120 USD Shanghai’s price arbitrage on gold

In recent weeks, we had experience high price divergence between Shanghai Free Trading Zone (based on Comex and LBMA pricings) and Shanghai Gold Exchange having its own benchmark and serving domestic market. This peaked as high as 120 USD. So is it finally time for gold’s price de-coupling to occur in between east and west? And should be expect price charts to explode? Nope. Not really. We’re going to try explain what’s happening in our opinion, however need to clearly emphasize, that amount of misinformation and misinterpretations surrounding subject is extraordinary.

What is arbitrage and does it occurs often?

Arbitrage is an investment strategy, where entity or person takes advantage from price differences across different markets, by buying commodity or currency cheaper and selling them on the more expensive market. Term itself derives from French term ‘arbiter’, so to referee or to arbitrate. Often, price discrepancies that are at the heart of arbitrage involve multiple geographies. They also occur when there is a lag in information, as can be the case with stocks trading on different exchanges or in cryptocurrency arbitrage.

This strategy usually is high volume and high capital heavy and is something that professional traders or investment entities perform, as retail trader may not be in possession and access of appropriate tools. Law of small numbers is often applicable on this occasion, as benefitting from small price difference using high value capital may vastly improve profit. Despite of fancy terminology it is simple operation, nearly risk-free, as trader clearly sees sell and buy prices on involved markets. These transactions usually represent small proportion of the total daily volume on the exchanges, but during sessions characterised by high volatility its share can reach up to double-digit share of turnover.

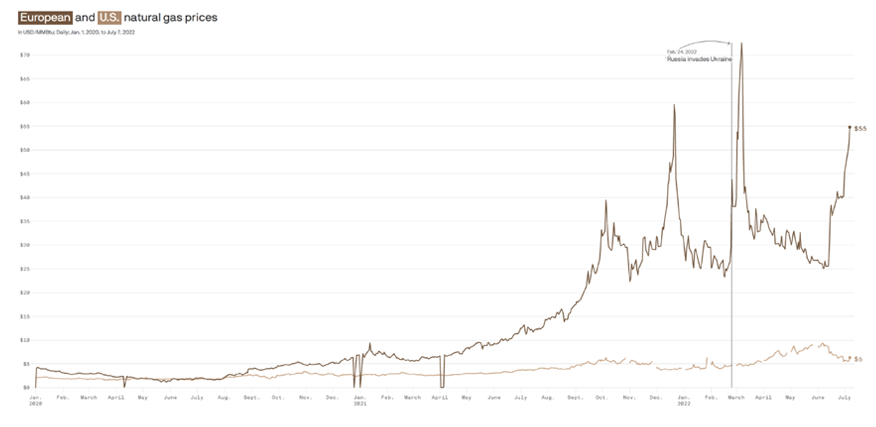

One of the interesting examples of arbitrage occurred on NatGas in 2021 and 2022, when spot price on US Henry Hub and futures on Netherland based Dutch TTF became very beneficial to US exporters selling liquefied gas to EU.

NatGas crisis of 2021 and 2022. Price arbitrage in between US Henry Hub and EU’s Dutch TTF reached record levels. Source: https://www.axios.com/2022/07/11/europe-natural-gas-prices

But as a side effect, arbitrage diminishes price difference between geographically different markets. I.e. buying gold on Comex at 1950 and selling it at SGE at 1960 eventually would lead to finding price balance between both, hence divergence would be diminished.

Of course in the past times possibilities to benefit from such mechanism were much profitable, as flow of goods and information on longer distances was difficult and dangerous. However since humanity progressed and developed technologically, world became smaller place. ‘In 80 days around the world’ turned from impossibility to slow pace travel. Nowadays we live in a global village connected with nearly lag-less and nearly free internet. And considering technological progress towards Internet of Things, cloud services, databases etc., we require faster speeds like 5 or 6G, and implementation of blockchain technologies to improve informational flow.

We could imagine how improvement of information flow affected past price arbitrage. One of the most popular fx trading pairs is USD/GBP. Its informal name is ‘the cable’. Name derives from transatlantic telegraph cable (and later cables), laid during the mid-19th century on the bottom of Pacific between British (at a time) Ireland and Canadian (British at the time) New Foundland. With both ends extending further to Great Britain and USA, it vastly improved communication between sides. A 2018 study in the American Economic Review established that just the above, substantially increased trade over the Atlantic and effected in reducing prices. Study estimates that "the efficiency gains of the telegraph to be equivalent to 8% of export value".

Overall, arbitrage is something normally occurring on the markets, and benefiting savvy investors. However it becomes widely interesting, when price difference between involved markets skyrockets above standard fluctuations.

On gold arbitrage and price divergence

So how above could be applicable to gold? Well, we have experienced slight price differences between markets in the past. In normal circumstances they didn’t exceed couple USD. After all, gold doesn’t have multiple types, like it is as standard on crude oil market. WTI doesn’t equal in price and quality to BRENT, Arab Light or Urals, hence price differences between above, related to certain factors. Gold however is one-isotope metal, and as investment product should have similar spot price for same volume around the world. Just valued in different currencies hence affected by fx changes.

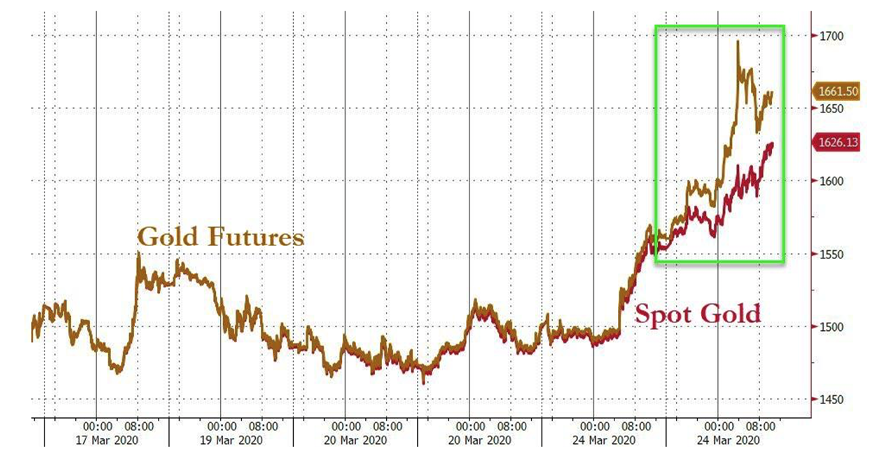

But to emphasize the point, we have to take a closer look onto one interesting example. Just couple years ago, in March 2020 we experienced price arbitrage between gold spot and futures on Comex. That was result of sharp interest in physical metal and short term delivery instead of having just exposition on price. Due to the shortage of physicals on the Comex, there was a price divergence between paper and physical gold in favour of the former. At some short peak point it reached approx. 100 USD, however for most time it oscillated just below 50 USD. Needless to say it was extreme example being effect of extreme countermeasures. On this occasion it was shutdown and lockdown of Swiss gold refineries, which effected in shocks and fear on LBMA and COMEX. After restoring supply, price divergence diminished.So question appears, is it possible to maintain high and long-term price divergence between markets. And between ‘paper gold’ and physical? After all, since 2008 we could’ve hear lot of voices advocating such to eventually occur permanently on Comex.

March 2020, price divergence between spot and nearest delivery futures. Source: https://www.zerohedge.com/commodities/gold-market-breaking-down-gold-spreads-explode-lbma-warns-liquidity-problems

Well, it is rather unlikely to achieve permanent price divergence between paper and physical gold. Existence of derivatives assumes solvency of both sides of transaction – seller and buyer. No futures or options would’ve been tradeable in serious manner, if not promise to realise upon maturity in base instrument. Terms and conditions of every contract are strictly determined with regards to volume and its fluctuation, means, terms and ways of delivery. Would owners of long position require settlement in actual commodity, each market has determined in terms and conditions that such request has to be made no earlier than x days before contract maturity. Usually it is 2 weeks. This period allows to prepare physical delivery.

Of course, the real liability lies within those shorting contracts. If by any reason i.e. Comex is unable to settle long position, it is one of its appointed agents that has to make delivery. If it has nowhere to buy gold from, it immediately buys long contracts of this or the next series, making price skyrocket. Short contract holders then receive a demand from agent to deliver gold. In practice, they have no gold, so they abruptly close their short positions, and so the price rushes upwards again. Now, appointed agent may give back its long contracts, the profit from which will be used for settlement. Otherwise, the lift on the derivatives rides upwards until settlement would occur.

Above mechanism is applicable not only to gold, but whole commodity market, including silver, oil, soy or grain. Not all of them are to be settled in actual goods. Big chunk are speculative positions are not interested in acquiring tanker of crude oil or dozens of 1000 oz bars of silver, as they simply are interested in having tools enabling exposure to price.

On this occasion of course we’re aware about high imbalance between Comex physical volume vs speculative positions. But it doesn’t scare us much now, as i.e. in 2014 physical to paper ratio stood even at approx. 1:100. When year 2020 happened, such misproportion combined with large demand to realise contracts in physical volume caused Comex to act like a black hole, sucking all available gold volumes from any possible markets and adjusting certain settlement mechanisms enabling this way settlements in LBMA 400oz bars instead of 100oz Comex bars. And of course some customers accepted proposition of settlement in USD. End of story – price divergence has been supressed by international institutional arbitrage. As Comex offered higher prices, physical volumes were directed there in coordinated manner. As key thing for commodity markets is promise to deliver accordingly. Failure to do so would’ve ripple around the world, impacting negatively market’s fame, causing outflow of customers and legal consequences.

But what does it has in common with SGE? Comex is predominantly derivative market, while SGE operates on physical volumes. Let us explain - on the occasion of current near 120 USD market arbitrage, one of the theories released by certain commentators was, that breakout we experience now is simply related to price discovery on primarily physical gold markets. It was supposed to be in opposition to naked shorts on Comex. Unfrotunatelly this theory could be scrapped as well, as year 2020 proved fully strength potential of gold derivative market.

Is Shanghai ahead of the heard for pricing gold?

We tried to explain arbitrage, now it is time to get to the point. Gold on LBMA’s and Comex closed 15th of September at a price 1923 USD. At the same time, trading at SHE (Shanghai Gold Exchange) could experience price at equivalent of approx. 2045 USD. That is over 120 USD and juicy 6%. Arbitrage of such magnitude would’ve been something absolutely astonishing to observe. Such arbitrage between markets would result in mass flows of gold towards Shanghai. London based vaults would’ve been emptied. Entities would’ve accused Beijing on price manipulation. Maybe, some governments would’ve eventually made decision on banning gold exports towards China or at all. Potential escalation would’ve been very vocal. But we didn’t hear any of the above.

Silence was to be only broken by same voices over again, stating that price discovery during crisis is shifting east, due to Petro Yuan being convertible to gold, BRICS, and that this is again the end of Comex. Apart of that, info appeared that Hong Kong switched from pricing precious metals from LBMA/Comex to SGE’s physical pricing, hence making them more expensive. Yes… and the dollar is collapsing… That is not entirely truth. Actually, this is far away from it.

Shanghai Free Zone vs Shanghai Gold Exchange. Source: https://twitter.com/JReade_WGC/status/1702340531001405453

On the above chart, yellow line reflects price of gold in the Shanghai Free Trade Zone (IAU9999), which is equal to London spot. White line reflects price of gold in the Chinese domestic market, in other words Shanghai Gold Exchange spot price..

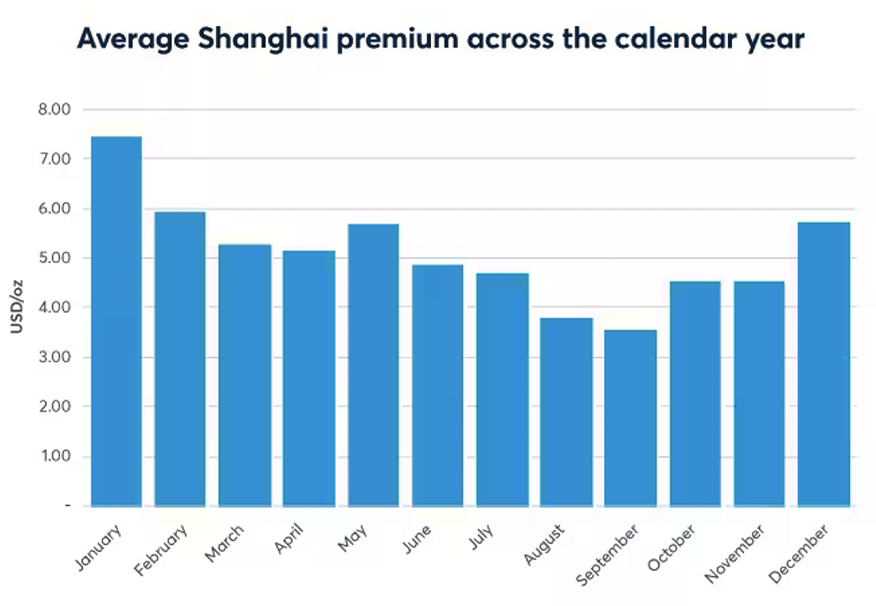

Thinking on possible divergence, first to come in mind is obviously celebration of Chinese New Year, that will be on 10th Feb 2024. Seasonality in China and India drives demand stronger during Q4 and Q1 of every year. That creates price divergence between our local markets and SGE. Bellow chart presents size of premiums across calendar year at SGE.

Average premiums on gold, at SGE, across calendar year. Source: https://www.cmegroup.com/education/articles-and-reports/how-much-does-new-year-buying-drive-the-chinese-gold-price.html

Strong seasonal demand wouldn’t explain such premiums. Answers therefore lies elsewhere. Would we take a closer look, we’ll see that suddenly, China focused on precious metals in every possible way.

- Shandong Gold Mining - principally engaged in the mining, processing and sales of gold, largest producer in China – did modest 5% on 14th September.

- The returns of 14 Chinese gold ETF funds have surged by 13-14% this year, and issuance of gold funds is booming. Gold ETF funds have become one of the main forces behind the recent rise in SGE/SFE gold and silver prices.

- Gold miners have returned to pre pandemic levels, with gold production increased by 2.24% y-o-y, consumption increased by 16.37% y-o-y, jewellery increasing by 14.82% y-o-y, and investment in gold bars increased by 30.12% y-o-y.

- Transaction volumes on SGE for Jan-Aug 23 reached new historical heights at 14,316 t.

- Gold rush effected in SGE delivering 923 t. of gold just in 7 weeks. As many customers decided to make a withdrawal, SGE issued a notice on 13th September, to establish an on-site reservation system.

- Silver stocks has been ravaged. Many dealers announced simply that they are out of stock.

- And to conclude, silver vaults in SGE continued significant volume outflows, from 1,842,270 t. to 1,783,140 t. That is data for weeks commencing 11 Sep and 18 Sep.

What is to be seen, is immense growth of demand to gold and silver, including jewellery. That creates price divergence between SGE and other gold markets, which could be used for arbitrage. However questions remain – what caused such immense growth on demand, and are there mass flows of gold and silver to Shanghai now?

From the fall of Yuan’s fx value to import restrictions on gold?

Surprisingly answer seems to be simple, but requires bit of explanation. Since mid-July 2023, US dollar strikes back. It gains on strength after reaching nearly 99 points on DXY index and made its way to nearly 105 now. DXY is a dollar strength index, which measures US currency strength against basket of main currencies. These are EUR, GBP, CAD, JPY, SEK and CHF. Higher dollar is on DXY, stronger it remains versus other currencies of the world. Current all-time highs were at approx. 114 points, which was reached in September 2022. How to translate that from indexed terms to fx? That time we had USD/PLN pair at nearly 5 PLN per dollar and Euro temporarily cheaper than USD.

DXY during 2023. Source: Tradingview

China's onshore Yuan on the other hand, slid to a 16-year low versus the greenback, under pressure from a property slump, weak consumer spending, and shrinking credit growth in the world's second-largest economy. Yuan sank to 7.32 per USD and currently lies on 7.29 levels. This marked the weakest point for Beijing’s controlled currency since December 2007. As a result of developing weakness, Chinese entities and retail made lot of sales on CNY, purchasing other available assets – whether it was USD or precious metals.

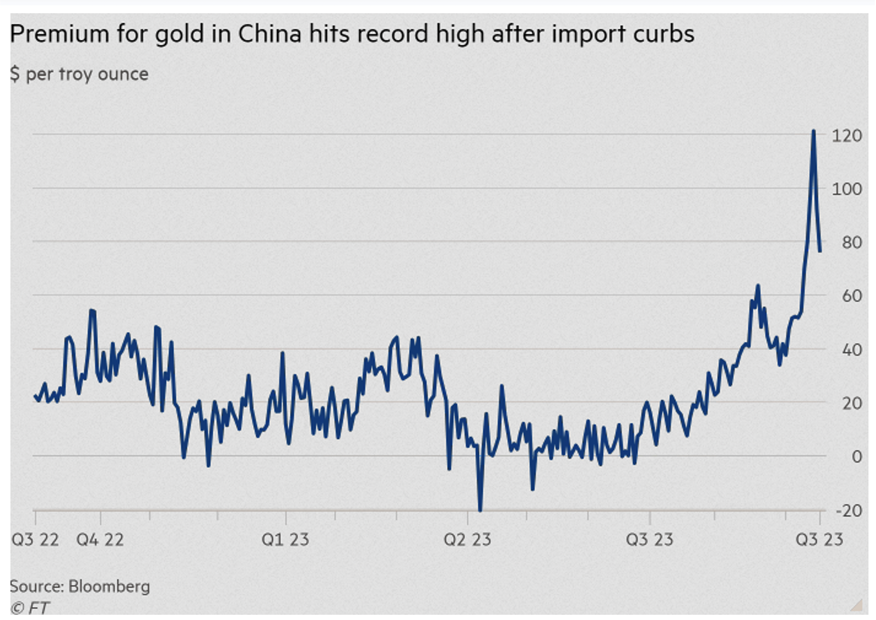

Sale on Yuan wasn’t caused only by its weakness to USD, but predominantly by condition of Chinese economy. Disappointing economic data and real estate turmoil spurred local central bank to cut interest rates. As its monetary policy diverges with the rest of the world, sending currency toward record lows offshore, PBoC has intervened. It issued a warning against those shorting Yuan, defining limits for trading against Yuan and as a part of wider package of capital controls it applied restrictions on gold imports into domestic market. Eventually in August PBoC had reduced and stopped granting quotas for international gold imports by banks to ease rush in purchases to hedge against a weaker domestic currency.

Before that happened, import volumes on non-monetary gold had fallen in June by 35% in comparison to previous month, to the lowest value since January. Package of credit controls caused in effect, that gold’s price on Chinese market ‘exploded’.

It is PBoC typically issues quotas to financial institutions for the amount of gold allowed to enter the country, though the exact details of permitted volumes are never publicly disclosed. At the same time some Chinese market commentators continue on ‘price discovery east vs west’ narrative. In addition, there are claims that quota system has been cancelled as it has been replaced by 3-10% tax applicable to certain imported volumes.

In this case, we have to reach to legal acts. Administrative Measures for the Import and Export of Gold and Gold Products which entered in force on 1st April 2015, had been repealed in 2016 by Decree No. 41 of the State Development and Reform Commission regarding the Decision to Repeal the Measures for the Administration on Licenses for Tobacco Monopoly and the Provisions on the Administration of Obtaining the Letter of Approval for Mining of Gold Minerals. Then in 2020, this has been reinstated as below. And in terms of gold imports and exports we read the following:

"The People's Bank of China is the competent authority for the import and export of gold and gold products, and implements the permit system for the import and export of gold and gold products.

"The People's Bank of China may, in accordance with the needs of national macroeconomic regulation and control, restrictively approve the quantity of import and export of gold and gold products.”

Document is available under fadada.com and could be easily translated to English using online translators.

Administrative Measures for the Import and Export of Gold and Gold Products of 2020. Document is available under https://m.fadada.com/notice/detail-17278.html, and could be easily translated to English using online translators.

Need to remember that as an asset, gold could be purchased by both entities and retail, and from this perspective, could be treated as a form of capital flight. From deteriorating in value local currency towards assets perceived as keeping value in time. On this occasion need to emphasise, that of course we’re far away from perceiving yuan as i.e. Turkish Lira, however scheme of capital movement and import quotas seems to be just similar as we described in our analysis ‘Is Türkiye ditching gold purchases?’ Considering that precious metals are in high esteem in China, should come as no surprise that it was one of the first assets, everyone turned their eyes on. Demand for gold in the country has remained largely subdued during 2023 until recent months when weaker yuan and economy started to boost purchases. So weakening economy with weakening currency triggered capital flows and increased demand. Which put pressure on local market, making premiums higher, and fuelled growths, as country imposed capital controls.

On 18th September 2023, upon literally concluding this analysis, Financial Times informed, that said curbs on gold imports have been temporarily lifted. As a result, price difference between Comex & London vs Shanghai went down to 76 USD.

Premiums on gold in SGE since Q3 2022, its peak and fall upon imposing and lifting import curbs cleary visible. Source: https://www.ft.com/content/b8406698-b98f-444b-b1a7-03c29f6f5779

Conclusions

For now it seems that just temporarily issue has been solved. Need to keep an eye on both price divergence between east and west, but also on Yuan itself in relation to USD. However as everything related to China, whole ‘capital control’ subject seems to be shrouded in mystery and cause analysts to wander in the dark.

However, there is another lesson for savvy investors looking to protect their assets from inflation and loss of purchasing power. Upon overly currency depreciation, authorities have array of legal means and measures they could use to impose capital control. Not to seize forcibly certain assets, but simply in fight to preserve currency, and made alternative assets temporally unavailable as a side effect of greater package. Demand-supply law will elevate their prices higher in such occasion.

And since we’re one foot in recession already, it really seems to be time to fight for preservance of owned capital.