Boom and bust of BRICS’ gold currency

This August, in Johannesburg, South Africa, BRICS was supposed to present its gold backed currency/token to be used for trade purposes. Or at least some sketch. It showed nothing - to major disappointment of some commentators. So was it nativity to expect ‘grand premiere’, or did BRICS’s project just failed because it is impossible to have gold-backed currency in modern days. Or maybe it was victim of inner-BRICS policies? And could we now finally say now, it is entirely ditched?

On initial note

Couple months in the past we decided to discuss theoretical concept of BRICS currency. Not entirely denying it, but simply presenting theoretical assumptions behind, set within frameworks of modern monetary system. We attempted to make this cycle educational, as amount of stupidity, misinformation and misinterpretation surrounding us is immense and growths exponentially. De-dollarization? Exists, but USD holds well, won’t die, and remains extremely powerful currency both in trade and in reserves. Even in so called decline. Gold / commodity backed currency? How to sort out exchangeability? How to organise storage? Especially if some of said commodities are scarce and well-priced. Dollar-killer? Compare size and function of most popular reserve assets and you’ll have an answer on that.

And so, we created three entries about BRICS currency concept..

- In part one of ‘Gold in concept of common BRICS currency’, we presented modern functions of gold and USD in economy and monetary system. We have shown how gold backed currencies have been replaced by fiat currencies, and tried to show USD strength as being on the top of a food chain. With regards to gold, we also focused on certain

- In part two of our ‘Gold in concept of common BRICS currency’ we initially focused on Euro. We had shown it as example of unifying, international currency, serving purpose of common trade market and benefiting just some of its participants. At the same time designed the way to never become threat to USD. Then we had focused on evolution of official reserves in the last 15 years and role of USD, EUR and gold in them. We attempted to show that need for liquidity is a key and answer to all questions.

- Then in part three of ‘Gold in concept of common BRICS currency’ we finally presented BRICS. Not as monolith, but as a forum. Group of countries bounded by single idea of internationalising usage of their currencies, instead of being overly-dependent to dollar. Each member of BRICS presents different approach and speed. So we focused on their national currencies, especially emphasizing growth of China’s Yuan as most used and recognisable of BRICS’s currencies. Eventually, we speculated on how such trading token (BRICS currency) could possibly work - in closed loop to pay for equal in size balance for transactions, on backing its commodity basket, its composition and means to establish and strengthen local commodity benchmarks.

Of course, would’ve been much, much easier to straight away say that such currency being backed up by gold, would diminish uneven balances of gold reserves of BRICS members, as they had to be partially locked in the purpose of backing up. It would’ve been much easier to say, that having currency backed by commodity is meaningless if there is no real exchange on demand mechanism, unless such solution would be accepted by all interested counterparts. Then we could’ve continued about potential reliability of internal mechanisms – different for each member country – preventing outflow of gold from local markets. After all, history of gold-backed post war US dollar, clearly shown that such must’ve been in existence. Also, why to use gold-backed currency when you could simply create bookkeeping entries for volumes of gold times price as for equivalent of needed commodity. We could’ve also underline fact, that such magnificent weapon of de-dollarization has been announced, not by Beijing, not by all members altogether, but by portal Russia Today and tweet from Russian embassy in Kenya. Based on paper by Joseph Sullivan published on Foreign Policy by the way, who referred to words of Alexander Babakov - deputy chairman of Russia’s State Duma.

But instead, we assumed slightly different approach. We used opportunity to expand our tale, and simply set it in certain frameworks. As concepts of international currencies are well known and discussed. Like Bancor proposed by J.M. Keynes in Bretton Woods 1944. Or SDR – special drawing rights – created by International Monetary Fund. Or even Euro, which despite of its strengths and design flows, is being used since nearly 25 years. And frankly speaking it is somehow fascinating to see if theoretical concepts remain on drawing boards or how they are being implemented. Another fascinating is, observing how members would decide to give up control over its currency - one of the pillars defining independent entity – for the purpose of unification, greater good or chasing dreams.

Eventually it turned out we were highly sceptical to perceive BRICS’ currency as USD- killer, positive on concept’s role in further de-coupling between east and west and eastern de-dollarisation, moderately optimistic with regards to its long-term share on global trade, and overly optimistic on possibility of its creation on time. At the same time, we were strongly negative on its real convertibility to commodities, and rather perceived it more as set of tokens, recognised by counterparts, to be used for trade and circulating in closed loop.

Considering what happened – or should we rather say, what hadn’t happened – at BRICS Summit in Johannesburg, seems our very moderate optimism was even too much. It seems that gold backed common currency was predominantly Russia’s “pipedream” that would allow Moscow at least partially circumvent G7 sanctions. So could we call the whole concept a failure?

15th BRICS Summit in Johannesburg

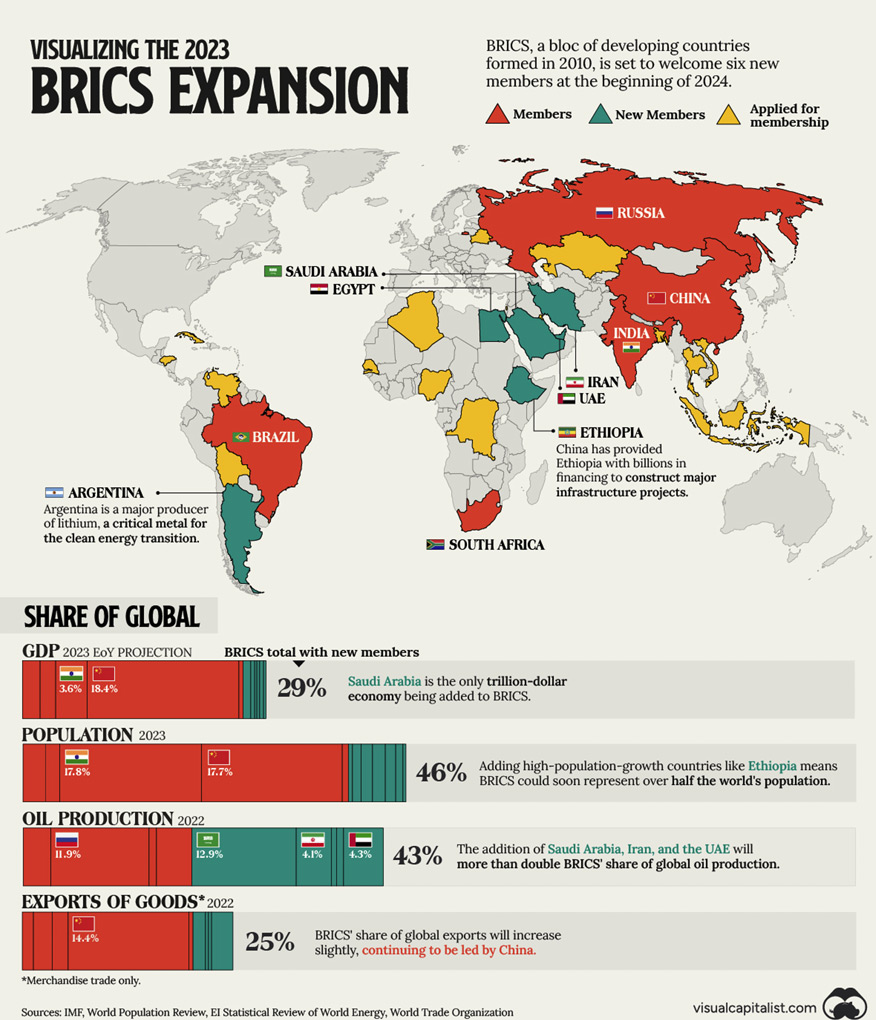

Members arrived to South Africa’s 15th BRICS Summit in Johannesburg with different expectations, as some opted to expand group and some preferred to keep it ‘exclusive club’. Subject of expansion dominated summit, because in the last few months, approx. 40 countries at some point either shown some interest or formally applied to join the bloc. Eventually BRICS has been extended by Saudi Arabia, Egypt, UAE, Argentina, Iran and Ethiopia. That made already energy commodities heavy BRICS lean towards this direction even more.

BRICS after 2023 expansion. Source: BRICS website

But second main element discussed in Johannesburg – to accelerate use of local currencies for international trade. Non-existing subject of BRICS currency only proved that original members came with different strategies about this. As no one addressed this issue, not in agenda and not even on informal meetings. ‘De-dollarization’ as such wasn’t even mentioned by name in official agenda. But within BRICS it seem to be ongoing, as just 28.7% of trade between members had been conducted in USD in 2022 (plus China stopped purchasing US debt and even slowly discards it.

South African finance minister Enoch Godongwana said in an interview:

"Setting up a common currency presupposes setting up a central bank, and that presupposes losing independence on monetary policies, and I don’t think any country is ready for that."

The bloc's leaders did announce however, that their finance ministers would be tasked with exploring the issues of local currencies, payment instruments and platforms, and will report back in a year.

"It’s not an alternative to SWIFT. It is a payment system which facilitates a deepening of the use of local currencies."

Anil Sooklal, South Africa’s ambassador to BRICS, also continued in this tone.

"The currency is being discussed but let me correct: It’s not about a BRICS currency. It is too early to talk about a BRICS currency (…) What we are talking about is creating more financial inclusion in terms of global financial transactions, global financial trade and how we conduct our payments."

"goal is a diversified global monetary system, our own payment systems, which would not be held hostage to one or two currencies through which we must trade to our detriment."

On BRICS’ currency, it seems that this idea was just predominantly on Russia’s and Brazil’s political agenda. And as BRICS’ plans are hindered by lack of local currencies to cover trade, hence BRICS mainly discussed on this subject – of capital and trade flows. In example - Russia receives rupees from India to pay for New Delhi’s gas and oil imports. However, in free circulation there is not enough rubbles and rupees (both strongly devaluing) to cover whole trade between counterparts. In addition, there are foreign exchange restrictions on all five BRICS countries, making settlements even more complicated. Hence Russia remains with substantial amount of Indian currency, which may be subject of partial swap settlement at the end of the year, but lack of appropriate mechanisms doesn’t fully resolve problem. On the other hand, when settling in Yuan, fees, tariffs, and taxes may amount even to 30% of trade value.

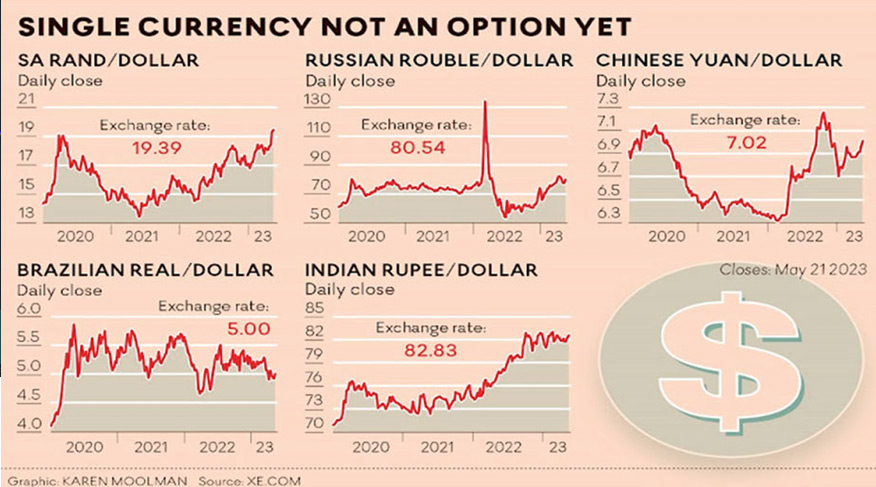

Fluctuations of BRICS’ currencies. Unfortunately, compilation shows only part of the picture, as with beginnings of September we have DXY (dollar index) at 104 already. Source: https://chinaglobalsouth.com/2023/05/23/the-uphill-journey-to-a-brics-currency/

What remains main political point for BRICS’ emerging markets is to have its own piece of a cake. In other words – to be represented. In the past, during cold war, Non-aligned Movement has been one of the key movers attempting reforms in United Nations, World Bank and International Monetary Fund, to better represent status of nations worldwide. These had been pressing for reforms for decades, however, USA and EU had been refusing such attempts, as it benefited their position and influences. Due to inability to change system dominated by G7, and especially USA, UK and France, many countries realised, they are in need for alternative alliances. And hence growth of BRICS-like groups and alliances – made to reduce effectiveness of established institutions.

Jim O’Neil – former Goldman Sachs chair, and inventor of BRIC/BRICS acronym, responsible for its popularisation of this open forum in the world – admitted, that China was the only country that met long term assumed development expectations. After all, original members were commodity-heavy economies, and period 2014-2020 wasn’t the best time for neither gold, nor oil or gas. He also admitted that BRICS’s evolution as organisation and recent expansion were also disappointing and far from original expectations. Not even to mention, most of new members are either one-commodity reliant (UAE, Saudi Arabia, Iran), or simply their economies are highly underdeveloped, troubled by inflation or in need of capital injections (Argentina, Egypt, Ethiopia) and torn by internal issues (once again Ethiopia). Of course, there are some significant numbers behind BRICS, which we had shown in the past already. These are regards to global population’s share, share of global economy, share of global trade, GDP, GDP per capita and - especially after admitting new members – on oil production.

BRICS expansion in 2023. Source: https://www.visualcapitalist.com/visualizing-the-brics-expansion-in-4-charts/

But what is BRICS main weakness (some perceive it as a strength) - it remains forum, just like G20. It didn’t develop hegemonistic and one-directional approach of G7, dominated by USA and followed by its allies or clients. Nor it didn’t develop organisational structures. It remains focused on certain chosen aspects - on replacing USD in bilateral trade between members, and ascertaining role of emerging economies in the world - which bounds different countries of different priorities and approaches. Often conflicted on some levels – like India and China over borders and basically every trade aspect. Egypt vs Ethiopia engaged in conflict over Grand Ethiopian Renaissance Dam that could impact sweet water flows on Nile. Shia Iran and Sunni Saudi Arabia remained conflicted over dominance in Muslim world and Mid-East. Chinese diplomatic initiative made them to bury the hatchet. However question remains on what if any of these will get better offer from USA? Or if Beijing won’t be able to support them in the darkest hour. Not even to mention about ‘special’ relationship between Israel and Iran. Wahhabi House of Sauds since decades was pillar co-making petro-dollar, militarily dependant on US and UK’s military exports. Now it wants to partially trade oil in Chinese currency. On the other hand, mutually conflicted Iran and USA recently played game of cat and mouse seizing and releasing each other’s crude tankers. However, Iran has reached an agreement with USA to ease sanctions, enabling country to increase its oil exports to China even more. And JCOPA, commonly known as the Iran nuclear deal, remains on a table.

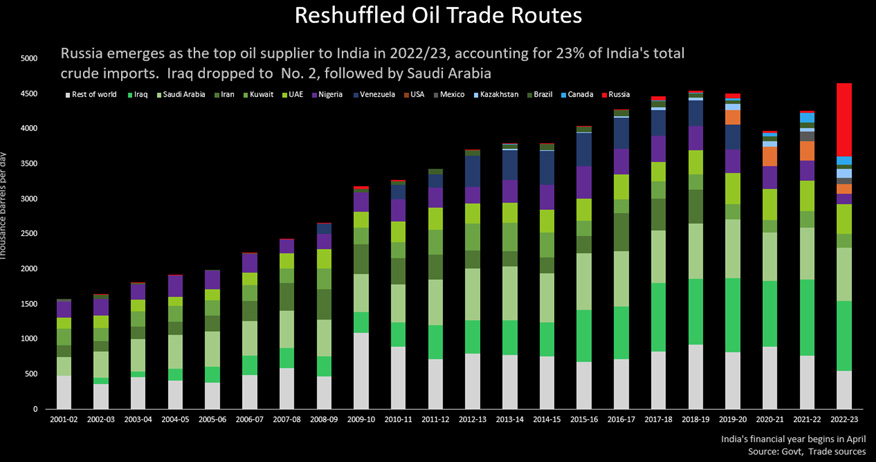

Paths of a breathless dragon

Many commentators missed the fact, that it was just second foreign visit of Xi Jinping since 2020. That shows significant importance of BRICS to Beijing. Why is that? China as a main economical motor opted for expansion of group, as it would well serve its geo and economic interests. Above all, this means cheap oil gas and other commodities. Of course China invests heavy in nuclear energy – without Chinese plans, so called ‘nuclear renaissance’ would be just a hollow phrase. However ability to preserve flow of cheap energy commodities (long-term gas deals with USA and Russia, long-term oil deals with Iran and Saudi Arabia, not even mentioning Kuwait and UAE), allows China to preserve stable energy prices (and potentially to avoid future blackdowns). Especially if compared to what is happening since 2021 in USA and Europe.

BRICS are energy commodity-heavy economies. Fall on i.e. crude oil prices 2014-2020 heavily impacted their economies and budgets. The only exception was China – strongest economy of all BRICS. Actually, previous recession could be considered shallow, only because China managed to continue business as close as possible to usual. But with certain deterioration of economic conditions on internal Chinese market, Beijing seems to be focused right now on market interventions and even more focused on growth of international trade. Hence One Belt One Road initiative is being continued, even despite local counter-actions by G7.

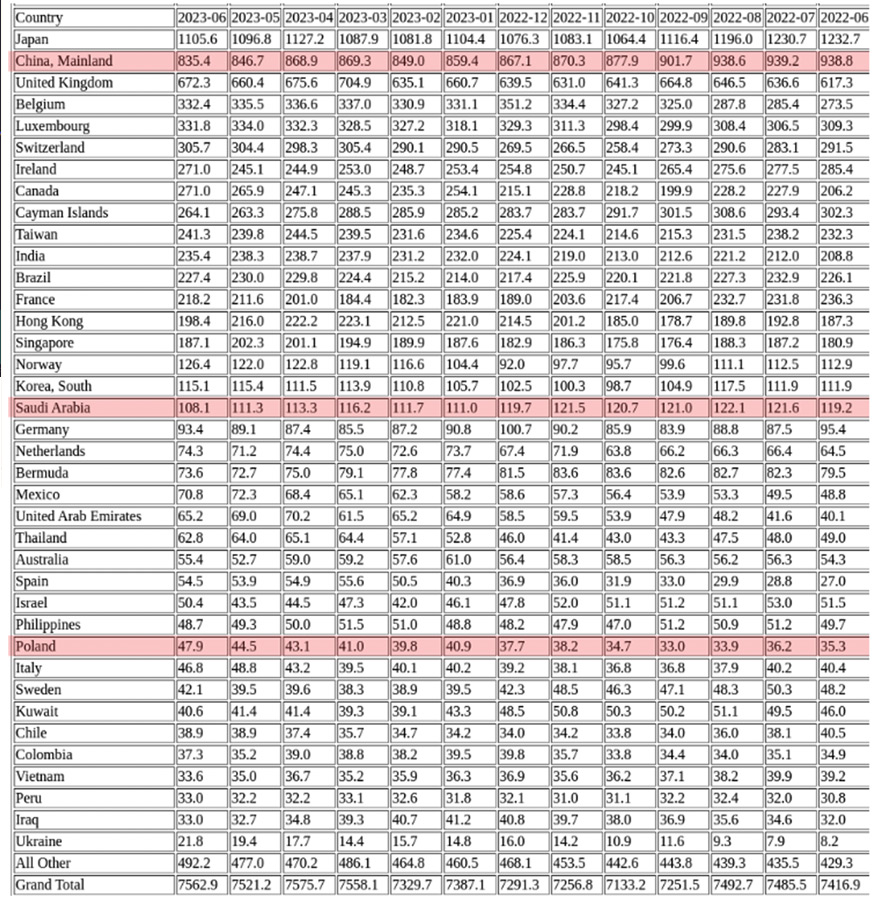

Scale of getting rid of US bonds by China and Saudi Arabia. Source: bigshortbetsresearch

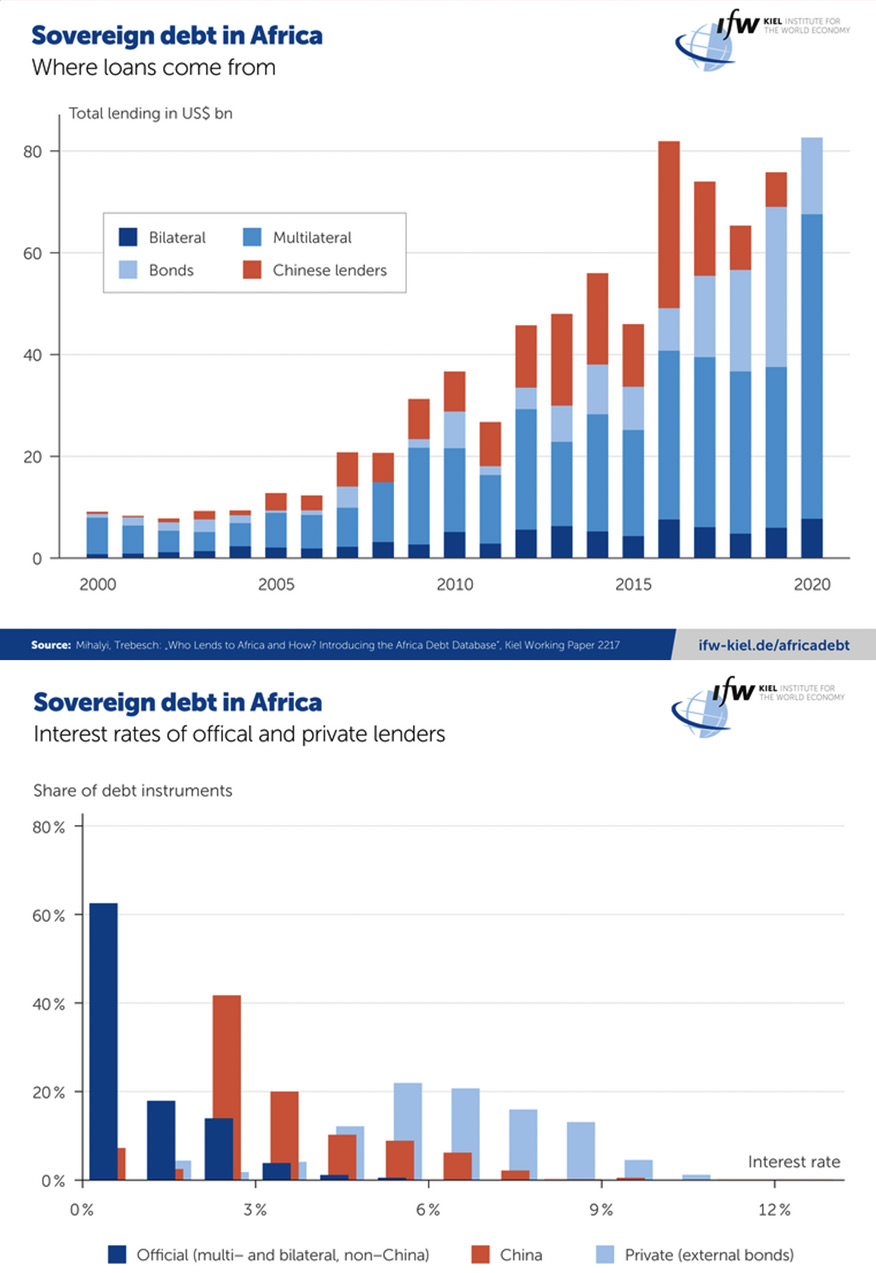

China remains less interested in purchasing western debt, and instead focuses its efforts on building global infrastructure, ensuring local investments and flow of processed on site cheaper commodities. Difference between ‘western’ and ‘eastern’ approach is, that China loans money for infrastructure development without demanding sectoral privatisation or democratisation in return. That makes Chinese or BRICS’s offer more interesting to 3rd world, than these proposed by IMF or World Bank. Especially since African nations remain heavily indebted to the above. And that serves China’s interests, even if they must give certain shares in investments to local entities or governments. Hence, in exchange, export of processed goods to China allows Chinese producers to cut on production costs, pushes ESG responsibilities to 3rd parties. And eventually re-negotiate contract terms when African nation-in-debt remain on brink of insolvency.

‘Chinese debt trap’ vs long-term approach of G7, IMF, Paris Club etc. Source: https://www.ifw-kiel.de/publications/news/sovereign-debt-in-africa-large-interest-rate-differences-across-creditors//

And what else could better serve purpose of ascertaining Chinese economic dominance, than establishment of special ties between partners, combined with bilateral usage of local currencies, or especially Yuan.

Modern enfant terrible

Another member of bloc is ‘enfant terrible’ of big part of international society - Russia. Vladimir Putin has been informed that his presence in South Africa would be unwelcome, as Cape Town would have to follow international arrest warrant. Although – obviously - he was allowed to speech and be present online. South Africa didn’t treat Putin per se as persona non grata, however signal was clear.

As ‘Special Operation’ in Ukraine didn’t go exactly as planned, Russia aggressively seeks allies of any sort. At the same time, it moves deeper and deeper onto Beijing’s caring arms, making Russia even more dependent on China. That’s probably not exactly what Putin had in mind announcing in the past ‘pivot to east’, and hoping Russia to become equal trading counterpart.

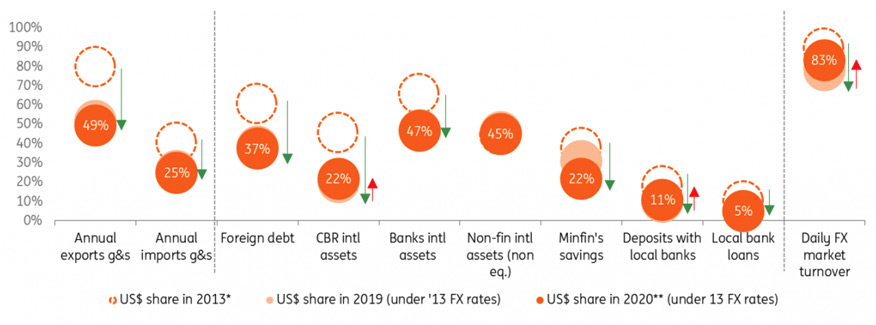

Since years, Moscow was strongest proponent of de-dollarization – which we have to admit was impressive approach for a country being member of OPEC+ and having pre-war approx. 40% of its budget income from trading oil and gas. Needless to say, that bulk of that was conducted in USD. Just before February 2022, USD share in Russia’s reserves remained on historically low levels. This also characterises trade in between BRICS members.

Russian made de-dollarisation. Levels for 2013, 2019 and 2020. Source: https://think.ing.com/uploads/charts/_w1200/Dedollarization_2020.png

With sanctions, recent depreciation of rouble and certain assets being frozen by international institutions, Russians advocated for all possible alternatives to the dollar as they are restricted from using western based international financial infrastructure. Of course, Moscow attempts to circumvent sanctions using various tools. We described some of them in our series discussing flows of Russian precious metals in 2022. Whether that would be special trading zones, gold backed blockchain tokens or gold backed special financial products, Russia lacks something larger in size and proper exchange mechanisms. Should be therefore obvious that Russia was proponent of international currency backed with gold. On this occasion we could only speculate, if infamous info from Russian embassy in Kenya on BRICS currency was juts an attempt to probe partners and general opinion on subject? However it seems that for now it currently remains not applicable.

Attempt to probe partners, soft push or disinformation? Source: https://www.gainesvillecoins.com/blog/brics-gold-backed-currency-august-2023

Indifferent or opportunistic

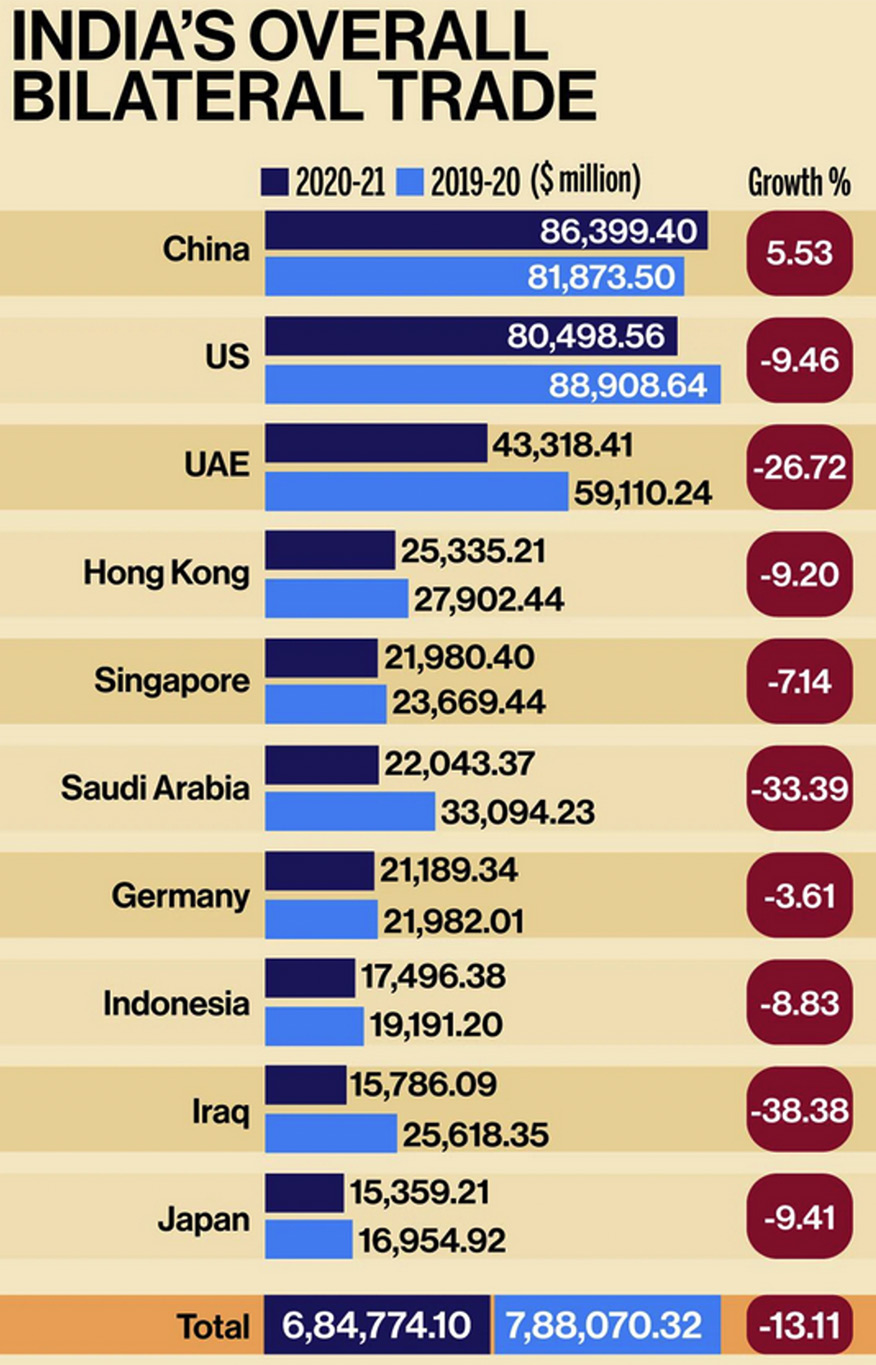

India simply wants recognition of its importance and international status affirmation. It is interested in growth in usage of rupee in international trade. Hence its stance leans much more towards rupee and its controlled internalisation in trade. Especially since bulk of its trade is being conducted in USD, creating unnecessary exposure to US monetary and fiscal policies. India is one of the Non-aligned emerging superpowers, trying to remain its status in uneasy balance between influences of Washington and neighbouring Beijing. Hence media informs sometimes on leaning towards China, sometimes towards USA, but in heavily polarised world not many seems to acknowledge, that India tries to choose its own way, and whatever suits them most.

Values for India’s trade. Most invoiced in USD. Source: https://www.businesstoday.in/latest/economy-politics/story/boycott-china-flops-mainland-china-overtakes-us-to-become-indias-largest-trade-partner-in-fy21-300020-2021-06-29

Considering hostilities between India and China – on trade, on shape of borders, outsourcing, tech etc. it may be somehow astonishing, that India remains in BRICS. It seems, that non-western-style-integration and de-dollarization in bilateral trade suits New Delhi needs. And so, while attention of everyone is on Washington, Beijing and Moscow, Narenda Modi plays its own low-profile game. International trade doesn’t care about friends or lovers and does not care about ideologies rooting from ancient European cultures – like demos kratos. It simply requires counterparts interested in making profit, selling goods at high price and purchasing as cheap as possible. Hence India didn’t turn its back to Russia in 2022, but kept importing Russian crude with discounts, blending it, refining and acting as an intermediary, legalising in fact flows of Russian Urals and Sokol to Europe. Above compliant with US sanctions that clearly state Russian oil processed elsewhere is not to be considered Russian anymore..

Russian crude for New Delhi. Source: https://www.reuters.com/graphics/INDIA-OIL/znvnbneowvl/Pasted%20image%201682075212215.png

Any attempt to implement gold backed common currency would end up with New Delhi being dominated by China – strongest economically of original five members. Chinas dominance would be ascertained by trade volumes and strong exposition on oil-producing nations. Especially since core OPEC producers – now admitted to BRICS – are all keen to settle certain crude volumes in Yuan. And they do so. Again – it doesn’t mean that USD would be ditched in oil trade, but it could be seen as shock to petro-dollar, serving long-term Chinese influence.

Also to have such international gold trade token, requires gold. India’s official gold reserves are on approx. 750 t., which is highly inadequate to New Delhi’s international aspirations, especially if to be compared to reserves held by China and Russia. Estimated private ownership surpass 25k t., but domestic production remains underdeveloped, making India dependent on precious metals imported i.e. from UAE. Hence, assuming if any discussions on common currency had been maintained, logical stance for India would be to oppose idea of gold backed currency, as not beneficial. As for now that would be solution heavily weighting towards China with regards to international settlements.

On aligned Non-aligned

And now on BRICS members having less political and economic weight, but at the same time remaining important commodity producing nations - South Africa and Brazil are those BRICS members following old-school cold-war approach of Non-Aligned Movement. Cape Town leaned in the past slightly more towards Russia, i.e. Zuma’s government spent billions of dollars to buy Russian nuclear reactors. But let’s be honest – South Africa seems to be the weakest link in pre-expansion BRICS and is in need for heavy capital injections and investments. Especially in energy sector. Now President Ramaphosa’s government leans more towards BRICS’ made New Development Bank (designed to be alternative to IMF) and idea of BRICS bond issuance. But at the same time it greets all possible forms of Chinese financing with arms wide open.

South Africa’s blackouts in recent years. Year 2023 is even worse. Source: https://www.energyconnects.com/news/utilities/2023/march/south-africa-s-energy-crisis-could-worsen-electricity-minister-warns/

Brazil leans towards China as its main trade partner and strong investor. Seems that country under left-wing president Lula became vocal proponent of multilateralism and idea of tradeable currency / token. Brazil recognises same problem in its trade balance as rest of the forum – too large exposure to USD. However, considering of course geographical proximity and trade ties to USA, Lula also tried to emphasize that BRICS doesn’t want to become counterpoint to G7.

Still far from conclusion

BRICS answer to the IMF and the World Bank, is New Development Bank, currently led by former Brazilian president Dilma Rousseff, same party as Lula. He is believed to share his vision of economics and the global order. Although not even NDB seems to acknowledge need for one currency for entire bloc. Instead, it emphasis fact, that BRICS and NDB are firmly embedded in the dollar hemisphere and development of any alternative to the greenback is a medium or longer-term ambition and aspiration.

Dilma Rousseff – president of New Development Bank – BRICS’ investment arm. Source: LinkedIn

So NDB’s ambitions for trade and financing remain very short-term, with idea of issuance bonds in local currencies. South Africa’s had been issued, Indian is expected by the end of 2023.

“We want to deepen our focus on local currency financing (…) Each of our countries have very strong domestic bond markets, very strong local capital markets. Up to 30% of our lending will be in local currency, which means we raise local currency bonds and then lend in that local currency.”

With fx instability on emerging markets’ currencies, all type of controls and inflationary environment, it cannot be ascertained however if such solutions will remain stable and grow on popularity.

"Now we start thinking seriously... to use one member country's currency to finance projects with that currency in another member (…) Let's say, a project in South Africa to be financed in CNY (Yuan), not with USD.”

Hence BRICS’ focus remains on local currencies and plans for common gold backed token remained in sphere of dreams, Especially Russian. However no one knows would it be ditched for real, used occasionally as a spooky monster or just shelved until general economic conditions would further deteriorate, affecting drastically main trade currencies like USD and EUR. And hence creating need for any possible recognisable liquidity tool.