Everything you'd like to know about gold in Poland, but are afraid to ask p. 4

I n below series, we focus on the subject of gold in Poland, hoping to cover all gold related aspects and trying to answer important questions of who, where, when, why and how much. We aim to do that deeply, so our esteemed readers could use it as a compendium of facts for years to come. In 1st and 2nd part we focused on official reserves. In 3rd we attempted to describe polish gold deposits and mining. In concluding part of the cycle, we’ll attempt to answer uneasy question – how much gold Poles may own.

Poles and gold hoarding during communist regime

Genocides and destruction of Second World War finally came to an end in 1945. War proved that assets held in bank, hard currency and even real estate could become worthless in a second, being ceased by occupants, robbed by marauding soldiers, or simply destroyed. In occupied country, Poles tried to hoard jewellery and gold as a last resort assets and means to start anew post war. Those forcibly settled to USSR or Nazi Germany also attempted to secretly keep some ‘hard assets’ for same reasons. It was no easy task, considering brutal policies both occupants applied. Most popular financial last resorts were precious stones, gold jewellery, but on some occasions even gold 20-rouble coins remembering times before First World War – anything not too spacious and easy to transfer.

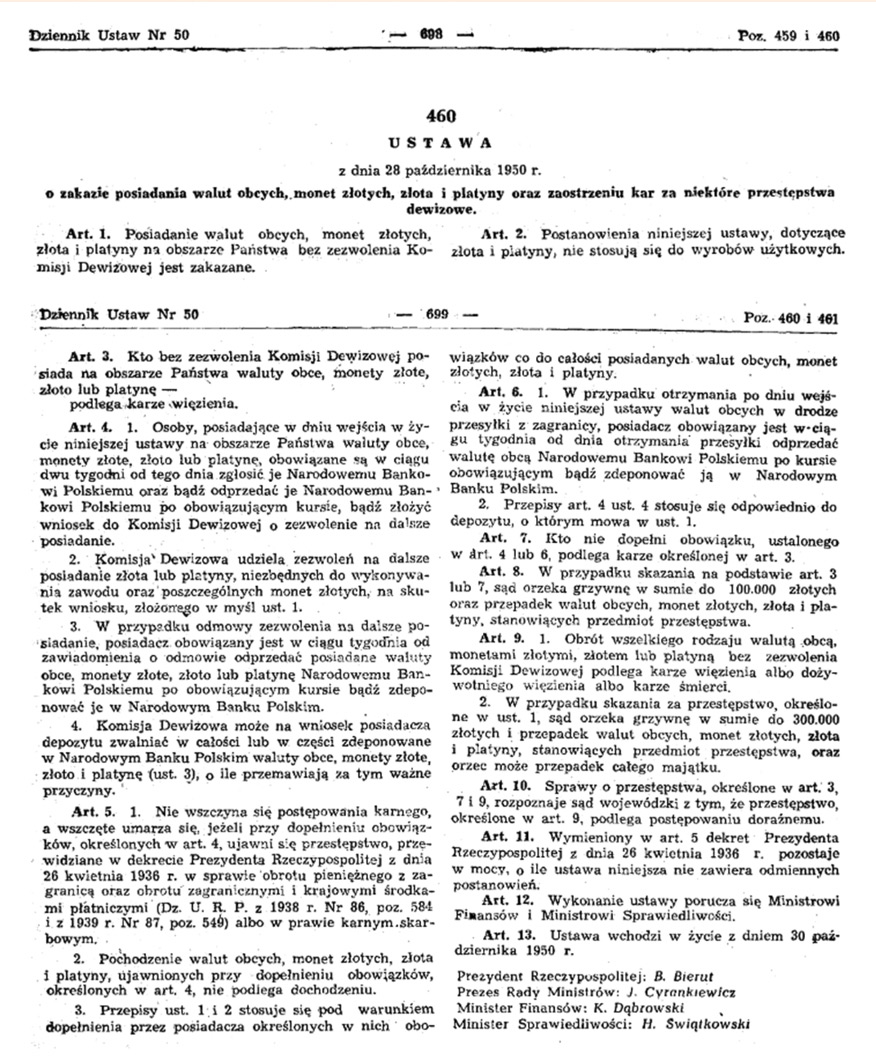

But end of war didn’t mean freedom. Restored Poland has been pushed to become member of communist bloc under leadership of Stalin’s Soviet Union. Establishment of communist government was paired with introduction of terror apparatus directed against all enemies of new establishment – real, imaginary, or just not too enthusiastic. Quickly communist terror has been widened to the economic sphere and directed against private and cooperative trade. On 28 October 1950 communist regime introduced new brutal economical legislation. It prepared swift monetary reform adversely affecting purchasing power and savings that Poles had. Bank assets were replaceable 100:3, however upon attempt to exchange money saved in ‘land bank’, exchange course was at 100:1. Regime also introduced law prohibiting circulation and ownership of foreign currencies, platinum and gold. Possession of above was punishable with imprisonment of 15 years but trading even with capital punishment. Restrictions were not lifted until November 1956.

28th October 1950. Day, when ownership of gold became punishable in Poland. Source: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU195005004600

Demand-Supply law dictated prohibited goods would therefore become highly desirable, hence dollars and precious metals remained in circulation on black market, even despite of risks to owners. Political thaw of 1956 lifted draconian laws, making ownership again non-punishable. As regime was in need for assets recognisable abroad, it years to come it set state owned currency exchange points, enabling exchange of foreign currency onto vouchers that enabled purchase of usually unavailable western made goods in specially dedicated ‘Pewex’ stores. This effected in common national memory improvement. Suddenly Poles started to recall that they actually might have some ‘forgotten’ gold and dollars stashed in safety.

During 1945-1990, Poles remained strongly attached to gold and foreign currencies, with demand being elevated upon times of political tensions between superpowers or upon internal state issues. It allowed to establish interesting saving trends. While US dollar was being kept for liquidity needs and to be spent domestically on grey zone or abroad for goods officially unavailable, gold was being held with approach to obtain long-term security. Hence existence of grey zone for foreign currencies and gold thrived during rules of communist regime. After all, ‘lokaciarze’ and ‘cinkciarze’ (grey market illegal currency and gold exchanging individuals, often acting in organised groups) were spending profits domestically, providing hard assets to the state. And state required recognisable internationally currencies to maintain trade or simply to process its international debt. This developed effect of national schizophrenia, where law recognised trading or smuggling hard assets as criminal activities, but at the same time turned blind on most of it. And on macroeconomic note, gold purchases made by Poles were taking off the market certain amounts of local currency, hence contributed to steaming off growing inflation.

So forget about gold confiscation that Roosevelt prepared for US citizens in 1933. As it was nothing in comparison to what communist regimes initially prepared for its own citizens.

Gold and commercial tourism

In between 1945-1990 it was profitable to transport gold to Poland, as high demand was making price higher than in neighbouring countries. This however was prone to be changed sometimes, due to internal policies and external economics. Although not often:

- Another set of restrictions introduced in 1969 that lasted until the early 1970s (however nowhere near strict as one from 50’s). It led to temporary convergence of the private sector. And as a result to strong drop on prices of gold and USD.

- Oil crisis of 1979-1980 effected in sharp spike of gold prices worldwide. To the point that price temporarily surpassed prices offered in Poland and successfully acted as temporary demand destructor.

Luźne szacunki dotyczące przepływów prywatnego kapitału dokonane w 1972 r. zakładały, że każdego roku 10 mln USD miało na stałe opuszczać Polskę. Zamiast tego, wśród innych "importowanych" dóbr miało być sprowadzane ok. 2,5 t złota rocznie w postaci monet, w formie sproszkowanej czy biżuterii. Problematyczne jest jednak oszacowanie ogólnej ilości, ponieważ większość z tak „spolonizowanego” złota znajdowała się w ciągłym obiegu. Przerzucane do Polski, kupowane po cichu na ulicach, celem zachowania, jako zabezpieczenie na gorsze czasy, sprzedawane innym osobom lub państwu. W przypadku zakupu przez państwo, metal najprawdopodobniej trafiał z powrotem na zachód w formie spłaty odsetek od linii kredytowych. Zakładając oczywiście, że nie wylądował one w sejfie notabli partii komunistycznej. Można zatem spokojnie założyć, że na obrocie złotem w komunizmie zbudowano zalążki niektórych fortun.

Loose estimations regard to flows of private capital made in 1972 were, that every year 10 mln USD was to leave Poland for good. Instead, among other ‘imported’ goods was approx. 2.5 t. of gold yearly in form of coins, powder or jewellery was to be brought back. It is however problematic to assess overall volume, as most of it was in constant circulation. Transferred to Poland, purchased quietly on the streets to be either left as security for worse times, sold to other individuals or to the state. If purchased by state, most likely it was to be sold back to the west in attempt to gather capital to pay interest of credit lines. Assuming of course it didn’t land in a safe box of communist party notable. It is therefore reasonable to assume, that some fortunes had been built on gold circulation.

In attempt to maximise profits and for its own security, many smugglers tend to avoid declaring volumes brought to Poland, although tariffs on gold imports were low. Above was applicable not only to professional smugglers. Top sportsmen, diplomats, sailors, people of high social prestige, foreigners on delegations to Poland, or simple tourists on polish or foreign passports were continuing to do so. Polish newspapers at a time were full of news about busted gold smugglers. But reason for popularity of gold smuggling, was exactly the same why in 80’s Poles travelled to Yugoslavia and Hungary. Because of availability of goods unavailable back home. Because they could’ve been sold with profit back home and therefore improve life status. Because of the mistrust to falling communist state and high inflation. And due to simple hopes to have better lives. There were few main directions for gold ‘imports’ and they had changed in time due to various reasons. In 60-70’s jewellery was coming from Soviet Union or European dominant sectoral superpower of that time – Italy. Hamburg and Amsterdam were sources for bars and bullion coins popular mostly among sailors. Vienna and West Berlin served as main centres for bars and bullion coins for frequent flyers. In 70’s Turkey, Middle East and Cuba had grown on popularity as end routes. In 80’s market has been dominated by was India and South-East Asia.

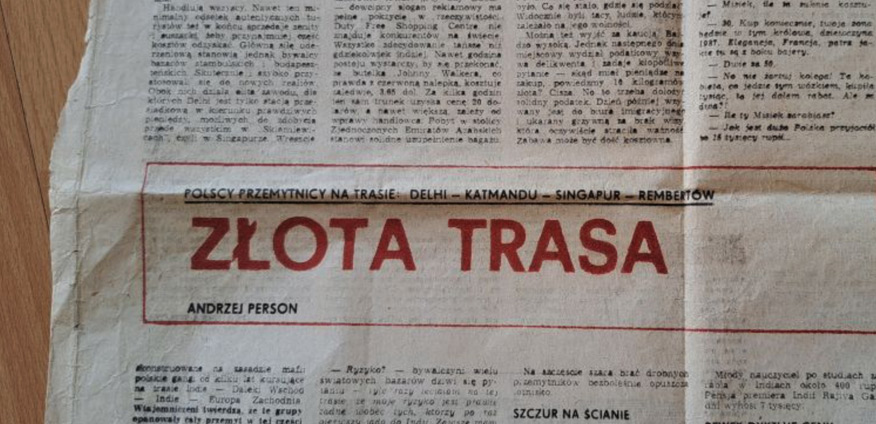

‘The golden route’ in ‘Polityka’ from 28th of March 1987. Source: https://www.fly4free.pl/forum/zlota-trasa-w-czasach-prl,18,171068

Article ‘The golden route’ by Andrzej Person, published in ‘Polityka’ on 28th of March 1987 described in details how unofficial goods and gold trading on route Poland-Middle East-South-East Asia looked like. Apparently, this exact print run has been sold immediately. Main centre to purchase Asian gold was Singapore. However obligatory stop on route to Singapore was India – that time, country of high tariffs and restrictive import bans. Hence tourists from abroad could sell there everything and anything (duty-free alcohols, Russian made Zenith cameras and many more), hence improve liquidity before Singaporean shopping. From there organised groups were transporting gold in volumes 1-2 kg per person. Asian golden trail peaked on popularity in 80’s, but lost on importance at very end of decade. Year 1989 marked democratisation and gradual fall of communism in Poland. With introduction of economic freedoms, polish central bank issued in 1990 first permission to private entrepreneur allowing gold trading. Yellow metal was finally ‘free’.

Above serves as a good explanation on why attempt to even loosely assess volumes of gold Poles had in 1990 is nearly impossible. Lack of data, fact that large share of transactions had been conducted in grey zone, constant inflows and outflows and ‘tourism’ simply make it impossible. This could be extended to years 1990-2000, period of great economical changes, organised crime groups, establishment of free market, period of high unemployment and making great fortunes at the same time. Gold was popular then in the form of jewellery and bars, but would we discuss 100 or 1000 tonnes including new volumes and inheritance of communist times – nobody knows.

Some thoughts on how much gold Poles may own

According to 2021 national census held in Poland, country was inhabited by 38 mln people. Of course since then, number has changed a lot especially as an effect of war in Ukraine which caused flows of Ukrainian men, women and children trying to escape war-torn country. So, as numbers may vary depending on source, wave and direction, for our calculations we assume latest official census data. To make the job easier, let’s ignore further demographic division between minors, Poles in productive age and elderly, and factors like nationalities, ethnical groups and gender.

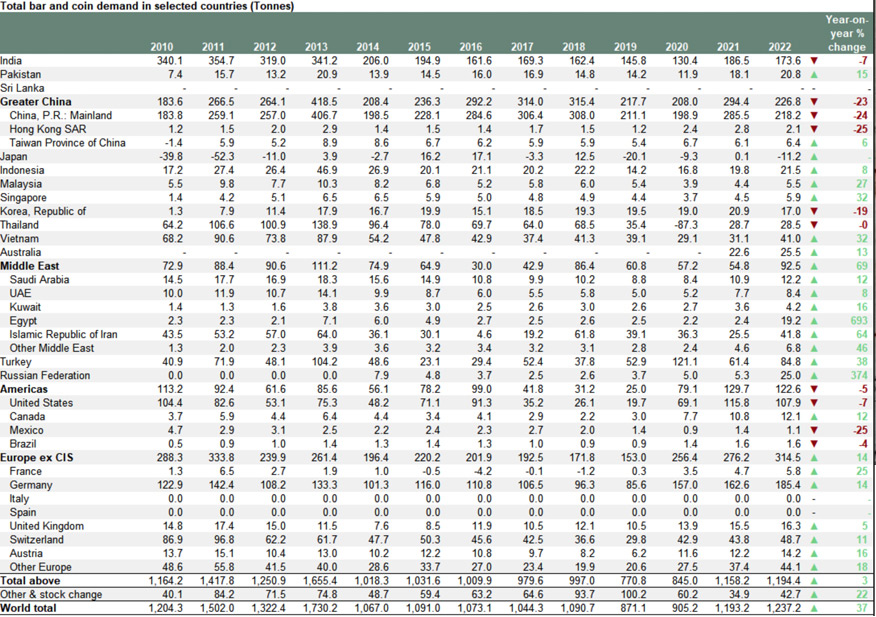

There is however problem regards to possible volumes Poles may held. Considering average growth on sales data of companies that have agreed to make such numbers available, it is reasonable to assume, that between 2000 to 2019 Poles purchased altogether 100 t. of gold. Global pandemic, inflation, and war on Ukraine (just to mention some of the main factors) caused uncertainty, which resulted in increased volume being purchased. Between 2015 – 2019 and preceding years purchases oscillated at approx. 5-6 t. per year, In 2020 were at 9,3 t. and in 2021 tallied at 14.2 t. During course of 2022, Poles made a purchase of grand total of 19 t. of gold. Adding that all up, we therefore have 100 t. purchased in between 2000 – 2019 and additional estimated 49 t. purchased in between 2020-2022. Again, need to underline fact that it is just part of the picture. Is that a lot? Polish gold demand up to 2020 would be therefore comparable to Singapore’s or Malaysian. However, for 2021 and 2022 Poles surpassed i.e. United Kingdom and Saudi Arabia I terms of yearly gold purchases.

Demand for investment gold. Poland is part of ‘Other Europe’ category. Source: World Gold Council

For 2022, gold purchases made by Poles moved Poland to European top 3 (excluding Turkey and Russia), after Germany (185,4 t.), Switzerland (48.7 t.) and ahead of UK (16.3 t.) and Austria (14.2 t.). Considering that average monthly wages in Germany as per Q4 2021 were at equivalent of 4464 USD, in Switzerland for 2022 it was at 7491 USD per month, pre-Brexit Britain had equivalent of 2798 USD per month, Austrian average salary in 2021 was at 2745 USD and polish average salary at Q1 2023 stood at 1728 USD per month, that is quite impressive result, especially considering long-term loss of value on PLN vs USD, even despite this is being offset by strengthening PLN since September 2022. Above of course doesn’t take under consideration certain factors. First and foremost, it is nearly impossible to establish gold volume Poles owned before year 2000. Second of all, above data is most likely incomplete as some dealers declined providing answers. Third factor is, we have data about purchases, but have none on sales. If above 149 t. in private hands would be all (doubtfull), this means there is an average of nearly 3 g. of gold per Pole.

Is that a lot? Let’s consider example of Czechia, who is Poland’s southern neighbour. Both countries has been part of communist camp until 1989, both undertook extensive free market reforms, both have been admitted to EU and NATO at the same time, hence some similarities despite of certain cultural differences. It was estimated at the end of 2021, that private individuals in Czech Republic owned 19.35 t. of gold. It is volume higher than official reserves of Czech National Bank, which owns 16.5 t. as per June 2023. How much gold then could be attributed per person? Country is inhabited by 10.5 mln people according to 2021 census. Result would be nearly 1.84 g. of gold per person.

Above fades however in comparison to Germany. It is estimated that while Bundesbank owns 3.3k tonnes of gold, Germans own much more – over 9k t. of yellow metal. This again could be subjected to some volume related errors, as Germans preferred to preserve anonymity while buying gold. With Germany’s population at 2022 to be 84.2, and again ignoring population pyramid and detailed factors like nationality or gender, volume per person would result at slightly over 106 g. per citizen. That is astonishing result of 3 troy ounces (93 g.) per inhabitant.

Continuing on some other west-European countries known to own sizeable gold reserves: In Italy it is estimated that 6.4k t. are being privately owned, compared to 2,452 tons owned by the local Central Bank. With 58.8 mln inhabitants, that would be 41.6 g. of gold per person. In France estimations confirm 4.7k t. of private-owned gold in comparison to 2.4k t. owned by Banque du France. With 68 mln inhabiting France according to 2021 data, results in slightly over 69 g. per citizen.

Supportive and aversive factors for gold purchases in Poland

So what supports gold purchases in Poland? Long term development which ended with geo-economical issues. From statistical point of view (according to Allianz Global Wealth Report), assets owned by Poles were growing in double digit terms in between 2019-2021, reaching 11.2% of net growth in 2021. That gives Poland average of net 11,250 EUR assets per capita. Considering that in 2011 they stood at 4,160 EUR, it marks nearly x3 growth. Poland, considered in past as emerging market and developing economy had been after all one of the beneficiaries of ‘long decade’ of growth started after last financial crisis. Overall, long term trend was supportive for Poles to make savings, with exception of couple last hectic years. At the end of 2021 households’ savings were at 106% of polish GDP but for 2022 they had fallen to 91% of GDP pushing us back to 2013 levels. For above, must be noted that approx. 25% owns savings at and below 1.1k EUR.

Why such a drop? Year 2020 brought global pandemic and unprecedented scale of economy affecting countermeasures, especially during first wave. Year 2021 passed under spike of overall demand, logistical clogs, double-digit increase on inflation and energy crisis. Year 2022 brought war on Ukraine and growing geopolitical tensions. All the above factors were strongly supportive to ownership and purchase of precious metals as anti-crisis hedge. Poles were therefore more prone to withdraw their assets from banking accounts and either keep them at home or purchase precious metals in need to secure their savings. Let us not forgot on this occasion about fluctuations of GDP and fx on PLN.

Considering that large chunk of savings is being parked directly and indirectly in various debt securities (i.e. via private retirement plans), sharp growth of interest rates effected in shrink of face value. Would it be of any consolidation – that was trend in whole EU. However double-digit inflation and adverse macro conditions speeded up wealth distribution trends contributed highly to the fact that about ¼ of Poles have small or no savings.

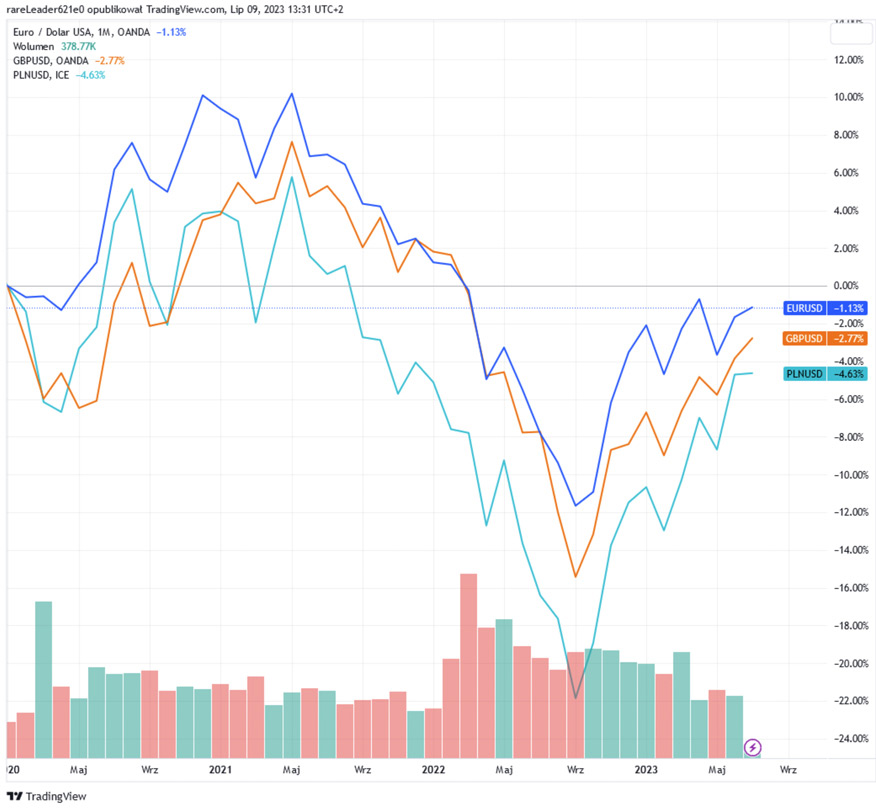

EUR, GBP and PLN 2020-2023 vs USD. Source: Tradingview

Since late 2022 we have witnessed trend on weakening USD which effected in PLN growing on strength. In October 2022 we were paying 5 PLN for 1 USD, in July 2023 that is just below 4 PLN. That contributed to certain reversal, as share of foreign currencies among savings of Poles dropped. Also, Relative calming on geo-economic factors contributed to temporary falls on price of gold in Q2 and Q3 of 2023. All of the above contributed to price correction we experience on precious metals in Q2 and Q3 2023, which was supportive to make purchases in Poland. In the middle of June 2023, price of gold had fallen below 8000 PLN for the second time since outbreak of war on Ukraine.

Despite of over the decade of cheap credit lines polish household debt do GDP oscillated for most of last decade at 35%, which is falling since H2 2021 and currently stands at 26.6%. Considering that in UK this indicator stands at 90% and in Germany is at 55%, this means, Poles know their priorities upon facing aversive market conditions.

There is also another, in-direct factor that may contribute somehow to elevation of gold purchases in Poland, with scale to be determined. In recent years, we have seen legislation changes in Germany regards to overall cash purchases. Since January 2020, new national legislation dramatically reduced threshold on anonymous buying of precious metals from existing 10k EUR limit to a far lower limit of 2k EUR - all that as a part of money laundering prevention (and very probably as a part of strong trend of fight against physical cash). In Poland, such limits are higher. Additionally, fact that gold is purchased within Schengen zone, allows its transfer between EU member countries without formalities and impedes traceability, making gold again anonymous. This may however change, as limits of cash payments in Poland may remain reduced in 2024.

What are trends on gold purchases among Poles?

On spring 2021 it has been reported that phrase ‘gold price’ / ‘price of gold’ (cena złota) had appeared in browser search engines in Poland in approximately 6.6k online searches. In the context of all internet users, this is the equivalent of 0.19 online searches each month for gold price per 1,000 active internet users in Poland. Poles were vastly outpaced by such golden superpowers like India, USA or United Kingdom, however above allowed them to reach 45th worldwide position.

Top 20 nations most interested in tracking price of gold. Source: https://focusonbusiness.eu/en/news/ranked-poland-among-countries-most-interested-in-gold-price/4167

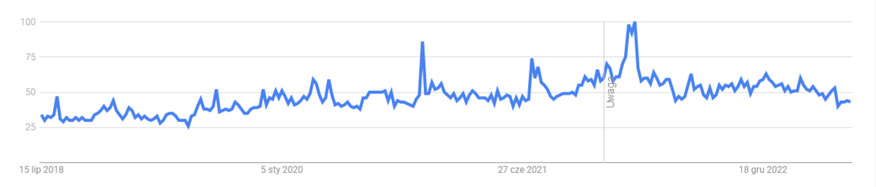

Above was result of usage of paid database. Indeed, usage of modern tools to determine trends may show some interesting results. We decided to use most basic tool - Google Trends. So upon checking phrase ‘gold’ (złoto) for Poland, and applying 5 years range we’ll be shown following results:

Google trends – ‘gold’ (typed in Polish - złoto) for Poland – results for last 5 years. Source: Google trends

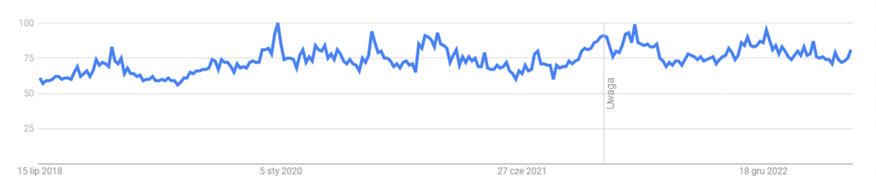

We seem to have growing trend on search initiated in June 2019, when gold price had broken out from ‘Maginot Line’. First clearly visible tops above trend line appeared in March and April of 2020, when first wave of Covid struck Europe. During August of 2020 – that is when gold established its previous price records - phrase searches remained on elevated plateau. First strong spike in internet search appeared in 2nd week of November 2020, and was predominantly caused by US presidential elections, along with pandemic in the background. Another strong growth in search happened in July and August of 2021, when tensions between EU & USA vs Russia had grown, and last one decided to blackmail EU on natural gas. Then, record in search has been established late February – early March of 2022, when Europe heard drums of war rolling for the first time since bloody partition of Yugoslavia. However spike in search doesn’t seem to go in line with growing inflation, which (for now) peaked in Poland in H2 2022- Q1 2023. In the indexed terms, 6-12 March of 2022 set up new heights understood as 100 points. Hence on previous occasions described, spike in search was at 74 points in 2021 and 86 in late 2020. Let’s compare that to search trends for ‘gold’ in Germany and ‘gold’ in UK.

Google trends – ‘gold’ (typed in German - gold) for Germany – results for last 5 years. Source: Google trends

Google trends – ‘gold’ (typed in English - gold) for UK – results for last 5 years. Source: Google trends

Search trend remained strongest in Lubuskie, Śląskie and Lower Silesian Voivodeships and weakest in Great-Poland Pomorskie and Podkarpackie Voivodeships. Of course, has to be noted, that some of ‘gold searches’ were not typed in with precious metals in mind, as word ‘gold’ was being used in the last five years also in titles of movies or songs. However strong presence of investment gold related subjects proves point.

Poland has set another record for gold sales in 2022, with customers buying a total of about 19 t. of gold, placing our country in the Top five in Europe in terms of sales. Due to variety of geopolitical and economical factors demand for gold in Poland will most likely remain high, and the price as a result of political uncertainty in Europe, turmoil in the global banking market and continued high inflation will rise.

So what are the trends on buying gold by Poles? According to research conducted by the ARC Rynek i Opinia studio on behalf of Treasury Mint, only 14% of Poles bought gold as an investment so far. It is men (18%) who reach for gold as a security for their savings more often than women (10%). In terms of geography, south-western Poland with Lower Silesia Voivodship stands out on the map of Poland, as it was there that the largest number of respondents declared purchase.

Following survey results, it appears that women and youths (age 18-24) purchase mostly gold bars, while men and overall above age 35 prefer gold bullion. On that, Nearly 50% people aged 18-34 appreciate possibility of buying bullion online, However Poles also appreciate seller's presence on the market for at least 10 years. Survey also determined that Poles do not have a favourite gold investment product. 49% of respondents indicated they prefer to purchase gold bars, while 48% declared they lean towards gold bullion. Among this group most esteemed are most recognisable brands as Maple Leaf, Krugerrand, and Philharmonic etc. Largest group that prefers to buy gold bars are young Poles between 18 and 24, so entering adulthood. Bullion coins are most often bought by those aged 35-44.

It is therefore reasonably to assure, majority of Poles deal with gold mostly in a form of jewellery or gifts on special occasion, as birthdays, weddings or first communion. This strong trend on gold jewellery finds confirmation in form of reported incomes and revenues made by largest polish jewellers. However, as investment gold is being considered as good asset for bad times, survey noted strong and growing interest in gifts in a form of smaller in size investment products. 31% of Poles among all options would consider giving gold coins or small gold bars (up to 400 PLN) as a wedding gift. 19% of respondents could buy gold for a child for communion, and 16% of respondents would be happy to buy gold as a souvenir for baptism or birth of an offspring.

Final words

With above dataset about trends, we’re pleased to conclude our series dedicated entirely to the subject of gold in Poland. We had a pleasure to cover national and private ownership, mining, and deposits in total of four parts. It doesn’t mean however subject of gold in Poland is never to be addressed anymore. After all, precious metals’ market is growing and changing quickly, especially now, during times of financial and geopolitical turmoil.

Just to mention, some data presented in part two is already slightly outdated, as polish central bank – Narodowy Bank Polski – made another purchase, marking three consecutive months of gold buying, hence added nearly 50 t. to national reserves just during course of 2023 alone.