But how the 2022’s deals look like?

- In the largest deal of 2022, Australian BHP Group acquired copper-focused OZ Minerals for 5.94 bln USD. First bid was rejected as too low, second has been accepted as appropriate to company’s value. Deal related to over 11 mln t. of copper reserves.

- Second biggest mining deal was gold-oriented. Canadian gold miner Yamana Gold was subject of two different offers. First was made by Gold Fields and eventually rejected. Second bid was joint proposition laid by Agnico Eagle Mines and famous Pan American Silver and worthy 4.8 bln USD. By accepting this offer, Canadians agreed to dispose projects containing 49.3 mln ounces of gold and 4.7 million t. of copper. On this occasion, buyers made a division of assets, with Pan American Silver taking South America and Agnico Eagle Mines being focused on acquired Canadian based assets.

- In the third-largest deal, Rio Tinto completed acquisition of the remaining 49.2% share in Turquoise Hill Resources, previously purchased for 3,25 bln USD. 2022 made tranche brought to international giant’s portfolio 15.7 mln t. of copper. Among assets purchased, is very perspective open pit operation Oyu Tolgoi located in Mongolia.

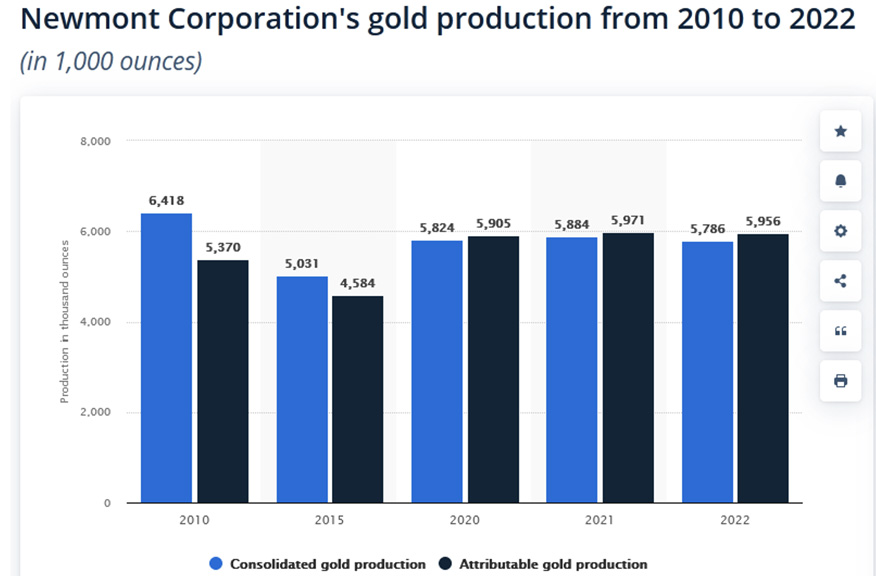

Newmont’s acquisition of Newcrest

Above bleak however in comparison to largest acquisition of 2023. Currently it seems it is Denver based Newmont Mining that is ahead of heard. Newmont is the largest by market cap (33 bln USD) gold miner in the world with its operations located worldwide. It is diversified giant, capable to deliver before Australia’s Newcrest’s acquiriing nearly 6 mln ounces of gold yearly. It should therefore come as no surprise that Newmont is an obligatory component of any major ETF giving exposure to large gold miners. Just in Q1 2023 it produced 1.27 mln ounces of gold and 288k gold equivalent ounces, combining copper, lead, silver and zinc – metals commonly associated with gold in ores. Must bear in mind however, that market sentiment around giant has been negative since some time, due to slip to a losing quarter and lower production rates.

On the other hand, there is Newcrest Mining – Australian based miner, with operations in Australia and Papua New Guinea, and just recently expanding towards Canada in form of joint ventures made with other entities. What is interesting, Newcrest was originally stablished in 1966 as a subsidiary to Newmont. It has been separated only in 1990, as a result of series of local mergers and acquisitions.

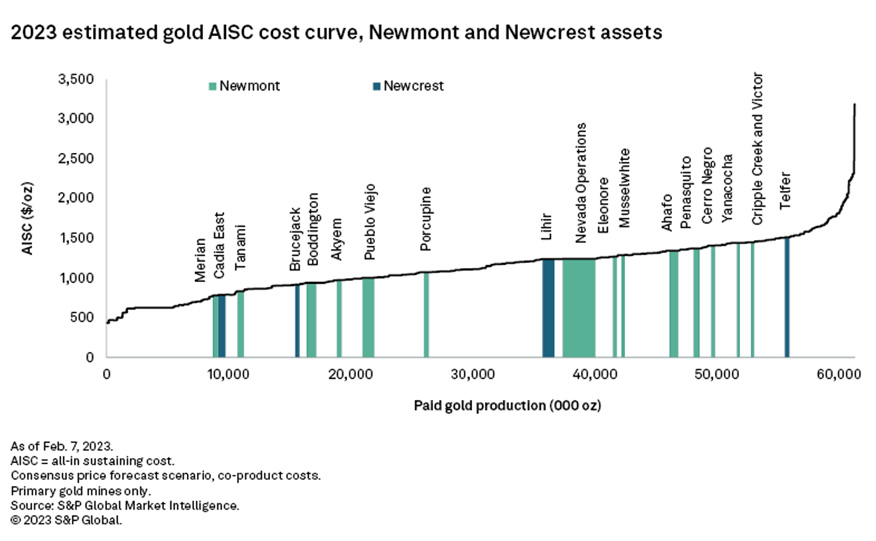

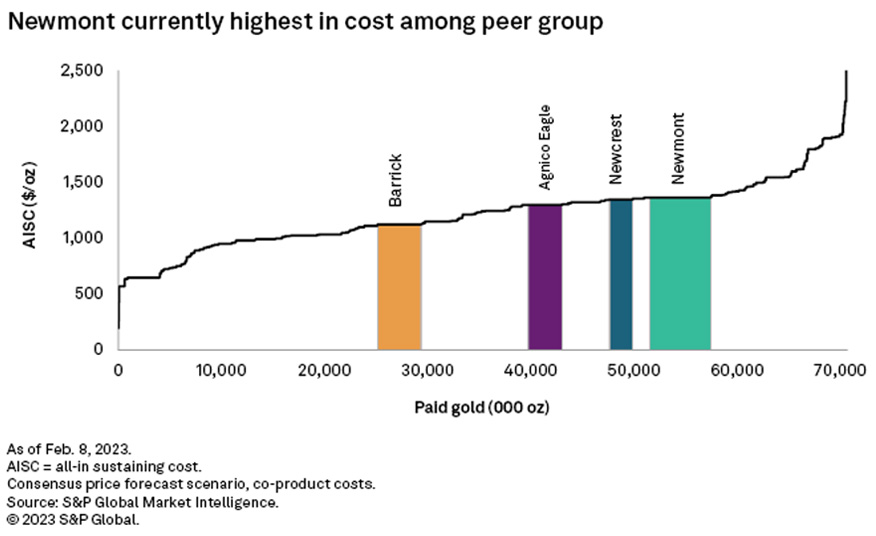

Newcrest had market cap at 15.8 bln USD, but it’s not only size that matters. It’s also AISC. AISC is short for all in sustaining cost. That is basically cost to deliver ounce of pure gold, that miner has to occur. Gold mining sector started reporting that relatively recently, as i.e. in 2010, that would be considered as data not to be public. With average spot price for gold ounce at 2000 USD during course of 2022, globally reported AISC for miners stood at a time at 1270 USD per ounce. Newmont Mining had it at 1211, which was sharp growth compared to previous years. However, Newcrest was different - its AISC was 1012 USD. Smaller in market cap, with good looking books, better AISC, and few mines being in considered as worldwide top or at least local Australian top, it had to be considered as interesting.

AISC for gold mining projects under Newmont and Newcrest banners. Source: S&P Global

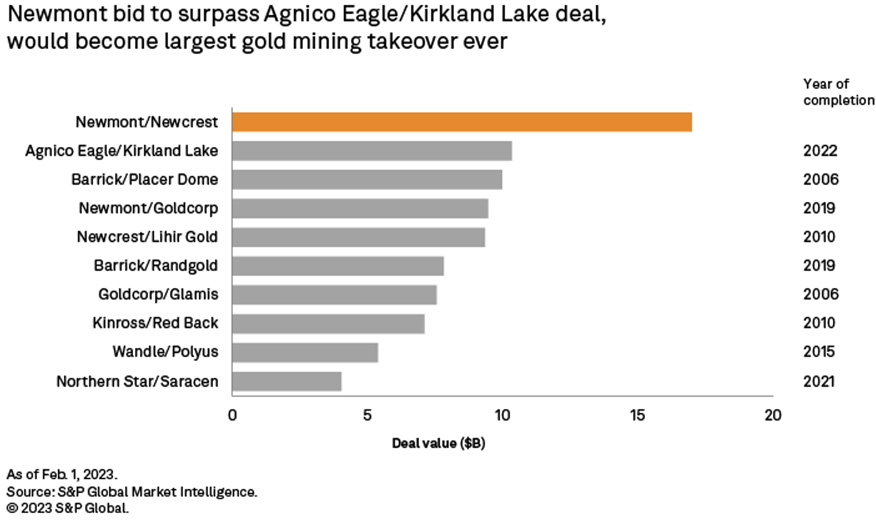

Newcrest initially rejected acquisition offer made by Newmont in February 2023. However, Newmont made higher bid in May, which resulted in Newcrest’s board to re-consider and eventually approve proposition. Worthy 19.2 bln USD deal awaits regulatory approval and is considered largest deal in the history of gold mining. It even surpassed announced in January 2019 acquisition of Goldcorp which cost Newmont 5.4 bln USD at a time.

Most expensive acquisitions in gold mining sector. Newmont definitely leads. Source: S&P Global

As a result Newmont will add to its portfolio additional operations – 17 altogether including their original. Among them are belonging to Newcrest Cadia and Lihir mines considered as ‘tier one’. As already mentioned, Newmont produced closer to 5.8 mln ounces of gold in 2022. Deal ads to their portfolio nearly 2 mln additional ounces capacity per year. However, it is most likely giant will de-invest or simply put on sale some of newly acquired assets. And it most likely it will keep approx. 10 low cost and long-life operations. Newmont’s CEO – Tom Palmer admitted there are possible synergies allowing to save 0.5 bln USD within 2 years since completion, and opportunities to generate 2 bln USD trough portfolio optimisations.

But there is additional aspect in it as Newmont’s made shopping significantly increases its exposure to copper. Gold miners extract it from ore anyway, as a bi-product of gold extraction. It appears that all the assumptions regards to development of electronic vehicles, renewable energy sources or technological advances in general, incorporating all possible technological innovations (5G/6G + AR/VR + IT + Internet of things + Cloud + Crypto + DeFi + Big Data + Other) will be very metal-hungry. As a result, it is widely expected that a global imbalance of supply and demand in the copper sector could potentially emerge around 2026. Seems that experienced by previous decade gold miners, prepare themselves already for production diversification.

Newmont gold production 2010-2022. Source: Statista

With regards to Newcrest’s shareholders, Newmont publicly stated offer in which 0.4 Newmont’s share would equal 1 Newcrest’s share, along with dividend up to 1.10 USD per share. That means, offer does not increase Newmont’s debt, as it is all share deal. Also, based on the above, current Newcrest’s shareholders will own slightly over 30% of ownership of the newly formed larger Newmont Mining. Additionally, in terms of AISC, Newcrest is over 30% more efficient than Denver based giant, so it should bring good effect to Newmont’s balance sheet. On the other hand, deal has to be considered as expensive for Newmont shareholders from a pure production per enterprise value perspective.

Barrick’s gold-copper offer (for now) turned down

In mid-June 2023, First Quantum turned down Canadian-based international miner Barrick Gold's informal takeover offer. First Quantum is seventh in size globally copper miner that delivered 776k t. of this base metal. Gold, silver and other are in its case considered as by-product. Just last year, giant delivered in such way 283k of yellow metal. If this transaction was to occur, Barrick - world's second-largest gold miner - would be transformed into a significantly important player in gold and significant in copper production, strengthening its market position. Barrick Gold’s capitalisation is at the moment at near 29 bln USD. It has delivered 4.1 mln ounces of gold in 2022 and aims to boost this result to 4.8 mln ounces by the end of decade. However not only in gold it trusts, as copper was responsible for solid 8% of revenue generated at Barrick Gold in 2022.

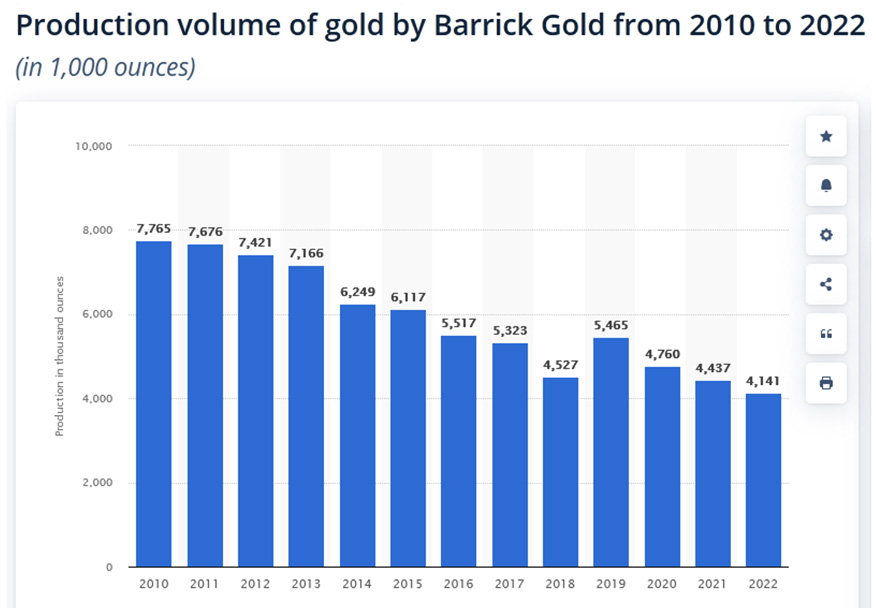

Gold mining volumes delivered by Barrick Gold 2010-2022. Source: Statista

Above merger attempt happened right after Newcrest eventually accepted Newmont’s offer. Considering that Newmont and Barrick are considered competitors, refusal probably wasn’t easily accepted by Canadians. However, offer was informal and seems denial won’t curb Barrick’s ambitions. Its CEO - Mark Bristow - is well known for bold moves. Like in 2019, when Barrick made declined bid valued 17.8 bln USD in attempt to acquire its largest competitor - Newmont Gold. There were even speculations that Barrick might merge with Freeport-McMoRan, one of the world’s largest copper producers and owner of famous Grasberg mine. However rise on price of copper occurred between 2021-2022 (despite of falls in H2 2022, price still remain high), helped to elevate Freeport’s market cap to nearly twice of Barrick’s.

It is uncertain when and if Barrick attempt to renew its offer, however what means a lot is fact that it finally actioned to expand its operation base. Just recently its CEO - Mark Bristow - confirmed hunt for new mines is about to commence, admitting additionally that in recent past…

‘We talk a lot about M&A, but have done very little,

Barrick seems to apply slightly different approach then its competitor. Its gold output is lesser than Newmont’s, however in terms of AISC Barrick experience lesser costs then rest of its main competitors.

Barrick Gold experience smallest production cost per ounce of gold. Source: S&P Global

Barrick Gold strongly advocated in 2020 for consolidation within the gold industry. At the time they were even issuing warnings about an impending significant reserve crisis that sector will be facing. In addition, now and on different occasions, its CEO underlined need for diversification. Mr. Bristow referred copper as a "strategic" metal, highlighting its pivotal role in the future. According to his past and present words, current copper supply is insufficient to meet green-energy objectives. And it is hard not to agree to that.

‘Copper is the most strategic metal.(…) It is more strategic than cobalt, more strategic than lithium. You can't replace copper on conductivity. It is a modern metal.’

‘It's processing characteristics are identical to gold; you can leach it, you can concentrate it, you can smelt it. It is a very uncomplicated process. It's the same as gold, and it comes with gold.’

And of course - Barrick maintains a keen focus on copper assets with addition of precious metals – like in case of First Quantum and Freeport-McMoRan. In the meantime, Toronto based giant advances with its large investment - Reko Diq copper and gold operation in Pakistan. Project signifies one of the world's largest undeveloped copper-gold projects, with production expected to commence in 2028. Of course there are some doubts about as Pakistan faces energy blackouts, natural catastrophes and internal instability – all of that occured just in last two years. However, Barrick has just 50% stake in Reko Diq project, with other half being split between local government of Balochistan region and other Pakistani state-owned enterprises. Applying ‘sharing the cake’ approach seems should bring Barrick support whenever it will be necessary. Despite that, Barrick is expected to produce approx.. 200k t. of copper just in 2023. It will come both from its copper focused portfolio and in form of by-product from processing gold bearing ores. Just to have comparison in scale – KGHM in 2022 mined 442k t. of copper from its domestic, Polish operations and 145k t. from its foreign operations.

Need to curb the costs and improve profitability could make even hardened competitors to join their forces. Below is an example of largest joint-venture in gold mining sector, which exists until these days.

In 2019, Newmont Mining and Canadian Goldcorp announced merger. This was to take place under Newmont’s banners and cost Americans the 5.4 bln USD. Just month later, Newmont received a bid from its largest competitor - said Barrick Gold. Canadians offered to buy Newmont, but Newmont's shareholders rejected an offer. At the time, Barrick Gold was also just after great acquisition as it acquired Randgold Resources for 6.1 bln USD. After Newmont initially rejected the offer, Barrick played all in, proposing 17.8 bln USD all-stock bid against Newmont.

According to Mark Bristow possible acquisition of Newmont could generate synergies resulting savings at total of 7 bln USD. Of course new and bigger Barrick would also made disposal of less valuable assets. Apparently Barrick wanted to keep Newmont’s Nevada and African operation, selling Australian assets to Newcrest. Oh irony - same Newcrest that has been established in effect of division in 1990 and which Newmont acquired in July 2023.

Newmont’s board eventually declined offer stating that merger would cause drop on shares. In press statement it informed, that Barrick ignore risks and exaggerate potential benefits of such move. In addition Newmont negatively assessed Barrick’s risk and return and put its operational model in question. Saying that, Newmont continued on its previous course of action on acquiring Goldcorp. Decisive and rather unpleasant decline didn’t mean however that cooperation is impossible, as operational potential for a joint venture in Nevada was recognised. After all, both giants maintained gold focused operations in so called ‘Silver state’.

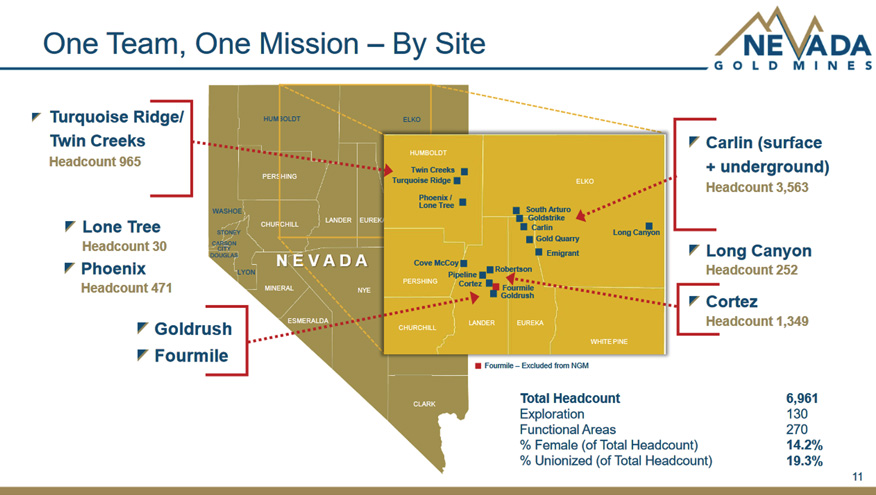

Established in 2019 Nevada Gold Mines, is a joint venture operation maintained by two rivals, and remains until these days. In many rankings it is being even considered largest mining operation in the world. It is a complex of several gold mines located in the state of Nevada. Combined operation comprised initially 10 underground and 12 open pit mines, as well as processing infrastructure and administration. In 2022 these mines were responsible for producing approx. 3.5 mln ounces yellow metal, however perspectivelly this volume will increase, as soon some investment works will be concluded. Nevada Gold Mines combines among many Long Canyon, Carlin, Goldstrike, Turquoise Ridge, Phoenix, Cortez and Goldrush gold mines. The share split is 38.5% for Newmont and 61.5% for Barrick who also remains operator.

Nevada Gold Mines is an example of possible synergies achievable between two competitors. Source: Nevada Gold Mines – Analyst Presentation, September 19, 2019

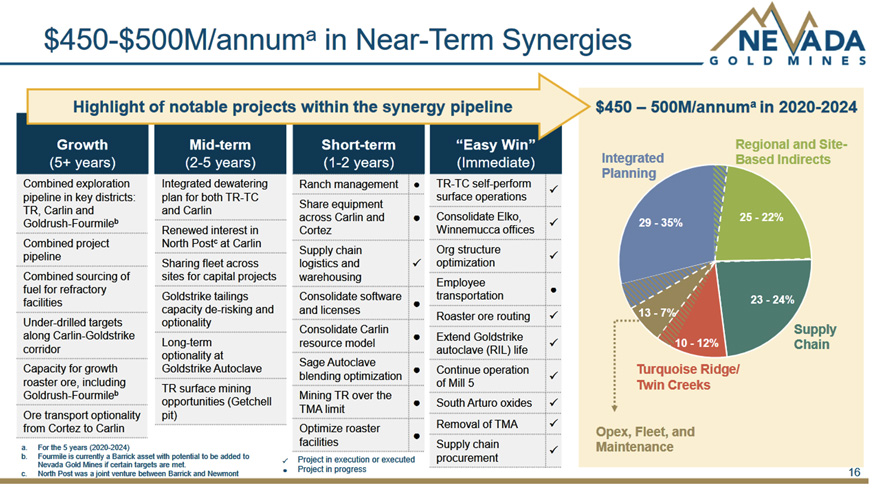

Apart of worldwide scale, it shouldn’t surprise that Nevada Gold Mines became number one position on the list of gold producers in the state of Nevada. Already, both Barrick and Newmont were among state's major mining employers. By forming a joint operation they became an unrivalled giant. Since then, Nevada Gold Mines delivers 3.5-4.1 mln ounces of yellow metal yearly. In addition there are large volumes of silver and copper mining m- that just has to be impressive. Especially upon realising, that second largest mining operation in the wold – Uzbekistan’s Muruntau – delivers 2-2.2 mln ounces per year. As a whole, Nevada Gold Mines now has advanced onto stage of structural work on its facilities individually, as well as creating synergies between them. Hence, gold production is lower than in the year of the investment's inception - in 2018 it was at 4.1 mln ounces, now closer to 3.5 mln ounces.

Planned integration on Nevada Gold Mines, presented in 2019. Hence, work in progress. Source: Nevada Gold Mines – Analyst Presentation, September 19, 2019

Final words on trends in mergers and acquisitions

Growing number and value on mergers and acquisitions seem to be logical approach, considering sad past experiences, growth in price of gold and risk aversion that some market participants might’ve developed. It is less risky to purchase developed and promising miner than to invest heavily in a new mine. Especially since its development may be affected by variety of factors being result of macro-economic and geopolitical troubles. Considering sectoral issues experienced for the years after 2012, mergers and acquisitions seem to be simply safer.

For entities with appropriate cashflow it provides opportunity to develop operationally, expand in size and develop higher, long-term volumes of mining output. If adding possible synergies and sales of less promising / more capital requiring / less developed assets, acquiring miners additionally send strong signal to market participants, that their financial position is stable.

The only problem is that in the global scale, such approach delivers savings, but does not deliver additional volumes. In effect it extends lifetime of mining entity, strengthen its position, recognisability, and financial position, but doesn’t provide additional ounces to the global supply equation. And these can be added by proprietary activities and old-fashioned mine building. Hence issue of looming depletion of reserves remain unsolved. And supply matters may be further affected, especially when taking under consideration changes in approach of until recently “mining friendly” jurisdictions, especially in Latin America, Africa, Asia or Oceania.